Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (Teck)

today announced its unaudited fourth quarter results for 2024.

"2024 was a transformational year as we

repositioned Teck as a pure-play energy transition metals company

with the sale of the steelmaking coal business and record annual

copper production," said Jonathan Price, President and CEO. "Our

copper production in the fourth quarter set a new quarterly

production record with strong performance at QB, and we continued

to return cash to shareholders through share buybacks and dividends

that totaled $1.8 billion in 2024. Our strong financial position,

ongoing returns to shareholders and value accretive copper growth

strategy position us for long-term value creation."

Highlights

- Adjusted EBITDA1 of $835 million in Q4 2024 was driven by

record copper production as Quebrada Blanca (QB) continued to

ramp-up, achieving design throughput rates by the end of the year,

as well as strong base metals pricing. Copper and zinc sales

volumes each increased by 24% compared to the same period last

year. Our profit from continuing operations before taxes was $256

million in Q4 2024.

- Adjusted profit from continuing operations attributable to

shareholders1 was $232 million, or $0.45 per share, in Q4 2024. Our

profit from continuing operations attributable to shareholders was

$385 million.

- We returned $1.8 billion to shareholders through share buybacks

and dividends in 2024, of which $549 million was completed in the

fourth quarter. As at February 19, 2025, we have completed $1.45

billion of our authorized buyback program of $3.25 billion.

- We reduced our debt by US$196 million in Q4 2024, including a

scheduled semi-annual repayment on the QB project financing

facility. In 2024, we reduced our debt by US$1.8 billion.

- Our liquidity as at February 19, 2025 is $11.3 billion,

including $7.1 billion of cash. We generated cash flows from

operations of $1.3 billion in Q4 and we had a net cash1 position of

$2.1 billion at December 31, 2024.

- We achieved our third consecutive quarter of record copper

production with 122,100 tonnes produced in Q4 2024, of which 60,700

tonnes were from QB. With the ramp-up of QB, we achieved record

annual copper production of 446,000 tonnes in 2024, up 50% from

last year.

- Our copper business generated gross profit before depreciation

and amortization1 of $732 million in the fourth quarter, up 160%

from a year ago, with strong sales volumes of 124,900 tonnes and

higher copper prices. Gross profit from our copper business was

$299 million in the fourth quarter.

- Our zinc business generated gross profit before depreciation

and amortization1 of $320 million in the fourth quarter, up 112%

from a year ago, supported by strong zinc prices and sales volumes

from Red Dog. Gross profit from our zinc business was $243 million

in the fourth quarter.

- Two of three of QB's labour unions, representing 78% of QB's

workforce, and Antamina's labour union each ratified new three-year

collective bargaining agreements during Q4 2024.

- Our High-Potential Incident (HPI) Frequency rate continued to

remain low at 0.12 in 2024.

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

Financial Summary Q4 2024

|

Financial Metrics (CAD$ in millions, except per

share data) |

Q4 2024 |

Q4 2023 |

|

Revenue |

$ |

2,786 |

|

$ |

1,843 |

|

|

Gross profit |

$ |

542 |

|

$ |

152 |

|

|

Gross profit before depreciation and amortization1 |

$ |

1,052 |

|

$ |

432 |

|

|

Profit (loss) from continuing operations before taxes |

$ |

256 |

|

$ |

(324 |

) |

|

Adjusted EBITDA1 |

$ |

835 |

|

$ |

321 |

|

|

Profit (loss) from continuing operations attributable to

shareholders |

$ |

385 |

|

$ |

(167 |

) |

|

Adjusted profit from continuing operations attributable to

shareholders1 |

$ |

232 |

|

$ |

23 |

|

|

Basic earnings (loss) per share from continuing operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

|

Diluted earnings (loss) per share from continuing operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

|

Adjusted basic earnings per share from continuing operations1 |

$ |

0.45 |

|

$ |

0.04 |

|

|

Adjusted diluted earnings per share from continuing

operations1 |

$ |

0.45 |

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

Key Updates

Executing on Our Copper Growth

Strategy

- We achieved record copper production of 446,000 tonnes in 2024,

up 50% from 2023, supported by the ramp-up of QB. We expect our

annual 2025 copper production to further increase to between

490,000 and 565,000 tonnes as QB continues to ramp-up, consistent

with our previously disclosed guidance issued on January 20,

2025.

