Today's Logistics Report: Resilient Food Supply Chains; Walmart Pops Up; Crude's Slipping Demand

November 13 2020 - 9:52AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Food supply chains have bent under the coronavirus pandemic but

they haven't broken. Food supplies have defied dire warnings of

global shortages by holding up through months of turmoil, the WSJ's

Lucy Craymer reports, as suppliers, distributors and markets have

adapted to disruptions from production to transportation. The value

of food imported in the first half of 2020 was roughly in line with

the first of half of 2019, one sign that food supply chains "have

been remarkably resilient," says Michael Rogers, chief executive of

Australian Fresh Produce Alliance. There have been problems along

the way, especially in fruit and vegetable supply chains, but

experts say some nations abandoned protectionist policies adopted

earlier in the pandemic and developing countries have filled supply

gaps. Food organizations warn that levels of acute hunger are

growing as economies and incomes falter, however, and that delays

at ports are persisting.

SUPPLY CHAIN STRATEGIES

Walmart Inc. is adding another tool to its logistics kit for the

holidays. The retailer is placing "pop-up" fulfillment centers into

many of its regional distribution facilities, the WSJ Logistics

Report's Jennifer Smith writes, as it braces for an expected surge

in online sales in the coming weeks. Parcel carriers are already

warning of delivery delays and retailers are urging consumers to

get orders in early this year, a result of coronavirus-driven

demand that promises to strain peak-season supply chains. Walmart

is partitioning off parts of its sprawling distribution centers

that normally handle palletized goods and using software to

synchronize the sites with stores and its broader logistics

systems. The strategy is the latest by retailers trying to adapt

existing supply chains to the explosion in online sales. Walmart,

Target Corp. and others are using stores to handle some

fulfillment, but Walmart's pop-up plan suggests that tactic has

limits.

QUOTABLE

COMMODITIES

A prospective coronavirus vaccine won't solve the oil sector's

woes anytime soon. The International Energy Agency gave a darker

outlook for crude consumption in its latest monthly report, the

WSJ's David Hodari reports, citing resurgent Covid-19 infection

rates in the U.S. and Europe that it says will slash demand at

least into the first quarter of 2021. That's grim news for a crude

tanker market that has been foundering since a boost from so-called

floating storage in the spring dissipated. Transport heavyweight

Teekay Tankers Inc. just reported that its net profit hit $3.1

million in the third quarter, an improvement from a loss a year ago

but down more than 96% from the second quarter. The IEA report

holds out some hope for the sector, noting expectations for crude

demand in the economic powerhouses of the developing world such as

China and India is improving.

IN OTHER NEWS

The U.K. economy expanded 15.5% in the third quarter, a weaker

pace than its peers in Europe. (WSJ)

U.S. initial jobless claims slipped in the past week to the

lowest level since March. (WSJ)

U.S. consumer prices were flat in October despite higher costs

for dining out and groceries. (WSJ)

Nissan Motor Co. trimmed its outlook for a loss this year on

improving prices and tight automotive inventory. (WSJ)

Cosmetics maker Revlon Inc. says it has enough support from

creditors to avert a bankruptcy filing. (WSJ)

Ministers from 15 Asia-Pacific countries agreed to sign the

Regional Comprehensive Economic Partnership trade agreement.

(Nikkei Asian Review)

Apple Inc. supplier Pegatron Corp. is considering adding a

factory in the U.S. to speed up parts deliveries. (Taipei

Times)

Industrial goods supplier Schneider Electric Inc. will spend $40

million to upgrade its U.S. supply chain. (Supply Chain Dive)

Maritime supply chains have grown increasingly strained under

this year's sharp swings in demand. (Lloyd's List)

Taiwan's Yang Ming Marine Transport Corp. swung to a $92 million

third-quarter profit and the container line said it will "set

financial stability as its priority." (Journal of Commerce)

At least 20 bulk carriers have been stranded, some for months,

unable to unload millions of tons of Australian coal.

(Bloomberg)

DHL Express projects U.S. parcel volumes will surge 30% this

year over normal peak-season growth. (Logistics Management)

Emirates Airlines fell to its first loss in more than 30 years

in the first half of the year. (Reuters)

Singapore Airlines plans to issue $630 million in convertible

bonds to shore up its cash position. (Straits Times)

Glyn Hughes was named head of the International Air Cargo

Association. (Air Cargo News)

Developer CBRE plans to convert a golf course and country club

south of Chicago into a 130-acre logistics park. (Chicago

Tribune)

Private-equity firm Welsh, Carson, Anderson & Stowe is

buying logistics technology provider TrueCommerce. (DC

Velocity)

U.S. safety investigators say Walmart implemented new

truck-driver fatigue guidelines after the fatal 2014 crash that

injured comedian Tracy Morgan. (Commercial Carrier Journal)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage, @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

November 13, 2020 09:37 ET (14:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

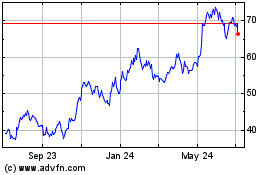

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

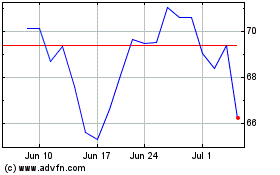

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Apr 2023 to Apr 2024