UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14a Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ¨

Filed by a Party other than the Registrant ý

Check the appropriate box:

|

|

ý

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

|

SUPERIOR

INDUSTRIES INTERNATIONAL, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

D.C.

Capital Partners, l.p.

D.C.

Capital advisors, limited

D.C.R.

Partners, l.p.

douglas

l. dethy

raynard

d. benvenuti

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

¨

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

REVISED PRELIMINARY COPY SUBJECT

TO COMPLETION

DATED MARCH 5, 2020

D.C. CAPITAL PARTNERS, L.P.

___________________, 2020

Dear Fellow Stockholder:

D.C. Capital Partners,

L.P. and the other participants in this solicitation (collectively, “D.C. Capital”, “we” or “our”)

are the beneficial owners of an aggregate of 1,232,500 shares of Common Stock, $0.01 par value per share (the “Common Stock”),

of Superior Industries International, Inc., a Delaware corporation (“SUP” or the “Company”), representing

approximately 4.9% of the outstanding shares of Common Stock. We believe strongly that there is significant value for stockholders

to be recovered at SUP. However, given the Company’s prolonged operating and stock price underperformance, and based on D.C.

Capital’s extended period of interaction with SUP, we also believe strongly that recovery requires the Board of

Directors of the Company (the “Board”), under the Chairmanship of Mr. Timothy McQuay, to be refreshed, as soon as possible,

with new, independent and objective perspectives.

We are seeking your

support for the election of our nominee to the Board at the 2020 annual meeting of stockholders scheduled to be held at [_______________],

on [_____, _______, 2020] at [_:__ _.m., EDT] (including any adjournments or postponements thereof and any meeting which may be

called in lieu thereof, the “Annual Meeting”). We are seeking representation on the Board because we believe that the

Board will benefit from the addition of a new independent director with relevant skill sets and a shared objective of accelerating

the recovery of value for the benefit of all SUP stockholders. The individual that we have nominated is highly-qualified, capable

and ready to serve the stockholders of SUP.

The Board is currently

composed of nine (9) directors, all of whom are up for election at the Annual Meeting. Through the attached Proxy Statement, we

are soliciting proxies to elect not only our one (1) nominee, but also the candidates who have been nominated by the Company other

than [_____]. This gives stockholders who wish to vote for our nominee the ability to vote for a full slate of nine (9) nominees

in total. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found

in the Company’s proxy statement. Your vote to elect our nominee will have the legal effect of replacing one incumbent director

with our nominee. If elected, our nominee will constitute a minority on the Board and there can be no guarantee that our nominee

will be able to implement the actions that he believes are necessary to unlock stockholder value. However, we believe the election

of our nominee will be a catalyst to change the boardroom dynamics that have hampered SUP’s progress.

[We are aware that

GAMCO Assets Management Inc. (“GAMCO”) has notified the Company of its intention to nominate one nominee for election

to the Board at the Annual Meeting (the “GAMCO Nominee”). Neither this proxy statement nor the enclosed WHITE

proxy card is soliciting votes to elect the GAMCO Nominee. We make no recommendation with respect to the GAMCO Nominee.]

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning

the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being

furnished to the stockholders on or about ____________, 2020.

You can only vote for

our Nominee on our WHITE proxy card. Since only your latest dated proxy card will count, we urge you not to return any proxy

card you receive from the Company [or GAMCO]. Even if you return the management proxy card [or GAMCO’s proxy card] marked

“withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent

to us. Please make certain that the latest dated proxy card you return is the WHITE proxy card. If you have already voted

for the incumbent management slate [or on GAMCO’s proxy card], you have every right to change your vote by signing, dating

and returning a later dated WHITE proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any

assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free numbers

listed below.

|

|

Thank you for your support,

/s/ Douglas L. Dethy

Douglas L. Dethy

D.C. Capital Partners, L.P.

|

|

If you have any questions, require

assistance in voting your WHITE proxy card,

or need additional copies of

D.C. Capital’s proxy materials,

please contact:

Stockholders call toll free

at (888) 368-0379

Email: info@saratogaproxy.com

|

REVISED PRELIMINARY COPY SUBJECT

TO COMPLETION

DATED MARCH 5, 2020

2020 ANNUAL MEETING OF STOCKHOLDERS

OF

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

_________________________

PROXY STATEMENT

OF

D.C. CAPITAL PARTNERS, L.P.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

D.C. Capital Partners,

L.P., a Delaware limited partnership (“D.C. Capital Partners”), and the other participants in this solicitation (collectively,

