Teleflex Incorporated (NYSE: TFX) (the “Company”) today announced

financial results for the second quarter ended June 30, 2024.

Second quarter financial

summary

- GAAP revenue of $749.7 million,

up 0.9% compared to the prior year period

- Adjusted revenue of

$763.5 million, excluding the impact from increases in our

reserves related to the Italian payback measure pertaining to prior

years, up 2.7% compared to the prior year period, up 3.4% on a

constant currency basis.1

- GAAP diluted EPS from continuing

operations of $1.69, compared to $2.35 in the prior year

period

- Adjusted diluted EPS from continuing

operations of $3.42, compared to $3.41 in the prior year

period

2024 guidance summary

- Raising GAAP revenue growth guidance

range to 3.40% to 4.40%

- Raising adjusted constant currency

revenue growth guidance range to 4.25% to 5.25%, which excludes the

impact from increases in our reserves related to the Italian

payback measure pertaining to prior years1

- Lowering GAAP EPS from continuing

operations guidance range to $6.43 to $6.83

- Raising adjusted diluted EPS from

continuing operations guidance range to $13.80 to $14.20

Share repurchase program

- Announced share

repurchase authorization for up to $500 million of common stock,

including the commencement of an accelerated share repurchase

program for $200 million

"The second quarter was consistent with our

strategic focus on durable revenue growth." said Liam Kelly,

Teleflex's Chairman, President and Chief Executive Officer.

"Revenue momentum for Barrigel remained strong, and we continued to

be on track with our integration of Palette Life Sciences AB. Our

first half results reflect the benefits of our diversified product

portfolio and corporate strategy for growth. As a sign of

confidence, our Board of Directors has authorized a share

repurchase program for up to $500 million of our common stock,

inclusive of a $200 million accelerated share repurchase. The

Teleflex Board of Directors and Management remain confident in the

company’s long-term growth profile and ability to create

significant shareholder value. Our strong balance sheet allows us

to opportunistically repurchase shares as part of a broader capital

allocation strategy while not compromising the company’s capacity

to invest in the growth of our business, including the execution of

value creating M&A opportunities.”

(1) Refer to Notes on Non-GAAP Financial Measures

for detail on Italian payback measure.

NET REVENUE BY SEGMENTThe

following table provides information regarding net revenues in each

of the Company's reportable operating segments for the three and

six months ended June 30, 2024 and the comparable prior year

periods on a GAAP, adjusted and adjusted constant currency

basis.

|

|

Three Months Ended |

| |

As reported |

|

Adjusted |

|

|

June 30, 2024 |

July 2, 2023 |

Reported Revenue Growth |

|

June 30, 2024 |

July 2, 2023 |

Adjusted Constant Currency Revenue Growth |

|

Americas |

$426.8 |

$424.7 |

0.5% |

|

$426.8 |

$424.7 |

0.6% |

|

EMEA |

147.1 |

147.8 |

(0.5)% |

|

160.9 |

147.8 |

9.8% |

|

Asia |

87.0 |

86.7 |

0.4% |

|

87.0 |

86.7 |

4.0% |

|

OEM |

88.8 |

84.1 |

5.6% |

|

88.8 |

84.1 |

5.8% |

|

Consolidated |

$749.7 |

$743.3 |

0.9% |

|

$763.5 |

$743.3 |

3.4% |

|

|

Six Months Ended |

| |

As reported |

|

Adjusted |

|

|

June 30, 2024 |

July 2, 2023 |

Reported Revenue Growth |

|

June 30, 2024 |

July 2, 2023 |

Adjusted Constant Currency Revenue Growth |

|

Americas |

$833.1 |

$836.5 |

(0.4)% |

|

$833.1 |

$836.5 |

(0.5)% |

|

EMEA |

306.7 |

291.2 |

5.3% |

|

320.5 |

291.2 |

9.7% |

|

Asia |

171.2 |

165.4 |

3.5% |

|

171.2 |

165.4 |

7.4% |

|

OEM |

176.5 |

161.1 |

9.6% |

|

176.5 |

161.1 |

9.5% |

|

Consolidated |

$1,487.5 |

$1,454.2 |

2.3% |

|

$1,501.3 |

$1,454.2 |

3.6% |

|

|

|

|

|

|

|

|

|

NET REVENUE BY GLOBAL PRODUCT

CATEGORYThe following table provides information regarding

net revenues in each of the Company's global product categories for

the three and six months ended June 30, 2024 and the

comparable prior year periods on a GAAP, adjusted and adjusted

constant currency basis.

