SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2019

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

2019 Third Quarter Results

Highlights

Migrating from Volume to Value: a new customer base profile

· Postpaid customer base reached 39% of the total base, up by 8,2% YoY;

· TIM Live's UBB customer base grew 19.6% YoY, totaling 537k connections;

· Mobile ARPU maintained a solid advance of 5.6% YoY, reaching R$ 23.9;

· TIM Live ARPU posted robust growth of 8.6%, reaching R$ 81.8.

Customer Experience Evolution with a Solid Infrastructure Development

· Leader in 4G coverage spanning 3,355 cities;

· Expanding the efficiency in the use of spectrum with the refarming of 1.8 GHz and 2.1 GHz;

· VoLTE technology available in 3,253 cities, improving voice user experience;

· Acceleration of FTTH to 1.9 million homes covered by fiber optic in 20 cities as of September.

Revenue Acceleration is Gradual and Consistent, which combined with Costs Under Control contributed for Solid EBITDA Growth

· Services Revenues rose 3.0% YoY with Mobile seeing a 2.8% increase and Fixed up 7.3%;

· TIM Live Revenues rose 31.5% YoY, maintaining a fast growth;

· Normalized Costs and Expenses* down by 0.6% YoY, demonstrating an efficient approach at TIM;

· Normalized EBITDA* maintained its solid evolution at 6.8% YoY;

· Normalized EBITDA Margin* reached 39,6%, maintaining the YoY pace of expansion (+1,7 p.p.);

· Normalized Net Income expanded 61% YoY, totaling R$ 619 million;

· Shareholders remuneration: announcement of the first two tranches summing R$ 747.7 million in IOE. Total amount estimated in ~R$ 1 billion for 2019.

*Operating Costs and EBITDA normalized based on -R$ 37.2 million in 3Q19, -R$ 1,494 million in 2Q19, +R$ 1.5 million in 1Q19, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18. Net Income also normalized by: -R$ 31.2 million in 3Q19, -R$ 185 million in 2Q19 and +R$ 30.3 million in 1Q19.

|

Conference Call in English:

|

Conference Call in Portuguese:

|

|

November 6, 2019 at

10:00 a.m. Brasilia Time

08:00 a.m. US (NY)

Tel: +1 646 828 8246 (US)

+55 11 3193-1001 or +55 11 2820-4001 (Brazil)

+1 800 492-3904 (other countries)

Code: TIM

|

November 6, 2019 at

10:00 a.m. Brasilia Time

08:00 a.m. US (NY)

Simultaneous translation from English to Portuguese available via webcast only.

|

Financial Performance (Excluding effects of IFRS 16 and including effects of IFRS 9 + 15)

OPERATING REVENUE

In 9M19, Net Revenues amounted R$ 12,791 million, a 2.1% increase YoY underpinned by Services Net Revenues which advanced 2.1% – Mobile Service rising 1.7% YoY and Fixed Service up by 10.0% YoY – and by the 2.2% expansion YoY of Products Net Revenues.

In 3Q19, Total Gross Revenues increased 3.6% YoY, exceeding Total Net Revenues growth. The discounts given to customers remain as the most significant element to change the dynamics of the deductions over gross revenues. The scenario of greater rationality in granting discounts, within the context of volume to value transformation and a less conflicted competitive environment, should contribute in the long run, but the positive signs are still very early.

|

Mobile Segment Details (net of taxes and deductions):

Mobile Service Revenues (MSR) reached R$ 3,918 million in 3Q19, growth of 2.8% compared to 3Q18. The result points to an acceleration in sequential growth when compared to previous quarters of 2019. The expansion is mainly due to mobile ARPU (Average Monthly Revenues per User) which rose 5.6% YoY and reached R$ 23.9, mostly influenced by migrations to higher value plans, in addition to higher spending by prepaid customers.

|

|

ARPU by segment, which exclude revenues of "non-TIM" clients and other mobile revenues, rose in prepaid by 4.0% YoY (R$ 12) and in postpaid (ex-M2M) by 0.9% YoY (R$ 44.1) with better performances versus 2Q19.

Breakdown of each mobile segment:

(i) In the postpaid segment, despite the increased involuntary disconnections, in the period, due to the cancellation of inactive clients, the company kept presenting a good dynamic in the migration to higher value plans and good performance in the acquisition of new lines (+6.6% YoY, excluding Data only clients). As a result of these effects, Postpaid Revenues advanced 5.0% YoY.

