UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

o TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________________________________ to ______________________________

Commission File Number: 001-05353

____________________

A.Full title of the plan and the address of the plan, if different from that of the issuer named below:

Teleflex 401(k) Savings Plan

B.Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Teleflex Incorporated

550 East Swedesford Road, Suite 400

Wayne, Pennsylvania 19087

TELEFLEX 401(k) SAVINGS PLAN

AUDITED FINANCIAL STATEMENTS AND SCHEDULE

Years Ended December 31, 2019 and 2018

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

Page No.

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

1

|

|

|

|

|

|

|

AUDITED FINANCIAL STATEMENTS

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

3

|

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

4

|

|

|

|

|

|

|

Notes to Financial Statements

|

5

|

|

|

|

|

|

|

SUPPLEMENTAL SCHEDULE

|

|

|

|

|

|

|

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

|

12

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants

Teleflex 401(k) Savings Plan

Wayne, Pennsylvania

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Teleflex 401(k) Savings Plan (the “Plan”) as of December 31, 2019 and 2018, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes and schedules (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2019 and 2018, and the changes in net assets available for benefits for the years ended December 31, 2019 and 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Teleflex 401(k) Savings Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2019 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2004.

/s/ Maillie LLP

Oaks, Pennsylvania

June 26, 2020

________________

TELEFLEX 401(k) SAVINGS PLAN

STATEMENTS OF NET ASSETS

AVAILABLE FOR BENEFITS

December 31, 2019 and 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

$

|

5,339

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

|

|

|

|

|

|

|

|

|

|

Registered investment companies

|

|

|

|

|

388,130,546

|

|

|

311,576,929

|

|

|

|

|

Common stock fund

|

|

|

|

|

113,433,359

|

|

|

88,539,848

|

|

|

|

Investments, at fair value

|

|

|

|

|

|

501,563,905

|

|

|

400,116,777

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at contract value

|

|

|

|

|

|

34,756,729

|

|

|

36,086,351

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS

|

|

536,320,634

|

|

|

436,203,128

|

|

|

|

Receivables

|

|

|

|

|

|

|

|

|

|

|

|

Participant loans receivable

|

|

|

|

|

7,770,393

|

|

|

6,784,060

|

|

|

|

|

Employer profit sharing receivable

|

|

|

|

|

254,249

|

|

|

—

|

|

|

|

|

|

|

|

TOTAL RECEIVABLES

|

|

8,024,642

|

|

|

6,784,060

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

|

|

|

|

|

|

|

|

|

AVAILABLE FOR BENEFITS

|

$

|

544,350,615

|

|

$

|

442,987,188

|

|

See accompanying notes

TELEFLEX 401(k) SAVINGS PLAN

STATEMENTS OF CHANGES IN NET ASSETS

AVAILABLE FOR BENEFITS

For the years ended December 31, 2019 and 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONS TO NET ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Contributions

|

|

|

|

|

|

|

|

|

|

|

|

Employer

|

|

|

|

$

|

14,651,682

|

|

$

|

13,230,182

|

|

|

|

|

Employee

|

|

|

|

|

25,747,261

|

|

|

23,306,047

|

|

|

|

|

Rollover

|

|

|

|

|

6,425,574

|

|

|

11,266,515

|

|

|

|

|

Other contributions

|

|

|

|

|

63,147

|

|

|

256,056

|

|

|

|

|

|

|

|

TOTAL CONTRIBUTIONS

|

|

46,887,664

|

|

|

48,058,800

|

|

|

|

Investment income

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividends

|

|

|

|

|

15,873,861

|

|

|

15,333,764

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

|

|

|

99,091,398

|

|

|

(28,917,065)

|

|

|

|

|

|

|

|

TOTAL INVESTMENT (LOSS) INCOME

|

|

114,965,259

|

|

|

(13,583,301)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ADDITIONS

|

|

161,852,923

|

|

|

34,475,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEDUCTIONS FROM NET ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

|

|

|

|

59,879,122

|

|

|

39,952,377

|

|

|

|

Administrative fees

|

|

|

|

|

|

534,025

|

|

|

549,000

|

|

|

|

Other deductions

|

|

|

|

|

|

76,349

|

|

|

—

|

|

|

|

|

|

|

|

TOTAL DEDUCTIONS

|

|

60,489,496

|

|

|

40,501,377

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE)

|

|

101,363,427

|

|

|

(6,025,878)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BEGINNING OF YEAR

|

|

442,987,188

|

|

|

449,013,066

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

END OF YEAR

|

$

|

544,350,615

|

|

$

|

442,987,188

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

NOTE A GENERAL DESCRIPTION OF THE PLAN AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Description of the Plan