- Increased QB copper production of 60,700 tonnes in the fourth

quarter, compared to 52,500 tonnes in the third quarter of 2024.

Annual copper production in 2024 from QB was 207,800 tonnes, within

our previously disclosed guidance range of 200,000 to 210,000

tonnes.

- We achieved design mill throughput rates at QB by the end of

2024, as expected, with record daily production achieved throughout

the fourth quarter. We also saw an improvement in grades, as

expected, and recoveries in the fourth quarter as compared with the

third quarter of 2024, driving increased production in the fourth

quarter.

- We had scheduled planned maintenance in January 2025 at QB for

minor modifications; however, we extended the scheduled shutdown to

18 days to conduct maintenance and reliability work, and complete

additional tailings lifts as part of the operational ramp-up. Since

production recommenced, we have been processing transition ores

which was expected in the first quarter of 2025 in our mine plan.

We continue to expect to see an overall increase in ore grades in

2025 over 2024 as we carry out the scheduled mine plan. Consistent

with our operating plan, we expect to continue to have quarterly

maintenance shutdowns. Our previously disclosed 2025 annual copper

production for QB is unchanged at between 230,000 and 270,000

tonnes.

- In the fourth quarter, we continued to make progress in

advancing our copper growth strategy, reinforcing our commitment to

long-term value creation through a balanced approach of growth

investments and shareholder returns. Our focus remains on advancing

our near-term projects – Highland Valley Copper Mine Life Extension

(HVC MLE), Zafranal, San Nicolás - for potential sanction decisions

in 2025, and advancing optimization of QB, with a strong focus on

identifying near-term growth opportunities for debottlenecking

within the current asset base. All growth projects must meet

stringent criteria, delivering attractive risk-adjusted returns and

competing for capital in alignment with Teck’s capital allocation

framework.

Safety and Sustainability

Leadership

- Our High-Potential Incident (HPI) Frequency rate continued to

remain low at 0.12 in 2024.

- On October 30, 2024, Teck was named to the Forbes list of the

World’s Top Companies for Women 2024, an employee-driven ranking of

multinational corporations from 37 countries around the world.

- On November 15, 2024, Teck was named one of Canada’s Top 100

Employers for the eighth consecutive year by Mediacorp Canada’s Top

Employers program, which recognizes companies for exceptional human

resource programs and innovative workplace policies.

- On December 2, 2024, we released our Climate Change and Nature

2024 Report, which for the first time combines the recommendations

of the Taskforce on Nature-related Financial Disclosures (TNFD)

with the recommendations of the Taskforce on Climate-related

Financial Disclosures (TCFD) to deliver an integrated report

covering both climate and nature-related aspects of our

business.

Guidance

- On January 20, 2025, we disclosed our 2025 annual guidance,

which is unchanged in this news release.

- Our guidance is outlined in summary below and our usual

guidance tables, including three-year production guidance, can be

found on pages 25–28 of Teck’s fourth quarter results for 2024 at

the link below.

|

2025 Guidance – Summary |

Current |

|

Production Guidance |

|

|

Copper (000’s tonnes) |

490 – 565 |

|

Zinc (000’s tonnes) |

525 – 575 |

|

Refined zinc (000’s tonnes) |

190 – 230 |

|

Sales Guidance – Q1

2025 |

|

|

Red Dog zinc in concentrate sales (000’s tonnes) |

75 – 90 |

|

Unit Cost Guidance |

|

|

Copper net cash unit costs (US$/lb.)1 |

1.65 – 1.95 |

|

Zinc net cash unit costs (US$/lb.)1 |

0.45 – 0.55 |

| |

|

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

All dollar amounts expressed in this news release

are in Canadian dollars unless otherwise noted.

