Sysco Corporation (NYSE: SYY) today announced financial results for

its 13-week first fiscal quarter ended September 26, 2020.

First Quarter Fiscal 2021 Highlights

- Sales decreased 23.0% to $11.8

billion

- Gross profit decreased 24.6% to

$2.2 billion; gross margin decreased 39 basis points

- Operating income decreased 37.2% to

$419.6 million; adjusted¹ operating income decreased 50.8% to

$364.7 million

- Earnings per share (“EPS”)

decreased $0.45 to $0.42; adjusted¹ EPS decreased $0.64 to

$0.34

“Although our first quarter 2021 results

continue to be impacted by the pandemic, we are pleased with our

overall expense management and our ability to produce positive free

cash flow and a profitable quarter despite a 23% reduction in

sales. We saw improvement in the overall sales environment

throughout the quarter and remain resolutely focused upon serving

our customers. We are confident that Sysco’s business

transformation will accelerate profitable growth as we

differentiate our business from our competition to better serve the

evolving needs of our customers,” said Kevin Hourican, Sysco’s

president and chief executive officer. “I am pleased with the focus

and agility of Sysco’s associates as we work to transform the

company and manage the complexities of the COVID-19 pandemic.”

Our business transformation is on track as Sysco

continues to manage through the COVID-19 pandemic and is using the

crisis as an opportunity to accelerate our strategic

transformation, which will help improve how we serve our customers

and differentiate ourselves from the competition. Our strategic

transformation priorities include acceleration of our work across

our customer-facing tools and technology, sales transformation to

improve selling effectiveness and provide a more customer-centric

structure, regionalization of our U.S. Broadline business, and

becoming a more efficient company -- all of which will enable us to

improve profitability and fund new sources of business growth. Our

success comes from the success of our customers, and our

transformation initiatives will improve how we serve those

customers, both big and small.

¹ Earnings Per Share (EPS) are shown on a

diluted basis unless otherwise specified. Adjusted financial

results exclude certain items, which primarily include adjustments

to our bad debt reserve specific to aged receivables existing prior

to the COVID-19 pandemic, restructuring costs, transformational

project costs and acquisition-related costs. Specific to EPS, this

year’s Certain Items include the impact of a loss on the sale of

Cake Corporation and the impact of a new U.K. tax law change.

Reconciliations of all non-GAAP measures are included at the end of

this release. 2 Free cash flow is a non-GAAP measure that

represents net cash provided from operating activities less

purchases of plant and equipment and includes proceeds from sales

of plant and equipment. Reconciliations for all non-GAAP measures

are included at the end of this release.

First Quarter Fiscal 2021

Results

U.S. Foodservice Operations

Sales for the first quarter were $7.9 billion, a

decrease of 25.7% compared to the same period last year. Local case

volume within U.S. Broadline operations decreased 21.6% for the

first quarter, of which a decrease of 21.7% was organic, while

total case volume within U.S. Broadline operations decreased 25.8%,

of which a decrease of 25.9% was organic.

Gross profit decreased 25.4% to $1.6 billion,

and gross margin increased 7 basis points to 20.2%, compared to the

same period last year. Product cost inflation was 1.0% in U.S.

Broadline, as measured by the estimated change in Sysco’s product

costs, primarily in the dairy, paper and disposables, and meat

categories.

Operating expenses decreased $340.0 million, or

25.2%, compared to the same period last year. Adjusted operating

expenses decreased $250.5 million, or 18.6%, compared to the same

period last year.

Operating income was $588.4 million, a decrease

of $205.2 million, or 25.9%, compared to the same period last year.

Adjusted operating income was $503.0 million, a decrease of $294.7

million, or 36.9%, compared to the same period last year.

International Foodservice Operations

Sales for the first quarter were $2.2 billion, a

decrease of 25.7% compared to the same period last year. On a

constant currency basis, sales for the first quarter were $2.1

billion, a decrease of 27.1% compared to the same period last year.

Foreign exchange rates positively affected International

Foodservice Operations sales by 1.4% and total Sysco sales by 0.3%

during the quarter.

Gross profit decreased 25.6% to $450.4 million,

and gross margin increased 4 basis points to 20.8%, in each case as

compared to the same period last year. On a constant currency

basis, gross profit decreased 27.5% to $438.9 million. Foreign

exchange rates positively affected International Foodservice

Operations gross profit by 1.9% and total Sysco gross profit by

0.4% during the quarter.

Operating expenses decreased $99.5 million, or

18.1%, compared to the same period last year. Adjusted

operating expenses decreased $74.6 million, or 14.7%, compared to

the same period last year. On a constant currency basis, adjusted

operating expenses decreased $86.9 million, or 17.2%, compared to

the same period last year. Foreign exchange rates negatively

affected International Foodservice Operations operating expense by

2.4% and total Sysco operating expense by 0.6% during the

quarter.

The International Foodservice Operations segment

delivered an operating loss of $0.5 million, a decrease of $55.3

million compared to the same period last year. Adjusted operating

income was $18.8 million, a decrease of $80.2 million compared to

the same period last year. Foreign exchange rates did not have a

meaningful impact on International Foodservice Operations operating

income during the quarter.

Balance Sheet, Capital Spending and Cash

Flow

Capital expenditures, net of proceeds from sales

of plant and equipment, for the first 13 weeks of fiscal 2021 were

$102.4 million lower compared to the prior year period.

Cash flow from operations was $930.9 million for

the first 13 weeks of fiscal 2021, which was $759.3 million higher

compared to the prior year period. Free cash flow2 for the first 13

weeks of fiscal 2021 was $862.4 million, which was $861.7 million

higher compared to the prior year.

Conference Call &

Webcast

Sysco will host a conference call to review the

company’s first quarter fiscal 2021 financial results on Tuesday,

November 3, 2020, at 10:00 a.m. Eastern. A live webcast of the

call, accompanying slide presentation and a copy of this news

release will be available online at investors.sysco.com.