“D.C. Capital”, “we” or “our”) are significant stockholders of Superior Industries International,

Inc., a Delaware corporation (“SUP”, “Superior” or the “Company”), who collectively beneficially

own an aggregate of 1,232,500 shares of Common Stock, par value $0.01 per share (the “Common Stock”), of the Company,

representing approximately 4.9% of the outstanding shares of Common Stock. We believe that the Board of Directors of the Company

(the “Board”) needs to be reconstituted with new independent directors who have strong, relevant backgrounds and who

are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the annual meeting

of stockholders scheduled to be held at [_______________], on [_____, _______, 2020] at [_:__ _.m., EDT] (including any adjournments

or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

|

1.

|

To elect D.C. Capital’s director nominee, Raynard D. Benvenuti (the “Nominee”),

to hold office until the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) and until his successor has

been duly elected and qualified;

|

|

|

2.

|

To approve, in a non-binding advisory vote, the executive compensation of the Company’s

named executive officers;

|

|

|

3.

|

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2020; and

|

|

|

4.

|

To act upon such other matters as may properly come before the Annual Meeting or any postponements

or adjournments thereof.

|

The Board is currently

composed of nine (9) directors, all of whom are up for election at the Annual Meeting. Through this Proxy Statement, we are soliciting

proxies to elect not only our Nominee, but also the candidates who have been nominated by the Company other than [_____]. This

gives stockholders who wish to vote for our Nominee the ability to vote for a full slate of nine (9) nominees in total. The names,

backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s

proxy statement. Your vote to elect our Nominee will have the legal effect of replacing one incumbent director with our Nominee.

If elected, our Nominee will constitute a minority on the Board and there can be no guarantee that our Nominee will be able to

implement the actions that he believes are necessary to unlock stockholder value. However, we believe the election of our Nominee

will be a catalyst to change the boardroom dynamics that have hampered SUP’s progress.

[We are aware that

GAMCO Assets Management Inc. (“GAMCO”) has notified the Company of its intention to nominate one nominee for election

to the Board at the Annual Meeting (the “GAMCO Nominee”). Neither this proxy statement nor the enclosed WHITE

proxy card is soliciting votes to elect the GAMCO Nominee. We make no recommendation with respect to the GAMCO Nominee.]

As of the date hereof,

D.C. Capital Partners, together with D.C.R. Partners, L.P., a Delaware limited partnership (“D.C. GP”), D.C. Capital

Advisors, Limited, a Delaware limited company (“D.C. Capital Advisors”), Douglas L. Dethy (together with D.C. Capital

Partners, D.C. GP and D.C. Capital Advisors, the “D.C. Capital Group”) and the Nominee (each, a “Participant”,

and together, the “Participants”) collectively beneficially own 1,232,500 shares of Common Stock. The participants

intend to vote their shares FOR the election of the Nominee, [______] the non-binding advisory vote on executive

compensation, and FOR the ratification of the selection of Deloitte & Touche LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2020, as described herein.

The Company

has set the close of business on [______], 2020 as the record date for determining stockholders entitled to notice of and to vote

at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is

26600 Telegraph Rd., Southfield, MI 48033. Stockholders of record at the close of business on the Record Date will be entitled

to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [_______] shares of Common Stock outstanding

and [___] shares of Series A Perpetual Convertible Preferred Stock (the “Series A Redeemable Preferred Stock” and,

together with the Common Stock, the “Shares”) who are entitled to one vote on each matter for each share of Common

Stock held, or into which such holder’s Series A Redeemable Preferred Stock is convertible, on the Record Date.

We urge you to carefully

consider the information contained in the Proxy Statement and then support our efforts by signing, dating and returning the enclosed

WHITE proxy card today. The Proxy Statement and the enclosed WHITE proxy card are first being furnished to the stockholders

on or about ____________, 2020.

