SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2020

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

2019 Fourth Quarter Results

Highlights

From volume to value: another year of client base profile transformation

· Postpaid customer base reached 39.4% of the total base, up by 6.1% YoY;

· TIM Live's UBB customer base grew 21.1% YoY, totaling 565.8k connections;

· In 2019, Mobile ARPU had a solid advance of 5.6% YoY, reaching R$ 23.7;

· In the year, TIM Live ARPU posted growth of 8.0%, reaching R$ 80.9.

Customer Experience Advanced with a Solid Infrastructure Development

· Best and largest 4G coverage with 86% availability and reaching 3,477 cities;

· VoLTE technology available in 3,401 cities, improving users’ voice experience;

· Refarming of frequencies and new technologies (4G Massive MIMO) to expand network capacity;

· FTTH coverage rises to 2.3 million homes covered in 23 cities as of December.

Revenue and EBITDA post solid performance, consolidating the recovery trajectory during the year

· Services Revenue expanding 3.2% YoY in 4Q19; ending the year up by 2.4% YoY;

· TIM Live Revenues growing 26.5% YoY in 4Q19. 2019 up by 30.6% compared to 2018;

· Normalized Costs and Expenses * decreased by 0.7% YoY in 4Q19, ending the year at -0.3% YoY;

· Highest Normalized EBITDA* in TIM’s history, reaching R$ 2.0 billion and growing 8.1% YoY. In the year, growth was 6.7% vs. 2018;

· Highest Normalized EBITDA Margin* in the history of TIM, reaching 42.9% in the quarter and 39.1% in the year, completing 6 consecutive years of consistent margin expansion;

· Capex at R$ 1.3 billion, totaling R$ 3.9 billion in 2019 and accounting for 22% of net revenues;

· Normalized Net Income expanded 28.7% YoY, summing R$ 756 million. In the year, Normalized Net Income totaled R$ 2.0 billion (+32.1% YoY).

*Operating Costs and EBITDA normalized based on -R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19, +R$ 1.5 million in 1Q19, +R$ 2.1 million in 4Q18, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18. Net Income normalized by: -R$ 31.2 million in 3Q19, -R$ 185 million in 2Q19, +R$ 30.3 million in 1Q19, -R$ 42.8 million in 4Q18 and -R$ 950 million in 3Q18.

|

Conference Call in English:

|

Conference Call in Portuguese:

|

|

February 12th, 2020 at

10:00 a.m. Brasilia Time

08:00 a.m. US (NY)

Tel: +1 646 843 6054 (US)

+55 11 2188-0155 (Brazil)

Code: TIM

|

February 12th, 2020 at

10:00 a.m. Brasilia Time

08:00 a.m. US (NY)

+55 11 2188-0155 (Brazil)

Code: TIM

|

1

Financial Performance (Excluding effects of IFRS 16 and including IFRS 9 and 15)

OPERATING REVENUE

Mobile Segment Details (net of taxes and deductions):

Mobile Service Revenues (MSR) reached R$ 4,101 million in 4Q19, growth of 2.6% compared to the same quarter of 2018. The expansion is mainly due to mobile ARPU (Average Monthly Revenues per User) which rose 5.8% YoY and reached R$ 25.1, mostly influenced by higher spending by prepaid customers in addition to the company's ongoing efforts to monetize its postpaid client base via migrations to high-value plans.

The ARPU of the segments, which exclude other mobile revenues, rose in prepaid by 7.9% YoY (R$ 12.9) and in postpaid (ex-M2M) by 6.1% YoY (R$ 47.0).

2

Breakdown of each mobile segment in the fourth quarter:

(i) In postpaid, the TIM Black Família offer contributed to the positive dynamic of transfers to high-value plans and to the good performance in the acquisition of new lines (+7.6% YoY excluding M2M clients). Besides, the segment posted a reduction in disconnections, which resulted in the return of positive net additions, also contributing to the 5.7% annual growth observed in Postpaid Revenues in 4Q19 (7.2% YoY excluding interconnection). At the end of the year, the segment revenues represented 58% of service revenues, versus 56% in 2018.