Key Highlights:

|

|

13-Week Period Ended |

|

|

|

|

|

|

Financial Comparison: |

September 26, 2020 |

September 28, 2019 |

Change |

|

Sales |

$11.8 billion |

$15.3 billion |

-23.0% |

|

Gross profit |

$2.2 billion |

$2.9 billion |

-24.6% |

|

Gross Margin |

18.85% |

19.23% |

-39 bps |

|

|

|

|

|

|

GAAP: |

|

|

|

|

Operating expenses |

$1.8 billion |

$2.3 billion |

-20.9% |

|

Certain Items |

$(54.9) million |

$73.6 million |

-174.6% |

|

Operating Income |

$419.6 million |

$668.3 million |

-37.2% |

|

Operating Margin |

3.56% |

4.37% |

-80 bps |

|

Net Earnings |

$216.9 million |

$453.8 million |

-52.2% |

|

Diluted Earnings Per Share |

$0.42 |

$0.87 |

-51.7% |

|

|

|

|

|

|

Non-GAAP (1): |

|

|

|

|

Operating Expenses |

$1.9 billion |

$2.2 billion |

-15.7% |

|

Operating Income |

$364.7 million |

$741.9 million |

-50.8% |

|

Operating Margin |

3.10% |

4.85% |

-175 bps |

|

Net Earnings |

$173.5 million |

$510.3 million |

-66.0% |

|

Diluted Earnings Per Share (2) |

$0.34 |

$0.98 |

-65.3% |

|

|

|

|

|

|

Case Growth: |

|

|

|

|

U.S. Broadline |

-25.8% |

0.5% |

|

|

Local |

-21.6% |

1.5% |

|

|

|

|

|

|

|

Sysco Brand Sales as a % of Cases: |

|

|

|

|

U.S. Broadline |

38.81% |

38.66% |

15 bps |

|

Local |

46.33% |

47.39% |

-106 bps |

Note:

(1) A reconciliation of non-GAAP measures

is included at the end of this release.

(2) Individual components in the table above may

not sum to the totals due to the rounding.

Forward-Looking Statements

Statements made in this press release or in our

earnings call for the first quarter of fiscal 2021 that look

forward in time or that express management’s beliefs, expectations

or hopes are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements reflect the views of management at the

time such statements are made and are subject to a number of risks,

uncertainties, estimates, and assumptions that may cause actual

results to differ materially from current expectations. These

statements include: the effect, impact, potential duration or other

implications of the recent outbreak of a novel strain of

coronavirus (“COVID-19”) and any expectations we may have with

respect thereto; our expectations regarding our ability to manage

the current downturn and capitalize on our position as the industry

leader as the global economy recovers; our expectations regarding

future market share gains; our expectations regarding the effects

of our business transformation initiatives; our belief that our

transformation initiatives will improve how we serve customers; our

expectations regarding our efforts to regionalize our operations

and the benefits to our company from regionalization; our

expectations that our efforts across our customer-facing tools and

technology will improve service to our customers; our plans

regarding the timing of the commencement of piloting our new

pricing software; our plans regarding our sales transformation

initiative and our expectations regarding the effects of our new

sales process; our expectations regarding our company, and our

ability to attract and serve new customers, following the COVID-19

crisis; our plans to remove structural expense from our company’s

operations and the amount of structural savings we expect to

deliver; our expectations regarding savings starting in fiscal 2022

from additional cost improvement opportunities; the effects of our

planned investments in digital technology; our expectations

regarding the timing of improvements in the economy following the

COVID-19 crisis; the impact on our results of government-imposed

restrictions on restaurant operations; our expectations that our

work to accelerate growth will return to pre-COVID levels as demand

resurges; our expectations that our investments in technology and

our business will allow for future growth and exceptional customer

service; our belief that the steps undertaken as part of our

management of the COVID-19 crisis to date will help us retain and

win additional business from our independent restaurant customers

beyond the pandemic; our expectations regarding the impact of our

strategy on our future operations, including on the service we

provide our customers and on our ability to differentiate Sysco

from other companies in our industry; our plans to reinvest a

portion of our cost savings into our growth agenda; our ability to

deliver against our strategic priorities; statements regarding

economic trends in the United States and abroad; our expectations

regarding the amount of our capital expenditures in fiscal 2021;

our expectations regarding the deployment of capital proceeds that

Sysco currently holds; our expectations regarding the effects of

our divestiture of our CAKE business; our expectations regarding

our free cash flow during fiscal 2021; and our expectations

regarding our cash performance in the second quarter of fiscal

2021.

The success of our plans and expectations

regarding our operating performance are subject to the general

risks associated with our business, including the risks of

interruption of supplies due to lack of long-term contracts, severe

weather, crop conditions, work stoppages, intense competition,

technology disruptions, dependence on large, long-term regional and

national customers, inflation risks, the impact of fuel prices,

adverse publicity, labor issues, political or financial

instability, trade restrictions, tariffs, currency exchange rates,

transport capacity and costs and other factors relating to foreign

trade, any or all of which could delay our receipt of product or

increase our input costs. Risks and uncertainties also include the

impact and effects of public health crises, pandemics and

epidemics, such as the COVID-19 pandemic, and the adverse impact

thereof on our business, financial condition and results of

operations, including, but not limited to, our growth, product

costs, supply chain, labor availability, logistical capabilities,

customer demand for our products and industry demand generally,

consumer spending, our liquidity, the price of our securities and

trading markets with respect thereto, our credit ratings, our

ability to maintain compliance with the covenants in our credit

agreement, our ability to access capital markets, and the global

economy and financial markets generally. Risks and uncertainties

also include risks impacting the economy generally, including the

risks that the current general economic conditions will

deteriorate, or consumer confidence in the economy or consumer

spending, particularly on food-away-from-home, may decline. Market

conditions may not improve. Competition and the impact of GPOs may

reduce our margins and make it difficult for us to maintain our

market share, growth rate and profitability. We may not be able to

fully compensate for increases in fuel costs, and fuel hedging

arrangements intended to contain fuel costs could result in above

market fuel costs. Our ability to meet our long-term strategic

objectives depends on our ability to grow gross profit, leverage

our supply chain costs and reduce administrative costs. This will

depend largely on the success of our various business initiatives,

including efforts related to revenue management, expense

management, our digital e-commerce strategy and any efforts related

to restructuring or the reduction of administrative costs. There

are various risks related to these efforts, including the risk that

if sales from our locally managed customers do not grow at the same

rate as sales from regional and national customers, or if we are

unable to continue to accelerate local case growth, our gross

margins may decline; the risk that we are unlikely to be able to

predict inflation over the long term, and lower inflation is likely

to produce lower gross profit; the risk that our efforts to

mitigate increases in warehouse costs may be unsuccessful; the risk

that we may not be able to accelerate and/or identify additional

administrative cost savings in order to compensate for any gross

profit or supply chain cost leverage challenges; the risk that

these efforts may not provide the expected benefits in our

anticipated time frame, if at all, and may prove costlier than

expected; the risk that the actual costs of any initiatives may be

greater or less than currently expected; and the risk of adverse

effects to our business, results of operations and liquidity if

past and future undertakings, and the associated changes to our

business, do not prove to be cost effective or do not result in the

cost savings and other benefits at the levels that we anticipate.

