FALSE000009713400000971342025-02-172025-02-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | February 17, 2025 |

| | |

| TENNANT COMPANY |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Minnesota | 1-16191 | 41-0572550 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

10400 Clean Street Eden Prairie, Minnesota | 55344 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code | 763 540-1200 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.375 per share | | TNC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 17, the company issued the news release attached hereto as Exhibit 99 and incorporated herein by reference.

The information in this Item 2.02 and Exhibit 99 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Tennant Company |

| | |

| Date: February 17, 2025 | By: | /s/ Fay West |

| | Fay West

Senior Vice President and Chief Financial Officer |

Exhibit 99

Exhibit 99

Tennant Company Reports 2024 Fourth-Quarter and

Full-Year Results

Record Full-Year Net Sales and Adjusted EBITDA

Expanded Adjusted EBITDA Margin to 16.2%

Introduces Full-Year Guidance for 2025

MINNEAPOLIS, MN (Feb. 17, 2025)—Tennant Company ("Tennant" or the "Company") (NYSE: TNC) today reported its fourth-quarter and full-year financial results for 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | Incr / (Decr) | | 2024 | | 2023 | | Incr / (Decr) |

| Net sales | $ | 328.9 | | | $ | 311.4 | | | 5.6 | % | | $ | 1,286.7 | | | $ | 1,243.6 | | | 3.5 | % |

| Net income | $ | 6.6 | | | $ | 31.0 | | | (78.7) | % | | $ | 83.7 | | | $ | 109.5 | | | (23.6) | % |

| Diluted EPS | $ | 0.35 | | | $ | 1.64 | | | (78.7) | % | | $ | 4.38 | | | $ | 5.83 | | | (24.9) | % |

| | | | | | | | | | | |

Adjusted diluted EPS(a) | $ | 1.52 | | | $ | 1.92 | | | (20.8) | % | | $ | 6.57 | | | $ | 6.57 | | | — | % |

Adjusted EBITDA(a) | $ | 47.4 | | | $ | 41.5 | | | 14.2 | % | | $ | 208.8 | | | $ | 192.9 | | | 8.2 | % |

Adjusted EBITDA margin(a) | 14.4 | % | | 13.3 | % | | 110 bps | | 16.2 | % | | 15.5 | % | | 70 bps |

Highlights

•Fourth-quarter net sales increased 5.6% to $328.9 million. Organic growth of 6.3% led by volume growth in the Americas and EMEA.

•Delivered full-year net sales of $1,286.7 million, marking a 3.5% increase from 2023. Organic growth of 3.2% driven by price growth across all regions, favorable product and channel mix, and volume growth in the Americas.

•Achieved full-year adjusted EBITDA(a) of $208.8 million, an 8.2% increase compared to 2023. Full-year adjusted EBITDA margin(a) of 16.2% improved by 70 basis points, driven by strong sales growth driving increased operating leverage year over year.

•Generated full-year operating cash flow of $89.7 million and returned $41.0 million of capital to shareholders in 2024 through dividends and share repurchases. Board of Directors authorized new share repurchase program of 2,000,000 shares of the Company's common stock, in addition to approximately 580,000 shares remaining under its current repurchase program.

•Tennant announces the new X6 ROVR, a larger purpose-built AMR scrubber targeting retail, education, healthcare, manufacturing, logistics, warehousing, and large public spaces. The X6 ROVR also features a fully integrated autonomous charging station, eliminating the daily need for an operator to remember to charge the machine. Both the X6 ROVR and XC1 will be commercially available in the second quarter of 2025.

“We are pleased to report on Tennant's strong finish to a successful 2024. We achieved record results in 2024 with strong organic sales growth and margin expansion aligned with our long-range targets,” said Dave Huml,

(a)See Supplemental non-GAAP financial tables below for a reconciliation of adjusted non-GAAP financial measures to GAAP.

(more)

Page 2 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

Tennant President and Chief Executive Officer. “In the fourth quarter, we maintained our positive trajectory, achieving the third quarter of near double-digit order growth and shifting our mix to volume-driven growth.

Our talented global team is well-positioned to build on this momentum and to continue executing our growth strategies, including new products and expanded channels.

"Looking forward to 2025, we anticipate a stable demand environment outside of APAC and we are confident in our plans to deliver mid-single-digit order growth. However, this will not fully offset the year-over-year impact of backlog reduction, resulting in a decrease in organic sales on a constant currency basis between 1% to 4%. We anticipate that through prudent cost management and increased operating efficiencies we will deliver year-over-year margin expansion."