|

|

Three Months Ended |

| |

As reported |

|

Adjusted |

|

|

June 30, 2024 |

July 2, 2023 |

Reported Revenue Growth |

|

June 30, 2024 |

July 2, 2023 |

Adjusted Constant Currency Revenue Growth |

|

Vascular Access |

$181.1 |

$173.8 |

4.2% |

|

$181.1 |

$173.8 |

4.8% |

|

Interventional |

141.2 |

124.8 |

13.1% |

|

141.2 |

124.8 |

13.8% |

|

Anesthesia |

102.5 |

100.8 |

1.6% |

|

102.5 |

100.8 |

2.3% |

|

Surgical |

111.3 |

106.0 |

5.1% |

|

111.3 |

106.0 |

6.4% |

|

Interventional Urology |

83.1 |

77.8 |

6.8% |

|

83.1 |

77.8 |

7.1% |

|

OEM |

88.8 |

84.1 |

5.6% |

|

88.8 |

84.1 |

5.8% |

|

Other (1) |

41.7 |

76.0 |

(45.1)% |

|

55.5 |

76.0 |

(26.4)% |

|

Consolidated |

$749.7 |

$743.3 |

0.9% |

|

$763.5 |

$743.3 |

3.4% |

|

|

Six Months Ended |

| |

As reported |

|

Adjusted |

|

|

June 30, 2024 |

July 2, 2023 |

Reported Revenue Growth |

|

June 30, 2024 |

July 2, 2023 |

Adjusted Constant Currency Revenue Growth |

|

Vascular Access |

$362.5 |

$351.4 |

3.1% |

|

$362.5 |

$351.4 |

3.4% |

|

Interventional |

275.8 |

241.7 |

14.1% |

|

275.8 |

241.7 |

14.6% |

|

Anesthesia |

198.8 |

194.2 |

2.4% |

|

198.8 |

194.2 |

2.7% |

|

Surgical |

216.8 |

205.0 |

5.8% |

|

216.8 |

205.0 |

6.7% |

|

Interventional Urology |

162.8 |

153.2 |

6.3% |

|

162.8 |

153.2 |

6.6% |

|

OEM |

176.5 |

161.1 |

9.6% |

|

176.5 |

161.1 |

9.5% |

|

Other (1) |

94.3 |

147.6 |

(36.2)% |

|

108.1 |

147.6 |

(26.8)% |

|

Consolidated |

$1,487.5 |

$1,454.2 |

2.3% |

|

$1,501.3 |

$1,454.2 |

3.6% |

(1) In 2024, amounts reflect the impact from

increases in our reserves related to the Italian payback measure

pertaining to prior years.

OTHER FINANCIAL HIGHLIGHTS

-

Depreciation expense, amortization of intangible assets and

deferred financing charges for the six months ended June 30,

2024 totaled $135.9 million compared to $122.0 million for the

prior year period.

- Cash and cash equivalents at

June 30, 2024 were $238.6 million compared to

$222.8 million at December 31, 2023.

- Net accounts receivable at

June 30, 2024 were $448.9 million compared to

$443.5 million at December 31, 2023.

- Inventories at June 30, 2024 were

$636.9 million compared to $626.2 million at December 31,

2023.

2024 OUTLOOK The

Company increased its full year 2024 revenue growth outlook on a

GAAP basis from a range of 3.35% to 4.35% to a range of 3.40% to

4.40%, reflecting the impact from increases in our reserves for the

three and six months ended June 30, 2024 related to the

Italian payback measure pertaining to prior years and our estimate

of an approximately 0.40% negative impact of foreign exchange rate

fluctuations. On an adjusted constant currency basis, which

excludes the impact from the Italian payback measure pertaining to

prior years, the Company raised its full year 2024 revenue growth

outlook from a range of 3.75% to 4.75% to a range of 4.25% to 5.25%

year-over-year.

The Company lowered its full year 2024 GAAP diluted

earnings per share from continuing operations outlook from a range

of $6.87 to $7.22 to a range of $6.43 to $6.83, representing a

year-over-year change of (14.9)% to (9.7)%. The Company raised its

full year 2024 adjusted diluted earnings per share from continuing

operations guidance from a range of $13.60 to $13.95 to a range of

$13.80 to $14.20, representing growth of 2.1% to 5.0%

year-over-year.

Forecasted 2024

Adjusted Constant Currency Revenue Growth

Reconciliation

|

|

Low |

|

High |

|

Forecasted 2024 GAAP revenue growth |

3.40% |

|

4.40% |

|

Estimated impact of foreign currency exchange rate

fluctuations |

(0.40)% |

|

(0.40)% |

|

Italian payback measure |

(0.45)% |

|

(0.45)% |

|

Forecasted 2024 adjusted constant currency revenue growth |

4.25% |

|

5.25% |

|

|

|

|

|

Forecasted 2024

Adjusted Diluted Earnings Per Share From Continuing

Operations Reconciliation

|

|

Low |

|

High |

| Forecasted GAAP diluted

earnings per share from continuing operations |

$6.43 |

|

$6.83 |

| Restructuring, restructuring

related and impairment items, net of tax |

$0.59 |

|

$0.59 |

| Acquisition, integration and

divestiture related items, net of tax |

$0.35 |

|

$0.35 |

| Pension termination and

related charges, net of tax |

$1.77 |

|

$1.77 |

| ERP Implementation, net of

tax |

$0.33 |

|

$0.33 |

| MDR, net of tax |

$0.19 |

|

$0.19 |

| Italian payback measure, net

of tax |

$0.29 |

|

$0.29 |

| Intangible amortization

expense, net of tax |

$3.81 |

|

$3.81 |

| Tax adjustments |

$0.04 |

|

$0.04 |

| Forecasted adjusted diluted

earnings per share from continuing operations, net of tax |

$13.80 |

|

$14.20 |

| |

|

|

|

SHARE REPURCHASE PROGRAMThe Board

of Directors has authorized a share repurchase program for up to

$500 million of the Company’s common stock. The timing, price and

actual number of shares of Common Stock that may be repurchased

under the share repurchase authorization will depend on a variety

of factors including price, market conditions and corporate and

regulatory requirements. The repurchases may occur in open market

transactions, transactions structured through investment banking

institutions, in privately negotiated transactions, by direct

purchases of common stock or a combination of the foregoing, and

the timing and amount of stock repurchased will depend on market

and business conditions, applicable legal and credit requirements

and other corporate considerations. The share repurchase program

does not require the Company to repurchase shares of its Common

Stock and it may be discontinued, suspended or amended at any time,

without prior notice. The Company intends to commence an

accelerated share repurchase of $200 million of common stock under

the share repurchase program, effective August 2, 2024.

CONFERENCE CALL WEBCAST AND ADDITIONAL

INFORMATIONA webcast of Teleflex's second quarter 2024

investor conference call can be accessed live from a link on the

Company's website at teleflex.com. The call will begin at 8:00 am

ET on August 1, 2024.

An audio replay of the investor call will be

available beginning at 11:00 am ET on August 1, 2024, either

on the Teleflex website or by telephone. The call can be accessed

by dialing 1 800 770 2030 (U.S. and Canada) or 1 609 800 9909 (all

other locations). The confirmation code is 69028.