Our plans related to and the timing of any initiatives are subject

to change at any time based on management’s subjective evaluation

of our overall business needs. If we are unable to realize the

anticipated benefits from our efforts, we could become cost

disadvantaged in the marketplace, and our competitiveness and our

profitability could decrease. Adverse publicity about us or lack of

confidence in our products could negatively impact our reputation

and reduce earnings. Capital expenditures may vary based on changes

in business plans and other factors, including risks related to the

implementation of various initiatives, the timing and successful

completion of acquisitions, construction schedules and the

possibility that other cash requirements could result in delays or

cancellations of capital spending. Periods of significant or

prolonged inflation or deflation, either overall or in certain

product categories, can have a negative impact on us and our

customers, as high food costs can reduce consumer spending in the

food-away-from-home market, and may negatively impact our sales,

gross profit, operating income and earnings, and periods of

deflation can be difficult to manage effectively. Fluctuations in

inflation and deflation, as well as fluctuations in the value of

foreign currencies, are beyond our control and subject to broader

market forces. Expanding into international markets presents unique

challenges and risks, including compliance with local laws,

regulations and customs and the impact of local political and

economic conditions, including the impact of Brexit and the “yellow

vest” protests in France against a fuel tax increase, pension

reform and the French government, and such expansion efforts may

not be successful. Any business that we acquire may not perform as

expected, and we may not realize the anticipated benefits of our

acquisitions. Expectations regarding the financial statement impact

of any acquisitions may change based on management’s subjective

evaluation. A divestiture of one or more of our businesses may not

provide the anticipated effects on our operations. Meeting our

dividend target objectives depends on our level of earnings,

available cash and the success of our various strategic

initiatives. Changes in applicable tax laws or regulations and the

resolution of tax disputes could negatively affect our financial

results. We rely on technology in our business and any

cybersecurity incident, other technology disruption or delay in

implementing new technology could negatively affect our business

and our relationships with customers. For a discussion of

additional factors impacting Sysco’s business, see our Annual

Report on Form 10-K for the year ended June 27, 2020, as filed with

the SEC, and our subsequent filings with the SEC. We do not

undertake to update our forward-looking statements, except as

required by applicable law.

About Sysco

Sysco is the global leader in selling, marketing

and distributing food products to restaurants, healthcare and

educational facilities, lodging establishments and other customers

who prepare meals away from home. Its family of products also

includes equipment and supplies for the foodservice and hospitality

industries. With more than 57,000 associates, the company operates

326 distribution facilities worldwide and serves more than 625,000

customer locations. For fiscal 2020 that ended June 27, 2020, the

company generated sales of more than $52 billion. Information about

our CSR program, including Sysco’s 2020 Corporate Social

Responsibility Report, can be found at sysco.com/csr2020report.

For more information, visit

www.sysco.com or connect with Sysco on Facebook at

www.facebook.com/SyscoCorporation or Twitter at

https://twitter.com/Sysco. For important news and information

regarding Sysco, visit the Investor Relations section of the

company’s Internet home page at investors.sysco.com, which Sysco

plans to use as a primary channel for publishing key information to

its investors, some of which may contain material and previously

non-public information. Investors should also follow us at

www.twitter.com/SyscoStock and download the Sysco IR App, available

on the iTunes App Store and the Google Play Market. In

addition, investors should continue to review our news releases and

filings with the SEC. It is possible that the information we

disclose through any of these channels of distribution could be

deemed to be material information.

Sysco Corporation and its Consolidated

SubsidiariesCONSOLIDATED RESULTS OF

OPERATIONS(In Thousands, Except for Share and Per

Share Data)

| |

13-Week Period Ended |

| |

Sep. 26, 2020 |

|

Sep. 28, 2019 |

| |

|

|

|

|

Sales |

$ |

11,777,379 |

|

|

$ |

15,303,005 |

|

| Cost of sales |

9,557,534 |

|

|

12,359,635 |

|

| Gross profit |

2,219,845 |

|

|

2,943,370 |

|

| Operating expenses |

1,800,266 |

|

|

2,275,052 |

|

| Operating income |

419,579 |

|

|

668,318 |

|

| Interest expense |

146,717 |

|

|

83,335 |

|

| Other expense (income),

net |

14,124 |

|

|

3,112 |

|

| Earnings before income

taxes |

258,738 |

|

|

581,871 |

|

| Income taxes |

41,838 |

|

|

128,090 |

|

| Net earnings |

$ |

216,900 |

|

|

$ |

453,781 |

|

| |

|

|

|

| Net earnings: |

|

|

|

| Basic earnings per share |

$ |

0.43 |

|

|

$ |

0.88 |

|

| Diluted earnings per

share |

0.42 |

|

|

0.87 |

|

| |

|

|

|

| Average shares

outstanding |

509,127,405 |

|

|

513,496,296 |

|

| Diluted shares

outstanding |

510,738,760 |

|

|

518,761,456 |

|

Sysco Corporation and its Consolidated

SubsidiariesCONSOLIDATED BALANCE

SHEETS(In Thousands, Except for Share

Data)

