TSMC Sets Up for Soaring Chip Demand

April 15 2021 - 8:12AM

Dow Jones News

By Stephanie Yang and Yang Jie

Taiwan Semiconductor Manufacturing Co. said it would raise its

capital spending budget and revenue growth forecast for 2021, a

sign of confidence from the world's biggest contract chip maker

that soaring global demand for semiconductors will persist.

The chip maker said Thursday while reporting its quarterly

earnings that it would raise its capital expenditures to $30

billion this year, from an earlier range of $25 billion to $28

billion announced in January. The Hsinchu, Taiwan-based company

also raised its revenue growth forecast to 20% for the year, from

an earlier estimate of 15% growth.

The chip maker's heftier investment budget comes as its global

competitors also move to beef up production capacity amid a global

chip shortage that TSMC expects to extend into 2022.

TSMC's upward revision in capital spending for 2021 effectively

pulls forward some of the planned investment the semiconductor

giant had announced earlier this month, when it announced a record

spending spree of $100 billion over the next three years to build

out more of its production capacity.

"Our customers are currently facing challenges from the

industrywide semiconductor capacity shortage," said TSMC's chief

executive C.C. Wei. Mr. Wei blamed the shortage on what he thinks

will be a permanent increase in longer-term demand for chips, as

well as shorter-term imbalances in the supply chain.

Intel Corp. recently announced a $20 billion investment to build

two new chip factories in the U.S. starting in 2024, while South

Korea's Samsung Electronics Co. has said it plans to invest about

$116 billion by 2030 to diversify its semiconductor production

capabilities.

Mr. Wei said TSMC, which counts Intel as an important customer,

supports the Santa Clara, Calif.-based company's decision to invest

in its own manufacturing capabilities, though he said that TSMC

would also seek to compete with it.

"We will collaborate in some area[s] and compete in other

area[s]," Mr. Wei said. "TSMC has never been short on competition

in our 30-plus year history, and we know how to compete."

As competition in the semiconductor industry increases and

technological breakthroughs become more expensive, TSMC has begun

passing along the higher investment costs to buyers of its wafers.

In a recent letter to clients, TSMC said it would suspend wafer

price reductions for one year starting at the end of 2021.

"We are taking actions to ensure that we are earning a proper

return by firming up our price," Chief Financial Officer Wendell

Huang said Thursday.

On the question of the global semiconductor shortage, TSMC

executives said that while part of the current scarcity of chips

was due to short-term constraints, they expect supplies to be

strained well into next year as demand remains strong and customers

stockpile chips amid concerns about rising geopolitical tensions

and the continuing pandemic.

Auto makers were caught flat-footed after many canceled chip

orders in anticipation of a pandemic sales plunge that instead

became a surge in car buying. Meanwhile, the sudden shift to remote

work in many parts of the world sent demand for electronic devices

soaring.

The geographical concentration of the world's chipmaking

capabilities, two-thirds of which is located in Taiwan, has come

into focus as countries seek to limit their technology dependence

on others.

On Monday, U.S. President Joe Biden called for bipartisan

efforts to strengthen the domestic semiconductor industry at a

meeting to address the chip shortage. Mr. Biden's $2.3 trillion

infrastructure proposal includes $50 billion for the American

semiconductor industry.

TSMC has announced plans to build a $12 billion chip

manufacturing plant in Arizona, though the company said Thursday

that it would continue to focus its expansion efforts in

Taiwan.

TSMC's net profit for the first three months of the year rose

19% from the same period a year earlier to 139.69 billion New

Taiwan dollars, equivalent to $4.91 billion, beating analyst

estimates, boosted by continued strong demand for chips during the

pandemic. Revenue increased 17% from a year earlier to NT$362.41

billion.

Automotive chips and high-performance computing were drivers of

growth during the quarter, rising 30% and 14% respectively, while

revenue from smartphones fell 11%.

Kosaku Narioka contributed to this article.

Write to Stephanie Yang at stephanie.yang@wsj.com and Yang Jie

at jie.yang@wsj.com

(END) Dow Jones Newswires

April 15, 2021 07:57 ET (11:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

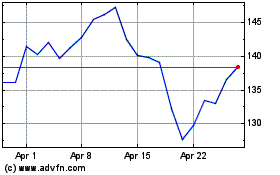

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024