A general description of the Teleflex 401(k) Savings Plan (the “Plan”) follows. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General - The Plan is a defined contribution plan, which was implemented effective July 1, 1985. Certain employees of Teleflex Incorporated (the “Company”) or one of its related entities that is a participating employer in the Plan who have attained age 21 are eligible to participate in the Plan. Full-time and part-time employees are eligible to enter the Plan at their date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

The Plan includes an employee stock ownership plan (ESOP) feature, as defined in Section 4975(e)(7) of the Internal Revenue Code of 1986, as amended (Code). The ESOP feature permits a participant to elect to have any dividend paid on the shares of Company common stock allocated to his or her account either paid in cash or deposited into his or her account in the ESOP portion of the Plan and reinvested in the Company common stock fund.

Safe Harbor Plan/Automatic Contributions - The Plan is intended to satisfy the requirements to be a “qualified automatic contribution arrangement” (QACA) with the meaning of Code Sections 401(k)(13) and 401(m)(12), as well as an “eligible automatic contribution arrangement” (EACA) within the meaning of Code Section 414(w). The EACA permits a penalty-free distribution of “accidental” automatic deferrals made to the Plan within 90 days of the effective date of a participant’s first automatic contribution. The QACA is a safe harbor plan design that allows the Plan to automatically satisfy annual nondiscrimination tests (the actual deferral percentage (ACP) and the actual contribution percentage (ACP) tests.

Under the safe harbor design, once a participant becomes eligible to participate in the Plan, the participant is automatically enrolled at a 3% deferral rate unless opting out of the automatic deferral feature. Thereafter, the automatic deferral percentage increases by 1% each year up to a maximum automatic deferral of 6%. As part of the QACA, the Company makes “Safe Harbor Matching Contributions” in an amount equal to 100% of a participant’s “elective deferral contributions”, described below, up to 5% of the participant’s compensation.”

Contributions - Participants were able to contribute up to the lesser of $19,000 and $18,500 or 50% of their annual compensation during 2019 and 2018, respectively. These contributions are referred to as “elective deferral contributions” and are withheld from participant’s pay on a pre-tax basis for federal income tax and most state income tax purposes. However, participants may designate all or part of their elective deferral contributions as “Roth elective deferral contributions.” Roth elective deferral contributions are made on an after-tax basis for federal income tax purposes.

In addition, participants who reach age 50 or older and contribute the maximum permitted under the Plan may make an additional pre-tax contribution (a “catch-up contribution”) of up to $6,000 during 2019 and 2018. As with regular elective deferral contributions, participants may elect to designate all or part of their catch-up contributions as after-tax “Roth catch-up contributions.” Participants may also contribute amounts representing distributions from other qualified benefit plans (via a rollover into the Plan). As stated above, the Company makes employer Safe Harbor Matching Contributions equal to 100% of elective deferral contributions (including Roth elective deferral contributions and catch-up contributions) up to 5% of compensation. For purposes of calculating contributions, compensation is limited to a maximum of $280,000 and $275,000 during 2019 and 2018, respectively.

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

Participant Accounts - Each participant’s account is credited with the participant’s contribution and the employer matching contribution, as well as an allocation of Plan earnings. Participants may access their accounts via a website and toll-free telephone number. Fund transfers and investment election changes may be elected daily or once in a 30-day timeframe depending on fund type. A participant may stop, start, or change their 401(k) salary deferral rate at will.

Plan Loans - Active employees may elect to take up to two loans from the Plan at any given time. As required by law, a loan amount is limited to the lesser of $50,000 or 50% of the participant’s vested account and must be repaid within five years unless the loan is for the purchase of a primary residence. Loan repayments are processed via payroll deduction on an after-tax basis. The entire unpaid balance on any outstanding loan and all interest due thereon will be processed as a taxable distribution and will reduce the participant’s distributable account balance if any of the following occur: (i) a participant fails to make an installment payment due under the loan by the last day of the calendar quarter following the calendar quarter in which the required installment payment was due; (ii) a participant on a leave of absence has an unpaid amount for a period of a year; or (iii) a participant incurs a severance from employment.