Click here to view Teck’s full fourth quarter

results for 2024.

WEBCAST

Teck will host an Investor Conference Call to

discuss its Q4/2024 financial results at 11:00 AM Eastern time,

8:00 AM Pacific time, on February 20, 2025. A

live audio webcast of the conference call, together with supporting

presentation slides, will be available at our website at

www.teck.com. The webcast will be archived at www.teck.com.

REFERENCE

Emma Chapman, Vice President, Investor

Relations: +44 207.509.6576 Dale Steeves, Director, External

Communications: +1 236.987.7405

USE OF NON-GAAP FINANCIAL MEASURES AND

RATIOS

Our annual financial statements are prepared in

accordance with IFRS® Accounting Standards as issued by the

International Accounting Standards Board (IASB). Our interim

financial results are prepared in accordance with IAS 34, Interim

Financial Reporting (IAS 34). This document refers to a number of

non-GAAP financial measures and non-GAAP ratios, which are not

measures recognized under IFRS Accounting Standards and do not have

a standardized meaning prescribed by IFRS Accounting Standards or

by Generally Accepted Accounting Principles (GAAP) in the United

States.

The non-GAAP financial measures and non-GAAP

ratios described below do not have standardized meanings under IFRS

Accounting Standards, may differ from those used by other issuers,

and may not be comparable to similar financial measures and ratios

reported by other issuers. These financial measures and ratios have

been derived from our financial statements and applied on a

consistent basis as appropriate. We disclose these financial

measures and ratios because we believe they assist readers in

understanding the results of our operations and financial position

and provide further information about our financial results to

investors. These measures should not be considered in isolation or

used as a substitute for other measures of performance prepared in

accordance with IFRS Accounting Standards.

Adjusted profit from continuing operations

attributable to shareholders – For adjusted profit from

continuing operations attributable to shareholders, we adjust

profit from continuing operations attributable to shareholders as

reported to remove the after-tax effect of certain types of

transactions that reflect measurement changes on our balance sheet

or are not indicative of our normal operating activities.

EBITDA – EBITDA is profit before

net finance expense, provision for income taxes, and depreciation

and amortization.

Adjusted EBITDA – Adjusted EBITDA

is EBITDA before the pre-tax effect of the adjustments that we make

to adjusted profit from continuing operations attributable to

shareholders as described above.

Adjusted profit from continuing operations

attributable to shareholders, EBITDA and Adjusted EBITDA highlight

items and allow us and readers to analyze the rest of our results

more clearly. We believe that disclosing these measures assists

readers in understanding the ongoing cash-generating potential of

our business in order to provide liquidity to fund working capital

needs, service outstanding debt, fund future capital expenditures

and investment opportunities, and pay dividends.

Adjusted basic earnings per share from

continuing operations – Adjusted basic earnings per share

from continuing operations is adjusted profit from continuing

operations attributable to shareholders divided by average number

of shares outstanding in the period.

Adjusted diluted earnings per share from

continuing operations – Adjusted diluted earnings per

share from continuing operations is adjusted profit from continuing

operations attributable to shareholders divided by average number

of fully diluted shares in a period.

Gross profit before depreciation and

amortization – Gross profit before depreciation and

amortization is gross profit with depreciation and amortization

expense added back. We believe this measure assists us and readers

to assess our ability to generate cash flow from our reportable

segments or overall operations.

Total cash unit costs – Total

cash unit costs for our copper and zinc operations includes

adjusted cash costs of sales, as described below, plus the smelter

and refining charges added back in determining adjusted revenue.

This presentation allows a comparison of total cash unit costs,

including smelter charges, to the underlying price of copper or

zinc in order to assess the margin for the mine on a per unit

basis.