(ii) In the prepaid segment: the TIM Pré Top offering, which now accounts for 60% of the prepaid base, keeps contributing to ease the structural pace of revenue decline in the segment, with higher spending by recharger client (+1.9% YoY). In addition, we had a 2.8% increase in the number of rechargers compared to 2Q19. The combination of these effects led Prepaid Revenues to fall 3.8% YoY, a slowdown in the rate of decline compared to past quarters.

CGR (Revenues from Voice, Data & Content) advanced 1.9% YoY in 3Q19, with its expansion limited by a macroeconomic environment that is still in slow recovery, reflected in the downward revision of GDP1 growth estimates, despite an improved consumer confidence2. In 9M19, MSR advanced 1.8% reaching R$ 10,586 million.

|

|

Interconnection (ITX) Revenues maintained a downward trajectory and in 3Q19 posted a 25.2% reduction YoY, reflecting the impact of the latest VU-M tariff (Mobile Termination Rate) cut by approximately 50% (from ~R$ 0.03 to ~R$ 0.01) and a lower incoming traffic growth. The incidence of VU-M on Net Service Revenues reached 2.0% in the quarter and in the year this exposure was 2.3%.

|

Other Revenues grew 55.7% YoY in 3Q19 and year to date the increase totaled 36.3%. This line is still impacted by revenues generated from network sharing and swap agreements, whose volume has been increasing significantly. These initiatives are aligned with the strategy to expand fiber infrastructure (backbone and backhaul) with efficient investment allocation and operating costs.

1 The Central Bank's Focus survey showed a prospect of the GDP retreating 2.5% in January 2019 to approximately 0.9% in September 2019.

2 The Consumer Confidence Index (“ICC” - FGV) fell 7.1% year to date. However, there was a 1.4% advance in 3Q19 compared to the previous quarter, interrupting a sequence of two consecutive quarterly declines. Despite the advance, the index maintains a low level historically.

3

Breakdown of Fixed Segment (net of taxes and deductions):

|

Fixed Service Revenues totaled R$ 233 million in the quarter, a 7.3% increase from 3Q18. This performance mainly reflects the growth of TIM Live, which in 3Q19 expanded 31.5% YoY, accounting for more than half of fixed service revenues. During the quarter, the company added its FTTH coverage to three new cities. TIM Live is currently present in 22 cities (including 6 capitals) and will further expand its coverage in the coming months. The remaining fixed segment services dropped 12% YoY, mainly explained by the termination of corporate contracts. In 9M19, Fixed Service Revenues totaled R$ 696 million, up by 10% YoY.

|

|

|

|

|

|

ARPU for TIM Live was R$ 81.8, 8.6% higher than 3Q18. The performance is explained by the growing penetration of high-value offers with faster speeds, and the July 2019 price readjustment for part of the plans.

|

|

Detailing Handsets and Devices (net of taxes and deductions):

In 3Q19, Revenues from Products were 12.2% lower than in 3Q18 while in 9M19 they were up by 2.2% YoY. The decline is mainly due to the ~10% reduction in the volume of handsets sold. In addition to this effect, the comparative base for the third quarter of 2018 was higher than the average level due to a large distributor making early purchases and lower than expected handset discounts. Smartphone penetration in the base for September 2019 rose to 86% (+3.0 p.p. YoY).

OPERATING COSTS AND EXPENSES

*Operating Costs normalized by adjustments to the sale-leaseback contract of towers (+R$ 11,000 in 2Q19, +R$ 1.5 million in 1Q19, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18), tax credit due to the exclusion of ICMS from the calculation basis for PIS/COFINS (-R$ 75.2 million in 3Q19 and -R$ 1,720 million in 2Q19), legal services connected to the PIS/COFINS court decision (R$ +4.4 million in 3Q19 and +R$ 3.5 million in 2Q19), revision of loss prognosis for labor contingencies related to employees, tax contingencies and civil contingencies (R$ +11.2 million in 3Q19, +R$ 221.8 million in 2Q19) and contract losses (+R$ 22.4 million in 3Q19).

Reported Operating Costs and Expenses were R$ 2,582 million in 3Q19 (-2.0% YoY). This line was impacted by total non-recurring expenses of R$ 37.1 million, a net result of the effects related to non-recurring items explained below.