Vesting - Participants are always 100% vested in their own 401(k) elective deferral contributions. With the exception of certain discretionary employer contributions (if any) that become 100% vested after three years of employment, the Company’s Safe Harbor Matching Contributions become 100% vested after two years of employment.

Payment of Benefits - The Plan provides that a participant may elect to withdraw 100% of his or her vested account balance at termination of employment. A participant who is an employee and has attained age 59½ may elect to withdrawal any portion of his non-forfeitable account in accordance with the procedures established by the Plan Administrator. Withdrawals shall be made on a pro-rata basis if a Participant elects to make a withdrawal from more than one sub-account in his account. In addition, a participant may elect a hardship withdrawal, as defined by the Plan, of his or her elective deferral contributions, Roth elective deferral contributions, catch-up contributions and Roth catch-up contributions. A participant may elect to withdraw his or her rollover account at any time.

Forfeitures - Forfeitures of terminated participants’ nonvested accounts are used to pay Plan expenses and reduce the amount of future contributions required to be made to the Plan by the Company and the other participating employers in the Plan. The amount of unallocated forfeitures at December 31, 2019 and 2018 were $189,526 and $108,085, respectively.

Plan Termination - Although it has not expressed any intent to do so, the Company has the right to discontinue its contributions at any time and to terminate the Plan at any time, subject to the provisions set forth in ERISA. In the event of Plan termination, distribution of participant accounts shall be in accordance with ERISA and its applicable regulations and Article V of the Plan document.

Plan Amendments - The Company amended and restated the Teleflex 401(k) Savings Plan effective January 1, 2019 to (i) remove union provisions, (ii) remove the 1,000 hours of required work hours for participation for part-timers, (iii) change the minimum participant deferral limit from two percent to one percent, (iv) allow installment payments for certain identified distributions and (v) provide that a participant's death benefit under the Plan is paid as soon as administratively practicable after notification of the participant's death, regardless of whether a spouse beneficiary consents to such payment timing.

Significant Accounting Policies

The significant accounting policies of the Plan employed in the preparation of the accompanying financial statements follow:

Investments - Participants direct the investment of their contributions into various investment

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

options offered by the Plan. The Plan currently offers several mutual funds, a common collective trust, as well as the Company common stock fund as investment options for participants.

Valuation of investments - The Plan’s investments are stated at fair value, except for fully benefit responsive investment contracts, pursuant to the provisions of Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) No. 820, Fair Value Measurements and Disclosures. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note E for further information on fair value measurements.

The Vanguard Retirement Savings Trusts, as described in Note F, which are fully benefit responsive investment contracts, are reported at contract value. Contract value is the relevant measurement attributable to fully benefit responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. See Note F for further information on fully benefit responsive investment contracts.

Participant Loans Receivable - All transactions are measured at their unpaid principal balance plus any accrued but unpaid interest. Any individual credit risk related to participant loans is mitigated by the fact that these loans are secured by the participant’s vested balance. If a participant were to default, the participant’s account balance would be offset by the unpaid balance of the loan, and the participant would be subject to tax on the unpaid loan balance. As such, the participant is the only party affected in the event of a default.

Revenue Recognition and Method of Accounting - All transactions are recorded on the accrual basis. Purchases and sales of investments are recorded on a trade-date basis. Interest income is accrued when earned. Dividend income is recorded on the ex-dividend date. Capital gain distributions are included in dividend income. Net appreciation (depreciation) includes the gains and losses on investments bought and sold as well as held during the year. Expenses are recorded as incurred.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets, liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Reclassifications - Certain reclassifications have been made to the prior year financial information to conform to the current year presentation.

NOTE B ADMINISTRATION OF THE PLAN

The Plan is administered by a committee of at least three members appointed by the Company’s Board of Directors. The committee is the Plan Administrator and fiduciary for ERISA purposes. The Company appointed Vanguard Fiduciary Trust Company (Vanguard) as trustee and third-party administrator of the Plan effective September 30, 2004. Effective September 30, 2019, the Company appointed Charles Schwab Bank (Schwab) to replace Vanguard as the trustee and third-party administrator of the Plan. Schwab charges a per participant fee for the administrative services that it provides to the Plan. Actively employed participants pay a small portion of the participant fee on a quarterly basis. The Company and any other Company affiliate that participates in the Plan (a "Participating Employer") pay the remaining portion of the fee for participants who are actively employed by the Company or a Participating Employer. Participants who are not actively employed by the Company or a Participating Employer pay the per participant administrative fee from their Plan accounts. Investment management fees charged by each mutual fund are netted against returns. Investment management fees charged by the Vanguard Retirement Savings Trusts, which are common collective investment trusts, are charged to participants with balances in the respective trust.