| |

Sep. 26, 2020 |

|

Jun. 27, 2020 |

| |

|

|

|

|

ASSETS |

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ |

5,985,532 |

|

|

$ |

6,059,427 |

|

| Accounts receivable, less

allowances of $265,597 and $334,810 |

3,106,466 |

|

|

2,893,551 |

|

| Inventories |

3,134,732 |

|

|

3,095,085 |

|

| Prepaid expenses and other

current assets |

197,074 |

|

|

192,163 |

|

| Income tax receivable |

9,294 |

|

|

108,006 |

|

| Total current assets |

12,433,098 |

|

|

12,348,232 |

|

| Plant and equipment at cost,

less accumulated depreciation |

4,404,597 |

|

|

4,458,567 |

|

| Other long-term

assets |

|

|

|

| Goodwill |

3,794,152 |

|

|

3,732,469 |

|

| Intangibles, less

amortization |

776,598 |

|

|

780,172 |

|

| Deferred income taxes |

228,234 |

|

|

194,115 |

|

| Operating lease right-of-use

assets, net |

621,307 |

|

|

603,616 |

|

| Other assets |

483,572 |

|

|

511,095 |

|

| Total other long-term

assets |

5,903,863 |

|

|

5,821,467 |

|

| Total assets |

$ |

22,741,558 |

|

|

$ |

22,628,266 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

| Current

liabilities |

|

|

|

| Notes payable |

$ |

5,408 |

|

|

$ |

2,266 |

|

| Accounts payable |

4,035,332 |

|

|

3,447,065 |

|

| Accrued expenses |

1,697,995 |

|

|

1,616,289 |

|

| Accrued income taxes |

— |

|

|

2,938 |

|

| Current operating lease

liabilities |

108,704 |

|

|

107,167 |

|

| Current maturities of

long-term debt |

1,320,628 |

|

|

1,542,128 |

|

| Total current liabilities |

7,168,067 |

|

|

6,717,853 |

|

| Long-term

liabilities |

|

|

|

| Long-term debt |

12,422,780 |

|

|

12,902,485 |

|

| Deferred income taxes |

54,011 |

|

|

86,601 |

|

| Long-term operating lease

liabilities |

545,485 |

|

|

523,496 |

|

| Other long-term

liabilities |

1,217,227 |

|

|

1,204,953 |

|

| Total long-term

liabilities |

14,239,503 |

|

|

14,717,535 |

|

| Commitments and

contingencies |

|

|

|

| Noncontrolling interest |

33,977 |

|

|

34,265 |

|

| Shareholders’

equity |

|

|

|

| Preferred stock, par value $1

per share Authorized 1,500,000 shares, issued none |

— |

|

|

— |

|

| Common stock, par value $1 per

share Authorized 2,000,000,000 shares, issued 765,174,900

shares |

765,175 |

|

|

765,175 |

|

| Paid-in capital |

1,534,281 |

|

|

1,506,901 |

|

| Retained earnings |

10,546,598 |

|

|

10,563,008 |

|

| Accumulated other

comprehensive loss |

(1,612,386 |

) |

|

(1,710,881 |

) |

| Treasury stock at cost,

256,075,772 and 256,915,825 shares |

(9,933,657 |

) |

|

(9,965,590 |

) |

| Total shareholders’

equity |

1,300,011 |

|

|

1,158,613 |

|

| Total liabilities and

shareholders’ equity |

$ |

22,741,558 |

|

|

$ |

22,628,266 |

|

Sysco Corporation and its Consolidated

SubsidiariesCONSOLIDATED CASH

FLOWS(In Thousands)

|

|

13-Week Period Ended |

| |

Sep. 26, 2020 |

|

Sep. 28, 2019 |

| Cash flows from operating

activities: |

|

|

|

|

Net earnings |

$ |

216,900 |

|

|

$ |

453,781 |

|

|

Adjustments to reconcile net earnings to cash provided by operating

activities: |

|

|

|

|

Share-based compensation expense |

25,834 |

|

|

21,386 |

|

|

Depreciation and amortization |

180,520 |

|

|

187,405 |

|

|

Operating lease asset amortization |

27,379 |

|

|

26,925 |

|

|

Amortization of debt issuance and other debt-related costs |

6,554 |

|

|

4,920 |

|

|

Deferred income taxes |

(53,579 |

) |

|

(25,494 |

) |

|

Provision for losses on receivables |

(77,790 |

) |

|

18,712 |

|

|

Loss on sale of business |

12,043 |

|

|

— |

|

|

Other non-cash items |

(6,641 |

) |

|

2,295 |

|

|

Additional changes in certain assets and liabilities, net of effect

of businesses acquired: |

|

|

|

|

Increase in receivables |

(111,261 |

) |

|

(236,136 |

) |

|

Increase in inventories |

(23,320 |

) |

|

(186,331 |

) |

|

Decrease (increase) in prepaid expenses and other current

assets |

5,577 |

|

|

(30,133 |

) |

|

Increase (decrease) in accounts payable |

577,013 |

|

|

(38,894 |

) |

|

Increase (decrease) in accrued expenses |

56,042 |

|

|

(92,661 |

) |

|

Decrease in operating lease liabilities |

(31,167 |

) |

|

(30,597 |

) |

|

Increase in accrued income taxes |

98,712 |

|

|

89,467 |

|

|

Decrease in other assets |

7,187 |

|

|

3,141 |

|

|

Increase in other long-term liabilities |

20,911 |

|

|

3,793 |

|

|

Net cash provided by operating activities |

930,914 |

|

|

171,579 |

|

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Additions to plant and equipment |

(75,539 |

) |

|

(175,728 |

) |

|

Proceeds from sales of plant and equipment |

7,064 |

|

|

4,902 |

|

|

Acquisition of businesses, net of cash acquired |

— |

|

|

(74,814 |

) |

|

Purchase of marketable securities |

(26,557 |

) |

|

(4,002 |

) |

|

Proceeds from sales of marketable securities |

12,166 |

|

|

3,018 |

|

|

Net cash used for investing activities |

(82,866 |

) |

|

(246,624 |

) |

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Bank and commercial paper borrowings, net |

3,110 |

|

|

533,400 |

|

|

Other debt borrowings |

6,159 |

|

|

31,789 |

|

|

Other debt repayments |

(762,858 |

) |

|

(16,139 |

) |

|

Proceeds from stock option exercises |

31,933 |

|

|

85,317 |

|

|

Treasury stock purchases |

— |

|

|

(349,314 |

) |

|

Dividends paid |

(228,714 |

) |

|

(200,037 |

) |

|

Other financing activities (1) |

(457 |

) |

|

(22,311 |

) |

|

Net cash (used for) provided by financing activities |

(950,827 |

) |

|

62,705 |

|

| |

|

|

|

|

Effect of exchange rates on cash, cash equivalents and restricted

cash |

17,095 |

|

|

(5,485 |

) |

| |

|

|

|

|

Net decrease in cash and cash equivalents (2) |

(85,684 |

) |

|

(17,825 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

6,095,570 |

|

|

532,245 |

|

| Cash, cash equivalents and

restricted cash at end of period (2) |

$ |

6,009,886 |

|

|

$ |

514,420 |

|

| |

|

|

|

| Supplemental disclosures of

cash flow information: |

|

|

|

| Cash paid during the period

for: |

|

|

|

|

Interest |

$ |

104,879 |

|

|

$ |

84,407 |

|

|

Income taxes |

6,851 |

|

|

70,013 |

|

(1) Change includes cash paid for shares withheld to

cover taxes, debt issuance costs and other financing

activities.

(2) Change includes restricted cash

included within other assets in the Consolidated Balance Sheet.