(ii) In prepaid, the TIM Pré Top offer, which now represents 67% of segment’s customer base, continues to contribute to good results. Therewith, for another quarter, we observed an increase in spending by rechargers (0.5% YoY), in addition to a rise of 2.9% QoQ in average rechargers. As a consequence, Prepaid revenues decrease reduced its pace when compared to previous quarters, reaching -1.3% YoY in 4Q19. If we exclude interconnection, the segment revenue grew 0.7% YoY.

In 2019, mobile ARPU stood at R$ 23.7, up by 5.6% YoY. In the same period, postpaid ARPU (ex-M2M) rose 0.6% and prepaid ARPU advanced 4.2%. As a result, MSR advanced 1.9% YoY versus 2018, reaching R$ 15,648 million. The acceleration of this line in the second half, recovering the more timid performance seen in the first six months, is noteworthy.

Client Generated Revenues - CGR (Revenues from Voice, Data & Content) rose 3.8% YoY in 4Q19, reflecting the successful efforts by the company to increase the penetration of high-value offers, despite a still recovering macroeconomic environment. In the year, CGR advanced 2.3%, reaching R$ 14,372 million.

|

Interconnection Revenues (ITX) continued a downward trajectory and, in 4Q19, posted a 40.9% reduction YoY, reflecting the impact of the latest VU-M tariff (Mobile Termination Rate) cut by approximately 50% (from ~R$ 0.03 to ~R$ 0.01) in February 2019, and a lower incoming traffic growth. In 12 months, Interconnection Revenues registered a decrease of 33.0% YoY. The incidence of VU-M on Net Service Revenues reached 1.9% in the quarter and in the year this exposure was 2.2%.

|

Other Revenues line grew 26.1% YoY in 4Q19 and by the end of the year the increase had totaled 33.5%. This performance remains impacted mainly by revenues generated by network sharing and swap agreements. The rise in network sharing volume is being central to the expansion strategy of the fiber optic transport infrastructure (backbone and backhaul) with greater efficiency in asset allocation (Capex and Opex).

3

Breakdown of Fixed Segment (net of taxes and deductions):

|

Fixed Service Revenues totaled R$ 256 million in 4Q19, an increase of 15.1% versus 4Q18. This performance reflects the 26.5% YoY growth of TIM Live and the reversal of the trend of revenues from other fixed segments (corporate and wholesale), which in 4Q19 increased 4.2% YoY. During the fourth quarter, the company expanded its FTTH coverage to three new cities and maintained a good pace of broadband client additions (~30 thousand new connections).

|

|

In 2019, Fixed Service Revenues totaled R$ 949 million, an 11.3% increase YoY, boosted mainly by growth in TIM Live (+30.6%), more than offsetting the 3.9% drop in revenues from other businesses in the fixed segment. In 2019, TIM Live Revenues represented 52% of Fixed Service Net Revenues.

|

ARPU for TIM Live was R$ 83.8, growing 4.4% versus 4Q18. The performance is explained by the penetration of higher value offers with higher speeds. In 2019, ARPU stood at R$ 80.9, up by 8.0% YoY.

|

|

Detailing Handsets and Devices (net of taxes and deductions):

In 4Q19, Product Revenues were 2.9% lower than those seen in 4Q18, following the decrease in the volume of handsets sold during the quarter (-2.5% YoY). In the year, Product Revenues was mostly stable (+0.6%), reflecting a better sales mix contributing to an increase in the average price of handsets sold, compensating for a lower sales volume.

4

OPERATING COSTS AND EXPENSES

*Operating Costs normalized by adjustments to the sale-leaseback contract of towers (+R$ 11,000 in 2Q19, +R$ 1.5 million in 1Q19, +R$ 431,000 in 4Q18, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18), tax credit due to the exclusion of ICMS from the calculation basis for PIS/COFINS (-R$ 75.2 million in 3Q19, -R$ 1,720 million in 2Q19 and -R$ 159.1 million in 4Q18), legal services connected to the PIS/COFINS court decision (R$ +4.4 million in 3Q19 and +R$ 3.5 million in 2Q19), revision of loss prognosis for labor contingencies related to employees, tax contingencies and civil contingencies (R$ +11.2 million in 3Q19, +R$ 221.8 million in 2Q19 and +R$ 156.5 million in 4Q18) and contract losses (+R$ 22.4 million in 3Q19).