THIS SOLICITATION IS

BEING MADE BY D.C. CAPITAL AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO

BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH D.C. CAPITAL

IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES

IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

D.C. CAPITAL URGES

YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEE.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT [OR GAMCO], YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY

ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION

OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting

This Proxy Statement and our WHITE

proxy card are available at

[______________________________]

IMPORTANT

Your vote is important, no matter how

few Shares you own. D.C. Capital urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election

of the Nominee and in accordance with D.C. Capital’s recommendations on the other proposals on the agenda for the Annual

Meeting.

|

|

·

|

If your Shares are registered in your own name, please sign and date the enclosed WHITE

proxy card and return it to D.C. Capital, c/o Saratoga Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid

envelope today.

|

|

|

·

|

If your Shares are held in a brokerage account or bank, you are considered the beneficial owner

of the Shares, and these proxy materials, together with a WHITE voting instruction form, are being forwarded to you by your

broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker

cannot vote your Shares on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone

or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote

by signing, dating and returning the enclosed voting form.

|

Since only your latest

dated proxy card will count, we urge you not to return any proxy card you receive from the Company [or GAMCO]. Even if you return

the management proxy card [or GAMCO’s proxy card] marked “withhold” as a protest against the incumbent directors,

it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our Nominee only on our WHITE

proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

|

If you have any questions, require

assistance in voting your WHITE proxy card,

or need additional copies of

D.C. Capital’s proxy materials,

please contact:

Stockholders call toll free

at (888) 368-0379

Email: info@saratogaproxy.com

|

Background to the

Solicitation

Below is a description of the material events leading up to

this solicitation:

|

|

·

|

On October 23, 2017, Messrs. Dethy and Benvenuti met with Donald Stebbins, then the Company’s

Chief Executive Officer and President, as well as other members of the Company’s management team, at the Company’s

headquarters in Detroit, Michigan, to discuss the Company’s operational results in Mexico, the Company’s debt following

its acquisition of Uniwheels AG (“Uniwheels”) in May 2017 (the “Uniwheels Acquisition”) and future synergies

anticipated from the acquisition.

|

|

|

·

|

On November 1, 2017, Messrs. Dethy and Benvenuti had a telephone conversation with Vice President

of Corporate Finance, Troy Ford. During the call, the parties further discussed the topics covered during their October 23, 2017

meeting.

|

|

|

·

|

On November 29, 2017, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. Ford following

the Company’s third quarter 2017 earnings call. During the call, D.C. Capital proposed a possible investment into Superior

to help deleverage the Company following the Uniwheels Acquisition.

|

|

|

·

|

Also on November 29, 2017, Mr. Dethy sent Mr. Ford an email to confirm Mr. Dethy’s upcoming

visit to certain of the Company’s facilities in Mexico in order to conduct due diligence. The email also included a draft

term sheet for D.C. Capital’s potential investment in the Company to fund identified initiatives to accelerate revenue growth

or operating improvements.

|

|

|

·

|

On February 1, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. Ford in

order to finalize the preparations for Mr. Dethy’s due diligence trip to certain of the Company’s facilities in Mexico.

|

|

|

·

|

On February 12, 2018, Mr. Dethy and a consultant hired by D.C. Capital visited three of the Company’s

facilities in Mexico in order for the consultant to review the Company’s Mexico manufacturing operations. The consultant’s

report was subsequently shared with the Company.

|

|

|

·

|

On April 9, 2018, Messrs. Dethy, Benvenuti and the consultant had a telephone conversation with

Mr. Ford and Robert Tykal, the Company’s Senior Vice President of Operations, North America, to discuss the consultant’s

review of the Mexican operations.

|

|

|

·

|

On May 9, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs. Stebbins,

Ford and Nadeem Moiz, the Company’s Executive Vice President and Chief Financial Officer, following the Company’s first

quarter 2018 earnings release. The parties discussed the Company generally.

|

|

|

·

|

On June 4, 2018, Messrs. Dethy, Benvenuti and the consultant had a telephone conversation with

Messrs. Ford, Moiz and the Company’s Treasurer, Clemens Denks. During the call, the parties discussed and reviewed the concerns

of D.C. Capital’s consultant regarding the Company’s operations in Mexico.

|

|

|

·

|

On August 8, 2018, Mr. Dethy and Messrs. Stebbins and Ford met in New York City for dinner. The

parties discussed the Company generally.

|

|

|

·

|

On September 9, 2018, Messrs. Dethy and Benvenuti met with Mr. Stebbins in New York City at a conference

hosted by Buckingham Research Group. Messrs. Dethy and Benvenuti set forth their concerns and misgivings regarding the Company’s

earnings shortfall. In addition, Messrs. Dethy and Benvenuti expressed their desire to learn more about the Company’s new

Executive Vice President and Chief Financial Officer, Matti Masanovich.

|

|

|

·

|

On October 25, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs. Denks,

Ford, Masanovich, Stebbins and the Company’s Director of Corporate Financial Planning and Analysis, Justin Swalberg. During

the call, Messrs. Dethy and Benvenuti again sought to discuss the Company’s earnings and cash shortfalls.

|

|

|

·

|

On

November 15, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs.