Net Sales

Consolidated net sales for the fourth quarter of 2024 totaled $328.9 million, a 5.6% increase compared to consolidated net sales of $311.4 million in the fourth quarter of 2023. Consolidated net sales for the full year 2024 totaled $1,286.7 million, a 3.5% increase compared to consolidated net sales of $1,243.6 million in 2023. Net sales performance benefited from a reduction of backlog of approximately $125 million in 2024 compared to $140 million in 2023. The components of the consolidated net sales change were as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 vs. 2023 |

| Price | | 0.8% | | 2.5% |

| Volume | | 5.5% | | 0.7% |

| Organic growth | | 6.3% | | 3.2% |

| Acquisitions | | 0.1% | | 0.7% |

| Foreign currency | | (0.8)% | | (0.4)% |

| Total growth | | 5.6% | | 3.5% |

Organic Sales

Organic sales, which exclude the effects of foreign currency and acquisitions, grew in both the fourth quarter and full year 2024 compared to 2023. Growth in the fourth quarter of 2024 was driven by volume growth in the Americas and EMEA, partially offset by price and volume declines in APAC. Full year 2024 growth was driven by price realization in all geographies and volume growth in the Americas, which was partially offset by volume declines in EMEA and APAC.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2024 | | Twelve Months Ended December 31, 2024 |

| Americas | | EMEA | | APAC | | Total | | Americas | | EMEA | | APAC | | Total |

| Organic net sales growth | 10.0% | | 4.0% | | (19.0)% | | 6.3% | | 6.3% | | (1.6)% | | (9.5)% | | 3.2% |

Americas: The 10% growth in the Americas during the fourth quarter was driven primarily by volume growth in equipment and service. Pricing realization also contributed to the organic growth, but to a lesser extent. The 6.3% growth during the full year was driven by price realization and volume increases in equipment and service, partially offset by volume declines in parts and consumables in North America.

Page 3 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

EMEA: The 4.0% increase in EMEA during the fourth quarter was driven by volume growth and price realization across all product categories. The 1.6% decline for the full year was due to volume declines in both equipment and parts and consumables partially offset by price realization in all product categories. During the first three quarters, equipment volumes were affected by weaker-than-expected market conditions and the effects of a stronger backlog reduction in the prior period. However, in the fourth quarter, market conditions improved, leading to a rebound in equipment volumes.

APAC: The 19.0% decrease in APAC during the fourth quarter and the 9.5% decline during the full year were mainly due to volume declines, partly offset by price realization in China and Australia. In China, market saturation continues to cause pricing pressure and margin compression as demand for our mid-tier products decreases. In Australia, there are signals of slowing demand due to market uncertainty, with some specific instances of customers delaying equipment orders or opting for rental units instead.

Operating Results

Gross profit margin decreased to 41.3% in the fourth quarter, down from 42.0% in the prior year. This decline was primarily due to inflation on materials and services, partially offset by a restructuring-related charge in the prior-year period. For the full year 2024, gross profit margin increased to 42.7%, compared to 42.4% in 2023. The adjusted gross profit margin(a) increased by 20 basis points compared to 2023, as pricing and cost-out initiatives more than offset the impact of inflation during the year.

Selling and Administrative ("S&A") expense was $116.4 million in the fourth quarter of 2024, a $20.7 million increase compared to the fourth quarter of 2023. S&A expense for the full year 2024 was $391.9 million, a $39.3 million increase compared to 2023. The increase in both periods was primarily driven by Enterprise Resource Planning ("ERP") modernization costs, legal contingency costs, restructuring-related charges and transaction and integration costs. When excluding these items, Adjusted S&A expense(a) as a percentage of net sales for the fourth quarter 2024 improved to 27.4% compared to 29.9% in 2023. Full-year adjusted S&A expense(a) as a percentage of net sales improved to 27.4%, compared to 28.0% in 2023. This positive S&A expense leverage in both periods was primarily driven by improved operating performance and diligent cost management throughout the year.

Adjusted EBITDA(a) was $47.4 million in the fourth quarter of 2024, compared to $41.5 million in 2023. Adjusted EBITDA margin(a) for the fourth quarter 2024 was 14.4%, a 110-basis-point increase from 2023. For the full year 2024, Adjusted EBITDA(a) was $208.8 million, compared to $192.9 million in 2023, an increase of $15.9 million. Adjusted EBITDA margin(a) for the full year 2024 was 16.2%, a 70-basis-point increase from 2023. The increase in both periods was primarily driven by strong sales growth and improved S&A leverage throughout the year.