Operating Costs and Expenses were R$ 2,619 million in 4Q19 (-0.6% YoY). This line was not impacted by non-recurring expenses in this quarter. In the year, Operating Costs and Expenses totaled R$ 9,049 million (-14.7%), impacted by non-recurring expenses of R$ 1,530 million, a net result of the effects related to items explained in the footnote to the table above.

The efficiency plan reached ~80% of the target for 2019. Despite the strict cost control, bad debt was a relevant offender impacting the annual guidance. Excluding these effects, the achievement would be higher than 110%. In the year, the plan initiatives generated economies that totaled approximately R$ 600 million.

Breakdown of Performance of Costs and Expenses:

Personnel Costs declined 1.4% YoY in 4Q19. Such performance was mostly influenced by lower spending on benefits. In 2019, Personnel saw a minor increase of 1.1% YoY impacted mostly by inflation. The weight of this line over normalized Opex was mostly stable at 9.5% in 2019 (vs. 9.4% in 2018).

Selling and Marketing Expenses fell 8.5% YoY in 4Q19, reflecting the structural trends seen in the prior quarters with efficiency gains from initiatives toward process digitalization, reduction of FISTEL expenses and lower prepaid recharging fees, as well as lower spending on advertising. In 2019, spending on selling and marketing fell 5.5% vs. 2018, despite the impact from the right of using the TIM trademark1.

The Network and Interconnection group fell 3.2% YoY in 4Q19, driven by lower costs in the interconnection subgroup (ITX). The decline in the ITX subgroup is explained by: (i) decline in mobile termination rate (MTR) and (ii) lower pressure from traffic to other operators. The Network subgroup saw an opposite movement and was negatively impacted by higher costs with infrastructure sharing and rental.

In 2019, the group Network and Interconnection fell 4.1% YoY, with drivers similar to those seen in the quarter.

1 On May 17, 2018, TIM Participações and Telecom Itália entered into a trademark license agreement, formally granting Tim Part and its subsidiaries the right to use the "Tim" trademark in exchange for the payment of royalties in the amount of 0.5% of the company's net revenues.

5

General and Administrative Expenses (G&A) increased 12.1% YoY in the quarter, mostly explained by higher spending on IT projects related to cybersecurity, and to a smaller extent by collection services. In 2019, G&A rose 8.6% YoY, with a slight increase in participation in total normalized Opex to 5.9%, versus 5.5% in 2018.

Cost of Goods Sold (COGS) advanced 1.5% YoY in 4Q19. Despite the reduction of sales volume in the period, high-value products were more relevant in the mix. In 2019, similar dynamic contributed to an increase of 5.4% YoY in COGS.

In 4Q19, Provisions for Doubtful Accounts (Bad Debt) decreased 6.9% QoQ, representing the first quarterly reduction since 2017. On top of that, the fourth quarter showed a deceleration in the speed of increase to 25.1% YoY (in 1Q19 the increase was +49.2%, in 2Q19 was +44.2% and in 3Q19 was +34.4%), remaining the most challenging cost-related line. In 2019, Bad Debt increased 37.3% vs. 2018. The performance of this account is explained by a higher revenue base exposed to delinquency, due to the 6.1% YoY increase in the postpaid base, in addition to a challenging macroeconomic environment (unemployment, income and indebtedness). Some changes in internal systems and processes during the first half also impacted the performance.

Other Operating Expenses normalized by non-recurring effects rose R$ 30 million in absolute value, due to a smaller amount of Other Operating Revenues. This account contains a seasonal component, impacted by oscillations within the year. Therefore, despite the quarterly increase, in 2019 it grew just 1.9%, leaving its participation over total normalized OPEX at 3.1%, just 0.1 p.p. higher than in 2018.

Subscriber Acquisition Costs (SAC = subsidy + commissioning + advertising expenses) totaled R$ 44.1 per gross addition in 4Q19, a decrease of 16.6% YoY. The sharp reduction was due to higher efficiency in selling and marketing linked to a higher volume of gross additions in the fourth quarter of 2019, mostly driven by the years’ end holidays.

|

|

The SAC/ARPU ratio (payback per client) fell YoY, reaching 1.8 month, versus 2.2 months in 4Q18.

|

6

FROM EBITDA TO NET INCOME

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19, +R$ 1.5 million in 1Q19, -R$ 2.1 million in 4Q18, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18). Net income normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19, -R$ 1,051 million in 2Q19 and -R$ 66.2 million in 4Q18). Net Income normalized by tax credit and other effects (+35.2 million in 3Q19, +R$ 865 million in 2Q19 and +23.4 million in 4Q18), by adjustment of deferred taxes (+R$ 30.3 million in 1Q19) and by tax credit due to the incorporation of TIM Celular by TIM S.A. (-R$ 950 million in 3Q18).