Ford and Masanovich. On the call, D.C. Capital proposed an investment into the Company

to fund the next 12 quarterly payments of dividends on the Series A Redeemable Preferred

Stock. Following this call, Mr. Dethy sent an email to Messrs. Ford and Masanovich with

a hypothetical press release detailing D.C. Capital’s proposed investment.

|

|

|

·

|

On November 28, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. Ford. During

the call, Mr. Ford disclosed that the Company was not interested in an investment by D.C. Capital in order to help deleverage the

Company, despite the Company’s mounting operational and financial shortfalls.

|

|

|

·

|

On December 14, 2018, the Company disclosed that Donald Stebbins, President and Chief Executive

Officer and Member of the Board, would retire effective December 31, 2018, and that Timothy McQuay, Chairman of the Board, would

assume the duties of interim President and Chief Executive Officer immediately. In addition, the Company announced that the Board

was initiating an external search for a permanent President and Chief Executive Officer.

|

|

|

·

|

Also on December 14, 2018, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs.

McQuay, Masanovich and Ford. During the call, Messrs. Dethy and Benvenuti once again sought to discuss their concerns regarding

the Company’s underperforming operations, limited cash flow and earnings shortfalls.

|

|

|

·

|

On January 2, 2019, D.C. Capital commissioned a market research study from Ducker Worldwide on

the Company, (the “Ducker Study”). The Ducker Study was a competitive market assessment of Superior compared against

other aluminum wheel manufacturers.

|

|

|

·

|

On January 16, 2019, Messrs. Dethy and Benvenuti met with Messrs. Masanovich and Ford at the Company

headquarters in Detroit, Michigan. Mr. McQuay was also present at the meeting. At the meeting, Messrs. Dethy and Benvenuti once

again sought to express their growing concerns with the Company’s underperforming operations, reduced earnings, limited cash

flow and idled PVD plant.

|

|

|

·

|

On February 26, 2019, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs. Ford,

Masanovich and McQuay. During the call the parties discussed the results of the Ducker Study, which indicated, as D.C. Capital

had been concerned about all along, that the Company was losing market share and certain customers had perceptions of poor operational

performance.

|

|

|

·

|

On March 18, 2019, Messrs. Dethy and Benvenuti as well as representatives of Ducker Worldwide and

authors of the Ducker Study, met with Messrs. Masanovich and Ford at the Company’s headquarters in Detroit. Mr. McQuay was

also present at the meeting via telephone. At the meeting, representatives of Ducker Worldwide reviewed and explained the Ducker

Study indicating market share loss and customer perceptions of poor operational performance.

|

|

|

·

|

On March 22, 2019, Mr. Dethy sent a private letter to Messrs. McQuay, Masanovich, Ford and Kakar

summarizing the meeting on March 18, 2019 and reiterating D.C. Capital’s concerns regarding the Company’s market share

loss, low yields and resultant cash flow, and the need for a Chief Commercial Officer. D.C. Capital urged the Company to develop,

articulate and execute on a turnaround plan and provided some suggestions on how to maximize profitability of the Company’s

Mexico facilities.

|

|

|

·

|

On April 1, 2019, the Company announced the appointment of Majdi Abulaban as the Company’s

new President and Chief Executive Officer, effective May 15, 2019.

|

|

|

·

|

Beginning on May 6, 2019, and continuing over the course of the next few months until August 2019,

Mr. Dethy repeatedly had telephone conversations with Mr. Ford requesting a meeting with the Company’s new Chief Executive

Officer to discuss D.C. Capital’s serious and growing concerns with the Company’s operational underperformance and

poor stock price performance. The Company would not accommodate D.C. Capital’s request during this time period.

|

|

|

·

|

On May 9, 2019, Messrs. Dethy and Benvenuti has a telephone conversation with Messrs. Ford and

Masanovich. During the call, Messrs. Dethy and Benvenuti once again expressed their serious concerns regarding the Company’s

poor operational performance, and asked for details regarding the Company’s yield underperformance, but were given no insight.

|

|

|

·

|

On August 9, 2019, D.C. Capital sent an email to Messrs. Abulaban, Masanovich and Ford with a sensitivity

analysis between unit production volume, value added content and resultant margins outlining the objective of getting the Company’s

net debt below $400 million by the end of 2022.

|

|

|

·

|

On August 27, 2019, Messrs. Dethy and Benvenuti had their first in person meeting with the Company’s

new Chief Executive Officer, Mr. Abulaban. Messrs. Masanovich and Ford were also present at the meeting. During the meeting, Messrs.

