Form 8-K - Current report

October 16 2024 - 6:01AM

Edgar (US Regulatory)

0001601712false00016017122024-10-162024-10-160001601712us-gaap:CommonStockMember2024-10-162024-10-160001601712us-gaap:SeriesAPreferredStockMember2024-10-162024-10-160001601712us-gaap:SeriesBPreferredStockMember2024-10-162024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

October 16, 2024

Date of Report

(Date of earliest event reported)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36560 | | 51-0483352 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 777 Long Ridge Road | | |

| Stamford, | Connecticut | | 06902 |

| (Address of principal executive offices) | | (Zip Code) |

(203) 585-2400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

The Company hereby furnishes the information in Exhibit 99.1 hereto, Monthly Charge-Off and Delinquency Statistics as of and for each of the thirteen months ended September 30, 2024.

The Company intends to continue to furnish these statistics on a monthly basis, noting that for the last month of each calendar quarter, the statistics will be furnished contemporaneously with the Company’s announcement of its financial results for such quarter.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly stated by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished as part of this report:

| | | | | | | | |

| | |

| Number | | Description |

| |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | SYNCHRONY FINANCIAL |

| | | |

Date: October 16, 2024 | | | | By: | | /s/ Jonathan Mothner |

| | | | Name: | | Jonathan Mothner |

| | | | Title: | | Executive Vice President, Chief Risk and Legal Officer |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SYNCHRONY FINANCIAL | | | | | | | | | | | | | | | | | | | | | | | |

| MONTHLY CHARGE-OFF AND DELINQUENCY STATISTICS | | | | | | | | | | | | | | | | | | |

| AS OF AND FOR EACH OF THE THIRTEEN MONTHS ENDED | | | | | | | | | | | | | | | | | | |

| (unaudited, $ in billions) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| The following table provides monthly charge-off and delinquency statistics as of and for each of the thirteen months ended September 30, 2024. |

| The year over year increase in the 30+ delinquency rate at September 30, 2024 and the year over year increase in net charge-off rate for the month ended September 30, 2024 reflect the continued impact of moderation in customer payment rates. Additionally, the increase in net charge-offs compared to the month of August 2024 was primarily due to five more charge-off cycles per the table below. |

|

| Sep 30,

2024 | | Aug 31,

2024 | | Jul 31,

2024 | | Jun 30,

2024 | | May 31,

2024 | | Apr 30,

2024 | | Mar 31,

2024 | | Feb 29,

2024 | | Jan 31,

2024 | | Dec 31,

2023 | | Nov 30,

2023 | | Oct 31,

2023 | | Sep 30,

2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Period-end loan receivables | $ | 102.2 | | | $ | 102.5 | | | $ | 102.7 | | | $ | 102.3 | | | $ | 102.4 | | | $ | 101.6 | | | $ | 101.7 | | | $ | 100.0 | | | $ | 101.3 | | | $ | 103.0 | | | $ | 101.2 | | | $ | 98.9 | | | $ | 97.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Average loan receivables, including held for sale | $ | 102.1 | | | $ | 102.1 | | | $ | 101.9 | | | $ | 102.0 | | | $ | 101.4 | | | $ | 101.1 | | | $ | 101.2 | | | $ | 100.3 | | | $ | 101.4 | | | $ | 102.0 | | | $ | 99.1 | | | $ | 97.9 | | | $ | 97.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

30+ delinquency rate(1) | 4.8 | % | | 4.6 | % | | 4.6 | % | | 4.5 | % | | 4.5 | % | | 4.6 | % | | 4.7 | % | | 5.0 | % | | 4.9 | % | | 4.7 | % | | 4.7 | % | | 4.6 | % | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net charge-off rate(1)(2) | 6.4 | % | | 5.6 | % | | 6.2 | % | | 6.1 | % | | 6.5 | % | | 6.7 | % | | 6.6 | % | | 6.5 | % | | 5.8 | % | | 5.7 | % | | 5.6 | % | | 5.4 | % | | 4.5 | % |