Net income was $6.6 million in the fourth quarter of 2024, a $24.4 million decrease compared to the fourth quarter of 2023. Net income for the full year 2024 was $83.7 million, a decrease of $25.8 million compared to 2023. The decrease in both periods was primarily driven by higher nonoperating costs discussed above, partly offset by higher net sales. Additionally, there were discrete noncash exceptional tax items that favorably impacted income taxes in both years, with a larger impact in the prior year.

Adjusted net income(a) was $29.0 million in the fourth quarter of 2024, a $7.2 million decrease compared to the fourth quarter of 2023. The decrease was primarily driven by an increase in income tax expense, partly offset by improved operating performance in the fourth quarter of 2024. Adjusted net income(a) for the full year 2024 was

(a)See Supplemental non-GAAP financial tables below for a reconciliation of adjusted non-GAAP financial measures to GAAP.

(more)

Page 4 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

$125.5 million, an increase of $2.1 million compared to 2023. The increase was primarily driven by higher net sales and improvements in gross margin, partly offset by higher S&A costs, research and development ("R&D") costs, as well as a higher effective tax rate.

Cash Flow, Liquidity and Capital Allocation

Tennant generated $89.7 million in cash flow from operations in 2024 compared to $188.4 million in 2023. Operating cash flow in 2024 was impacted by investments in the ERP modernization project as well as working capital investments related to inventory. Tennant generated free cash flow of $68.8 million in 2024, which included investments in ERP modernization of $37.3 million. When excluding ERP modernization cash flows, the Company converted 113% of net income to free cash flow in 2024.

Liquidity remained strong with a balance of $99.8 million in cash and cash equivalents as of the end of 2024, and $449.3 million of unused borrowing capacity under its revolving credit facility.

The Company continues to strategically deploy cash flow to meet operational capital requirements and to return capital to shareholders in alignment with its capital allocation priorities. In 2024, the Company invested $20.9 million in capital expenditures and returned $41.0 million to shareholders through dividends and share repurchases. The Company remains diligent in managing its debt and maintaining a strong balance sheet. The Company's net leverage ratio was 0.48 times Adjusted EBITDA, which is below its targeted range of 1x to 2x Adjusted EBITDA.

2025 Guidance

For 2025, Tennant provides the following guidance ranges:

| | | | | |

| (In millions, except per share data) | 2025

Guidance Ranges |

| Net sales | $1,210 - $1,250 |

| Organic net sales decline | (1.0)% - (4.0)% |

| Diluted net income per share | $3.80 - $4.30 |

| Adjusted diluted net income per share** | $5.70 - $6.20 |

| Adjusted EBITDA** | $196 - $209 |

| Adjusted EBITDA margin** | 16.2% - 16.7% |

| Capital expenditures | ~$20 |

| Adjusted effective tax rate** | 23% - 27% |

**Excludes ERP modernization costs and amortization expense.

Conference Call

Tennant will host a conference call to discuss its 2024 fourth-quarter and full-year results on February 18, 2025, at 9 a.m. Central Time (10 a.m. Eastern Time). The conference call and accompanying slides will be available via webcast on Tennant's investor website. To listen to the call live and view the slide presentation, go to investors.tennantco.com and click on the link at the bottom of the overview page. A replay of the conference call, with slides, will be available at investors.tennantco.com.

Company Profile

Founded in 1870, Tennant Company (TNC), headquartered in Eden Prairie, Minnesota, is a world leader in the design, manufacture and marketing of solutions that help create a cleaner, safer and healthier world. Its

(a)See Supplemental non-GAAP financial tables below for a reconciliation of adjusted non-GAAP financial measures to GAAP.

(more)

Page 5 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

products include equipment for maintaining surfaces in industrial, commercial and outdoor environments; detergent-free and other sustainable cleaning technologies; and cleaning tools and supplies. Tennant's global field service network is the most extensive in the industry. Tennant Company had sales of $1.29 billion in 2024 and has approximately 4,500 employees. Tennant has manufacturing operations throughout the world and sells products directly in more than 21 countries and through distributors in more than 100 countries. For more information, visit www.tennantco.com and www.ipcworldwide.com. The Tennant Company logo and other trademarks designated with the symbol “®” are trademarks of Tennant Company registered in the United States and/or other countries.