ADDITIONAL NOTESReferences in this

release to the impact of foreign currency exchange rate

fluctuations on adjusted diluted earnings per share include both

the impact of translating foreign currencies into U.S. dollars and

the impact of foreign currency exchange rate fluctuations on

foreign currency denominated transactions.

In the discussion of segment results, "new

products" refers to products for which we initiated commercial

sales within the past 36 months and "existing products" refers to

products we have sold commercially for more than 36 months.

Certain financial information is presented on a

rounded basis, which may cause minor differences. Segment results

and commentary exclude the impact of discontinued operations.

NOTES ON NON-GAAP FINANCIAL

MEASURESWe report our financial results in accordance with

accounting principles generally accepted in the United States,

commonly referred to as “GAAP”. In this press release, we provide

supplemental information, consisting of the following non-GAAP

financial measures: adjusted revenue, adjusted constant currency

revenue growth and adjusted diluted earnings per share. These

non-GAAP measures are described in more detail below. Management

uses these financial measures to assess Teleflex’s financial

performance, make operating decisions, allocate financial

resources, provide guidance on possible future results, and assist

in its evaluation of period-to-period and peer comparisons. The

non-GAAP measures may be useful to investors because they provide

insight into management’s assessment of our business, and provide

supplemental information pertinent to a comparison of

period-to-period results of our ongoing operations. The non-GAAP

financial measures are presented in addition to results presented

in accordance with GAAP and should not be relied upon as a

substitute for GAAP financial measures. Moreover, our non-GAAP

financial measures may not be comparable to similarly titled

measures used by other companies.

Tables reconciling changes in historical adjusted

constant currency net revenues and adjusted net revenues to

historical GAAP net revenues and historical adjusted diluted

earnings per share from continuing operations to historical GAAP

diluted earnings per share from continuing operations are set forth

below.

Adjusted revenue: This non-GAAP

measure is based upon net revenues, adjusted to exclude the impact

in the three and six months ended June 30, 2024 of an increase in

our reserves, and corresponding reduction to revenue within our

EMEA segment, for prior years. The reserve relates to the Italian

payback measure, a law that requires suppliers of medical devices

to the Italian National Healthcare System to make payments to the

Italian government if medical device expenditures in a given year

exceed regional expenditure ceilings established for that year. As

a result of a recent ruling from the Italian courts, we recognized

a $15.8 million increase in our reserves during the three and six

months ended June 30, 2024, of which $13.8 million related to prior

years. The prior year amounts do not represent normal adjustments

to revenue, are not expected to recur in future periods and are not

recurring in nature, making it difficult to contribute to a

meaningful evaluation of our operating performance. Accordingly,

management has excluded the $13.8 million prior year amount as it

is not indicative of our underlying core performance or business

trends.

Adjusted constant currency revenue

growth: This non-GAAP measure is based upon net revenues,

adjusted to exclude, depending on the period presented, the items

described in Adjusted revenue and to eliminate the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period. The impact of

changes in foreign currency may vary significantly from period to

period, and such changes generally are outside of the control of

our management. We believe that this measure facilitates a

comparison of our operating performance exclusive of currency

exchange rate fluctuations that do not reflect our underlying

performance or business trends.

Adjusted diluted earnings per

share: This non-GAAP measure is based upon diluted

earnings per share from continuing operations, the most directly

comparable GAAP measure, adjusted to exclude, depending on the

period presented, the items described below. Management does not

believe that any of the excluded items are indicative of our

underlying core performance or business trends.

Restructuring, restructuring related and impairment

items - Restructuring programs involve discrete initiatives

designed to, among other things, consolidate or relocate

manufacturing, administrative and other facilities, outsource

distribution operations, improve operating efficiencies and

integrate acquired businesses. Depending on the specific

restructuring program involved, our restructuring charges may

include employee termination, contract termination, facility

closure, employee relocation, equipment relocation, outplacement

and other exit costs associated with the restructuring program.

Restructuring related charges are directly related to our

restructuring programs and consist of facility consolidation costs,

including accelerated depreciation expense related to facility

closures, costs to transfer manufacturing operations between

locations, and retention bonuses offered to certain employees as an

incentive for them to remain with our company after completion of

the restructuring program. Impairment charges occur if, due to

events or changes in circumstances, we determine that the carrying

value of an asset exceeds its fair value. Impairment charges do not

directly affect our liquidity, but could have a material adverse

effect on our reported financial results.

Acquisition, integration and divestiture related

items - Acquisition and integration expenses are incremental

charges, other than restructuring or restructuring related

expenses, that are directly related to specific business or asset

acquisition transactions. These charges may include, among other

things, professional, consulting and other fees; systems

integration costs; inventory step-up amortization (amortization,

through cost of goods sold, of the increase in fair value of

inventory resulting from a fair value calculation as of the

acquisition date); fair value adjustments to contingent

consideration liabilities; and bridge loan facility and backstop

financing fees in connection with loan facilities that ultimately

were not utilized. Divestiture related activities involve specific

business or asset sales. Depending primarily on the terms of a

divestiture transaction, the carrying value of the divested

business or assets on our financial statements and other costs we

incur as a direct result of the divestiture transaction, we may

recognize a gain or loss in connection with the divestiture related

activities.

Italian payback measure - These adjustments

represent the exclusion of the impact from increases in our

reserves related to the Italian payback measure pertaining to prior

years as described in Adjusted revenue.

Pension termination and related charges - These

adjustments represent charges associated with the planned

termination of the Teleflex Incorporated Retirement Income Plan, a

frozen U.S. defined benefit pension plan, and related direct

incremental expenses including certain charges stemming from the

liquidation of surplus plan assets. These charges and costs do not

represent normal and recurring operating expenses, will be

inconsistent in amounts and frequency, and are not expected to

recur once the plan termination process has been completed.

Accordingly, management has excluded these amounts to facilitate an

evaluation of our current operating performance and a comparison to

our past operating performance.