Opex trajectory follows a better dynamic than estimated in the Company's Strategic Plan, with costs and expenses control performing a pivotal pillar. Year to date, the initiatives of the Efficiency Plan generated total savings of ~R$ 461 million.

Performance of Normalized Costs and Expenses Breakdown:

Personnel Costs declined 5.4% YoY in 3Q19. Such performance was mostly influenced by lower spending on benefits. Year to date, this line rose 2.0% YoY, maintaining a 9.4% participation in normalized Opex.

Selling and Marketing Expenses fell 8.6% YoY in 3Q19, reflecting the structural trends seen in the prior quarters with efficiency gains coming from initiatives toward process digitization, reduction of FISTEL expenses and lower prepaid recharging fees, as well as lower spending on advertising. In 9M19, spending on Selling and Marketing fell 4.5% vs. 9M18, despite the impact from accounting of expenses related to the right of using the TIM trademark3.

The Network and Interconnection group fell 0.7% YoY in 3Q19, helped by lower costs in the interconnection subgroup. The decrease in the ITX subgroup can be explained by: (i) decline in mobile termination rate (VU-M), (ii) lower pressure from traffic to other operators and (iii) cost reduction with content providers. The subgroup Network was negatively impacted by higher sharing costs. In 9M19, the group Network and Interconnection fell 4.4% YoY, with drivers similar to those seen in the quarter.

3 On May 17, 2018 TIM Participações and Telecom Itália entered into a trademark license agreement, formally granting TIM Part and its subsidiaries the right to use the “TIM” trademark in exchange for the payment of royalties in the amount of 0.5% of the company's net revenues.

5

General and Administrative Expenses (G&A) normalized by non-recurring effects4 rose 9.9% YoY in the quarter, mainly explained by higher expenses linked to collection services following the start of a new collection operation in late 2018. In addition to this effect, there was also an increase in spending on legal and cybersecurity projects. Year to date, G&A increased 7.3% YoY, keeping a share of 5.7% in the total normalized Opex.

Cost of Goods Sold (COGS) advanced 3.1% YoY in 3Q19, despite the reduction of sales volume in the period. In 9M19, the quarter's dynamic contributed for an increase of 7.1% YoY in COGS.

Provisions for Doubtful Accounts (Bad Debt) increased 34.4% YoY in 3Q19, a slight deceleration compared to the growth seen in 1Q19 (+49.2%) and in 2Q19 (+44.2%). It is still the most challenging cost-related line. The performance is explained by a higher revenue base exposed to the delinquency rate, due to the 8.2% YoY increase in the postpaid base in addition to a challenging macroeconomic environment (unemployment, and families' income and indebtedness). In addition, we still have the impact of changes in systems and internal processes made in the first half of the year, as well as an additional increase in bad debt level regarding the escalation of involuntarily disconnections of customers with lock-in offers. In 9M19, Bad Debt rose 42.0% vs. 9M18.

Other Operating Expenses normalized by non-recurring effects5 rose 14.6% YoY in 3Q19. The increase was mostly due to higher expenses with contingencies. Despite this increase in the quarter, in 9M19 this line fell 7.9% mainly reflecting the reduction in the FUST/FUNTEL contribution, leaving its participation in total normalized OPEX at 3.5%.

Subscriber Acquisition Costs (SAC = subsidy + commissioning + advertising expenses) totaled R$ 50.1 per gross addition in 3Q19, a decrease of 2.6% YoY following lower expenses with commissioning and advertising.

The SAC/ARPU ratio (indicating the payback per client) fell YoY reaching an even lower level of 2.1 months, compared to 2.3 months in 3Q18.

The SAC/ARPU ratio (indicating the payback per client) fell YoY reaching an even lower level of 2.1 months, compared to 2.3 months in 3Q18.

4 In 3Q19, general and administrative expenses had non-recurring effects negative by R$ 4.4 million related to legal services connected to the PIS/COFINS court order.

5 In 3Q19, other operating expenses had non-recurring effects of R$ 41 million, a net result of (a) gain from a court decision related to the exclusion of the ICMS tax from the calculation basis of PIS/COFINS; (b) revision of loss forecast to labor and tax provisions and (c) contractual losses due to system failures in the collection process.