EBITDA (Earnings before interest, taxes, depreciation and amortization)

EBITDA exposure to MTR was 0.3% in 4Q19. In this quarter, net MTR (revenue – cost) was positive due to interconnection revenues slightly higher than costs with MTR.

DEPRECIATION AND AMORTIZATION (D&A) / EBIT

In 4Q19, D&A rose 9.7% YoY, explained mostly by an increase in the amortization of the 700 MHz license related to the expansion of activation of the frequency in new cities. In 2019, D&A grew 5.9% YoY, totaling R$ 4,189 million, explained by the same elements of the past quarter. Normalized EBIT in 4Q19 rose 6.0% YoY, reflecting EBITDA growth. In 2019, Normalized EBIT totaled R$ 2,609 million, an increase of 8.0% YoY. Normalized EBIT margin ended the year in 15%, expanding 0.8 p.p. versus 2018.

NET FINANCIAL RESULT

Net Financial Result in 4Q19 was negative by R$ 81 million, a R$ 43 million improvement compared to 4Q18. The difference is mainly due to:

7

(i) Higher financial revenues from monetary correction over the tax credit balance stemming from the right to exclude the ICMS from the calculation basis of PIS and COFINS payments (the remaining balance at the end of each period is updated by the Selic rate until its full compensation, thus becoming a recurring element for the coming years);

(ii) Lower financial expenses due to the lower interest rate and, as consequence, lower interest accrual on debt;

In 2019, Normalized Net Financial Result was negative by R$ 504 million, R$ 100 million better compared to 2018.

INCOME TAX AND SOCIAL CONTRIBUTION

In 4Q19, Income Tax and Social Contribution were -R$ 13 million (a reduction of R$ 78 million in the negative amount). This amount mostly reflects the impact of the deductibility of Interest on Equity (IOE) of R$ 248 million, approved in December 2019. Also, the Deferred Income Tax and Social Contribution were impacted by the alignment of accounting practices related to fiscal treatment of leasing contracts. In 2019, the line reached -R$ 988 million, or -R$ 57 million in a normalized view.

In 4Q19 the effective tax was -1.7 vs. -13.4% in 4Q18. In the full year, the normalized effective tax was -2.7%.

NET INCOME

Reported Net Income rose 19.6% YoY. In 2019, Net Income amounted to R$ 3,765 million, up by 47.9%.

8

CASH FLOW, DEBT AND CAPEX

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Working Capital normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19) and according to the items in the Net Financial Results section (+R$ 66.4 million in 3Q19 and +R$ 1,051 million in 2Q19), reallocated under Cash Flow of non-operating activities.

CAPEX

Capex totaled R$ 1,334 million in 4Q19, down by 2.7% compared to 4Q18. Investments continue to be allocated in infrastructure (higher than 90% of the total) mainly projects in IT, 4G technology through 700MHZ, transport network and the FTTH expansion. In the year, Capex totaled R$ 3,853 million, growth of 0.6% YoY vs. 2018, of which approximately 10% were earmarked for TIM Live (vs. ~8% in 2018).

DEBT AND CASH

Gross Debt in 4Q19 was R$ 3,415 million, growth of R$ 90 million YoY. The current balance includes (i) leasing recognition in the total amount of R$ 1,428 million (related to the sale of towers, the LT Amazonas project and other financial leasing operations) and (ii) hedge position in the amount of R$ 42 million (reducing gross debt).

TIM’s debt is concentrated in long-term contracts (59% of the total) consisting mainly of BNDES financing and Debentures. Approximately 11% of the total debt is denominated in foreign currency (USD) and is fully hedged in local currency. The average cost of debt excluding leasing was 5.7% p.y. in 4Q19, down compared to 8.2% p.y. in 4Q18.