European medical device regulation - The European

Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”),

which replaces the existing Medical Devices Directive (“MDD”) and

imposes more stringent requirements for the marketing and sale of

medical devices in the EU, including requirements affecting

clinical evaluations, quality systems and post-market surveillance.

The MDR requirements became effective in May 2021, although certain

devices that previously satisfied MDD requirements can continue to

be marketed in the EU until December 2027 for highest-risk devices

and December 2028 for lower-risk devices, subject to certain

limitations. Significantly, the MDR will require the

re-registration of previously approved medical devices. As a

result, Teleflex will incur expenditures in connection with the new

registration of medical devices that previously had been registered

under the MDD. Therefore, these expenditures are not considered to

be ordinary course expenditures in connection with regulatory

matters (in contrast, no adjustment has been made to exclude

expenditures related to the registration of medical devices that

were not registered previously under the MDD).

Intangible amortization expense - Certain

intangible assets, including customer relationships, intellectual

property, distribution rights, trade names and non-competition

agreements, initially are recorded at historical cost and then

amortized over their respective estimated useful lives. The amount

of such amortization can vary from period to period as a result of,

among other things, business or asset acquisitions or

dispositions.

ERP implementation - These adjustments represent

direct and incremental costs incurred in connection with our

implementation of a new global enterprise resource planning ("ERP")

solution and related IT transition costs. An implementation of this

scale is a significant undertaking and will require substantial

time and attention of management and key employees. The associated

costs do not represent normal and recurring operating expenses and

will be inconsistent in amounts and frequency making it difficult

to contribute to a meaningful evaluation of our operating

performance.

Tax adjustments - These adjustments represent the

impact of the expiration of applicable statutes of limitations for

prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law or certain

other discrete changes affecting our deferred tax liability.

Reconciliation of Net Revenue (Dollars in

millions)