Forward-Looking Statements

Certain statements contained in this document are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. These statements do not relate to strictly historical or current facts and provide current expectations or forecasts of future events. Any such expectations or forecasts of future events are subject to a variety of factors. These include factors that affect all businesses operating in a global market as well as matters specific to us and the markets the Company serves. Particular risks and uncertainties presently facing it include: economic uncertainty throughout the world; geopolitical tensions or health epidemics; the Company's ability to comply with global laws and regulations; the Company's ability to adapt pricing to the competitive marketplace and customer pricing sensitivities; the competition in the Company's business; fluctuations in the cost, quality or availability of raw materials and purchased components; increasing cost pressures; unforeseen product liability claims or product quality issues; the Company's ability to attract, retain and develop key personnel and create effective succession planning strategies; the Company's ability to effectively develop and manage strategic planning and growth processes and the related operational plans; the Company's ability to successfully upgrade and evolve its information technology systems; the Company's ability to successfully protect our information technology systems from cybersecurity risks; the occurrence of a significant business interruption; the Company's ability to maintain the health and safety of its workers; the Company's ability to integrate acquisitions; and the Company's ability to develop and commercialize new innovative products and services.

The Company cautions that forward-looking statements must be considered carefully and that actual results may differ in material ways due to risks and uncertainties both known and unknown. Information about factors that could materially affect the Company's results can be found in its 2024 Form 10-K. Shareholders, potential investors and other readers are urged to consider these factors in evaluating forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements.

The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Investors are advised to consult any further disclosures by the Company in its filings with the Securities and Exchange Commission and in other written statements on related subjects. It is not possible to anticipate or foresee all risk factors, and investors should not consider any list of such factors to be an exhaustive or complete list of all risks or uncertainties.

Non-GAAP Financial Measures

This news release and the related conference call include presentation of Non-GAAP measures that include or exclude special items of a nonrecurring and/or nonoperational nature (hereinafter referred to as “special items”). Management believes that the Non-GAAP measures provide useful information to investors regarding the Company’s results of operations and financial condition because they permit a more meaningful comparison and understanding of Tennant Company’s operating performance for the current, past or future periods. Management uses these Non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of the comparative operating performance of the Company.

The Company believes that disclosing selling and administrative (“S&A”) expense – as adjusted, S&A expense as a percent of net sales – as adjusted, operating income – as adjusted, operating margin – as adjusted, income before income taxes – as adjusted, income tax expense – as adjusted, net income – as adjusted, net income per diluted share – as adjusted, EBITDA – as adjusted, and EBITDA margin – as adjusted (collectively, the “Non-GAAP measures”), excluding the impacts from special items, is useful to investors as a measure of operating performance. The Company uses these measures to monitor and evaluate operating performance. The Non-GAAP measures are financial measures that do not reflect United States Generally Accepted

Page 6 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

Accounting Principles (GAAP). The Company calculates the Non-GAAP measures by adjusting for legal contingency costs, ERP modernization costs, restructuring-related costs, transaction-related costs and amortization expense. The Company calculates income tax expense – as adjusted by adjusting for the tax effect of these Non-GAAP measures. The Company calculates net income per diluted share – as adjusted by adjusting for the after-tax effect of these Non-GAAP measures and dividing the result by the diluted weighted average shares outstanding. The Company calculates EBITDA margin – as adjusted by dividing EBITDA – as adjusted by net sales.

INVESTOR RELATIONS CONTACT:

Lorenzo Bassi

Vice President, Finance and Investor Relations

investors@tennantco.com

763-540-1242

FINANCIAL TABLES FOLLOW

Page 7 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except shares and per share data) | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 328.9 | | | $ | 311.4 | | | $ | 1,286.7 | | | $ | 1,243.6 | |

| Cost of sales | 192.9 | | | 180.6 | | | 736.7 | | | 715.8 | |

| Gross profit | 136.0 | | | 130.8 | | | 550.0 | | | 527.8 | |

| Selling and administrative expense | 116.4 | | | 95.7 | | | 391.9 | | | 352.6 | |

| Research and development expense | 12.0 | | | 10.6 | | | 43.8 | | | 36.6 | |

| Operating income | 7.6 | | | 24.5 | | | 114.3 | | | 138.6 | |

| Interest expense, net | (1.6) | | | (2.5) | | | (9.1) | | | (13.5) | |

| Net foreign currency transaction (loss) gain | — | | | (0.2) | | | 0.1 | | | 0.3 | |

| Other (expense) income, net | (0.7) | | | 0.2 | | | (0.5) | | | (1.6) | |

| Income before income taxes | 5.3 | | | 22.0 | | | 104.8 | | | 123.8 | |

| Income tax (benefit) expense | (1.3) | | | (9.0) | | | 21.1 | | | 14.3 | |

| Net income | $ | 6.6 | | | $ | 31.0 | | | $ | 83.7 | | | $ | 109.5 | |

| | | | | | | |

| Net income per share | | | | | | | |

| Basic | $ | 0.36 | | | $ | 1.67 | | | $ | 4.46 | | | $ | 5.92 | |

| Diluted | $ | 0.35 | | | $ | 1.64 | | | $ | 4.38 | | | $ | 5.83 | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 18,775,004 | | 18,579,763 | | 18,786,871 | | 18,509,523 |