9

At the end of the quarter, Cash and Securities totaled R$ 2,939 million, an increase of R$ 1,079 million YoY. The main movements that affected cash and securities in the last 12 months are presented below:

The average financial yield was stable at 4.6% p.y. in 4Q19, down compared to 6.5% p.y. in 4Q18 following the reduction of the Selic base rate. Year to date, the yield was 5.9% p.y. compared to 6.5% p.y. in 2018.

The Net Debt/EBITDA ratio was 0.07x in the quarter, down from 0.23x in 4Q18. In 4Q19, Net Debt totaled R$ 476 million, a R$ 989 million decrease compared to the previous year, when net debt was R$ 1,465 million.

10

QUARTERLY EVENTS AND SUBSEQUENT EVENTS

FITCH ASSIGNS INITIAL RATING “AAA (BRA)” TO TIM PARTICIPAÇÕES

On February 10th, 2020, the credit rating agency Fitch Ratings (“Fitch”) assigned to the Company the Initial Long-Term Rating on a National Scale “AAA(bra)”, with a stable outlook. In Fitch's view, TIM's initial rating reflects its strong business profile, supported by its relevant participation in the mobile telephony sector, as well as in relation to its conservative financial indicators, with reduced financial leverage and robust liquidity position. The assessment also incorporates the expectation that the Company will present an increasing cash flow from operations and points out that the Company is prepared to deal with the competitive and regulated telecommunications sector in Brazil.

FINANCING AGREEMENT WITH BANCO DO NORDESTE DO BRASIL

In January, 2020, the Company's wholly-owned subsidiary, TIM S.A., signed a financing agreement with Banco do Nordeste do Brasil, in the total amount of R$ 752,479: (i) R$ 325,071 at IPCA cost + 1.4386% and subject to a 15% default bond; and, (ii) R$ 427,408 at IPCA cost + 1.7582% and subject to a 15% default bond. The purpose of the line of credit is to finance Capex in the Northeast and north of the states of Minas Gerais and Espírito Santo from 2019 to 2022 with a total payment term of 8 years, being 3 grace years and 5 years of amortization. The operation will be guaranteed by (i) a bank guarantee proportional to 100% of the amount of each disbursement; and (ii) a bond of receivables proportional to 5% of the amount of each disbursement. To date, there were no disbursements.

PAYMENT OF INTEREST ON EQUITY

The Company's Board of Directors approved on December 19, 2019, the payment of R$ 247,747,058.82 in Interest on Equity, based on the result of the period ended December 31, 2019. The payment took place on January 29, 2020. The date for the identification of shareholders entitled to receive such values was January 17, 2020.

Also, the Company informed to the market on September 25, 2019, the anticipation of the payment of Interest on Equity in the amount of R$ 378,750,000.00 to January 24, 2020. It was initially scheduled to be paid no later than March 31, 2020. The date for the identification of shareholders entitled to receiving said values was set for October 7, 2019

The approved payments are part of a projection amounting to approximately R$ 1 billion as Interest on Equity, related to the fiscal year ending December 31, 2019.

TIM & VIVO NETWORK INFRASTRUCTURE SHARING AGREEMENT

On December 19, 2019, TIM Participações S.A. and Telefônica Brasil S.A. (“Vivo”), in addition to the Notice to the Market of July 23, 2019, informed of the advance of the negotiations initiated with the signing of a Memorandum of Understanding (MOU), which result in the implementation of two transfer-of-rights agreements for sharing 2G, 3G and 4G mobile network infrastructure.

11

TIM CONFIRMED FOR 12th CONSECUTIVE YEAR IN ISE PORTFOLIO

On November 29, 2019, the Company announced its maintenance in the select group of companies that comprise the Corporate Sustainability Index (ISE) on B3, for the twelfth consecutive year. TIM is the telecommunications company which remains longer in the ISE portfolio. The operator is also the only telecommunications company listed in the "Novo Mercado" segment of B3, recognized as the highest level in corporate governance.

IFRS 16/CPC 06 (R2) – “LEASES”

In the fourth quarter of 2019, the Company implemented a new tool that allowed management to control and calculate in an automated manner the accounting effects arising from lease agreements. Therefore, this new tool allowed management to make individualized calculations, both in relation to the measurement of the effects of assets and liabilities of leases, and also in relation to the monthly calculation of depreciation and interest that affect the result, which prior to the implementation of this new tool were made considering an average depreciation term and discount rate for each asset class (for example: land and infrastructure sharing). Therefore, through this new tool, it was possible to re-measure the depreciation and amortization accounts, financial income (expenses) and, consequently, income tax and social contribution resulting from the individualized calculations that were made. (Financial Statements, Note 14).