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

NOTE C TAX STATUS OF THE PLAN

The Plan obtained its latest determination letter on August 4, 2015, in which the Internal Revenue Service stated that the Plan, as then designed, was in compliance with the applicable requirements of the Internal Revenue Service Code.

Accounting principles generally accepted in the United States of America require the Plan’s management to evaluate tax positions taken by the Plan and recognize a tax liability or asset if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. The Plan Administrator has analyzed the tax positions by the Plan and has concluded that as of December 31, 2019 and 2018, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or asset or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan is no longer subject to income tax examinations for years prior to 2016.

NOTE D RELATED PARTY TRANSACTIONS AND PARTY IN INTEREST TRANSACTIONS

The Plan participants invest in shares of registered investment companies and a collective trust fund managed by affiliates of Vanguard or the trustee. The Plan participants also invest in shares of the Company’s stock through the Teleflex Incorporated common stock fund. The common stock fund held approximately 300,933 and 340,547 shares of the Teleflex Incorporated common stock representing 21% and 20% of Plan assets as of December 31, 2019 and 2018, respectively. These transactions, in addition to participant loan receivables, qualify as party-in-interest transactions and are exempt from the prohibited transactions rules.

Certain administrative functions of the Plan are performed by officers or employees of the Company. No such officer or employee received compensation from the Plan.

NOTE E FAIR VALUE MEASUREMENTS

FASB ASC 820 establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

Level 1 - inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 - inputs to the fair value measurement that include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3 - inputs to the fair value measurement that are unobservable inputs for the asset or liability.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

A summary by level within the fair value hierarchy (as defined above) of the Plan’s investments measured at fair value on a recurring basis is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

12/31/2019

|

|

|

|

|

|

|

|

|

|

Registered investment companies

|

$

|

388,130,546

|

|

$

|

—

|

|

$

|

388,130,546

|

|

|

Company common stock fund

|

|

—

|

|

|

113,433,359

|

|

|

113,433,359

|

|

|

Total

|

$

|

388,130,546

|

|

$

|

113,433,359

|

|

$

|

501,563,905

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

12/31/2018

|

|

|

|

|

|

|

|

|

|

Registered investment companies

|

$

|

311,576,929

|

|

$

|

—

|

|

$

|

311,576,929

|

|

|

Company common stock fund

|

|

—

|

|

|

88,539,848

|

|

|

88,539,848

|

|

|

Total

|

$

|

311,576,929

|

|

$

|

88,539,848

|

|

$

|

400,116,777

|

|

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2019 and December 31, 2018.

Registered investment companies are valued at quoted market prices, which represent the net asset value of shares held by the Plan at year end.

The Company common stock fund is valued at the combined market value of the underlying stock based upon the closing price of the stock on its primary exchange times the number of shares held and the short-term cash component at year end.

NOTE F VANGUARD RETIREMENT SAVINGS TRUSTS

As of December 31, 2019, and 2018 a portion of the Plan’s investments were in the Vanguard Retirement Savings Trust III (savings trust referred collectively as the “common collective trusts” or the "Vanguard Trusts"). The underlying investments in the common collective trusts are primarily in a pool of investment contracts that are issued by insurance companies and commercial banks and in contracts that are backed by high-quality bonds, bond trusts and bond mutual funds. These contracts meet the fully benefit responsive investment contract criteria and therefore are presented at contract value in determining the net assets available for benefits. Contract value represents contributions made under the contract, plus earnings, less withdrawals. The contract value is based on the net asset value of the fund as reported by Vanguard, the trustee, and is determined based on the units of the common collective trust fund held by the Plan at year end times the respective unit value. Investment contracts include traditional guaranteed investment contracts (GICs), synthetic investment contracts (SICs) including wrapper contracts, and short term investments such as a money market fund. The following represents the disaggregation of investments by type of investment contract included in the common collective trusts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