6

FROM EBITDA TO NET INCOME

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19, +R$ 1.5 million in 1Q19, +R$ 1.1 million in 2Q18 and +R$ 220,000 in 1Q18). Net income normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19 and -R$ 1,051 million in 2Q19). Net Income normalized by tax credit and other effects (+35.2 million in 3Q19 and +R$ 865 million in 2Q19), by adjustment of deferred taxes (+R$ 30.3 million in 1Q19) and by tax credit due to the incorporation of TIM Celular by TIM S.A. (-R$ 950 million in 3Q18).

EBITDA (Earnings before interest, taxes, depreciation and amortization)

|

|

EBITDA exposure to MTR was 0.1% in 3Q19. In this quarter, net MTR (revenue – cost) was close to zero due to a drop in mobile interconnection revenues similar in size to the decline seen in the MTR cost.

|

DEPRECIATION AND AMORTIZATION (D&A) / EBIT

In 3Q19, D&A rose 2.8% YoY, explained mostly by an increase in the amortization of the 700 MHz license related to starting operations in the totality of the cities considered for its amortization. Year to date, D&A grew 4.6% YoY totaling R$ 3,072 million. Normalized EBIT in 3Q19 rose 14.1% YoY, reflecting EBITDA growth. In 9M19, Normalized EBIT totaled R$ 1,759 million, an increase of 8.9% YoY.

NET FINANCIAL RESULT

Net Financial Result in 3Q19 was negative by R$ 114 million, impacted by non-recurring effects totaling 66 million6. Excluding these effects, Normalized Net Financial Result was negative by R$ 181 million, which represents a worsening of R$ 53 million when compared to 3Q18. This difference is mainly due to the net effect between:

(i) Higher financial revenues from monetary correction over the tax credit balance stemming from the right to exclude the ICMS from the calculation basis for PIS and COFINS payments (the remaining balance at the end of each period is updated by the Selic rate until its full compensation, becoming a recurring element over the next years);

(ii) Higher financial expense from the payment of PIS/COFINS over the inflow of Interest on Capital (from TIM S.A.);

(iii) Less positive impacts based on the use of 700MHz in more cities.

In 9M19, Normalized Net Financial Result was negative by R$ 422 million, R$ 57 million higher compared to the same period in 2018.

INCOME TAX AND SOCIAL CONTRIBUTION

In 3Q19, Income Tax and Social Contribution were R$ 106 million. This amount mainly reflects the impact from the deductibility of Interest on Equity (IOE) payments amounting to R$ 748 million, approved in two tranches – July and September 2019. Excluding the non-recurring effects previously explained, Normalized Income Tax and Social Contribution stood positive in R$ 142 million, versus negative R$ 66 million in the same quarter of the prior year. Year to date, this line totals -R$ 975 million, or a normalized -R$ 44 million.

The adjusted effective rate, this quarter, was impacted by the IOE deductibility, which caused an inversion in the indicator’s signal (+29.7% in 3Q19 vs. -14.6% in 3Q18). Year to date, the adjusted effective rate was -3.3%.

NET INCOME

6 In 3Q19, Net Financial Result was impacted by non-recurring effect totaling R$ 66 million, composed of: (i) acknowledgment of monetary correction on the right of excluding ICMS from the calculation basis of PIS and COFINS payments (Financial Statement Note 9) amounting to R$ 73 million, and (ii) monetary correction of labor, tax and civil contingencies following the revision of the prognosis for loss (Financial Statement Note 24) equaling R$ 7 million.

8

Reported Net Income totaled R$ 687 million in the quarter, a decline of 48.5% YoY, explained by the non-recurring effect related to the merger of TIM Celular into TIM S.A. Year to date, Reported Net Income reached R$ 3,009 million, a 57.3% increase.

CASH FLOW, DEBT AND CAPEX

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Working Capital normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19) and according to the items in the Net Financial Results section (+R$ 66.4 million in 3Q19 and +R$ 1,051 million in 2Q19), reallocated under Cash Flow of non-operating activities.

CAPEX

Capex totaled R$ 924 million no 3Q19, up by 6.7% compared to 3Q18. Investments continue to be allocated in infrastructure (exceeding 90% of the total) mainly projects in IT, 4G technology through 700MHZ, transport network and the expansion of FTTH. Year to date, Capex totaled R$ 2,519 million, up by 2.4% YoY compared to 9M18, of which approximately 10% were destined to TIM Live (vs. ~8% in 9M18).