12

Operating and Marketing Performance

Operating and Marketing Performance

MOBILE SEGMENT:

GENERAL MARKET

The Brazilian mobile market saw a retreat in the number of users for the 19th consecutive quarter. The consolidation dynamic for prepaid SIM cards recurred in 4Q19. Despite this factor, which was intensified by the seasonal effect of higher disconnections in the last quarter of the year, the 13.0 million user decline seen in the last 12 months was the best relative performance for the segment in 5 years.<0} Postpaid net additions reached 10.0 million users during the year. Slightly over half of this result came from human lines (ex-M2M), whose positive contribution to the sector has been slowing YoY since 2Q18, reaching in this period the lowest level since the end of 2016, i.e., +6.5% YoY.

TIM

TIM reported 54.4 million users in 4Q19, stable compared to the previous quarter and down by 2.6% YoY.

|

Postpaid ended the quarter with 21.5 million users, up by 6.1% YoY. The segment reached a new record with the highest share of the total base, 39.4% (+3.2 p.p. YoY). Net additions of 1.2 million users in the year were underpinned mainly by a growth in new activations. Involuntary churn was also a negative component for the base throughout the year, especially in 3Q19 due to the disconnection of inactive clients. In 2019, with the aim of ensuring the upgrade of the base, we highlight two milestones in value creation: TIM Black Família, which has made up 33% of new postpaid additions since its launch, and the handset discount campaign for the acquisition of control plans. Both were important differentiation drivers, avoiding price-based competition in the segment.

|

Prepaid ended the year with 33.0 million users. For the second consecutive quarter, TIM increased its share and reinforced its leadership in the segment, ending 4Q19 with a 28.2% market share. The 2.7 million retreat in the number of users seen in the last 12 months was a result of prepaid dynamics, simultaneously marked by high volumes of activations and disconnections (washing machine). The launch of TIM Pré Top has proved to be the right strategy, bringing consistency to the offer and leading to improved recurring acquisitions, increased spending per recharger and an improvement in the perception of the clients.

13

In 4Q19, the 4G customer base again posted sharp growth, 12.0% YoY, ending the quarter with 38.6 million users. Total handsets featuring this technology reached 76% of all human lines (+11.9 p.p. YoY).

The M2M base advanced 67.5% YoY, ending the quarter with 3.6 million users. The strong result in the year was mostly an outcome of the incorporation of the M2M user base of Porto Seguro Conecta in 2Q19.

FIXED SEGMENT:

TIM Live customer base rose 21.1% YoY, ending 4Q19 with 566 thousand customers. In this quarter, users above 100 mbps reached 32% of all connections, a +21 p.p. increase YoY.

|

Net additions to FTTH (Fiber To The Home) remained responsible for the good performance of the business and kept advancing at a fast pace, with 35 thousand new users in the quarter and 119 thousand in the past 12 months.

Aligned with the strategy of “clusterization” for the expansion of FTTH coverage, following the launch in the capital Recife we rolled out commercially three new cities in the state of Pernambuco: Olinda, Jaboatão dos Guararapes and Paulista. TIM Live's coverage ended the year in 25 cities, and 23 had FTTH presence.

|

|

14

Quality and Network

Quality and Network

QUALITY AND CUSTOMER EXPERIENCE

With the aim of offering the best customer service, the application Meu TIM delivered consistent results throughout the year, simplifying the caring processes – reducing communication via call centers – and providing greater transparency and control to customers to manage its plans. In 2019, the 18% growth YoY in the number of unique users on the platform, alongside the reduction of 17% YoY in human interactions, add to the importance of this channel.

Another important factor based on the Company's upselling strategy is sales via digital channels, which in postpaid and control consumer grew 28% YoY in 2019. The digital recharge mix also gained more relevance, up 6 p.p. YoY.

The digital mechanisms for billing and payments again reported accelerated growth during 2019. The invoices delivered via digital channels rose 18% YoY, while the number of users paying through digital channels advanced 14% YoY. Also, during the year, TIM offered its clients solutions for a new digital channel: the possibility to check one's balance, add credit, and receive invoices on WhatsApp.