Guaranteed investment contracts

|

|

$

|

1,573,580

|

|

|

$

|

1,576,169

|

|

|

Synthetic investment contracts

|

|

32,322,364

|

|

|

31,449,206

|

|

|

Short term investments

|

|

882,685

|

|

|

2,945,666

|

|

|

Other assets (liabilities)

|

|

(21,900)

|

|

|

115,310

|

|

|

Investments, at contract value

|

|

$

|

34,756,729

|

|

|

$

|

36,086,351

|

|

Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment in the Vanguard Trusts at contract value daily without any redemption notice or restrictions. Plan level initiated transactions require a twelve month redemption notice in order to withdrawal at contract value. Plan level initiated transactions with less than a twelve month redemption notice may incur

TELEFLEX 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

an adjustment to contract value.

The existence of certain conditions can limit the trust’s ability to transact at contract value with issuers of its investment contracts. Specifically, any event outside the normal operation of the common collective trusts that causes a withdrawal from an investment contract may result in a negative market value adjustment with respect to the withdrawal. Examples of such events include, but are not limited to, partial or complete legal termination of the trust or a unitholder, tax disqualification of the trust or unitholder, and certain trust amendments if issuers’ consent is not obtained. As of December 31, 2019, the occurrence of an event outside the normal operation of the trust that would cause a withdrawal from an investment contract is not considered to be probable.

In general, issuers may terminate the contract and settle at other than contract value if there is a change in the qualification status of a participant, employer, or plan, a breach of material obligations under the contract and misrepresentation by the contract holder, or failure of the underlying portfolio to conform to the pre-established investment guidelines.

NOTE G RISKS AND UNCERTAINTIES

Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility risks. Due to the level of risk associated with certain investments securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

NOTE H SUBSEQUENT EVENTS

Plan Management has evaluated all events or transactions that occurred through June 26, 2020, the date the financial statements were issued and determined that there are no matters requiring adjustment to or disclosure in the accompanying financial statements and related notes other than the matter described below.

On March 11, 2020, the World Health Organization declared the global outbreak of COVID-19 to be a pandemic. The COVID-19 pandemic has significantly impacted economic activity and markets around the world. The COVID-19 pandemic has also led to extreme volatility in financial markets and has affected, and may continue to affect, the market price of the Company’s common stock and other Plan assets. While the potential economic impact brought by, and the duration of, COVID-19 is difficult to assess or predict, a widespread pandemic could result in significant disruption of global financial markets. The extent to which COVID-19 impacts the financial markets will depend on future developments that are highly uncertain and cannot be predicted.

On March 27, 2020, the “Coronavirus Aid, Relief, and Economic Security (CARES) Act” was signed into law in the United States. The CARES Act, among other things, includes several relief provisions available to tax-qualified retirement plans and their participants. Participants eligible for the relief include those who (i) are diagnosed with COVID-19, (ii) have a spouse or dependent diagnosed with COVID-19 or (iii) experience certain adverse consequences due to the virus. Plan management has evaluated the relief provisions available under the CARES Act to eligible Plan participants and has implemented the following provisions:

•Made available, with no early withdrawal penalty and tax/repayment flexibility, coronavirus-related distributions up to $100,000;

•Increased the available loan amount as described in Note A to the lesser of $100,000 or 100% of the participant's vested account balance;

•Permitted loan repayments originally due on or after March 27, 2020 to be delayed until December 31, 2020; and

•Waived the required minimum distribution for those age 70 ½ and older for 2020.

Supplemental Schedule

TELEFLEX 401(k) SAVINGS PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

Year Ended December 31, 2019

Plan EIN# 23-1147939, Plan 010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b)

|

|

|

|

|

|

|

|

Identity of Issuer, Borrower,

|

|

(c)

|

|

(e)

|

|

(a)