| Diluted | 19,044,968 | | 18,906,887 | | 19,096,138 | | 18,783,633 |

GEOGRAPHICAL NET SALES(1) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Americas | $ | 226.4 | | | $ | 208.1 | | | 8.8 | % | | $ | 888.5 | | | $ | 840.3 | | | 5.7 | % |

| Europe, Middle East and Africa | 83.9 | | | 80.3 | | | 4.5 | % | | 318.5 | | | 314.4 | | | 1.3 | % |

| Asia Pacific | 18.6 | | | 23.0 | | | (19.1) | % | | 79.7 | | | 88.9 | | | (10.3) | % |

| Total | $ | 328.9 | | | $ | 311.4 | | | 5.6 | % | | $ | 1,286.7 | | | $ | 1,243.6 | | | 3.5 | % |

(1) Net of intercompany sales.

Page 8 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | | | | | | | | | |

| (In millions, except shares and per share data) | | | |

| December 31 | 2024 | | 2023 |

| ASSETS | | | |

| Cash, cash equivalents, and restricted cash | $ | 99.8 | | | $ | 117.1 | |

Receivables, less allowances of $7.1 and $7.2, respectively | 259.1 | | | 247.6 | |

| Inventories | 183.8 | | | 175.9 | |

| Prepaid and other current assets | 33.9 | | | 28.5 | |

| Total current assets | 576.6 | | | 569.1 | |

Property, plant and equipment, less accumulated depreciation of $310.9 and $304.0, respectively | 184.4 | | | 187.7 | |

| Operating lease assets | 54.6 | | | 41.7 | |

| Goodwill | 185.6 | | | 187.4 | |

| Intangible assets, net | 58.7 | | | 63.1 | |

| Other assets | 130.2 | | | 64.4 | |

| Total assets | $ | 1,190.1 | | | $ | 1,113.4 | |

| LIABILITIES AND TOTAL EQUITY | | | |

| Current portion of long-term debt | $ | 1.3 | | | $ | 6.4 | |

| Accounts payable | 126.9 | | | 111.4 | |

| Employee compensation and benefits | 60.5 | | | 67.3 | |

| Other current liabilities | 103.5 | | | 88.6 | |

| Total current liabilities | 292.2 | | | 273.7 | |

| Long-term debt | 198.2 | | | 194.2 | |

| Long-term operating lease liabilities | 36.3 | | | 27.4 | |

| Employee-related benefits | 13.5 | | | 13.3 | |

| Deferred income taxes | 4.9 | | | 5.0 | |

| Other liabilities | 22.9 | | | 21.5 | |

| Total long-term liabilities | 275.8 | | | 261.4 | |

| Total liabilities | $ | 568.0 | | | $ | 535.1 | |

Common Stock, $0.375 par value; 60,000,000 shares authorized; 18,849,456 and 18,631,384 shares issued and outstanding, respectively | 7.1 | | | 7.0 | |

| Additional paid-in capital | 76.7 | | | 64.9 | |

| Retained earnings | 609.7 | | | 547.4 | |

| Accumulated other comprehensive loss | (72.7) | | | (42.3) | |

| Total Tennant Company shareholders' equity | 620.8 | | | 577.0 | |

| Noncontrolling interest | 1.3 | | | 1.3 | |

| Total equity | 622.1 | | | 578.3 | |

| Total liabilities and total equity | $ | 1,190.1 | | | $ | 1,113.4 | |

Page 9 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) | | | | | | | | | | | |

| (In millions) | |

| December 31 | 2024 | | 2023 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 83.7 | | | $ | 109.5 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation expense | 40.1 | | | 36.4 | |

| Amortization expense | 15.0 | | | 14.7 | |

| Deferred income tax benefit | (9.8) | | | (26.9) | |

| Share-based compensation expense | 11.9 | | | 11.6 | |

| Bad debt and returns expense | 3.4 | | | 3.4 | |

| Other, net | 0.6 | | | 1.3 | |

| Changes in operating assets and liabilities: | | | |

| Receivables | (15.0) | | | 4.1 | |

| Inventories | (33.0) | | | 14.3 | |

| Accounts payable | 15.4 | | | (15.3) | |

| Employee compensation and benefits | (5.2) | | | 22.3 | |

| Other assets and liabilities | (17.4) | | | 13.0 | |

| Net cash provided by operating activities | 89.7 | | | 188.4 | |

| INVESTING ACTIVITIES | | | |

| Purchases of property, plant and equipment | (20.9) | | | (22.8) | |

| Purchase of investment | (32.1) | | | — | |

| Payments made in connection with business acquisition, net of cash acquired | (25.7) | | | — | |