Sysco Corporation and its Consolidated

SubsidiariesNon-GAAP Reconciliation

(Unaudited)Impact of Certain Items

Sysco’s results of operations for fiscal 2021

and fiscal 2020 were impacted by restructuring and transformational

project costs consisting of: (1) restructuring charges; (2)

expenses associated with our various transformation initiatives;

and (3) facility closure and severance charges. All

acquisition-related costs in fiscal 2021 and fiscal 2020 that have

been designated as Certain Items relate to the fiscal 2017

acquisition of Cucina Lux Investments Limited (the Brakes

Acquisition). These include acquisition-related intangible

amortization expense.

Fiscal 2021 results of operations were also

positively impacted by the reduction of bad debt expense previously

recognized in fiscal 2020 due to the unexpected impact of the

COVID-19 pandemic on the collectability of our pre-pandemic trade

receivable balances. Many of Sysco’s customers, including those in

the restaurant, hospitality and education segments, are operating

at a substantially reduced volume due to governmental requirements

for closures or other social-distancing measures and a portion of

Sysco’s customers are closed. Some of these customers ceased paying

their outstanding receivables, creating uncertainty as to their

collectability. We experienced an increase in past due receivables

and recognized additional bad debt charges in the third and fourth

quarters of fiscal 2020; however, collections have improved in

fiscal 2021. We have estimated uncollectible amounts based on the

current collection experience and by applying write-off percentages

based on historical loss experience, including loss experience

during times of local and regional disasters. The COVID-19 pandemic

is more widespread and longer in duration than historical disasters

impacting our business, and it is possible that actual

uncollectible amounts will differ and additional charges may be

required; however, if collections continue to improve, it is also

possible that additional reductions in our bad debt reserve could

occur. While Sysco traditionally incurs bad debt expense, the

magnitude of such expenses and benefits, that we have experienced

is not indicative of our normal operations. Our adjusted results

have not been normalized in a manner that would exclude the full

impact of the COVID-19 pandemic on our business. As such, Sysco has

not adjusted its results for lost sales, inventory write-offs or

other costs associated with the COVID-19 pandemic not previously

stated.

The results of our foreign operations can be

impacted due to changes in exchange rates applicable in converting

local currencies to U.S. dollars. We measure our International

Foodservice Operations results on a constant currency basis.

Constant currency operating results are calculated by translating

current-period local currency operating results with the currency

exchange rates used to translate the financial statements in the

comparable prior-year period to determine what the current-period

U.S. dollar operating results would have been if the currency

exchange rate had not changed from the comparable prior-year

period. The constant currency impact on our adjusted International

Foodservice Operations results are disclosed when the impact

exceeds a defined threshold of greater than 1% on the growth

metric. If the amount does not exceed this threshold, a disclosure

will be made that the impact of the currency change was not

significant.

Management believes that adjusting its operating

expenses, operating income, net earnings and diluted earnings per

share to remove these Certain Items and presenting its

International Foodservice Operations results on a constant currency

basis, provides an important perspective with respect to our

underlying business trends and results and provides meaningful

supplemental information to both management and investors that (1)

is indicative of the performance of the company’s underlying

operations, facilitating comparisons on a year-over-year basis and

(2) removes those items that are difficult to predict and are often

unanticipated and that, as a result, are difficult to include in

analysts’ financial models and our investors’ expectations with any

degree of specificity.

Although Sysco has a history of growth through

acquisitions, the Brakes Group was significantly larger than the

companies historically acquired by Sysco, with a proportionately

greater impact on Sysco’s consolidated financial statements.

Accordingly, Sysco is excluding from its non-GAAP financial

measures for the relevant period solely those acquisition costs

specific to the Brakes Acquisition. We believe this approach

significantly enhances the comparability of Sysco’s results for

fiscal 2021 and fiscal 2020.

Set forth below is a reconciliation of sales,

operating expenses, operating income, interest expense, net

earnings and diluted earnings per share to adjusted results for

these measures for the periods presented. Individual components of

diluted earnings per share may not add up to the total presented

due to rounding. Adjusted diluted earnings per share is

calculated using adjusted net earnings divided by diluted shares

outstanding.

Sysco Corporation and its Consolidated

SubsidiariesNon-GAAP Reconciliation

(Unaudited)Impact of Certain

Items(Dollars in Thousands, Except for Share and Per Share

Data)