|

|

Lessor, or Similar Party

|

|

Description of Investment

|

|

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

American Funds New Perspective Fund; Class R-6

|

|

Registered Investment Company

|

|

$

|

1,735,307

|

|

|

|

|

American Funds New World Fund; Class R6

|

|

Registered Investment Company

|

|

862,242

|

|

|

|

|

Delaware Value Fund; Class R6

|

|

Registered Investment Company

|

|

13,798,932

|

|

|

|

|

JPMorgan Small Cap Equity Fund; Class R6

|

|

Registered Investment Company

|

|

4,115,589

|

|

|

|

|

Metropolitan West Total Return Bond Fund; P Class

|

|

Registered Investment Company

|

|

1,772,375

|

|

|

*

|

|

Vanguard Explorer Fund: Admiral Shares

|

|

Registered Investment Company

|

|

10,096,281

|

|

|

*

|

|

Vanguard Extended Market Index Fund: Admiral Shares

|

|

Registered Investment Company

|

|

5,356,715

|

|

|

*

|

|

Vanguard Federal Money Market Fund

|

|

Registered Investment Company

|

|

3,100,429

|

|

|

*

|

|

Vanguard Inflation-Protected Securities Fund: Admiral Shares

|

|

Registered Investment Company

|

|

884,025

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2015 Fund

|

|

Registered Investment Company

|

|

5,216,825

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2020 Fund

|

|

Registered Investment Company

|

|

10,843,082

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2025 Fund

|

|

Registered Investment Company

|

|

29,688,692

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2030 Fund

|

|

Registered Investment Company

|

|

25,565,890

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2035 Fund

|

|

Registered Investment Company

|

|

41,110,076

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2040 Fund

|

|

Registered Investment Company

|

|

24,577,534

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2045 Fund

|

|

Registered Investment Company

|

|

25,907,224

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2050 Fund

|

|

Registered Investment Company

|

|

15,135,807

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2055 Fund

|

|

Registered Investment Company

|

|

10,471,179

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2060 Fund

|

|

Registered Investment Company

|

|

3,384,505

|

|

|

*

|

|

Vanguard Institutional Target Retirement 2065 Fund

|

|

Registered Investment Company

|

|

351,168

|

|

|

*

|

|

Vanguard Institutional Target Retirement Income Fund

|

|

Registered Investment Company

|

|

2,433,748

|

|

|

*

|

|

Vanguard Institutional Index Fund

|

|

Registered Investment Company

|

|

32,930,833

|

|

|

*

|

|

Vanguard International Growth: Admiral Shares

|

|

Registered Investment Company

|

|

16,152,777

|

|

|

*

|

|

Vanguard Real Estate Index: Admiral Shares

|

|

Registered Investment Company

|

|

1,483,011

|

|

|

*

|

|

Vanguard Small-Cap Index Fund: Admiral Shares

|

|

Registered Investment Company

|

|

1,896,027

|

|

|

*

|

|

Vanguard Strategic Equity Fund

|

|

Registered Investment Company

|

|

11,932,953

|

|

|

*

|

|

Vanguard Total Bond Market Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

15,638,625

|

|

|

*

|

|

Vanguard Total International Stock Index Fund Institutional Shares

|

|

Registered Investment Company

|

|

12,426,363

|

|

|

*

|

|

Vanguard Total World Stock Index Fund: Admiral Shares

|

|

Registered Investment Company

|

|

733,983

|

|

|

*

|

|

Vanguard US Growth Admiral Shares

|

|

Registered Investment Company

|

|

27,544,533

|

|

|

*

|

|

Vanguard Wellington Fund Admiral Shares

|

|

Registered Investment Company

|

|

30,983,816

|

|

|

*

|

|

Teleflex Stock Fund

|

|

Unitized Stock Fund

|

|

113,433,359

|

|

|

*

|

|

Vanguard Retirement Savings Trust III

|

|

Common Collective Trust

|

|

34,756,729

|

|

|

*

|

|

Participant Loans, 5.0% to 11.0%

|

|

Participant Loans with various maturities through August 2049

|

|

7,770,393

|

|

|

|

|

|

|

|

|

$

|

544,091,027

|

|

|

*Party-in-interest.

|

|

|

|

|

|

|

|

Cost information not required as all investments are participant-directed.

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Teleflex 401(k) Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Cameron P. Hicks

|

|

|

|

|

|

Cameron P. Hicks

Vice President, Global Human Resources

|

Dated: June 26, 2020

INDEX TO EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23.1

|

-

|

Consent of Independent Registered Public Accounting Firm

|

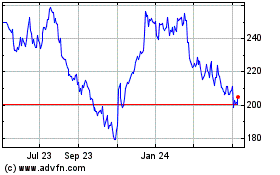

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

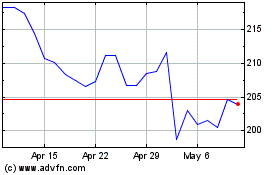

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024