15

NETWORK DEVELOPMENT

For another year, TIM strengthens its commitment to provide the best experience in usage and service quality for its customers. To this end, the Company maintained its focus on strategic investments in the expansion and enhancement of network infrastructure, a fundamental pillar of our business plan.

During the quarter, helped by analytical tools that ensure the efficient allocation of assets, ~90% of Capex was earmarked for infrastructure projects (Network + IT). The main initiatives include: expansion of the fiber optic network (backbone, backhaul and FTTH); aggregation of carriers; densification of sites, frequency refarming; sharing projects focused on 4G and on transport network.

Regarding the major ongoing projects focused on the continuous modernization and enhancement of our infrastructure, we highlight:

o Expansion of refarming of 2.1 GHz frequency in 4G, reaching approximately 298 cities;

o Infrastructure virtualization project;

o Installation of multiple data centers to enhance experience (35 at the end of 4Q), of which 14 are DCC (Data Center Core) and 21 are DCE (Data Center Edge);

o Expansion of VoLTE, available in more than 3,400 cities;

o Signing of agreements with Vivo toward sharing 2G, 3G and 4G mobile network infrastructure;

o Implementation of “5G Living Lab TIM” – benchmark centers for testing 5G, focused on promoting the applicability of the technology and exploring opportunities in new business models;

o Network capacity expansion through massive MIMO solution;

o Consolidation of the NB-IoT network present in more than 3,200 cities. This coverage will enable the creation of IoT solutions not only in large cities, but also in those farther from the capitals. TIM has pioneered the simultaneous launch of this platform with such broad coverage, aiming to boost the ecosystem of solution developers.

TIM once again maintains its leadership in 4G coverage, reaching 3,477 cities (94% of the country's urban population) at the end of 2019. The 36% growth YoY in network elements for this

technology once again adds to the Company's commitment to the evolution of quality and capacity of the mobile network's infrastructure.

16

As a result of this evolution, 4G data traffic exceeded 85% of the total (a 9 p.p. rise) compared to the previous year. This important milestone allowed TIM to confirm once more the superior quality of its 4G network, according to a news article published by Technoblog2 in Jan/20. This means that our clients used 4G more often – 85.7% of their time online (performance 8 p.p. above the second-placed provider). In addition, the Company led in terms of latency with 57.4 ms, equaling the time it takes for the information to be sent to the user.

The increased fixed broadband coverage keeps expanding, with 2.3 million households in FTTH and 3.6 million in FTTC, totaling 5.5 million households in 25 cities (FTTH + FTTC)3. In 4Q19, FTTH initiated commercial activities in three new cities: Olinda (PE), Jaboatão dos Guararapes (PE) and Paulista (PE).

Also in fixed broadband, TIM Live was elected as best “Fixed Broadband” by Prêmio Canaltech4, held by the technology-specific portal. Our Ultra Broadband was first placed in the “Estadão Melhores Serviços” ranking, a survey conducted by the news outlet Estadão. These achievements attest to the fact that TIM is on the right track in this segment, and that the investments made in fiber optic to ensure the best experience for our customers, have yielded significant results.

In transport infrastructure, TIM reached a total 19,812 sites in the last quarter of 2019, and 61% of said units connected via high capacity backhaul. It reached more than 100 thousand km with fiber optic for backbone and backhaul, an 11.9% advance YoY.

TIM reached a total of 1,582 active Biosites at the end of 2019 and keeps developing this infrastructure, which is aligned with the Company's corporate social responsibility values, in addition to being a solution for the densification of the mobile access network (antennas/towers) with a very low visual and urban impact. Biosites also have a lower cost, are installed quickly and contribute to the harmonization with the environment and urban infrastructure – a multi-functionality beyond the transmission of telecommunications, lighting and security cameras.

2 News released on Jan 16, 2020.

3 (+) Rio de Janeiro (RJ), São Gonçalo (RJ), Nilópolis (RJ), Nova Iguaçu (RJ), São João do Meriti (RJ), Duque de Caxias (RJ), São Paulo (SP), Mauá (SP), Poá (SP), Suzano (SP), Francisco Morato (SP), Franco da Rocha (SP), Diadema (SP), Salvador (BA), Lauro de Freitas (BA), Camaçari (BA), Feira de Santana (BA), Recife (PE), Goiânia (GO), Aparecida de Goiânia (GO), Anápolis (GO) and Manaus (AM).