Net cash unit costs – Net cash

unit costs of principal product, after deducting co-product and

by-product margins, are also a common industry measure. By

deducting the co- and by-product margin per unit of the principal

product, the margin for the mine on a per unit basis may be

presented in a single metric for comparison to other

operations.

Adjusted cash cost of sales –

Adjusted cash cost of sales for our copper and zinc operations is

defined as the cost of the product delivered to the port of

shipment, excluding depreciation and amortization charges, any

one-time collective agreement charges or inventory write-down

provisions and by-product cost of sales. It is common practice in

the industry to exclude depreciation and amortization, as these

costs are non-cash, and discounted cash flow valuation models used

in the industry substitute expectations of future capital spending

for these amounts.

Profit (Loss) from Continuing Operations

Attributable to Shareholders and Adjusted Profit from Continuing

Operations Attributable to Shareholders

|

|

Three months ended December 31, |

Year ended December 31, |

|

(CAD$ in millions) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Profit (loss) from continuing operations attributable to

shareholders |

$ |

385 |

|

$ |

(167 |

) |

$ |

(467 |

) |

$ |

(118 |

) |

|

Add (deduct) on an after-tax basis: |

|

|

|

|

|

Asset impairment |

|

— |

|

|

— |

|

|

828 |

|

|

— |

|

|

QB variable consideration to IMSA and Codelco |

|

23 |

|

|

69 |

|

|

32 |

|

|

95 |

|

|

Environmental costs |

|

(6 |

) |

|

84 |

|

|

3 |

|

|

88 |

|

|

Share-based compensation |

|

5 |

|

|

(13 |

) |

|

72 |

|

|

63 |

|

|

Labour settlement |

|

25 |

|

|

— |

|

|

19 |

|

|

7 |

|

|

Commodity derivatives |

|

(29 |

) |

|

(20 |

) |

|

(65 |

) |

|

9 |

|

|

Foreign exchange (gains) losses |

|

(208 |

) |

|

8 |

|

|

(137 |

) |

|

(8 |

) |

|

Tax items |

|

(51 |

) |

|

— |

|

|

178 |

|

|

69 |

|

|

Other |

|

88 |

|

|

62 |

|

|

142 |

|

|

84 |

|

|

|

|

|

|

|

|

Adjusted profit from continuing operations attributable to

shareholders |

$ |

232 |

|

$ |

23 |

|

$ |

605 |

|

$ |

289 |

|

|

|

|

|

|

|

|

Basic earnings (loss) per share from continuing

operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

$ |

(0.90 |

) |

$ |

(0.23 |

) |

|

Diluted earnings (loss) per share from continuing

operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

$ |

(0.90 |

) |

$ |

(0.23 |

) |

|

Adjusted basic earnings per share from continuing

operations |

$ |

0.45 |

|

$ |

0.04 |

|

$ |

1.17 |

|

$ |

0.56 |

|

|

Adjusted diluted earnings per share from continuing

operations |

$ |

0.45 |

|

$ |

0.04 |

|

$ |

1.16 |

|

$ |

0.55 |

|

| |

|

|

|

|

Reconciliation of Basic Earnings (Loss)

per share from Continuing Operations to Adjusted Basic Earnings per

share from Continuing Operations

|

|

Three months ended December 31, |

Year ended December 31, |

|

(Per share amounts) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Basic earnings (loss) per share from continuing

operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

$ |

(0.90 |

) |

$ |

(0.23 |

) |

|

Add (deduct): |

|

|

|

|

|

Asset impairment |

|

— |

|

|

— |

|

|

1.60 |

|

|

— |

|

|

QB variable consideration to IMSA and Codelco |

|

0.05 |

|

|

0.13 |

|

|

0.06 |

|

|

0.18 |

|

|

Environmental costs |

|

(0.01 |

) |

|

0.16 |

|

|

0.01 |

|

|

0.17 |

|

|

Share-based compensation |

|

0.01 |

|

|

(0.03 |

) |

|

0.14 |

|

|

0.12 |

|

|

Labour settlement |

|

0.05 |

|

|

— |

|

|

0.04 |

|

|

0.01 |

|

|

Commodity derivatives |

|

(0.06 |

) |

|

(0.04 |

) |

|

(0.13 |

) |

|

0.02 |

|

|

Foreign exchange (gains) losses |

|

(0.41 |

) |

|

0.02 |

|

|

(0.27 |

) |

|

(0.01 |

) |

|

Tax items |

|

(0.10 |

) |

|

— |

|

|

0.34 |

|

|

0.13 |

|

|

Other |

|

0.17 |

|

|

0.12 |

|

|

0.28 |

|

|

0.17 |

|

|

|

|

|

|

|

|

Adjusted basic earnings per share from continuing

operations |

$ |

0.45 |

|

$ |

0.04 |

|

$ |

1.17 |

|

$ |

0.56 |

|

| |

|

|

|

|

Reconciliation of Diluted Earnings (Loss)

per share from Continuing Operations to Adjusted Diluted Earnings

per share from Continuing Operations

|

|

Three months ended December 31, |

Year ended December 31, |

|

(Per share amounts) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Diluted earnings (loss) per share from continuing

operations |

$ |

0.75 |

|

$ |

(0.32 |

) |

$ |

(0.90 |

) |

$ |

(0.23 |

) |

|

Add (deduct): |

|

|

|

|

|

Asset impairment |

|

— |

|

|

— |

|

|

1.58 |

|

|

— |

|

|

QB variable consideration to IMSA and Codelco |

|

0.04 |

|

|

0.13 |

|

|

0.06 |

|

|

0.18 |

|

|

Environmental costs |

|

(0.01 |

) |

|

0.16 |

|

|

0.01 |

|

|

0.17 |

|

|

Share-based compensation |

|

0.01 |

|

|

(0.02 |

) |

|

0.14 |

|

|

0.12 |

|

|

Labour settlement |

|

0.05 |

|

|

— |

|

|

0.04 |

|

|

0.01 |

|

|

Commodity derivatives |

|

(0.06 |

) |

|

(0.04 |

) |

|

(0.13 |

) |

|

0.02 |

|

|

Foreign exchange (gains) losses |

|

(0.41 |

) |

|

0.02 |

|

|

(0.26 |

) |

|

(0.01 |

) |

|

Tax items |

|

(0.10 |

) |

|

— |

|

|

0.34 |

|

|

0.13 |

|

|

Other |

|

0.18 |

|

|

0.11 |

|

|

0.28 |

|

|

0.16 |

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share from continuing

operations |

$ |

0.45 |

|

$ |

0.04 |

|

$ |

1.16 |

|

$ |

0.55 |

|

| |

|

|

|

|

Reconciliation of EBITDA and Adjusted

EBITDA

|

|

Three months ended December 31, |

Year ended December 31, |

|

(CAD$ in millions) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Profit (loss) from continuing operations before taxes |