| |

13-WeekPeriod EndedSep. 26, 2020 |

|

13-WeekPeriod EndedSep. 28, 2019 |

|

Change inDollars |

|

% Change |

|

Operating expenses (GAAP) |

$ |

1,800,266 |

|

|

$ |

2,275,052 |

|

|

$ |

(474,786 |

) |

|

-20.9 |

% |

| Impact of restructuring and

transformational project costs (1) |

(25,964 |

) |

|

(56,722 |

) |

|

30,758 |

|

|

-54.2 |

|

| Impact of acquisition-related

costs (2) |

(17,755 |

) |

|

(16,909 |

) |

|

(846 |

) |

|

5.0 |

|

| Impact of bad debt reserve

adjustments (3) |

98,629 |

|

|

— |

|

|

98,629 |

|

|

NM |

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

1,855,176 |

|

|

$ |

2,201,421 |

|

|

$ |

(346,245 |

) |

|

-15.7 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(GAAP) |

$ |

419,579 |

|

|

$ |

668,318 |

|

|

$ |

(248,739 |

) |

|

-37.2 |

% |

| Impact of restructuring and

transformational project costs (1) |

25,964 |

|

|

56,722 |

|

|

(30,758 |

) |

|

-54.2 |

|

| Impact of acquisition-related

costs (2) |

17,755 |

|

|

16,909 |

|

|

846 |

|

|

5.0 |

|

| Impact of bad debt reserve

adjustments (3) |

(98,629 |

) |

|

— |

|

|

(98,629 |

) |

|

NM |

| Operating income

adjusted for Certain Items (Non-GAAP) |

$ |

364,669 |

|

|

$ |

741,949 |

|

|

$ |

(377,280 |

) |

|

-50.8 |

% |

| |

|

|

|

|

|

|

|

| Other (income) expense

(GAAP) |

$ |

14,124 |

|

|

$ |

3,112 |

|

|

$ |

11,012 |

|

|

NM |

| Impact of loss on sale of a

business |

(12,043 |

) |

|

— |

|

|

(12,043 |

) |

|

NM |

| Other (income) expense

(Non-GAAP) |

$ |

2,081 |

|

|

$ |

3,112 |

|

|

$ |

(1,031 |

) |

|

-33.1 |

% |

| |

|

|

|

|

|

|

|

| Net earnings

(GAAP) |

$ |

216,900 |

|

|

$ |

453,781 |

|

|

$ |

(236,881 |

) |

|

-52.2 |

% |

| Impact of restructuring and

transformational project costs (1) |

25,964 |

|

|

56,722 |

|

|

(30,758 |

) |

|

-54.2 |

|

| Impact of acquisition-related

costs (2) |

17,755 |

|

|

16,909 |

|

|

846 |

|

|

5.0 |

|

| Impact of bad debt reserve

adjustments (3) |

(98,629 |

) |

|

— |

|

|

(98,629 |

) |

|

NM |

| Impact of loss on sale of a

business |

12,043 |

|

|

— |

|

|

12,043 |

|

|

NM |

| Tax impact of restructuring

and transformational project costs (4) |

(5,920 |

) |

|

(13,921 |

) |

|

8,001 |

|

|

-57.5 |

|

| Tax impact of

acquisition-related costs (4) |

(4,048 |

) |

|

(4,149 |

) |

|

101 |

|

|

-2.4 |

|

| Tax impact of bad debt reserve

adjustments (4) |

22,488 |

|

|

— |

|

|

22,488 |

|

|

NM |

| Tax impact of loss on sale of

a business |

(7,553 |

) |

|

— |

|

|

(7,553 |

) |

|

NM |

| Impact of foreign tax rate

change |

(5,548 |

) |

|

924 |

|

|

(6,472 |

) |

|

NM |

| Net earnings adjusted

for Certain Items (Non-GAAP) |

$ |

173,452 |

|

|

$ |

510,266 |

|

|

$ |

(336,814 |

) |

|

-66.0 |

% |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share (GAAP) |

$ |

0.42 |

|

|

$ |

0.87 |

|

|

$ |

(0.45 |

) |

|

-51.7 |

% |

| Impact of restructuring and

transformational project costs (1) |

0.05 |

|

|

0.11 |

|

|

(0.06 |

) |

|

-54.5 |

|

| Impact of acquisition-related

costs (2) |

0.03 |

|

|

0.03 |

|

|

— |

|

|

NM |

| Impact of bad debt reserve

adjustments (3) |

(0.19 |

) |

|

— |

|

|

(0.19 |

) |

|

NM |

| Impact of loss on sale of a

business |

0.02 |

|

|

— |

|

|

0.02 |

|

|

NM |

| Tax impact of restructuring

and transformational project costs (4) |

(0.01 |

) |

|

(0.03 |

) |

|

0.02 |

|

|

-66.7 |

|

| Tax impact of

acquisition-related costs (4) |

(0.01 |

) |

|

(0.01 |

) |

|

— |

|

|

NM |

| Tax impact of bad debt reserve

adjustments (4) |

0.04 |

|

|

— |

|

|

0.04 |

|

|

NM |

| Tax impact loss on sale of a

business |

(0.01 |

) |

|

— |

|

|

(0.01 |

) |

|

NM |

| Tax impact of foreign tax rate

change |

(0.01 |

) |

|

— |

|

|

(0.01 |

) |

|

NM |

| Diluted EPS adjusted

for Certain Items (Non-GAAP) (5) |

$ |

0.34 |

|

|

$ |

0.98 |

|

|

$ |

(0.64 |

) |

|

-65.3 |

% |

| |

|

|

|

|

|

|

|

| Diluted shares

outstanding |

|

510,738,760 |

|

|

|

518,761,456 |

|

|

|

|

|

|

(1) |

Fiscal 2021 includes $13 million related to various transformation

initiative costs, primarily consisting of changes to our business

technology strategy, and $13 million primarily consisting of

restructuring charges. Fiscal 2020 includes $30 million related to

restructuring, facility closure and severance charges and $27

million related to various transformation initiative costs. |

|

(2) |

Fiscal 2021 and fiscal 2020 include $18 million and $17 million,

respectively, related to intangible amortization expense from the

Brakes Acquisition, which is included in the results of

International Foodservice. |

|

(3) |

Represents the reduction of bad debt charges previously taken on

pre-pandemic trade receivable balances in fiscal 2020. |

|

(4) |

The tax impact of adjustments for Certain Items are calculated by

multiplying the pretax impact of each Certain Item by the statutory

rates in effect for each jurisdiction where the Certain Item was

incurred. |

|

(5) |

Individual components of diluted earnings per share may not add up

to the total presented due to rounding. Total diluted earnings per

share is calculated using adjusted net earnings divided by diluted

shares outstanding. |

|

|

NM represents that the percentage change is not meaningful. |

Sysco Corporation and its Consolidated

SubsidiariesSegment

ResultsNon-GAAP Reconciliation

(Unaudited)Impact of Certain Items on Applicable

Segments(Dollars in Thousands)