Recovery adjustment(3) | (0.2) | % | | 0.1 | % | | 0.1 | % | | — | % | | (0.1) | % | | — | % | | (0.2) | % | | — | % | | 0.2 | % | | (0.1) | % | | — | % | | 0.2 | % | | (0.1) | % |

Adjusted net charge-off rate(4) | 6.2 | % | | 5.7 | % | | 6.3 | % | | 6.1 | % | | 6.4 | % | | 6.7 | % | | 6.4 | % | | 6.5 | % | | 6.0 | % | | 5.6 | % | | 5.6 | % | | 5.6 | % | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) References to “30+ delinquency rate” are to over-30 day loan delinquencies as a percentage of period-end loan receivables. References to “net charge-off rate” are to net charge-offs (annualized) as a percentage of average loan receivables, including held for sale. |

| (2) Charge-offs are executed on charge-off cycle dates which occur on various days during each calendar month. The number of different charge-off cycle dates in each month varies based on such factors as the calendar and the timing of billing cycles. As a result, the amount of charged-off loan receivables can vary between monthly periods with no corresponding change in the performance of the portfolio. The following table sets forth the number of different charge-off cycle dates for our consumer credit card loan receivables, which represent approximately 92% of total period end loan receivables at September 30, 2024, for the calendar months indicated. |

| 2023 | | 2024 | | | | | | | | | | | | | | | | | | | | | | |

| January | 30 | | 29 | | | | | | | | | | | | | | | | | | | | | | |

| February | 28 | | 27 | | | | | | | | | | | | | | | | | | | | | | |

| March | 28 | | 28 | | | | | | | | | | | | | | | | | | | | | | |

| April | 28 | | 28 | | | | | | | | | | | | | | | | | | | | | | |

| May | 29 | | 28 | | | | | | | | | | | | | | | | | | | | | | |

| June | 27 | | 28 | | | | | | | | | | | | | | | | | | | | | | |

| July | 28 | | 29 | | | | | | | | | | | | | | | | | | | | | | |

| August | 28 | | 25 | | | | | | | | | | | | | | | | | | | | | | |

| September | 26 | | 30 | | | | | | | | | | | | | | | | | | | | | | |

| October | 30 | | 28 | | | | | | | | | | | | | | | | | | | | | | |

| November | 28 | | 26 | | | | | | | | | | | | | | | | | | | | | | |

| December | 28 | | 30 | | | | | | | | | | | | | | | | | | | | | | |

| (3) Represents adjustment to allocate recoveries, including debt sales, evenly across the three calendar months of each respective quarterly reporting period. The adjustments for periods other than for the last month of each calendar quarter incorporate estimated recoveries for the applicable full quarterly reporting period. Such estimates are subject to change within each applicable quarter and may differ from actual quarterly results. |

| (4) Adjusted net charge-off rate represents adjusted net charge-offs as a percentage of average loan receivables, including held for sale. Adjusted net charge-offs are a non-GAAP financial measure that include the 'recovery adjustment' defined above. We believe the presentation of the adjusted net charge-off rate is useful to investors as it represents a monthly measure which is more indicative of both our quarterly and annual net charge-off rates. |

8-K Cover Page

|

Oct. 16, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 16, 2024

|

| Entity Registrant Name |

SYNCHRONY FINANCIAL

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36560

|

| Entity Tax Identification Number |

51-0483352

|

| Entity Address, Address Line One |

777 Long Ridge Road

|

| Entity Address, City or Town |

Stamford,

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

203

|

| Local Phone Number |

585-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001601712

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

SYF

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

SYFPrA

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B

|

| Trading Symbol |

SYFPrB

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

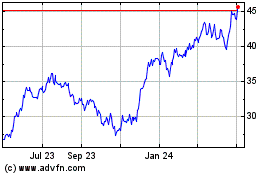

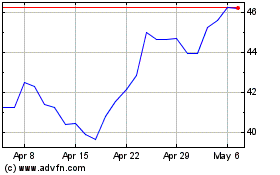

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Dec 2023 to Dec 2024