Net revenue by segment

| |

Three Months Ended |

|

% Increase / (Decrease) |

| |

June 30, 2024 |

|

July 2, 2023 |

|

|

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported Revenue Growth |

Currency Impact |

Adjustment impact |

Adjusted Constant Currency Revenue Growth |

| Americas |

$426.8 |

$— |

$426.8 |

|

$424.7 |

$— |

$424.7 |

|

0.5% |

(0.1)% |

—% |

0.6% |

| EMEA |

147.1 |

(13.8) |

160.9 |

|

147.8 |

— |

147.8 |

|

(0.5)% |

(0.9)% |

(9.4)% |

9.8% |

| Asia |

87.0 |

— |

87.0 |

|

86.7 |

— |

86.7 |

|

0.4% |

(3.6)% |

—% |

4.0% |

| OEM |

88.8 |

— |

88.8 |

|

84.1 |

— |

84.1 |

|

5.6% |

(0.2)% |

—% |

5.8% |

| Consolidated |

$749.7 |

($13.8) |

$763.5 |

|

$743.3 |

$— |

$743.3 |

|

0.9% |

(0.6)% |

(1.9)% |

3.4% |

| |

Six Months Ended |

|

% Increase / (Decrease) |

| |

June 30, 2024 |

|

July 2, 2023 |

|

|

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported Revenue Growth |

Currency Impact |

Adjustment impact |

Adjusted Constant Currency Revenue Growth |

| Americas |

$833.1 |

$— |

$833.1 |

|

$836.5 |

$— |

$836.5 |

|

(0.4)% |

0.1% |

—% |

(0.5)% |

| EMEA |

306.7 |

(13.8) |

320.5 |

|

291.2 |

— |

291.2 |

|

5.3% |

0.3% |

(4.7)% |

9.7% |

| Asia |

171.2 |

— |

171.2 |

|

165.4 |

— |

165.4 |

|

3.5% |

(3.9)% |

—% |

7.4% |

| OEM |

176.5 |

— |

176.5 |

|

161.1 |

— |

161.1 |

|

9.6% |

0.1% |

—% |

9.5% |

| Consolidated |

$1,487.5 |

($13.8) |

$1,501.3 |

|

$1,454.2 |

$— |

$1,454.2 |

|

2.3% |

(0.3)% |

(1.0)% |

3.6% |

Net revenue by global product category

| |

Three Months Ended |

|

% Increase / (Decrease) |

| |

June 30, 2024 |

|

July 2, 2023 |

|

|

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported Revenue Growth |

Currency Impact |

Adjustment impact |

Adjusted Constant Currency Revenue Growth |

| Vascular Access |

$181.1 |

$— |

$181.1 |

|

$173.8 |

$— |

$173.8 |

|

4.2% |

(0.6)% |

—% |

4.8% |

| Interventional |

141.2 |

— |

141.2 |

|

124.8 |

— |

124.8 |

|

13.1% |

(0.7)% |

—% |

13.8% |

| Anesthesia |

102.5 |

— |

102.5 |

|

100.8 |

— |

100.8 |

|

1.6% |

(0.7)% |

—% |

2.3% |

| Surgical |

111.3 |

— |

111.3 |

|

106.0 |

— |

106.0 |

|

5.1% |

(1.3)% |

—% |

6.4% |

| Interventional Urology |

83.1 |

— |

83.1 |

|

77.8 |

— |

77.8 |

|

6.8% |

(0.3)% |

—% |

7.1% |

| OEM |

88.8 |

— |

88.8 |

|

84.1 |

— |

84.1 |

|

5.6% |

(0.2)% |

—% |

5.8% |

| Other (1) |

41.7 |

(13.8) |

55.5 |

|

76.0 |

— |

76.0 |

|

(45.1)% |

(0.4)% |

(18.3)% |

(26.4)% |

| Consolidated |

$749.7 |

($13.8) |

$763.5 |

|

$743.3 |

$— |

$743.3 |

|

0.9% |

(0.6)% |

(1.9)% |

3.4% |

| |

Six Months Ended |

|

% Increase / (Decrease) |

| |

June 30, 2024 |

|

July 2, 2023 |

|

|

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported revenue |

Adjustment |

Adjusted Revenue |

|

Reported Revenue Growth |

Currency Impact |

Adjustment impact |

Adjusted Constant Currency Revenue Growth |

| Vascular Access |

$362.5 |

$— |

$362.5 |

|

$351.4 |

$— |

$351.4 |

|

3.1% |

(0.3)% |

—% |

3.4% |

| Interventional |

275.8 |

— |

275.8 |

|

241.7 |

— |

241.7 |

|

14.1% |

(0.5)% |

—% |

14.6% |

| Anesthesia |

198.8 |

— |

198.8 |

|

194.2 |

— |

194.2 |

|

2.4% |

(0.3)% |

—% |

2.7% |

| Surgical |

216.8 |

— |

216.8 |

|

205.0 |

— |

205.0 |

|

5.8% |

(0.9)% |

—% |

6.7% |

| Interventional Urology |

162.8 |

— |

162.8 |

|

153.2 |

— |

153.2 |

|

6.3% |

(0.3)% |

—% |

6.6% |

| OEM |

176.5 |

— |

176.5 |

|

161.1 |

— |

161.1 |

|

9.6% |

0.1% |

—% |

9.5% |

| Other (1) |

94.3 |

(13.8) |

108.1 |

|

147.6 |

— |

147.6 |

|

(36.2)% |

(0.1)% |

(9.3)% |

(26.8)% |

| Consolidated |

$1,487.5 |

($13.8) |

$1,501.3 |

|

$1,454.2 |

$— |

$1,454.2 |

|

2.3% |

(0.3)% |

(1.0)% |

3.6% |

(1) In 2024, amounts reflect the impact from increases in our

reserves related to the Italian payback measure pertaining to prior

years.

Reconciliation of Consolidated Statement of Income Items

(Dollars in millions, except per share data)