DEBT AND CASH

Gross Debt in 3Q19 was R$ 3,591 million, a reduction of R$ 434 million YoY. The current balance includes (i) leasing recognition in the total amount of R$ 1,427 million (related to the sale of towers, the LT Amazonas project and other financial leasing operations) and (ii) hedge position in the amount of R$ 36 million (reducing gross debt).

TIM’s debt is concentrated in long-term contracts (59% of the total) consisting mainly of BNDES financing and Debentures. Approximately 13% of the total debt is denominated in foreign currency (USD) and is fully hedged in local currency. The average cost of debt excluding leasing was 6.9% p.y., down compared to 8.2% p.y. in 3Q18. During the past 12 months, important debt prepayments were made to BNDES, which together with our normal amortization and interest payments totaled R$ 1,249 million.

At the end of the quarter, Cash and Securities totaled R$ 1,658 million, an increase of R$ 408 million YoY. The main movements that affected cash and securities in the last 12 months are presented below:

The average financial yield was 5.9% p.y. in 3Q19, down compared to 6.4% p.y. in 3Q18 following the reduction of the Selic rate. Year to date, the yield was 6.3% p.y. compared to 6.5% p.y. in 9M18.

The Net Debt/EBITDA ratio was 0.29x in the quarter, down from 0.44x in 3Q18. In 3Q19, Net Debt totaled R$ 1,933 million, a R$ 842 million decrease compared to 3Q18, when net debt was R$ 2,776 million.

QUARTER’S IMPORTANT AND SUBSEQUENT EVENTS

CVM CATEGORY A REGISTRATION REQUEST FOR TIM S.A.

On October 28, 2019 the Company's Board of Directors approved the submission of a request for registration as a publicly held company in category “A” for TIM S.A (“TSA”) to the CVM (without a securities offer), in compliance with CVM Instruction 480/09, with the appropriate reformulation and consolidation of its Bylaws. The Company and TSA emphasized that there will be no request for registration of a Securities Offer, which is why this event should not be considered as a public offering of shares or other securities by the Company or the TSA.

PAYMENT OF INTEREST ON EQUITY

The Company's Board of Directors approved on July 30, 2019 the payment of R$ 368.941.176,47 million in Interest on Equity (“IOE”), based on the result of the period ended in June 30, 2019. The payment took place on October 8, 2019, being August 9, 2019 the date for the identification of shareholders entitled to receive such values.

A second payment was approved by the Company's Board of Directors on September 25, 2019, totaling R$ 378,750,000.00 million in Interest on Equity, based on the result of the period ended in September 30, 2019. The payment will take place no later than March 31, 2020 and the date for the identification of shareholders entitled to receive such values was October 7, 2019.

The approved payments are part of a projection amounting to approximately R$ 1 billion as Interest on Equity, related to the fiscal year ending December 31, 2019.

TIM’S CONDUCT ADJUSTMENT TERM (TAC) WITH ANATEL

On August 22, 2019 ANATEL's Board of Directors unanimously approved TIM's Conduct Adjustment Term, which had been negotiated since June 2018 with the regulator. The agreement covers a sanction reference value of R$ 627 million. TIM's commitment foresees actions for improvement in three pillars - customer experience, quality and infrastructure - through initiatives associated with improvements in the licensing process of stations, efficient use of numbering resources, evolution of digital caring channels, reducing complaint rates, repairing users and strengthening transport and access networks. In addition, it includes an additional commitment to bring mobile broadband through the 4G network to 366 municipalities with less than 30,000 inhabitants reaching over 3.4 million people. The new infrastructure will be implemented in three years - more than 80% in the first two years – being guaranteed by the Company the sharing regime with the other providers.

MOU OF INFRASTRUCTURE SHARING BETWEEN TIM AND VIVO

On July 23, 2019 TIM Participações S.A. and Telefônica Brasil S.A. signed a memorandum of understanding (“MOU”) with the objective of starting negotiations on projects related to network sharing in multiple frequencies and technologies. With discussions and negotiations evolving in a good pace, the MOU was renewed for another 60 days with the objective that the companies may complete the details of the sharing agreements.

Operating and Marketing Performance

Operating and Marketing Performance

MOBILE SEGMENT:

OVERALL MARKET7

In 3Q19, the Brazilian mobile market saw a decline in total users for the 16th consecutive quarter, resulting from the consolidation of SIM cards. This result reflects the performance of the prepaid segment, which reported a decrease of 17.1 million lines in the past 12 months. The segment disconnections show an improved trajectory compared to the past four years, despite the still significant volume. The postpaid segment remains in a positive path, reporting 11.0 million net additions in the past 12 months, growth of 11.6% YoY.

