UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 12)

(Name of Issuer)

Texas Pacific Land Trust

(Title of Class of Securities)

Sub-share Certificates

(CUSIP Number)

882610108

Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

Jay Kesslen

c/o Horizon Kinetics LLC

470 Park Avenue South

New York, NY 10016

(Date of Event which Requires Filing of this Statement)

December 14, 2020

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1. Names of Reporting Persons.

Horizon Kinetics Asset Management LLC

13-3776334

|

|

2. Check the Appropriate Box if a Member of a Group

|

|

(a) ☐

|

|

(b) ☐

|

|

|

|

3. SEC Use Only

|

|

4. Source of Funds

WC

|

|

|

|

5. Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

☐

|

|

6. Citizenship or Place of Organization

|

|

Delaware

|

|

Number of Shares

Beneficially

Owned by

Each Reporting

Person With:

|

7. Sole Voting Power

|

|

1,622,551

|

|

|

|

8. Shared Voting Power

|

|

|

|

|

|

9. Sole Dispositive Power

|

|

1,622,551

|

|

|

|

10. Shared Dispositive Power

|

|

|

|

|

|

11. Aggregate Amount Beneficially Owned by Each Reporting Person

|

|

1,622,551

|

|

12. Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

|

☐

|

|

13. Percent of Class Represented by Amount in Row (11)

|

|

20.92

|

|

14. Type of Reporting Person

|

|

IA

|

This Amendment No. 12 to the Schedule 13D (this "Amendment No. 12") relates to the sub-share certificates of proprietary interests (the "Shares") of Texas Pacific Land Trust ("TPL") and amends the Schedule 13D Amendment 11 filed on October 16, 2020 (the "Schedule 13D 11" and, together with this Amendment No. 12, the "Schedule 13D"). Capitalized terms used and not defined in this Amendment No. 12 have the meanings set forth in the Original Schedule 13D.

This Amendment No. 12 is being filed by Horizon Kinetics Asset Management LLC ("Horizon") a Delaware limited liability company, a wholly owned subsidiary of Horizon Kinetics LLC.

This Amendment No. 12 is being filed to amend Item 4, Item 5, Item 6 and Item 7 of the Schedule 13D as follows:

ITEM 4. PURPOSE OF TRANSACTION

Item 4 of the Schedule 13D is amended by adding the following:

As previously disclosed, on June 11, 2020, in connection with the plan of the Trust to reorganize (the "corporate reorganization") into a corporation formed under Delaware law (the "New Corporation"), Horizon Kinetics LLC and Horizon Kinetics Asset Management LLC entered into a Stockholders' Agreement (the "Stockholders' Agreement") with the Trust, SoftVest LP, SoftVest Advisors and Mission Advisors, LP.

The Stockholders' Agreement, which establishes certain features of governance for the New Corporation, provides that the agreement will terminate if the corporate reorganization has not been completed by December 31, 2020 (the "Outside Date"). On December 14, 2020, the parties entered into the First Amendment to Settlement Agreement (the "Amendment"), to change the Outside Date to January 31, 2021.

Other than as expressly modified pursuant to the Amendment, the Stockholders' Agreement, which was filed as Exhibit 10 to the Schedule 13D filed by the Reporting Persons with the U.S. Securities and Exchange Commission on June 15, 2020, remains in full force and effect.

The foregoing description of the Amendment is qualified by the full text of such amendment, which is attached hereto as Exhibit 11 and is incorporated by reference herein.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Schedule 13D is amended by adding the following:

Percentages of the Shares outstanding reported in this Amendment No. 12 are calculated based upon the 7,756,156 Shares outstanding as of October 30, 2020, as reported in TPL's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020, filed by TPL with the SEC on November 5, 2020.

The aggregate number and percentage of the class of securities identified pursuant to Item 1 beneficially owned by Horizon, on behalf of its clients, including its proprietary accounts may be found in rows 11 and 13 of the cover page, which is hereby incorporated by reference.