| Three

Months Ended June 30, 2024 |

|

|

Revenue |

Gross margin |

SG&A (1) |

R&D (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing

operations |

|

GAAP Basis |

$749.7 |

55.6% |

33.4% |

5.5% |

15.6% |

$97.5 |

$17.3 |

17.8% |

$1.69 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

Restructuring, restructuring related and impairment items (A) |

— |

0.5 |

(0.1) |

— |

1.6 |

12.2 |

2.1 |

|

0.21 |

|

Acquisition, integration and divestiture related items (B) |

— |

— |

(0.7) |

— |

0.7 |

5.6 |

— |

|

0.12 |

|

Italian payback measure (C) |

13.8 |

0.7 |

(0.6) |

— |

1.4 |

13.8 |

— |

|

0.29 |

|

ERP implementation |

— |

— |

(0.4) |

— |

0.4 |

3.0 |

0.4 |

|

0.06 |

|

MDR |

— |

— |

— |

(0.5) |

0.4 |

3.1 |

— |

|

0.07 |

|

Intangible amortization expense |

— |

4.0 |

(2.6) |

— |

6.6 |

49.6 |

5.0 |

|

0.94 |

|

Tax adjustments |

— |

— |

— |

— |

— |

— |

(2.1) |

|

0.04 |

|

Adjustments total |

13.8 |

5.2 |

(4.4) |

(0.5) |

11.1 |

87.3 |

5.4 |

|

1.73 |

|

Adjusted basis |

$763.5 |

60.8% |

29.0% |

5.0% |

26.7% |

$184.8 |

$22.7 |

12.3% |

$3.42 |

| Three

Months Ended July 2, 2023 |

|

|

Gross margin |

SG&A (1) |

R&D (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income taxrate |

Diluted earnings per share from continuing

operations |

|

GAAP Basis |

54.9% |

30.0% |

5.3% |

19.3% |

$127.0 |

$15.5 |

12.2% |

$2.35 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

Restructuring, restructuring related and impairment items (A) |

1.0 |

— |

(0.2) |

1.5 |

10.8 |

1.7 |

|

0.19 |

|

Acquisition, integration and divestiture related items (B) |

— |

1.0 |

— |

(1.0) |

(7.5) |

— |

|

(0.16) |

|

ERP implementation |

— |

(0.2) |

— |

0.2 |

1.3 |

0.3 |

|

0.02 |

|

MDR |

— |

— |

(1.0) |

1.0 |

7.6 |

— |

|

0.16 |

|

Intangible amortization expense |

3.1 |

(2.5) |

— |

5.6 |

42.0 |

2.1 |

|

0.85 |

|

Tax adjustments |

— |

— |

— |

— |

— |

— |

|

— |

|

Adjustments total |

4.1 |

(1.7) |

(1.2) |

7.3 |

54.2 |

4.1 |

|

1.06 |

|

Adjusted basis |

59.0% |

28.3% |

4.1% |

26.6% |

$181.2 |

$19.6 |

10.8% |

$3.41 |

|

Notes: |

(1) Selling, general and administrative expenses and research and

development expenses are shown as a percentage of as reported and

adjusted revenues. (2) Operating margin defined as Income

from continuing operations before interest, loss on extinguishment

of debt and taxes as a percentage of as reported and adjusted

revenues. |

| |

|

| Totals may not sum due to rounding. |

| Six

Months Ended June 30, 2024 |

|

|

Revenue |

Gross margin |

SG&A (1) |

R&D (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing

operations |

|

GAAP Basis |

$1,487.5 |

56.0% |

42.5% |

5.3% |

7.5% |

$71.7 |

$(24.2) |

(33.8)% |

$2.02 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

Restructuring, restructuring related and impairment items (A) |

— |

0.4 |

(0.1) |

— |

1.2 |

18.0 |

3.1 |

|

0.32 |

|

Acquisition, integration and divestiture related items (B) |

— |

0.1 |

(0.5) |

— |

0.6 |

9.0 |

0.4 |

|

0.18 |

|

Italian payback measure (C) |

13.8 |

0.3 |

(0.4) |

— |

0.9 |

13.8 |

— |

|

0.29 |

|

ERP implementation |

— |

— |

(0.2) |

— |

0.2 |

3.1 |

0.4 |

|

0.06 |

|

MDR |

— |

— |

— |

(0.5) |

0.4 |

6.3 |

— |

|

0.13 |

|

Pension termination costs |

— |

— |

(9.3) |

— |

9.3 |

138.6 |

58.2 |

|

1.70 |

|

Intangible amortization expense |

— |

4.1 |

(2.6) |

— |

6.6 |

99.8 |

10.1 |

|

1.89 |

|

Tax adjustments |

— |

— |

— |

— |

— |

— |

(2.1) |

|

0.04 |

|

Adjustments total |

13.8 |

4.9 |

(13.1) |

(0.5) |

19.2 |

288.6 |

70.1 |

|

4.61 |

|

Adjusted basis |

$1,501.3 |

60.9% |

29.4% |

4.8% |

26.7% |

$360.3 |

$45.9 |

12.7% |

$6.63 |

| Six Months

Ended July 2, 2023 |

|

|

Grossmargin |

SG&A (1) |

R&D (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Dilutedearnings per share from continuing

operations |

|

GAAP Basis |

55.0% |

31.4% |

5.6% |

17.8% |

$224.4 |

$35.7 |

15.9% |

$3.99 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

Restructuring, restructuring related and impairment items (A) |

1.1 |

— |

(0.2) |

1.6 |

22.8 |

3.5 |

|

0.41 |

|

Acquisition, integration and divestiture related items (B) |

— |

0.3 |

— |

(0.3) |

(4.4) |

0.1 |

|

(0.10) |

|

ERP implementation |

— |

(0.2) |

— |

0.2 |

2.5 |

0.6 |

|

0.04 |

|

MDR |

— |

— |

(1.2) |

1.2 |

17.9 |

— |

|

0.38 |

|

Intangible amortization expense |

3.1 |

(2.6) |

— |

5.7 |

83.6 |

4.1 |

|

1.68 |

|

Tax adjustments |

— |

— |

— |

— |

— |

(4.8) |

|

0.10 |

|

Adjustments total |

4.2 |

(2.5) |

(1.4) |

8.4 |

122.4 |

3.5 |

|

2.51 |

|

Adjusted basis |

59.2% |

28.9% |

4.2% |

26.2% |

$346.8 |

$39.2 |

11.3% |

$6.50 |

|

Notes: |

(1) Selling, general and administrative expenses and research and

development expenses are shown as a percentage of as reported and

adjusted revenues.(2) Operating margin defined as Income from

continuing operations before interest, loss on extinguishment of

debt and taxes as a percentage of as reported and adjusted

revenues. |

|

|

|

|

Totals may not sum due to rounding. |

|

|

Tickmarks to Reconciliation Tables

|

(A) |

|

Restructuring, restructuring related and impairment items

– For the three months ended June 30, 2024, pre-tax

restructuring charges were $7.9 million and restructuring related

charges were $4.4 million. For the three months ended July 2, 2023,

pre-tax restructuring charges were $1.5 million and restructuring

related charges were $9.3 million. For the six months ended June

30, 2024, pre-tax restructuring charges were $8.4 million;

restructuring related charges were $7.5 million; and impairment

charges were $2.1 million. For the six months ended July 2, 2023,

pre-tax restructuring charges were $3.7 million and restructuring

related charges were $19.1 million. |

| |

|

|

| (B) |

|

Acquisition, integration

and divestiture related items – For the three and six

months ended June 30, 2024 and July 2, 2023, these

charges related to changes in the estimated fair value of our

contingent consideration liabilities and the acquisition of Palette

Life Sciences AB. |

| |

|

|

| (C) |

|

Italian payback measure

– Adjustment reflects the impact of an increase in

reserves for prior years related to the Italian payback measure and

its impact on the adjusted basis for each Non-GAAP financial

measure presented within the table. |

| |

|

|

ABOUT TELEFLEX INCORPORATEDAs a global provider

of medical technologies, Teleflex is driven by our purpose to

improve the health and quality of people’s lives. Through our

vision to become the most trusted partner in healthcare, we offer a

diverse portfolio with solutions in the therapy areas of

anesthesia, emergency medicine, interventional cardiology and

radiology, surgical, vascular access, and urology. We believe that

the potential of great people, purpose driven innovation, and

world-class products can shape the future direction of

healthcare.

Teleflex is the home of Arrow™, Barrigel™, Deknatel™, LMA™,

Pilling™, QuikClot™ Rüsch™, UroLift™ and Weck™ – trusted brands

united by a common sense of purpose.

At Teleflex, we are empowering the future of healthcare. For

more information, please visit teleflex.com.

CAUTION CONCERNING FORWARD-LOOKING

INFORMATIONThis press release contains forward-looking

statements, including, but not limited to, the implementation and

execution of our share repurchase program, including our planned

accelerated share repurchase; statements related to our long-term

growth profile and ability to create significant shareholder value;

our ability to opportunistically repurchase shares as part of a

broader capital allocation strategy while not compromising the

company’s capacity to invest in the growth of our business,

including the execution of value creating M&A opportunities;

forecasted 2024 GAAP and constant currency revenue growth and GAAP

and adjusted diluted earnings per share; and our estimates

regarding the projected impact of foreign currency exchange rate

fluctuations on our 2024 financial results. Actual results could

differ materially from those in the forward-looking statements due

to, among other things, delays or cancellations in shipments;

demand for and market acceptance of new and existing products; our

inability to provide products to our customers, which may be due

to, among other things, events that impact key distributors,

suppliers and third-party vendors that sterilize our products; our

inability to integrate acquired businesses into our operations,

realize planned synergies and operate such businesses profitably in

accordance with our expectations; the inability of acquired

businesses to generate revenues in accordance with our

expectations; our inability to effectively execute our

restructuring plans and programs; our inability to realize

anticipated savings from restructuring plans and programs; the

impact of healthcare reform legislation and proposals to amend,

replace or repeal the legislation; changes in Medicare, Medicaid

and third party coverage and reimbursements; the impact of enacted

tax legislation and related regulations; competitive market

conditions and resulting effects on revenues and pricing; increases

in raw material costs that cannot be recovered in product pricing;

global economic factors, including currency exchange rates,

interest rates, trade disputes, sovereign debt issues and

international conflicts and hostilities, such as the ongoing

conflicts in the Ukraine and the Middle East; public health

epidemics; difficulties in entering new markets; general economic

conditions; and other factors described or incorporated in our

filings with the Securities and Exchange Commission, including our

most recently filed Annual Report on Form 10-K. We expressly

disclaim any obligation to update forward-looking statements,

except as otherwise specifically stated by us or as required by law

or regulation.