TIM

TIM ended the quarter with 55.0 million active lines, slightly down QoQ and -3.0% YoY. In 3Q19, both the prepaid and postpaid segments contributed to negative net additions compared to the previous quarter.

|

|

The postpaid client base stood at 21.2 million customers in 3Q19, a 8.2% increase YoY. Net additions of 1.6 million users in the last 12 months contributed to the biggest mix ever recorded for the segment, 39% of the total base (+4.0 p.p. YoY). The new activations maintained a positive pace, resulting from the continued focus on ensuring a superior quality for its base. TIM Black Família plan accounted for 50% of gross additions in pure postpaid. In September 2019, we launched an innovative campaign for the control segment, which encourages client’s engagement through social networks, using the concept of giving a discount in exchange for a post. Despite this, in postpaid consolidated dynamic, involuntary churn was an important component in the negative performance of the base QoQ, due to the disconnection of inactive clients.

|

Prepaid reported 33.3 million users at the end of 3Q19. The reduction of 3.3 million lines in the last 12 months was lower than the market average, reaffirming TIM as the segment leader with a 27.4% share. The segment dynamics, marked by a high volume of new activations and churn, was stable in the period. In the beginning of the year, TIM launched a new offer platform for the prepaid segment named TIM Pré Top, which, in September, reached 60% of the client base of this segment. This new plan, focused in

simplifying the offering, has been helping to increase the level of commitment of the clients and generating an increase in spending per recharger by 2.2% YoY.

7 Based on data from August 2019 (ANATEL).

13

The total 4G base rose 12.5% YoY, ending 3Q19 with 37.2 million users. In line with TIM's strategy of equipping customers with handsets that provide better data usage experience, 4G handsets reached 73% of the total voice users (+12.0 p.p. YoY)8.

The M2M and Data terminals base advanced 65.3% YoY, ending 3Q19 with 3.8 million users. The accelerated growth reflects an inorganic effect, the incorporation of the user base of Porto Seguro Conecta, which took place in 2Q19.

FIXED SEGMENT:

|

In 3Q19, the TIM Live base reached 537,000 customers, growth of 19.6% YoY.

Net adds in FTTH (Fiber To The Home) continue to rise, reaching 34,000 new users in 3Q19 and 105,000 in the last 12 months. The sale of plans with faster speeds contributed for an increase in the penetration of offers above 100 mbps by +20 p.p. YoY, reaching almost 30% of total connections.

|

|

In 3Q19, three new cities were launched commercially: Recife (PE), Feira de Santana (BA) and Diadema (SP), in line with the strategy of expanding the FTTH-covered area. The Company ended 3Q19 with this technology present in 20 cities and 37% of total households covered through FTTH technology.

In the last 12 months, TIM Live Internet, the residential broadband offer through the mobile network (WTTX), was launched in 80 new cities. Compared to 2Q19, its commercial availability was stable in 166 locations. The customer base doubled in the last 12 months, similarly to 2Q19. The Company understands that the experience in the commercialization of this product is a relevant differential to explore this segment with the arrival of 5G.

8 Based on data from August 2019 (ANATEL).

14

Quality and Network

Quality and Network

QUALITY AND CUSTOMER EXPERIENCE

TIM seeks to continually improve customer experience and to move ever closer to its clients. Our 3Q19 results prove once again that we have been successful in our digital transformation initiatives, which have enabled significant advances in internal processes. As a result, these improvements generate a better user experience, reinforcing TIM's commitment to service quality.

With this mentality, the company adopts a strategy that aims to bring more empowerment to the client, based on three pillars: self-caring, self-provision and self-healing.

Meu TIM is a fundamental tool that simplifies the caring processes and provides functionalities that make it easier for the client to obtain information and manage plans, reducing communication via call centers. The 23% growth YoY in the number of unique users in the platform and the 14% reduction YoY in interactions via human customer service prove this channel's relevance to the client.

The digital mechanisms for billing and payment again reported accelerated growth in 3Q19. The invoices delivered via digital channels rose 43% YoY, while the number of users paying via digital channels advanced 11% YoY. After the launch of recharging and balance visualization on WhatsApp for prepaid clients, in 3Q19 TIM brought another feature: invoicing through the app. This channel, unprecedented in the market, is another facility that the company provides for its clients.