| |

13-WeekPeriod EndedSep. 26, 2020 |

|

13-WeekPeriod EndedSep. 28, 2019 |

|

Change inDollars |

|

%/bps Change |

| U.S. FOODSERVICE

OPERATIONS |

|

|

|

|

|

|

|

|

Sales |

$ |

7,921,533 |

|

|

$ |

10,658,633 |

|

|

$ |

(2,737,100 |

) |

|

-25.7 |

% |

| Gross Profit |

1,599,707 |

|

|

2,144,886 |

|

|

(545,179 |

) |

|

-25.4 |

% |

| Gross Margin |

20.19 |

% |

|

20.12 |

% |

|

|

|

7 bps |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

1,011,298 |

|

|

$ |

1,351,268 |

|

|

$ |

(339,970 |

) |

|

-25.2 |

% |

| Impact of restructuring and

transformational project costs (1) |

(940 |

) |

|

(4,126 |

) |

|

3,186 |

|

|

-77.2 |

|

| Impact of bad debt reserve

adjustments (2) |

86,317 |

|

|

— |

|

|

86,317 |

|

|

NM |

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

1,096,675 |

|

|

$ |

1,347,142 |

|

|

$ |

(250,467 |

) |

|

-18.6 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(GAAP) |

$ |

588,409 |

|

|

$ |

793,618 |

|

|

$ |

(205,209 |

) |

|

-25.9 |

% |

| Impact of restructuring and

transformational project costs (1) |

940 |

|

|

4,126 |

|

|

(3,186 |

) |

|

-77.2 |

|

| Impact of bad debt reserve

adjustments (2) |

(86,317 |

) |

|

— |

|

|

(86,317 |

) |

|

NM |

| Operating income

adjusted for Certain Items (Non-GAAP) |

$ |

503,032 |

|

|

$ |

797,744 |

|

|

$ |

(294,712 |

) |

|

-36.9 |

% |

| |

|

|

|

|

|

|

|

| INTERNATIONAL

FOODSERVICE OPERATIONS |

|

|

|

|

|

|

|

| Sales

(GAAP) |

$ |

2,163,693 |

|

|

$ |

2,912,388 |

|

|

$ |

(748,695 |

) |

|

-25.7 |

% |

| Impact of currency

fluctuations (3) |

(40,640 |

) |

|

— |

|

|

(40,640 |

) |

|

1.4 |

|

| Comparable sales using

a constant currency basis (Non-GAAP) |

$ |

2,123,053 |

|

|

$ |

2,912,388 |

|

|

$ |

(789,335 |

) |

|

-27.1 |

% |

| |

|

|

|

|

|

|

|

| Gross Profit

(GAAP) |

$ |

450,398 |

|

|

$ |

605,185 |

|

|

$ |

(154,787 |

) |

|

-25.6 |

% |

| Impact of currency

fluctuations (3) |

(11,512 |

) |

|

— |

|

|

(11,512 |

) |

|

1.9 |

|

| Comparable gross

profit using a constant currency basis (Non-GAAP) |

$ |

438,886 |

|

|

$ |

605,185 |

|

|

$ |

(166,299 |

) |

|

-27.5 |

% |

| |

|

|

|

|

|

|

|

| Gross Margin

(GAAP) |

20.82 |

% |

|

20.78 |

% |

|

|

|

4 bps |

| Impact of currency

fluctuations (3) |

0.15 |

|

|

— |

|

|

|

|

15 bps |

| Comparable gross

margin using a constant currency basis (Non-GAAP) |

20.67 |

% |

|

20.78 |

% |

|

|

|

-11 bps |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

450,935 |

|

|

$ |

550,385 |

|

|

$ |

(99,450 |

) |

|

-18.1 |

% |

| Impact of restructuring and

transformational project costs (4) |

(12,993 |

) |

|

(27,272 |

) |

|

14,279 |

|

|

-52.4 |

|

| Impact of acquisition-related

costs (5) |

(17,755 |

) |

|

(16,909 |

) |

|

(846 |

) |

|

5.0 |

|

| Impact of bad debt reserve

adjustments (2) |

11,429 |

|

|

— |

|

|

11,429 |

|

|

NM |

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

431,616 |

|

|

$ |

506,204 |

|

|

$ |

(74,588 |

) |

|

-14.7 |

% |

| Impact of currency

fluctuations (3) |

(12,329 |

) |

|

— |

|

|

(12,329 |

) |

|

2.4 |

|

| Comparable operating

expenses adjusted for Certain Items using a constant currency basis

(Non-GAAP) |

$ |

419,287 |

|

|

$ |

506,204 |

|

|

$ |

(86,917 |

) |

|

-17.2 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(loss) (GAAP) |

$ |

(537 |

) |

|

$ |

54,800 |

|

|

$ |

(55,337 |

) |

|

-101.0 |

% |

| Impact of restructuring and

transformational project costs (4) |

12,993 |

|

|

27,272 |

|

|

(14,279 |

) |

|

-52.4 |

|

| Impact of acquisition-related

costs (5) |

17,755 |

|

|

16,909 |

|

|

846 |

|

|

5.0 |

|

| Impact of bad debt reserve

adjustments (2) |

(11,429 |

) |

|

— |

|

|

(11,429 |

) |

|

NM |

| Operating income

adjusted for Certain Items (Non-GAAP) * |

$ |

18,782 |

|

|

$ |

98,981 |

|

|

$ |

(80,199 |

) |

|

-81.0 |

% |

| |

|

|

|

|

|

|

|

| SYGMA |

|

|

|

|

|

|

|

| Sales |

$ |

1,524,148 |

|

|

$ |

1,446,994 |

|

|

$ |

77,154 |

|

|

5.3 |

% |

| Gross Profit |

131,541 |

|

|

125,918 |

|

|

5,623 |

|

|

4.5 |

% |

| Gross Margin |

8.63 |

% |

|

8.70 |

% |

|

|

|

-7 bps |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

119,849 |

|

|

$ |

118,348 |

|

|

$ |

1,501 |

|

|

1.3 |

% |

| Impact of restructuring and

transformational project costs (1) |

(13 |

) |

|

(2,585 |

) |

|

2,572 |

|

|

-99.5 |

|

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

119,836 |

|

|

$ |

115,763 |

|

|

$ |

4,073 |

|

|

3.5 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(GAAP) |

$ |

11,692 |

|

|

$ |

7,570 |

|

|

$ |

4,122 |

|

|

54.5 |

% |

| Impact of restructuring and

transformational project costs (1) |

13 |

|

|

2,585 |

|

|

(2,572 |

) |

|

-99.5 |

|

| Operating income

adjusted for Certain Items (Non-GAAP) |

$ |

11,705 |

|

|

$ |

10,155 |

|

|

$ |

1,550 |

|

|

15.3 |

% |

| |

|

|

|

|

|

|

|

| OTHER |

|

|

|

|

|

|

|

| Sales |

$ |

168,005 |

|

|

$ |

284,990 |

|

|

$ |

(116,985 |

) |

|

-41.0 |

% |

| Gross Profit |

40,430 |

|

|

71,744 |

|

|

(31,314 |

) |

|

-43.6 |

% |

| Gross Margin |

24.06 |

% |

|

25.17 |

% |

|

|

|

-111 bps |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

40,435 |

|

|

$ |

61,607 |

|

|

$ |

(21,172 |

) |

|

-34.4 |

% |

| Impact of bad debt reserve

adjustments (2) |

883 |

|

|

— |

|

|

883 |

|

|

NM |

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

41,318 |

|

|

$ |

61,607 |

|

|

(20,289 |

) |

|

-32.9 |

% |

| |

|

|

|

|

|

|

|

| Operating (loss)

income (GAAP) |

$ |

(5 |

) |

|

$ |

10,137 |

|

|

$ |

(10,142 |

) |

|

-100.0 |

% |

| Impact of bad debt reserve

adjustments (2) |

(883 |

) |

|

— |

|

|

(883 |

) |

|

NM |

| Operating (loss)