| |

|

TELEFLEX INCORPORATEDCONSOLIDATED

STATEMENTS OF INCOME(Unaudited) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, 2024 |

|

July 2, 2023 |

|

June 30, 2024 |

|

July 2, 2023 |

| |

(Dollars and shares in thousands, except per

share) |

|

Net revenues |

$ |

749,691 |

|

|

$ |

743,259 |

|

|

$ |

1,487,540 |

|

|

$ |

1,454,191 |

|

| Cost of goods sold |

|

333,233 |

|

|

|

335,436 |

|

|

|

654,948 |

|

|

|

654,988 |

|

|

Gross profit |

|

416,458 |

|

|

|

407,823 |

|

|

|

832,592 |

|

|

|

799,203 |

|

| Selling, general and

administrative expenses |

|

250,631 |

|

|

|

223,306 |

|

|

|

493,461 |

|

|

|

456,022 |

|

| Research and development

expenses |

|

41,094 |

|

|

|

39,448 |

|

|

|

78,393 |

|

|

|

80,917 |

|

| Pension settlement charge |

|

— |

|

|

|

— |

|

|

|

138,139 |

|

|

|

— |

|

| Restructuring and impairment

charges |

|

7,855 |

|

|

|

1,508 |

|

|

|

10,514 |

|

|

|

3,729 |

|

|

Income from continuing operations before interest and taxes |

|

116,878 |

|

|

|

143,561 |

|

|

|

112,085 |

|

|

|

258,535 |

|

| Interest expense |

|

21,168 |

|

|

|

17,762 |

|

|

|

43,851 |

|

|

|

36,099 |

|

| Interest income |

|

(1,787 |

) |

|

|

(1,156 |

) |

|

|

(3,453 |

) |

|

|

(1,999 |

) |

|

Income from continuing operations before taxes |

|

97,497 |

|

|

|

126,955 |

|

|

|

71,687 |

|

|

|

224,435 |

|

| Taxes (benefit) on income from

continuing operations |

|

17,332 |

|

|

|

15,532 |

|

|

|

(24,219 |

) |

|

|

35,716 |

|

|

Income from continuing operations |

|

80,165 |

|

|

|

111,423 |

|

|

|

95,906 |

|

|

|

188,719 |

|

| Operating loss from

discontinued operations |

|

(164 |

) |

|

|

(114 |

) |

|

|

(751 |

) |

|

|

(825 |

) |

| Tax benefit on operating loss

from discontinued operations |

|

(37 |

) |

|

|

(26 |

) |

|

|

(172 |

) |

|

|

(189 |

) |

|

Loss from discontinued operations |

|

(127 |

) |

|

|

(88 |

) |

|

|

(579 |

) |

|

|

(636 |

) |

|

Net income |

$ |

80,038 |

|

|

$ |

111,335 |

|

|

$ |

95,327 |

|

|

$ |

188,083 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

1.70 |

|

|

$ |

2.37 |

|

|

$ |

2.03 |

|

|

$ |

4.02 |

|

|

Loss from discontinued operations |

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

(0.02 |

) |

| Net income |

$ |

1.70 |

|

|

$ |

2.37 |

|

|

$ |

2.02 |

|

|

$ |

4.00 |

|

|

Diluted: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

1.69 |

|

|

$ |

2.35 |

|

|

$ |

2.02 |

|

|

$ |

3.99 |

|

|

Loss from discontinued operations |

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

(0.01 |

) |

| Net income |

$ |

1.69 |

|

|

$ |

2.35 |

|

|

$ |

2.01 |

|

|

$ |

3.98 |

|

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

47,151 |

|

|

|

46,981 |

|

|

|

47,130 |

|

|

|

46,965 |

|

|

Diluted |

|

47,361 |

|

|

|

47,329 |

|

|

|

47,378 |

|

|

|

47,307 |

|

| |

|

TELEFLEX INCORPORATEDCONSOLIDATED BALANCE

SHEETS(Unaudited) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| |

(Dollars in thousands) |

| ASSETS |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

238,567 |

|

$ |

222,848 |

|

Accounts receivable, net |

|

448,897 |

|

|

443,467 |

|

Inventories |

|

636,908 |

|

|

626,216 |

|

Prepaid expenses and other current assets |

|

94,826 |

|

|

107,471 |

|

Prepaid taxes |

|

18,890 |

|

|

7,404 |

|

Total current assets |

|

1,438,088 |

|

|

1,407,406 |

| Property, plant and equipment,

net |

|

491,996 |

|

|

479,913 |

| Operating lease assets |

|

112,010 |

|

|

123,521 |

| Goodwill |

|

2,892,629 |

|

|

2,914,055 |

| Intangible assets, net |

|

2,379,916 |

|

|

2,501,960 |

| Deferred tax assets |

|

6,424 |

|

|

6,748 |

| Other assets |

|

120,577 |

|

|

98,943 |

|

Total assets |

$ |

7,441,640 |

|

$ |

7,532,546 |

| LIABILITIES AND

EQUITY |

|

|

|

| Current liabilities |

|

|

|

|

Current borrowings |

$ |

93,750 |

|

$ |

87,500 |

|

Accounts payable |

|

113,450 |

|

|

132,247 |

|

Accrued expenses |

|

153,403 |

|

|

146,880 |

|

Payroll and benefit-related liabilities |

|

113,112 |

|

|

146,535 |

|

Accrued interest |

|

5,771 |

|

|

5,583 |

|

Income taxes payable |

|

19,731 |

|

|

41,453 |

|

Other current liabilities |

|

57,534 |

|

|

46,547 |

|

Total current liabilities |

|

556,751 |

|

|

606,745 |

| Long-term borrowings |

|