The digital recharge mix keeps gaining relevance, with a 6 p.p. increase YoY in 3Q19. Meanwhile, in acquisitions of Consumer postpaid and control through digital channels advanced 39% YoY. In sales, TIM has been testing two important technologies: Naked SIM and e-SIM. Sales on these options provide more freedom for clients to choose from any of the available plans, either through an electronic menu or via QR Code. TIM has been the frontrunner in testing these innovations, for it understands that both have the

disruptive power to significantly expand its sales channels and bring more comfort for the client by simplifying the acquisition process.

Another innovative opportunity the Company has explored is the development of solutions with the use of artificial intelligence. These innovations aim at generating benefits for clients such as the implementation of troubleshooting tools, which suggest corrective measures or actually solve issues. This initiative, in favor of customers, corroborates TIM's purpose to evolve continually.

NETWORK DEVELOPMENT

As an important strategic pillar in TIM's business plan, investment in infrastructure expansion and improvement is a fundamental factor to generate operating efficiency, providing enhanced quality and services expansion.

In 3Q19 more than 90% of Capex was earmarked for infrastructure projects (Network + IT), allocated more efficiently via analytical tools. Highlighted projects:

o Expansion of fiber optic network (backbone, backhaul and FTTH);

o Sites densification;

o Frequency refarming;

o Carriers aggregation;

o Sharing initiatives focused on 4G and on the transport network.

Regarding the main actions and projects underway focused on modernization, efficiency and/or enhancement of our infrastructure during this quarter, we highlight:

o Expansion of the refarming of the 2.1 GHz frequency to 4G, reaching approximately 290 cities;

o Infrastructure virtualization project;

o Installation of multiple data centers to enhance experience, being 25 at the end of 3Q, of which 14 DCC (Data Center Core) and 11 DCE (Data Center Edge);

o Expansion of VoLTE, present in more than 3,250 cities;

o Signing of a memorandum of understanding (MOU) with Vivo to start discussions about opportunities in network sharing, aiming for quality improvement and efficiency in the allocation of CAPEX and OPEX;

o Launch of the NB-IoT network in more than 3 thousand municipalities, coverage that will enable the creation of IoT solutions not only in the big cities, but also in the ones more distant to capitals. With the intention to boost the developer’s ecosystem for this type of solution, TIM was pioneer in simultaneously launching such coverage.

o Implementation of “5G Living Lab TIM” – benchmark centers for testing 5G, focused on promoting the applicability of the technology and exploring opportunities of new business models.

For another quarter, TIM was the leader in 4G coverage, reaching 3,355 cities or 93% of the country's urban population. The 35% YoY growth in network elements for this technology reinforces the Company's commitment to expand the mobile network's capacity and quality. As a result, 84% of TIM’s customer data traffic was over 4G network this quarter, up 11 p.p. compared to 3Q18.

With 1,442 active Biosites at the end of 3Q19, the development of Biosite installation projects is also aligned with the Company's corporate social responsibility values. These structures provide a solution for the densification of the mobile access network (antennas/towers) with a very low visual impact. Biosites also contribute to harmonization with the environment and urban infrastructure – a multifunctionality capable of adding telecommunications transmission, lighting and security cameras – these structures are cheaper and faster to install.

At the end of 3Q19, TIM reached a total of 19,582 sites of which 68% were connected through a high capacity backhaul. In transport infrastructure, the total fiber optic for backbone and backhaul ended the quarter at 94.9 thousand km, a 10.8% advance YoY.

FTTH initiated commercial activities in three new cities in the quarter: Recife (PE), Feira de Santana (BA) and Diadema (SP). Fixed residential broadband has 1.9 million households in FTTH, while FTTC has 3.6 million, totaling 5.1 million households in 22 cities (FTTH + FTTC)9.

Currently, the Company is authorized to use more than 110 MHz, with 36 MHz in frequencies below 1 GHz distributed as follows:

|

Average Spectrum Weighted by Population

|

|

700 MHz

|

850 MHz

|

900 MHz

|

1.800 MHz

|

2.100 MHz

|

2.500 MHz

|

|

20

|

11

|

5

|

35

|

22

|

20

|

9 (+) Rio de Janeiro (RJ), São Gonçalo (RJ), Nilópolis (RJ), Nova Iguaçu (RJ), São João do Meriti (RJ), Duque de Caxias (RJ), São Paulo (SP), Mauá (SP), Poá (SP), Suzano (SP), Francisco Morato (SP), Franco da Rocha (SP), Salvador (BA), Lauro de Freitas (BA), Camaçari (BA), Goiânia (GO), Aparecida de Goiânia (GO), Anápolis (GO) and Manaus (AM).