| Investment in leased assets | (0.5) | | | (1.2) | |

| Cash received from leased assets | 0.8 | | | 0.8 | |

| Net cash used in investing activities | (78.4) | | | (23.2) | |

| FINANCING ACTIVITIES | | | |

| Proceeds from borrowings | 40.9 | | | 20.0 | |

| Repayments of borrowings | (42.5) | | | (120.0) | |

| Payment of debt financing costs | (2.2) | | | — | |

| Change in finance lease obligations | — | | | 0.2 | |

Proceeds from exercise of stock options, net of employee tax withholdings obligations of $3.8, $1.7, and $2.0, respectively | 19.6 | | | 19.0 | |

| Repurchases of common stock | (19.6) | | | (21.7) | |

| Dividends paid | (21.4) | | | (20.1) | |

| Net cash used in financing activities | (25.2) | | | (122.6) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (3.4) | | | (2.9) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (17.3) | | | 39.7 | |

| Cash, cash equivalents and restricted cash at beginning of year | 117.1 | | | 77.4 | |

| Cash, cash equivalents and restricted cash at end of year | $ | 99.8 | | | $ | 117.1 | |

Page 10 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Net Income and Net Income Per Share

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | Three Months Ended December 31, | | Twelve Months Ended December 31, | |

| 2024 | | 2023 | | 2024 | | 2023 | |

| Net income - as reported | $ | 6.6 | | | $ | 31.0 | | | $ | 83.7 | | | $ | 109.5 | | |

| Adjustments: | | | | | | | | |

| Amortization expense | 2.6 | | | 2.7 | | | 11.0 | | | 10.6 | | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.5 | | | — | | | 0.5 | | |

Restructuring-related charge (S&A expense) (2) | 5.6 | | | 0.8 | | | 6.0 | | | 1.6 | | |

ERP modernization costs (S&A expense) (3) | 3.5 | | | 1.2 | | | 10.5 | | | 1.2 | | |

Transaction and integration-related costs (S&A expense) (4) | 0.4 | | | — | | | 4.0 | | | — | | |

Legal contingency costs (S&A expense) (5) | 10.3 | | | — | | | 10.3 | | | — | | |

| Net income - as adjusted | $ | 29.0 | | | $ | 36.2 | | | $ | 125.5 | | | $ | 123.4 | | |

| | | | | | | | |

| Net income per share - as reported: | | | | | | | | |

| Diluted | $ | 0.35 | | | $ | 1.64 | | | $ | 4.38 | | | $ | 5.83 | | |

| Adjustments: | | | | | | | | |

| Amortization expense | 0.14 | | | 0.14 | | | 0.58 | | | 0.56 | | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.03 | | | — | | | 0.03 | | |

Restructuring-related charge (S&A expense) (2) | 0.29 | | | 0.05 | | | 0.31 | | | 0.09 | | |

ERP modernization costs (S&A expense) (3) | 0.18 | | | 0.06 | | | 0.55 | | | 0.06 | | |

Transaction and integration-related costs (S&A expense) (4) | 0.02 | | | — | | | 0.21 | | | — | | |

Legal contingency costs (S&A expense) (5) | 0.54 | | | — | | | 0.54 | | | — | | |

| Net income per diluted share - as adjusted | $ | 1.52 | | | $ | 1.92 | | | $ | 6.57 | | | $ | 6.57 | | |

(2) Restructuring expenses reflect our ongoing global reorganization efforts to align our expense structure with key strategic initiatives and long-term business objectives. These restructuring actions are expected to generate annualized cost savings beginning in 2025.

(3) Enterprise Resource Planning (ERP) modernization initiative investment. In 2024, the Company invested $37.3 million in ERP initiatives. Of this amount, $23.3 million was capitalized, while the remaining $14.0 million was recorded as a Selling and Administration expense in the Consolidated Statements of Income. This investment is expected to drive future operational efficiencies across the organization.

(4) Due diligence and integration costs associated with the acquisition of TCS, and costs associated with the investment in Brain Corp, Inc., a privately held autonomous technology company.

(5) Legal settlement charge related to an intellectual property dispute regarding ec-H2O™ option on commercial floor cleaning machines sold between 2015 and 2023. On November 25, 2024, a jury ruled against the Company in a case brought by Oxygenator Water Technologies, Inc. (OWT), awarding $14.5 million in damages and interest. The ruling does not impact the Company's ability to sell its products or affect its long-term business objectives. For further details, see Note 16, Commitments and Contingencies, in "Item 8. Financial Statement and Supplementary Data" of the 2024 Form 10-K.