This Schedule 13D does not include approximately 24,166 Shares of TPL held personally by senior portfolio managers of Horizon and their families. The right to dividends from, or proceeds from the sale of such Shares resides with the beneficial owners of such accounts, and Horizon with respect to its proprietary accounts. Transactions effected by Horizon in the last 60 days are as listed below. All sales were the result of a client direction or account limitation, and no sales were made in any proprietary account.

|

Name of Reporting Person

|

Date of Transaction

|

Buy/Sale

|

Aggregate Amount of Securities

|

Average Price Per Share

|

|

Horizon Kinetics Asset Management LLC

|

10/16/2020

|

Buy

|

95

|

469.42

|

|

Horizon Kinetics Asset Management LLC

|

10/16/2020

|

Sale

|

133

|

471.45

|

|

Horizon Kinetics Asset Management LLC

|

10/19/2020

|

Buy

|

84

|

472.00

|

|

Horizon Kinetics Asset Management LLC

|

10/19/2020

|

Sale

|

89

|

472.00

|

|

Horizon Kinetics Asset Management LLC

|

10/20/2020

|

Buy

|

84

|

469.98

|

|

Horizon Kinetics Asset Management LLC

|

10/20/2020

|

Sale

|

3155

|

470.37

|

|

Horizon Kinetics Asset Management LLC

|

10/21/2020

|

Buy

|

86

|

463.05

|

|

Horizon Kinetics Asset Management LLC

|

10/21/2020

|

Sale

|

638

|

466.58

|

|

Horizon Kinetics Asset Management LLC

|

10/22/2020

|

Buy

|

93

|

479.17

|

|

Horizon Kinetics Asset Management LLC

|

10/22/2020

|

Sale

|

739

|

477.51

|

|

Horizon Kinetics Asset Management LLC

|

10/23/2020

|

Buy

|

104

|

477.98

|

|

Horizon Kinetics Asset Management LLC

|

10/23/2020

|

Sale

|

109

|

477.98

|

|

Horizon Kinetics Asset Management LLC

|

10/26/2020

|

Buy

|

135

|

472.98

|

|

Horizon Kinetics Asset Management LLC

|

10/26/2020

|

Sale

|

154

|

472.55

|

|

Horizon Kinetics Asset Management LLC

|

10/27/2020

|

Buy

|

92

|

463.20

|

|

Horizon Kinetics Asset Management LLC

|

10/27/2020

|

Sale

|

97

|

463.20

|

|

Horizon Kinetics Asset Management LLC

|

10/28/2020

|

Buy

|

94

|

449.49

|

|

Horizon Kinetics Asset Management LLC

|

10/28/2020

|

Sale

|

316

|

449.34

|

|

Horizon Kinetics Asset Management LLC

|

10/29/2020

|

Buy

|

317

|

464.62

|

|

Horizon Kinetics Asset Management LLC

|

10/29/2020

|

Sale

|

332

|

464.32

|

|

Horizon Kinetics Asset Management LLC

|

10/30/2020

|

Buy

|

92

|

450.41

|

|

Horizon Kinetics Asset Management LLC

|

10/30/2020

|

Sale

|

822

|

453.74

|

|

Horizon Kinetics Asset Management LLC

|

11/2/2020

|

Buy

|

92

|

465.44

|

|

Horizon Kinetics Asset Management LLC

|

11/2/2020

|

Sale

|

97

|

465.44

|

|

Horizon Kinetics Asset Management LLC

|

11/3/2020

|

Buy

|

303

|

483.35

|

|

Horizon Kinetics Asset Management LLC

|

11/3/2020

|

Sale

|

536

|

481.54

|

|

Horizon Kinetics Asset Management LLC

|

11/4/2020

|

Buy

|

95

|

474.51

|

|

Horizon Kinetics Asset Management LLC

|

11/4/2020

|

Sale

|

100

|

474.51

|

|

Horizon Kinetics Asset Management LLC

|

11/5/2020

|

Buy

|

426

|

506.83

|

|

Horizon Kinetics Asset Management LLC

|

11/5/2020

|

Sale

|

470

|

505.43

|

|

Horizon Kinetics Asset Management LLC

|

11/6/2020

|

Buy

|

91

|

497.58

|

|

Horizon Kinetics Asset Management LLC

|

11/6/2020

|

Sale

|

253

|

499.43

|

|

Horizon Kinetics Asset Management LLC

|

11/9/2020

|

Buy

|

133

|

574.98

|

|

Horizon Kinetics Asset Management LLC

|

11/9/2020

|

Sale

|

235

|

576.12

|

|

Horizon Kinetics Asset Management LLC

|

11/10/2020

|

Buy

|

124

|

556.02

|

|

Horizon Kinetics Asset Management LLC

|

11/10/2020