17

Corporate Social Responsibility

To access the quarterly report on Social and Corporate Responsibility, please refer to: www.tim.com.br/ir/ESG-Report.

Disclaimer

The consolidated financial and operating information disclosed in this document, except where otherwise indicated, is presented in accordance with the International Financial Reporting Standards (IFRS) excluding the effects of IFRS 16, and in Brazilian Reais (R$), in compliance with the Brazilian Corporate Law (Law 6,404/76). Comparisons refer to the third quarter of 2018 (3Q18) and the year to date 2019 (9M19), except where otherwise indicated.

This document may contain forward-looking statements. Such statements are not historical facts and reflect the beliefs and expectations of the Company's management. The words "anticipates,” "believes,” "estimates,” "expects,” "forecasts,” "plans,” "predicts,” "projects,” "targets" and similar words are intended to identify these statements, which necessarily involve known and unknown risks and uncertainties foreseen, or not, by the Company. Therefore, the Company’s future operating results may differ from current expectations and readers of this report should not base their assumptions exclusively on the information given herein. Forward-looking statements only reflect opinions on the date on which they are made and the Company is not obliged to update them in light of new information or future developments.

Investor Relations Contacts

Telephone Nos.: (+55 21) 4109-3360 / 4112-6048

E-mail: ri@timbrasil.com.br

Investor Relations Website: www.tim.com.br/ri

ATTACHMENTS

Attachment 1: Balance Sheet (Without effects of IFRS 16)

Attachment 2: Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 3: Income Statement (Without effects of IFRS 16)

Attachment 4: Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 5: Cash Flow Statement (Without effects of IFRS 16)

Attachment 6: Cash Flow Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 7: Operating Indicators

The Complete Financial Statements, including the Explanatory Notes, are available on the Company's Investor Relations website.

Attachment 1

TIM PARTICIPAÇÕES S.A.

Balance Sheet (Without effects of IFRS 16)

Attachment 2

TIM PARTICIPAÇÕES S.A.

Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.

Attachment 3

TIM PARTICIPAÇÕES S.A.

Income Statement (Without effects of IFRS 16)

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.1 million in 2Q18). Net income normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19 and -R$ 1,051 million in 2Q19). Net Income normalized by tax credit and other effects (+35.2 million in 3Q19 and +R$ 865 million in 2Q19), by adjustment of deferred taxes (+R$ 30.3 million in 1Q19) and by tax credit due to the incorporation of TIM Celular by TIM S.A. (-R$ 950 million in 3Q18).

Attachment 4

TIM PARTICIPAÇÕES S.A.

Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.;

**EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.1 million in 2Q18). Net income normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19 and -R$ 1,051 million in 2Q19). Net Income normalized by tax credit and other effects (+35.2 million in 3Q19 and +R$ 865 million in 2Q19), by adjustment of deferred taxes (+R$ 30.3 million in 1Q19) and by tax credit due to the incorporation of TIM Celular by TIM S.A. (-R$ 950 million in 3Q18).

Attachment 5

TIM PARTICIPAÇÕES S.A.

Cash Flow Statement (Without effects of IFRS 16)

*EBITDA normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Working Capital normalized according to the items in the Costs section (-R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19) and according to the items in the Net Financial Results section (+R$ 66.4 million in 3Q19 and +R$ 1,051 million in 2Q19), reallocated under Cash Flow of non-operating activities.

Attachment 6

TIM PARTICIPAÇÕES S.A.

Cash Flow Statement (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

*Without effects of IFRS 9, 15 and 16.

**EBITDA normalized based on the items in the Costs section (-R$ 37.1 million in 3Q19).

Attachment 7

TIM PARTICIPAÇÕES S.A.

Operating Indicators

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: November 5, 2019

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

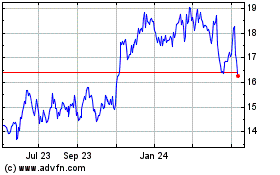

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

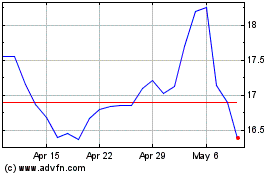

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024