$ |

256 |

|

$ |

(324 |

) |

$ |

(718 |

) |

$ |

(75 |

) |

|

Finance expense net of finance income |

|

141 |

|

|

25 |

|

|

719 |

|

|

50 |

|

|

Depreciation and amortization |

|

523 |

|

|

292 |

|

|

1,726 |

|

|

925 |

|

|

|

|

|

|

|

|

EBITDA |

|

920 |

|

|

(7 |

) |

|

1,727 |

|

|

900 |

|

|

|

|

|

|

|

|

Add (deduct): |

|

|

|

|

|

Asset impairment |

|

— |

|

|

— |

|

|

1,053 |

|

|

— |

|

|

QB variable consideration to IMSA and Codelco |

|

37 |

|

|

115 |

|

|

51 |

|

|

156 |

|

|

Environmental costs |

|

(8 |

) |

|

115 |

|

|

— |

|

|

119 |

|

|

Share-based compensation |

|

5 |

|

|

(15 |

) |

|

91 |

|

|

81 |

|

|

Labour settlement |

|

38 |

|

|

— |

|

|

29 |

|

|

11 |

|

|

Commodity derivatives |

|

(40 |

) |

|

(27 |

) |

|

(90 |

) |

|

12 |

|

|

Foreign exchange (gains) losses |

|

(235 |

) |

|

18 |

|

|

(146 |

) |

|

(9 |

) |

|

Other |

|

118 |

|

|

122 |

|

|

218 |

|

|

166 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

835 |

|

$ |

321 |

|

$ |

2,933 |

|

$ |

1,436 |

|

| |

|

|

|

|

Reconciliation of Gross Profit Before

Depreciation and Amortization

|

|

Three months ended December 31, |

Year ended December 31, |

|

(CAD$ in millions) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Gross profit |

$ |

542 |

|

$ |

152 |

|

$ |

1,607 |

|

$ |

1,112 |

|

|

Depreciation and amortization |

|

510 |

|

|

280 |

|

|

1,665 |

|

|

861 |

|

|

|

|

|

|

|

|

Gross profit before depreciation and amortization |

$ |

1,052 |

|

$ |

432 |

|

$ |

3,272 |

|

$ |

1,973 |

|

|

|

|

|

|

|

|

Reported as: |

|

|

|

|

|

Copper |

|

|

|

|

|

Quebrada Blanca |

$ |

304 |

|

$ |

(79 |

) |

$ |

766 |

|

$ |

(61 |

) |

|

Highland Valley Copper |

|

100 |

|

|

101 |

|

|

471 |

|

|

391 |

|

|

Antamina |

|

275 |

|

|

228 |

|

|

1,038 |

|

|

899 |

|

|

Carmen de Andacollo |

|

52 |

|

|

34 |

|

|

121 |

|

|

44 |

|

|

Other |

|

1 |

|

|

(3 |

) |

|

5 |

|

|

(8 |

) |

|

|

|

|

|

|

|

|

|

732 |

|

|

281 |

|

|

2,401 |

|

|

1,265 |

|

|

|

|

|

|

|

|

Zinc |

|

|

|

|

|

Trail Operations |

|

15 |

|

|

12 |

|

|

12 |

|

|

103 |

|

|

Red Dog |

|

303 |

|

|

141 |

|

|

851 |

|

|

611 |

|

|

Other |

|

2 |

|

|

(2 |

) |

|

8 |

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

320 |

|

|

151 |

|

|

871 |

|

|

708 |

|

|

|

|

|

|

|

|

Gross profit before depreciation and amortization |

$ |

1,052 |

|

$ |

432 |

|

$ |

3,272 |

|

$ |

1,973 |

|

| |

|

|

|

|

CAUTIONARY STATEMENT ON FORWARD-LOOKING

STATEMENTS

This news release contains certain forward-looking

information and forward-looking statements as defined in applicable

securities laws (collectively referred to as forward-looking

statements). These statements relate to future events or our future

performance. All statements other than statements of historical

fact are forward-looking statements. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “predict”, “potential”, “should”, “believe” and

similar expressions is intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. These statements speak only as of the

date of this news release.

These forward-looking statements include, but are

not limited to, statements concerning: our focus and strategy,

including being a pure-play energy transition metals company;