Page 11 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported Net Income to Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income - as reported | $ | 6.6 | | | $ | 31.0 | | | $ | 83.7 | | | $ | 109.5 | |

| Less: | | | | | | | |

| Interest expense, net | 1.6 | | | 2.5 | | | 9.1 | | | 13.5 | |

| Income tax (benefit) expense | (1.3) | | | (9.0) | | | 21.1 | | | 14.3 | |

| Depreciation expense | 10.5 | | | 10.0 | | | 40.1 | | | 36.4 | |

| Amortization expense | 3.6 | | | 3.7 | | | 15.0 | | | 14.7 | |

| EBITDA | 21.0 | | | 38.2 | | | 169.0 | | | 188.4 | |

| Adjustments: | | | | | | | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.7 | | | — | | | 0.7 | |

Restructuring-related charge (S&A expense) (2) | 7.6 | | | 1.0 | | | 8.2 | | | 2.2 | |

ERP modernization costs (S&A expense) (3) | 4.8 | | | 1.6 | | | 14.0 | | | 1.6 | |

Transaction and integration-related costs (S&A expense) (4) | 0.5 | | | — | | | 4.1 | | | — | |

Legal contingency costs (S&A expense) (5) | 13.5 | | | — | | | 13.5 | | | — | |

| EBITDA - as adjusted | $ | 47.4 | | | $ | 41.5 | | | $ | 208.8 | | | $ | 192.9 | |

| EBITDA margin - as adjusted | 14.4 | % | | 13.3 | % | | 16.2 | % | | 15.5 | % |

Page 12 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Selling and Administrative Expense (S&A expense) and Operating Income

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Gross profit - as reported | $ | 136.0 | | | $ | 130.8 | | | $ | 550.0 | | | $ | 527.8 | |

| Gross margin - as reported | 41.3 | % | | 42.0 | % | | 42.7 | % | | 42.4 | % |

| Adjustments: | | | | | | | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.7 | | | — | | | 0.7 | |

| Gross profit - as adjusted | $ | 136.0 | | | $ | 131.5 | | | $ | 550.0 | | | $ | 528.5 | |

| Gross margin - as adjusted | 41.3 | % | | 42.2 | % | | 42.7 | % | | 42.5 | % |

| | | | | | | |

| S&A expense - as reported | $ | 116.4 | | | $ | 95.7 | | | $ | 391.9 | | | $ | 352.6 | |

| S&A expense as a percent of net sales - as reported | 35.4 | % | | 30.7 | % | | 30.5 | % | | 28.4 | % |

| Adjustments: | | | | | | | |

Restructuring-related charge (S&A expense) (2) | (7.6) | | | (1.0) | | | (8.2) | | | (2.2) | |

ERP modernization costs (S&A expense) (3) | (4.8) | | | (1.6) | | | (14.0) | | | (1.6) | |

Transaction and integration-related costs (S&A expense) (4) | (0.5) | | | — | | | (4.1) | | | — | |

Legal contingency costs (S&A expense) (5) | (13.5) | | | — | | | (13.5) | | | — | |

| S&A expense - as adjusted | $ | 90.0 | | | $ | 93.1 | | | $ | 352.1 | | | $ | 348.8 | |

| S&A expense as a percent of net sales - as adjusted | 27.4 | % | | 29.9 | % | | 27.4 | % | | 28.0 | % |

| | | | | | | |

| Operating income - as reported | $ | 7.6 | | | $ | 24.5 | | | $ | 114.3 | | | $ | 138.6 | |

| Operating margin - as reported | 2.3 | % | | 7.9 | % | | 8.9 | % | | 11.1 | % |

| Adjustments: | | | | | | | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.7 | | | — | | | 0.7 | |

Restructuring-related charge (S&A expense) (2) | 7.6 | | | 1.0 | | | 8.2 | | | 2.2 | |

ERP modernization costs (S&A expense) (3) | 4.8 | | | 1.6 | | | 14.0 | | | 1.6 | |

Transaction and integration-related costs (S&A expense) (4) | 0.5 | | | — | | | 4.1 | | | — | |

Legal contingency costs (S&A expense) (5) | 13.5 | | | — | | | 13.5 | | | — | |

| Operating income - as adjusted | $ | 34.0 | | | $ | 27.8 | | | $ | 154.1 | | | $ | 143.1 | |

| Operating margin - as adjusted | 10.3 | % | | 8.9 | % | | 12.0 | % | | 11.5 | % |

