Raises Serious Concerns About Sexist and

Racially Charged Ad Hominem Attacks from Jon Schleuss, David

Goodfriend and Andrew Schwartzman of The NewsGuild

Highlights Significant Support for Proposed

Acquisition of TEGNA from Numerous Civil Rights and Labor

Organizations, Legislators, and Minority Media Groups

Standard General L.P. (“Standard General”) today responded to

the repeated ad hominem attacks made by opponents of its proposed

acquisition of TEGNA Inc. (“TEGNA”) (NYSE: TGNA) at the U.S.

Federal Communications Commission (“FCC”), raising concerns with

certain opposing parties’ conduct in the proceeding.

Deb McDermott and I have a proven track record of enhancing

stations’ service to their local communities. As a woman and a

minority, respectively, we may well have had to work twice as hard

as most to get to where we are in the media industry. We will bring

decades of experience and perspectives to the ownership and

leadership of TEGNA, an important media company.

We are extremely concerned by the manner in which Jon Schleuss,

David Goodfriend and Andrew Schwartzman of the NewsGuild continue

to ignore the facts of this deal, and more troubling are their

sexist and racially charged ad hominem attacks. They claim:

- Soo Kim’s investment is “anonymous

foreign investment in American newsrooms”

- This deal should be especially scrutinized because of

“China(‘s) increased tensions in the Taiwan Strait”

- Soo Kim’s transaction “does not promote

ownership diversity as it is understood by the public

interest and civil rights community,

and by commission policy”

- “Mr. Kim is not barred by his race from becoming a successful

entrepreneur” while “Ms. McDermott is not barred by her gender to

be selected to run a large corporation.”

To be clear, I am ethnically Korean. And I am a proud

American citizen. These three men are attempting to define what

constitutes a minority or what is the right kind of diversity—this

is offensive and inappropriate. And it is beyond the pale for

Schleuss, Goodfriend, and Schwartzman to use my ethnicity to

postulate theories of my being an agent of foreign ownership. These

fact-free statements are careless given that even a cursory

inspection of the documents we have provided would show that I am

currently the attributable owner of multiple radio and television

stations today.

Notably, the NewsGuild did not comment on other recent

Broadcasting deals such as the Scripps acquisition of ION or the

Gray acquisitions of Meredith or Quincy – all deals that were not

as straight-forward as ours given that they resulted in tremendous

consolidation and required station divestitures to address

regulatory/DOJ concerns.

Fortunately, Deb and I are not alone. We have received letters

of support from legislators including the Chairs of the Black

Caucus for Georgia, South Carolina, and North Carolina; civil

rights groups including the Arc of Justice and the NAACP Atlanta;

minority media groups like the National Association of Hispanic

Publications; and many others.

We are confident that our applications are in order, our deal

complies with all regulations, and we have been happy to answer

forthright any and all questions. In full transparency, we have

submitted 3 million documents and over 12 million pages of

records and have nothing but respect for the regulatory

process. We will continue to work collaboratively with FCC staff in

their review of the facts of the proposed transaction.

We are confident that the public statements from these three men

will be seen for what they are—sentiments that have no place in

America today.

Supportive Parties:

- Southern Legislator Group

- Senator Tonya P. Anderson - Chair of Georgia Legislative Black

Caucus; Georgia Senate

- Representative Patricia M. Henegan - Chair of South Carolina

Legislative Black Caucus; South Carolina General Assembly

- Representative Kelly M. Alexander Jr. - Chair of North Carolina

Legislative Black Caucus; North Carolina General Assembly

- Representative Terry Brown Jr. – North Carolina House District

92

- Joyce Dickerson, Former Chair, FCC Intergovernmental Advisory

Committee

- Stephen L. Gilchrist, Chairman of the South Carolina

African-American Chamber of Commerce

- Reverend Kirsten John Foy - Arc of Justice

- Richard Rose - President of NAACP Atlanta

- NAHP (National Association of Hispanic Publications)

- Tower of Babel (Frank Washington)

- Michael R Bailey Jr. – The Minority Eye

- Estrella Media

- Council for Korean Americans

- National Asian/Pacific Islander American Chamber of Commerce

and Entrepreneurship

- AWT Organization (Advocating for Women in Tech)

- Seattle Local 46

- American Consumer Institute

- Jay Huizenga – KELOLAND Media Group

About Standard General

Standard General was founded in 2007 and manages capital for

public and private pension funds, endowments, foundations, and

high-net-worth individuals. Standard General is a

minority-controlled and operated organization. Mr. Kim is supported

by a diverse, highly experienced 17-person team, including seven

investment professionals with over 120 years of collective

investing experience.

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes forward-looking statements within

the meaning of the “safe harbor” provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on a number of assumptions about future events

and are subject to various risks, uncertainties and other factors

that may cause actual results to differ materially from the views,

beliefs, projections and estimates expressed in such statements.

These risks, uncertainties and other factors include, but are not

limited to, the following: (1) the timing, receipt and terms and

conditions of the required governmental or regulatory approvals of

the proposed transaction and the related transactions involving the

parties that could reduce the anticipated benefits of or cause the

parties to abandon the proposed transaction, (2) risks related to

the satisfaction of the conditions to closing the proposed

transaction (including the failure to obtain necessary regulatory

approvals), and the related transactions involving the parties, in

the anticipated timeframe or at all, (3) the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of TEGNA’s common stock, (4)

disruption from the proposed transaction making it more difficult

to maintain business and operational relationships, including

retaining and hiring key personnel and maintaining relationships

with TEGNA’s customers, vendors and others with whom it does

business, (5) the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into pursuant to the proposed transaction or of

the transactions involving the parties, (6) risks related to

disruption of management’s attention from TEGNA’s ongoing business

operations due to the proposed transaction, (7) significant

transaction costs, (8) the risk of litigation and/or regulatory

actions related to the proposed transaction or unfavorable results

from currently pending litigation and proceedings or litigation and

proceedings that could arise in the future, (9) other business

effects, including the effects of industry, market, economic,

political or regulatory conditions, (10) information technology

system failures, data security breaches, data privacy compliance,

network disruptions, and cybersecurity, malware or ransomware

attacks, and (11) changes resulting from the COVID-19 pandemic,

which could exacerbate any of the risks described above.

Readers are cautioned not to place undue reliance on

forward-looking statements made by or on behalf of Standard

General. Each such statement speaks only as of the day it was made.

Standard General undertakes no obligation to update or to revise

any forward-looking statements. The factors described above cannot

be controlled by Standard General. When used in this communication,

the words “believes,” “estimates,” “plans,” “expects,” “should,”

“could,” “outlook,” and “anticipates” and similar expressions as

they relate to Standard General or its management are intended to

identify forward looking statements. Forward-looking statements in

this communication may include, without limitation: statements

about the potential benefits of the proposed acquisition,

anticipated growth rates, Standard General’s plans, objectives,

expectations, and the anticipated timing of closing the proposed

transaction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221016005058/en/

For media inquiries: Standard General Andy Brimmer /

Jamie Moser / Jack Kelleher Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

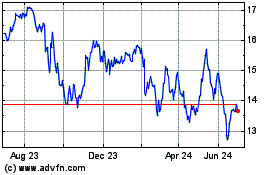

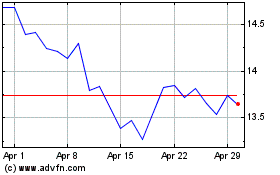

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Apr 2023 to Apr 2024