4 News released on Jan 27, 2020.

17

Currently, the Company is authorized to use more than 110 MHz, with 36 MHz in frequencies below 1 GHz distributed as follows:

|

Average Spectrum Weighted by Population

|

|

700 MHz

|

850 MHz

|

900 MHz

|

1.800 MHz

|

2.100 MHz

|

2.500 MHz

|

|

20

|

11

|

5

|

35

|

22

|

20

|

18

Corporate Social Responsibility

To access the quarterly report on Social and Corporate Responsibility, please refer to: www.tim.com.br/ri/ESG-Report.

Disclaimer

The consolidated financial and operating information disclosed in this document, except where otherwise indicated, is presented in accordance with the International Financial Reporting Standards (IFRS) excluding the effects of IFRS 16 and in Brazilian Reais (R$), in compliance with Brazilian Corporate Law (Law 6,404/76). Comparisons refer to the third quarter of 2018 (4Q18) and the year 2019 (12M19), except when otherwise indicated.

This document may contain forward-looking statements. Such statements are not statements of historical fact and reflect the beliefs and expectations of the Company's management. The words "anticipates,” "believes,” "estimates,” "expects,” "forecasts,” "plans,” "predicts,” "projects,” "targets" and similar words are intended to identify these statements, which necessarily involve known and unknown risks and uncertainties foreseen, or not, by the Company. Therefore, the Company’s future operating results may differ from current expectations and readers of this report should not base their assumptions exclusively on the information given herein. Forward-looking statements only reflect opinions on the date on which they are made and the Company is not obliged to update them in light of new information or future developments.

19

Investor Relations Contacts

Telephone Number: (+55 21) 4109-3360 / 4112-6048

E-mail: ri@timbrasil.com.br

Investor Relations Website: www.tim.com.br/ri

Attachments

Attachment 1: Balance Sheet (Without effects of IFRS 16)

Attachment 2: Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 3: Income Statement (Without effects of IFRS 16)

Attachment 4: Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 5: Cash Flow Statement (Without effects of IFRS 16)

Attachment 6: Cash Flow Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 7: Operatinal Indicators

The Complete Financial Statements, including the Explanatory Notes, are available on the Company's Investor Relations website.

20

Attachment 1

TIM PARTICIPAÇÕES S.A.

Balance Sheet (Without effects of IFRS 16)

21

Attachment 2

TIM PARTICIPAÇÕES S.A.

Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.

22

Attachment 3

TIM PARTICIPAÇÕES S.A.

Income Statement (Without effects of IFRS 16)

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19, -R$ 2.1 million in 4Q18, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18). Net income normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19, -R$ 1,051 million in 2Q19 and -R$ 66.2 million in 4Q18). Net Income normalized by tax credit and other effects (+35.2 million in 3Q19 and +R$ 865 million), by adjustment of deferred taxes (+R$ 30.3 million in 1Q19 and +R$ 23.4 million in 4Q18) and by tax credit due to the incorporation of TIM Celular by TIM S.A. (-R$ 950 million in 3Q18).

23

Attachment 4

TIM PARTICIPAÇÕES S.A.

Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.

**No normalization in 4Q19.

24

Attachment 5

TIM PARTICIPAÇÕES S.A.

Cash Flow Statement (Without effects of IFRS 16)

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Working Capital normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19) and according to the items in the Net Financial Results section (+R$ 66.4 million in 3Q19 and +R$ 1,051 million in 2Q19), reallocated under Cash Flow of non-operating activities.

Attachment 6

TIM PARTICIPAÇÕES S.A.

Cash Flow Statement (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.

25

Attachment 7

TIM PARTICIPAÇÕES S.A.

Operational Indicators

26

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: February 11, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

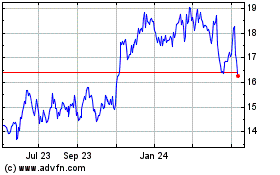

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

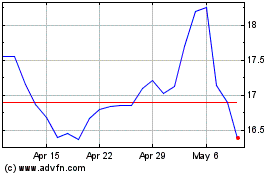

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024