Page 13 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Reported to Adjusted Income Before Income Taxes and Income Tax Expense

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income before income taxes - as reported | $ | 5.3 | | | $ | 22.0 | | | $ | 104.8 | | | $ | 123.8 | |

| Adjustments: | | | | | | | |

| Amortization expense | 3.6 | | | 3.7 | | | 15.0 | | | 14.7 | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.7 | | | — | | | 0.7 | |

Restructuring-related charge (S&A expense) (2) | 7.6 | | | 1.0 | | | 8.2 | | | 2.2 | |

ERP modernization costs (S&A expense) (3) | 4.8 | | | 1.6 | | | 14.0 | | | 1.6 | |

Transaction and integration-related costs (S&A expense) (4) | 0.5 | | | — | | | 4.1 | | | — | |

Legal contingency costs (S&A expense) (5) | 13.5 | | | — | | | 13.5 | | | — | |

| Income before income taxes - as adjusted | $ | 35.3 | | | $ | 29.0 | | | $ | 159.6 | | | $ | 143.0 | |

| | | | | | | |

| Income tax (benefit) expense - as reported | $ | (1.3) | | | $ | (9.0) | | | $ | 21.1 | | | $ | 14.3 | |

| Effective tax rate - as reported | (24.5) | % | | (40.9) | % | | 20.1 | % | | 11.6 | % |

Adjustments (6): | | | | | | | |

| Amortization expense | 1.0 | | | 1.0 | | | 4.0 | | | 4.1 | |

Restructuring-related charge (Cost of sales) (2) | — | | | 0.2 | | | — | | | 0.2 | |

Restructuring-related charge (S&A expense) (2) | 2.0 | | | 0.2 | | | 2.2 | | | 0.6 | |

ERP modernization costs (S&A expense) (3) | 1.3 | | | 0.4 | | | 3.5 | | | 0.4 | |

Transaction and integration-related costs (S&A expense) (4) | 0.1 | | | — | | | 0.1 | | | — | |

Legal contingency costs (S&A expense) (5) | 3.2 | | | — | | | 3.2 | | | — | |

| Income tax expense (benefit) - as adjusted | $ | 6.3 | | | $ | (7.2) | | | $ | 34.1 | | | $ | 19.6 | |

| Effective tax rate - as adjusted | 17.8 | % | | (24.8) | % | | 21.4 | % | | 13.7 | % |

(6) For determining the tax impact, the statutory tax rate was applied for each jurisdiction where income or expenses were generated.

Page 14 – Tennant Company Reports 2024 Fourth-Quarter and Full-Year Results

TENNANT COMPANY

SUPPLEMENTAL NON-GAAP FINANCIAL TABLES

Free Cash Flow Conversion

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income - as reported | $ | 6.6 | | | $ | 31.0 | | | $ | 83.7 | | | $ | 109.5 | |

| Adjustments: | | | | | | | |

ERP modernization costs (S&A expense) (3) | 3.5 | | | 1.2 | | | 10.5 | | | 1.2 | |

| Net income - as adjusted | $ | 10.1 | | | $ | 32.2 | | | $ | 94.2 | | | $ | 110.7 | |

| | | | | | | |

| Cash provided by operating activities - as reported | $ | 37.5 | | | $ | 63.8 | | | $ | 89.7 | | | $ | 188.4 | |

| Less: | | | | | | | |

| Capital expenditures | (9.4) | | | (7.5) | | | (20.9) | | | (22.8) | |

Free cash flows (7) | $ | 28.1 | | | $ | 56.3 | | | $ | 68.8 | | | $ | 165.6 | |

| Adjustments: | | | | | | | |

| ERP modernization spend | 11.7 | | | 1.8 | | | 37.3 | | | 1.8 | |

| Free cash flows - as adjusted | $ | 39.8 | | | $ | 58.1 | | | $ | 106.1 | | | $ | 167.4 | |

| | | | | | | |

| Net income to free cash flows conversion | 394 | % | | 180 | % | | 113 | % | | 151 | % |

(7) Free Cash Flow reflects cash provided by operating activities less capital expenditures

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

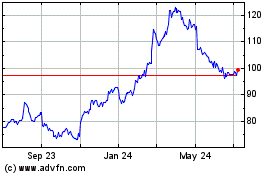

Tennant (NYSE:TNC)

Historical Stock Chart

From Jan 2025 to Feb 2025

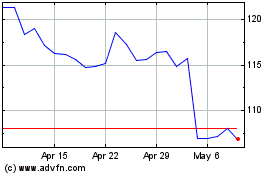

Tennant (NYSE:TNC)

Historical Stock Chart

From Feb 2024 to Feb 2025