anticipated global and regional supply, demand and market outlook

for our commodities; our business, assets, and strategy going

forward, including with respect to future and ongoing project

development; our ability to execute our copper growth strategy in a

value accretive manner; the expected use of proceeds from the sale

of our steelmaking coal business, including the timing and format

of any cash returns to shareholders; the anticipated benefits of

the sale of our steelmaking coal business; our expectations

regarding the continued ramp-up and future optimization and

debottlenecking of QB2, including the occurrence, timing and length

of required maintenance shutdowns; expectations regarding

inflationary pressures and our ability to manage controllable

operating expenditures; expectations with respect to the potential

impact of any tariffs, countervailing duties or other trade

restrictions; expectations with respect to execution of our copper

growth strategy, including the timing and occurrence of any

sanction decisions and prioritization and amount of planned growth

capital expenditures; expectations regarding advancement of our

copper growth portfolio projects, including advancement of study,

permitting, execution planning, detailed engineering and design,

risk mitigation, and advanced early works, community and Indigenous

engagement, completion of updated cost estimates, tendering

processes, and timing for receipt of permits related to QB

debottlenecking, the HVC Mine Life Extension, San Nicolás, and

Zafranal projects, as applicable; expectations with respect to

timing and outcome of the regulatory approvals process for the HVC

Mine Life Extension, including with respect to the dispute

resolution process underway; expectations with respect to the

construction of an exploration access road and advancement of

prefeasibility study work in the Red Dog district; expectations

regarding timing and amount of income tax payments and our

effective tax rate; liquidity and availability of borrowings under

our credit facilities; requirements to post and our ability to

obtain additional credit for posting security for reclamation at

our sites; all guidance appearing in this document including but

not limited to the production, sales, cost, unit cost, capital

expenditure, capitalized production stripping, operating outlook,

and other guidance under the headings “Guidance” and "Outlook" and

as discussed elsewhere in the various reportable segment sections;

our expectations regarding inflationary pressures and increased key

input costs; and expectations regarding the adoption of new

accounting standards and the impact of new accounting

developments.

These statements are based on a number of

assumptions, including, but not limited to, assumptions disclosed

elsewhere in this document and assumptions regarding general

business and economic conditions, interest rates, commodity and

power prices; acts of foreign or domestic governments and the

outcome of legal proceedings; the imposition of tariffs, import or

export restrictions, or other trade barriers by foreign or domestic

governments; the continued operation of QB2 in accordance with our

expectations; the possibility that the anticipated benefits from

the sale of our steelmaking coal business are not realized in the

time frame anticipated or at all as a result of changes in general

economic and market conditions, including credit, market, currency,

operational, commodity, liquidity and funding risks generally and

relating specifically to the transaction; the possibility that our

business may not perform as expected or in a manner consistent with

historical performance; the supply and demand for, deliveries of,

and the level and volatility of prices of copper and zinc and our

other metals and minerals, as well as steel, crude oil, natural gas

and other petroleum products; the timing of the receipt of permits

and other regulatory and governmental approvals for our development

projects and other operations, including mine extensions; positive

results from the studies on our expansion and development projects;

our ability to secure adequate transportation, including rail and

port services, for our products; our costs of production and our

production and productivity levels, as well as those of our

competitors; continuing availability of water and power resources

for our operations; changes in credit market conditions and

conditions in financial markets generally; the availability of

funding to refinance our borrowings as they become due or to

finance our development projects on reasonable terms; availability

of letters of credit and other forms of financial assurance

acceptable to regulators for reclamation and other bonding

requirements; our ability to procure equipment and operating

supplies in sufficient quantities and on a timely basis; the

availability of qualified employees and contractors for our

operations, including our new developments and our ability to

attract and retain skilled employees; the satisfactory negotiation

of collective agreements with unionized employees; the impact of

changes in Canadian-U.S. dollar, Canadian dollar-Chilean Peso and

other foreign exchange rates on our costs and results; engineering

and construction timetables and capital costs for our development

and expansion projects; our ability to develop technology and

obtain the benefits of technology for our operations and

development projects; closure costs; environmental compliance

costs; market competition; the accuracy of our mineral reserve and

resource estimates (including with respect to size, grade and

recoverability) and the geological, operational and price

assumptions on which these are based; tax benefits and statutory

and effective tax rates; the outcome of our copper, zinc and lead

concentrate treatment and refining charge negotiations with

customers; the resolution of environmental and other proceedings or

disputes; our ability to obtain, comply with and renew permits,

licenses and leases in a timely manner; and our ongoing relations

with our employees and with our business and joint venture

partners.