1,624,222 |

|

|

1,727,572 |

| Deferred tax liabilities |

|

453,028 |

|

|

456,080 |

| Pension and postretirement

benefit liabilities |

|

23,026 |

|

|

23,989 |

| Noncurrent liability for

uncertain tax positions |

|

3,271 |

|

|

3,370 |

| Noncurrent operating lease

liabilities |

|

102,572 |

|

|

111,300 |

| Other liabilities |

|

120,051 |

|

|

162,502 |

|

Total liabilities |

|

2,882,921 |

|

|

3,091,558 |

| Commitments and

contingencies |

|

|

|

|

Total shareholders' equity |

|

4,558,719 |

|

|

4,440,988 |

|

Total liabilities and shareholders' equity |

$ |

7,441,640 |

|

$ |

7,532,546 |

| |

|

TELEFLEX INCORPORATEDCONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited) |

| |

| |

Six Months Ended |

| |

June 30, 2024 |

|

July 2, 2023 |

| |

(Dollars in thousands) |

| Cash flows from operating

activities of continuing operations: |

|

|

|

|

Net income |

$ |

95,327 |

|

|

$ |

188,083 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Loss from discontinued operations |

|

579 |

|

|

|

636 |

|

|

Depreciation expense |

|

34,487 |

|

|

|

36,723 |

|

|

Intangible asset amortization expense |

|

99,686 |

|

|

|

83,600 |

|

|

Deferred financing costs and debt discount amortization

expense |

|

1,716 |

|

|

|

1,700 |

|

|

Pension settlement charge |

|

138,139 |

|

|

|

— |

|

|

Fair value step up of acquired inventory sold |

|

1,722 |

|

|

|

— |

|

|

Changes in contingent consideration |

|

5,852 |

|

|

|

(6,776 |

) |

|

Assets impairment charge |

|

2,110 |

|

|

|

— |

|

|

Stock-based compensation |

|

15,739 |

|

|

|

14,020 |

|

|

Deferred income taxes, net |

|

(62,953 |

) |

|

|

460 |

|

|

Interest benefit on swaps designated as net investment hedges |

|

(8,000 |

) |

|

|

(10,288 |

) |

|

Other |

|

2,168 |

|

|

|

2,824 |

|

|

Changes in assets and liabilities, net of effects of acquisitions

and disposals: |

|

|

|

|

Accounts receivable |

|

(11,238 |

) |

|

|

(16,587 |

) |

|

Inventories |

|

(23,775 |

) |

|

|

(45,630 |

) |

|

Prepaid expenses and other assets |

|

11,443 |

|

|

|

12,120 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

(34,157 |

) |

|

|

(53,766 |

) |

|

Income taxes receivable and payable, net |

|

(64,313 |

) |

|

|

(36,501 |

) |

|

Net cash provided by operating activities from

continuing operations |

|

204,532 |

|

|

|

170,618 |

|

| Cash flows from investing

activities of continuing operations: |

|

|

|

|

Expenditures for property, plant and equipment |

|

(73,232 |

) |

|

|

(39,374 |

) |

|

Payments for businesses and intangibles acquired, net of cash

acquired |

|

(70 |

) |

|

|

(129 |

) |

|

Net proceeds on swaps designated as net investment hedges |

|

18,262 |

|

|

|

10,275 |

|

|

Proceeds from sales of investments |

|

7,300 |

|

|

|

— |

|

|

Purchase of investments |

|

(7,300 |

) |

|

|

— |

|

|

Net cash used in investing activities from continuing

operations |

|

(55,040 |

) |

|

|

(29,228 |

) |

| Cash flows from financing

activities of continuing operations: |

|

|

|

|

Reduction in borrowings |

|

(98,250 |

) |

|

|

(154,500 |

) |

|

Net proceeds from share based compensation plans and related tax

impacts |

|

2,398 |

|

|

|

572 |

|

|

Payments for contingent consideration |

|

(122 |

) |

|

|

(121 |

) |

|

Dividends paid |

|

(32,018 |

) |

|

|

(31,941 |

) |

|

Net cash used in financing activities from continuing

operations |

|

(127,992 |

) |

|

|

(185,990 |

) |

| Cash flows from discontinued

operations: |

|

|

|

|

Net cash used in operating activities |

|

(2,239 |

) |

|

|

(454 |

) |

|

Net cash used in discontinued operations |

|

(2,239 |

) |

|

|

(454 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(3,542 |

) |

|

|

3,836 |

|

| Net increase (decrease) in

cash and cash equivalents |

|

15,719 |

|

|

|

(41,218 |

) |

| Cash and cash equivalents at

the beginning of the period |

|

222,848 |

|

|

|

292,034 |

|

| Cash and cash equivalents at

the end of the period |

$ |

238,567 |

|

|

$ |

250,816 |

|

| |

|

|

|

|

|

|

|

Contacts:Teleflex Incorporated:Lawrence

KeuschVice President, Investor Relations and Strategy

Development

investors.teleflex.com 610-948-2836

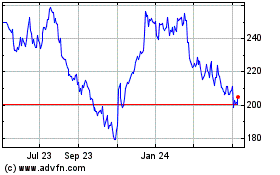

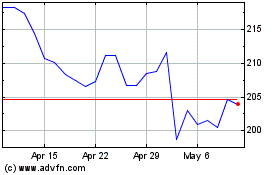

Teleflex (NYSE:TFX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Nov 2023 to Nov 2024