income adjusted for Certain Items (Non-GAAP) |

$ |

(888 |

) |

|

$ |

10,137 |

|

|

(11,025 |

) |

|

-108.8 |

% |

| |

|

|

|

|

|

|

|

|

CORPORATE |

|

|

|

|

|

|

|

| Gross Profit |

$ |

(2,231 |

) |

|

$ |

(4,363 |

) |

|

$ |

2,132 |

|

|

-48.9 |

% |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

177,749 |

|

|

$ |

193,444 |

|

|

$ |

(15,695 |

) |

|

-8.1 |

% |

| Impact of restructuring and

transformational project costs (6) |

(12,018 |

) |

|

(22,739 |

) |

|

10,721 |

|

|

-47.1 |

|

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

165,731 |

|

|

$ |

170,705 |

|

|

$ |

(4,974 |

) |

|

-2.9 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(GAAP) |

$ |

(179,980 |

) |

|

$ |

(197,807 |

) |

|

$ |

17,827 |

|

|

-9.0 |

% |

| Impact of restructuring and

transformational project costs (6) |

12,018 |

|

|

22,739 |

|

|

(10,721 |

) |

|

-47.1 |

|

| Operating income

adjusted for Certain Items (Non-GAAP) |

$ |

(167,962 |

) |

|

$ |

(175,068 |

) |

|

$ |

7,106 |

|

|

-4.1 |

% |

| |

|

|

|

|

|

|

|

| TOTAL

SYSCO |

|

|

|

|

|

|

|

| Sales |

$ |

11,777,379 |

|

|

$ |

15,303,005 |

|

|

$ |

(3,525,626 |

) |

|

-23.0 |

% |

| Gross Profit |

2,219,845 |

|

|

2,943,370 |

|

|

(723,525 |

) |

|

-24.6 |

% |

| Gross Margin |

18.85 |

% |

|

19.23 |

% |

|

|

|

-39 bps |

| |

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

1,800,266 |

|

|

$ |

2,275,052 |

|

|

$ |

(474,786 |

) |

|

-20.9 |

% |

| Impact of restructuring and

transformational project costs (1) (4) (6) |

(25,964 |

) |

|

(56,722 |

) |

|

30,758 |

|

|

-54.2 |

|

| Impact of acquisition-related

costs (5) |

(17,755 |

) |

|

(16,909 |

) |

|

(846 |

) |

|

5.0 |

|

| Impact of bad debt reserve

adjustments (2) |

98,629 |

|

|

— |

|

|

98,629 |

|

|

NM |

| Operating expenses

adjusted for Certain Items (Non-GAAP) |

$ |

1,855,176 |

|

|

$ |

2,201,421 |

|

|

$ |

(346,245 |

) |

|

-15.7 |

% |

| |

|

|

|

|

|

|

|

| Operating income

(GAAP) |

$ |

419,579 |

|

|

$ |

668,318 |

|

|

$ |

(248,739 |

) |

|

-37.2 |

% |

| Impact of restructuring and

transformational project costs (1) (4) (6) |

25,964 |

|

|

56,722 |

|

|

(30,758 |

) |

|

-54.2 |

|

| Impact of acquisition-related

costs (5) |

17,755 |

|

|

16,909 |

|

|

846 |

|

|

5.0 |

|

| Impact of bad debt reserve

adjustments (2) |

(98,629 |

) |

|

— |

|

|

(98,629 |

) |

|

NM |

| Operating income

adjusted for Certain Items (Non-GAAP) |

$ |

364,669 |

|

|

$ |

741,949 |

|

|

$ |

(377,280 |

) |

|

-50.8 |

% |

|

(1) |

Includes charges related to restructuring and business

transformation projects. |

|

(2) |

Represents the reduction of bad debt charges previously taken on

pre-pandemic trade receivable balances in fiscal 2020. |

|

(3) |

Represents a constant currency adjustment, which eliminates the

impact of foreign currency fluctuations on current year

results. |

|

(4) |

Includes restructuring, severance and facility closure costs

primarily in Europe. |

|

(5) |

Fiscal 2021 and fiscal 2020 include $18 million and $17 million,

respectively, related to intangible amortization expense from the

Brakes Acquisition. |

|

(6) |

Fiscal 2021 and fiscal 2020 include various transformation

initiative costs, primarily consisting of changes to our business

technology strategy. |

|

* |

Foreign exchange rates did not have a meaningful impact during the

period; therefore, the constant currency adjustment is not

disclosed. |

|

|

NM represents that the percentage change is not meaningful. |

Sysco Corporation and its Consolidated

SubsidiariesNon-GAAP Reconciliation

(Unaudited)Free Cash Flow(In

Thousands)

Free cash flow represents net cash provided from

operating activities less purchases of plant and equipment and

includes proceeds from sales of plant and equipment. Sysco

considers free cash flow to be a liquidity measure that provides

useful information to management and investors about the amount of

cash generated by the business after the purchases and sales of

buildings, fleet, equipment and technology, which may potentially

be used to pay for, among other things, strategic uses of cash

including dividend payments, share repurchases and acquisitions.

However, free cash flow may not be available for discretionary

expenditures, as it may be necessary that we use it to make

mandatory debt service or other payments. Free cash flow should not

be used as a substitute for the most comparable GAAP measure in

assessing the company’s liquidity for the periods presented. An

analysis of any non-GAAP financial measure should be used in

conjunction with results presented in accordance with GAAP. In the

table that follows, free cash flow for each period presented is

reconciled to net cash provided by operating activities.

| |

13-WeekPeriod EndedSep. 26, 2020 |

|

13-WeekPeriod EndedSep. 28, 2019 |

|

13-WeekPeriod Changein Dollars |

|

Net cash provided by operating activities

(GAAP) |

$ |

930,914 |

|

|

$ |

171,579 |

|

|

$ |

759,335 |

| Additions to plant and

equipment |

(75,539 |

) |

|

(175,728 |

) |

|

100,189 |

| Proceeds from sales of plant

and equipment |

7,064 |

|

|

4,902 |

|

|

2,162 |

| Free Cash Flow

(Non-GAAP) |

$ |

862,440 |

|

|

$ |

753 |

|

|

$ |

861,687 |

|

For more information contact: |

|

|

|

|

Shannon MutschlerMedia Contactmutschler.shannon@corp.sysco.comT

281-584-4059 |

Rachel LeeInvestor Contactlee.rachel@corp.sysco.comT

281-436-7815 |

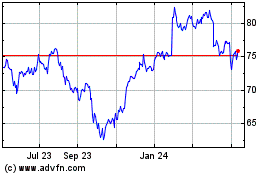

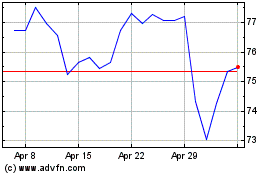

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024