Statements regarding the availability of our

credit facilities are based on assumptions that we will be able to

satisfy the conditions for borrowing at the time of a borrowing

request and that the facilities are not otherwise terminated or

accelerated due to an event of default. Assumptions regarding the

costs and benefits of our projects include assumptions that the

relevant project is constructed, commissioned and operated in

accordance with current expectations. Expectations regarding our

operations are based on numerous assumptions regarding the

operations. Our Guidance tables include disclosure and footnotes

with further assumptions relating to our guidance, and assumptions

for certain other forward-looking statements accompany those

statements within the document. Statements concerning future

production costs or volumes are based on numerous assumptions

regarding operating matters and on assumptions that demand for

products develops as anticipated, that customers and other

counterparties perform their contractual obligations, that

operating and capital plans will not be disrupted by issues such as

mechanical failure, unavailability of parts and supplies, labour

disturbances, interruption in transportation or utilities, or

adverse weather conditions, and that there are no material

unanticipated variations in the cost of energy or supplies. The

foregoing list of assumptions is not exhaustive. Events or

circumstances could cause actual results to vary materially.

Factors that may cause actual results to vary

materially include, but are not limited to, changes in commodity

and power prices; changes in market demand for our products;

changes in interest and currency exchange rates; acts of

governments and the outcome of legal proceedings; the imposition of

tariffs, import or export restrictions, or other trade barriers by

foreign or domestic governments; inaccurate geological and

metallurgical assumptions (including with respect to the size,

grade and recoverability of mineral reserves and resources);

operational difficulties (including failure of plant, equipment or

processes to operate in accordance with specifications or

expectations, cost escalation, unavailability of labour, materials

and equipment); government action or delays in the receipt of

government approvals; changes in royalty or tax rates; industrial

disturbances or other job action; adverse weather conditions;

unanticipated events related to health, safety and environmental

matters; union labour disputes; any resurgence of COVID-19 and

related mitigation protocols; political risk; social unrest;

failure of customers or counterparties (including logistics

suppliers) to perform their contractual obligations; changes in our

credit ratings; unanticipated increases in costs to construct our

development projects; difficulty in obtaining permits; inability to

address concerns regarding permits or environmental impact

assessments; and changes or further deterioration in general

economic conditions. The amount and timing of capital expenditures

is depending upon, among other matters, being able to secure

permits, equipment, supplies, materials and labour on a timely

basis and at expected costs. Certain operations and projects are

not controlled by us; schedules and costs may be adjusted by our

partners, and timing of spending and operation of the operation or

project is not in our control. Certain of our other operations and

projects are operated through joint arrangements where we may not

have control over all decisions, which may cause outcomes to differ

from current expectations. Ongoing monitoring may reveal unexpected

environmental conditions at our operations and projects that could

require additional remedial measures. Production at our QB and Red

Dog Operations may also be impacted by water levels at site. Sales

to China may be impacted by general and specific port restrictions,

Chinese regulation and policies, and normal production and

operating risks.

We assume no obligation to update forward-looking

statements except as required under securities laws. Further

information concerning risks, assumptions and uncertainties

associated with these forward-looking statements and our business

can be found in our Annual Information Form for the year ended

December 31, 2023 filed under our profile on SEDAR+

(www.sedarplus.ca) and on EDGAR (www.sec.gov) under cover of Form

40-F, as well as subsequent filings that can also be found under

our profile.

Scientific and technical information in this

quarterly report regarding our material properties was reviewed,

approved and verified by Rodrigo Alves Marinho, P.Geo., a

contractor of Teck and a Qualified Person as defined under National

Instrument 43-101.

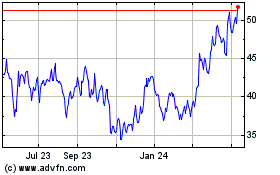

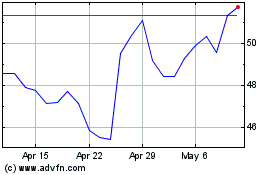

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Feb 2024 to Feb 2025