|

Sale

|

129

|

556.02

|

|

Horizon Kinetics Asset Management LLC

|

11/11/2020

|

Buy

|

113

|

540.25

|

|

Horizon Kinetics Asset Management LLC

|

11/11/2020

|

Sale

|

118

|

540.25

|

|

Horizon Kinetics Asset Management LLC

|

11/12/2020

|

Buy

|

89

|

537.22

|

|

Horizon Kinetics Asset Management LLC

|

11/12/2020

|

Sale

|

94

|

537.22

|

|

Horizon Kinetics Asset Management LLC

|

11/13/2020

|

Buy

|

99

|

549.85

|

|

Horizon Kinetics Asset Management LLC

|

11/13/2020

|

Sale

|

104

|

549.85

|

|

Horizon Kinetics Asset Management LLC

|

11/16/2020

|

Buy

|

121

|

579.99

|

|

Horizon Kinetics Asset Management LLC

|

11/16/2020

|

Sale

|

174

|

576.15

|

|

Horizon Kinetics Asset Management LLC

|

11/17/2020

|

Buy

|

142

|

583.01

|

|

Horizon Kinetics Asset Management LLC

|

11/17/2020

|

Sale

|

176

|

582.21

|

|

Horizon Kinetics Asset Management LLC

|

11/18/2020

|

Buy

|

116

|

581.59

|

|

Horizon Kinetics Asset Management LLC

|

11/20/2020

|

Buy

|

404

|

579.17

|

|

Horizon Kinetics Asset Management LLC

|

11/20/2020

|

Sale

|

270

|

575.63

|

|

Horizon Kinetics Asset Management LLC

|

11/24/2020

|

Buy

|

10

|

630.00

|

|

Horizon Kinetics Asset Management LLC

|

11/24/2020

|

Sale

|

5

|

618.05

|

|

Horizon Kinetics Asset Management LLC

|

11/25/2020

|

Buy

|

111

|

622.98

|

|

Horizon Kinetics Asset Management LLC

|

11/25/2020

|

Sale

|

110

|

617.34

|

|

Horizon Kinetics Asset Management LLC

|

11/27/2020

|

Buy

|

160

|

591.87

|

|

Horizon Kinetics Asset Management LLC

|

11/27/2020

|

Sale

|

129

|

591.23

|

|

Horizon Kinetics Asset Management LLC

|

11/30/2020

|

Buy

|

108

|

609.92

|

|

Horizon Kinetics Asset Management LLC

|

11/30/2020

|

Sale

|

113

|

609.92

|

|

Horizon Kinetics Asset Management LLC

|

12/1/2020

|

Buy

|

116

|

614.01

|

|

Horizon Kinetics Asset Management LLC

|

12/1/2020

|

Sale

|

121

|

614.01

|

|

Horizon Kinetics Asset Management LLC

|

12/2/2020

|

Buy

|

122

|

620.20

|

|

Horizon Kinetics Asset Management LLC

|

12/2/2020

|

Sale

|

130

|

620.16

|

|

Horizon Kinetics Asset Management LLC

|

12/3/2020

|

Buy

|

189

|

640.52

|

|

Horizon Kinetics Asset Management LLC

|

12/3/2020

|

Sale

|

204

|

639.79

|

|

Horizon Kinetics Asset Management LLC

|

12/4/2020

|

Buy

|

187

|

669.96

|

|

Horizon Kinetics Asset Management LLC

|

12/4/2020

|

Sale

|

192

|

669.96

|

|

Horizon Kinetics Asset Management LLC

|

12/7/2020

|

Buy

|

167

|

669.39

|

|

Horizon Kinetics Asset Management LLC

|

12/7/2020

|

Sale

|

176

|

669.39

|

|

Horizon Kinetics Asset Management LLC

|

12/8/2020

|

Buy

|

167

|

672.00

|

|

Horizon Kinetics Asset Management LLC

|

12/8/2020

|

Sale

|

305

|

668.83

|

|

Horizon Kinetics Asset Management LLC

|

12/9/2020

|

Buy

|

167

|

682.88

|

|

Horizon Kinetics Asset Management LLC

|

12/9/2020

|

Sale

|

452

|

677.60

|

|

Horizon Kinetics Asset Management LLC

|

12/10/2020

|

Buy

|

167

|

693.02

|

|

Horizon Kinetics Asset Management LLC

|

12/10/2020

|

Sale

|

172

|

693.02

|

|

Horizon Kinetics Asset Management LLC

|

12/11/2020

|

Buy

|

156

|

692.00

|

|

Horizon Kinetics Asset Management LLC

|

12/11/2020

|

Sale

|

201

|

692.00

|

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Item 6 of the Schedule 13D is amended by adding the following:

The response to Item 4 of this Amendment No. 12 is incorporated herein by reference.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Item 7 of the Schedule 13D is amended by adding thereto the following:

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: December 14, 2020

/s/ Jay Kesslen

Jay Kesslen

General Counsel

Horizon Kinetics LLC

Horizon Kinetics Asset Management LLC

FIRST AMENDMENT TO STOCKHOLDERS' AGREEMENT

This FIRST AMENDMENT TO STOCKHOLDERS' AGREEMENT (this "Amendment") is made and entered into as of December 14, 2020, by and among Texas Pacific Land Trust (the "Trust"), on the one hand, and Horizon Kinetics LLC ("Horizon Kinetics") and Horizon Kinetics Asset Management LLC (together with Horizon Kinetics and collectively with their Affiliates, "Horizon"), SoftVest Advisors, LLC ("SoftVest Advisors") and SoftVest, L.P. (together with SoftVest Advisors, their respective Affiliates and Horizon, the "Investor Group"), and Mission Advisors, LP (together with the Investor Group and its members, collectively, the "Stockholders"), on the other hand. The Trust and the Stockholders are each herein referred to as a "party" and collectively as the "parties." Capitalized terms used but not defined herein shall have the meaning set forth in the Stockholders Agreement (as defined below) for such term.

WHEREAS, the parties previously entered into that certain Stockholders' Agreement, dated June 11, 2020 (the "Stockholders' Agreement");

WHEREAS, pursuant to Section 11(a)(i)(C) of the Stockholders' Agreement, subject to certain terms and conditions, the Stockholders' Agreement shall terminate, if the Distribution Time has not yet occurred, on December 31, 2020 (the "Outside Date"); and

WHEREAS, the parties desire to amend the Stockholders' Agreement to provide that the Outside Date be January 31, 2021.

NOW, THEREFORE, in consideration of the foregoing premises, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound hereby, agree as follows:

Section 11(a)(i)(C) of the Stockholders' Agreement is hereby deleted in its entirety and replaced with the following words: "January 31, 2021 (the "Outside Date")".

This Amendment modifies the Stockholders' Agreement only to the extent set forth herein. Except as specifically amended by this Amendment, the Stockholders' Agreement shall remain in full force and effect in accordance with its terms and is hereby ratified and confirmed. In the event of any conflict between the terms of this Amendment and the Stockholders' Agreement, this Amendment shall control.

This Amendment, and any disputes arising out of or related to this Amendment (whether for breach of contract, tortious conduct or otherwise), shall be governed by, and construed in accordance with, the laws of the State of Delaware, without regard to conflict of laws principles that would require the application of laws of another jurisdiction.

This Amendment may be executed in one or more textually identical counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement. Signatures to this Amendment transmitted by facsimile transmission, by electronic mail in "portable document format" (".pdf") form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document bearing the original signature.

This Amendment shall be binding upon, inure to the benefit of, and be enforceable by and against the permitted successors and assigns of each party.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties has executed this Amendment, or caused the same to be executed by its duly authorized representative, as of the date first above written.

|

|

TEXAS PACIFIC LAND TRUST

|

|

|

|

|

|

By: /s/David E. Barry

|

|

|

Name: David E. Barry

|

|

|

Title: Trustee

|

|

|

|

|

|

|

|

|

By: /s/John R. Norris III

|

|

|

Name: John R. Norris III

|

|

|

Title: Trustee

|

|

|

Horizon Kinetics LLC

|

|

|

|

|

|

By: /s/Jay Kesslen

|

|

|

Name: Jay Kesslen

|

|

|

Title: General Counsel

|

|

|

|

|

|

Horizon Kinetics Asset Management LLC

|

|

|

|

|

|

By: /s/ Jay Kesslen

|

|

|

Name: Jay Kesslen

|

|

|

Title: General Counsel

|

|

|

|

|

|

|

|

|

SoftVest Advisors, LLC

|

|

|

|

|

|

By: /s/Eric L. Oliver

|

|

|

Name: Eric L. Oliver

|

|

|

Title: President

|

|

|

|

|

|

|

|

|

SoftVest, L.P.

|

|

|

|

|

|

By: /s/Eric L. Oliver

|

|

|

Name: Eric L. Oliver

|

|

|

Title: President

|

|

|

Mission Advisors, LP

|

|

|

|

|

|

By: /s/Dana F. McGinnis

|

|

|

Name: Dana F. McGinnis

|

|

|

Title: Chief Investment Officer

|

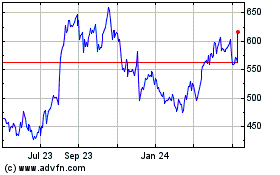

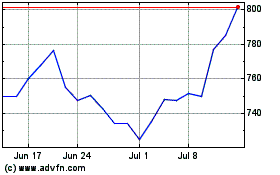

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2023 to Apr 2024