Dethy and Benvenuti once again expressed their now grave concerns regarding the Company’s sustained operational underperformance

and high debt and cash flow shortages. In addition, they encouraged the Company to cut its dividends in order to help reduce debt

and deleverage the Company. Further, Messrs. Dethy and Benvenuti requested both a meeting with the Board and that the Board undertake

measures to refresh itself.

|

|

|

·

|

On September 1, 2019, Mr. Dethy delivered a private letter to Mr. Abulaban summarizing their August

27, 2019, meeting and reiterating his request for a meeting with the Board.

|

|

|

·

|

On

September 12, 2019, Messrs. Dethy and Benvenuti met with Ransom Langford (the “Preferred

Stock Director”), who was appointed to the Board by TPG Group Holdings (SBS) Advisors,

Inc. (“TPG”) in connection with TPG’s investment to purchase Series

A Redeemable Preferred Stock and Series B Perpetual Preferred Stock to finance the acquisition

of Uniwheels. Messrs. Dethy and Benvenuti expressed their concerns relative to the Company’s

market share losses, operational, earnings and cash shortfalls, and disappointment regarding

Board and management inaction to address these issues.

|

|

|

·

|

On September 23, 2019, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. Ford,

during which, they once again requested a meeting with the Board and to coordinate schedules.

|

|

|

·

|

On September 30, 2019, Mr. Dethy delivered a private letter to the Board c/o Mr. Abulaban. In the

letter, Mr. Dethy noted D.C. Capital was encouraged by the suspension of the dividend and ceasing wheel production in Fayetteville

but emphasized it took the Company much longer to enact than expected. D.C. Capital then outlined the challenges facing the Company,

including poor operational performance in Mexico, competitive market share loss, underperforming contracts in the United States,

and insufficient cash flow to meaningfully pay down debt. Mr. Dethy also stated in the letter that he was discouraged by both management’s

and the Board’s apparent lack of urgency regarding the matters set forth above. In addition, Mr. Dethy expressed D.C. Capital’s

belief that it was time for the Board to be refreshed, particularly with directors who have both operational and turnaround experience,

and welcomed an initiative to shrink the Board so that it can work quickly, nimbly and extensively with the management team to

execute a turnaround plan.

|

|

|

·

|

On October 7, 2019, Mr. Abulaban delivered a letter to Mr. Dethy suggesting he meet with a subset

of the Board on October 29, 2019, almost three months after Mr. Dethy’s initial request.

|

|

|

·

|

On October 8, 2019, Mr. Dethy delivered a private letter to Mr. Abulaban thanking him for the invitation

to meet with a subset of the Board, but expressing his disappointment at the timing and apparent lack of urgency in scheduling

it for the end of the month. In the letter, Mr. Dethy once again noted Superior’s continued underperformance and also attached

an article outlining steps that General Electric was making to aggressively reduce its debt and replace seven of ten incumbent

directors over a three year period.

|

|

|

·

|

On October 10, 2019, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. Langford

to follow up on their discussions on September 12, 2019. During the call, Mr. Langford refused to engage in a meaningful discussion.

|

|

|

·

|

On October 29, 2019, Messrs. Dethy and Benvenuti met with Messrs. Abulaban, McQuay, Masanovich,

Ford and Richard Giromini, who is also a member of the Board, at the Company’s headquarters in Detroit, Michigan. At the

meeting, Messrs. Dethy and Benvenuti delivered a presentation clearly setting forth and reiterating their concerns as disclosed

in the private letter delivered to the Company on September 30, 2019. In addition, at the meeting, D.C. Capital requested a Board

seat because it believed that the Board was in need of a stockholder representative who would bring new and refreshed perspective.

|

|

|

·

|

On November 11, 2019, Mr. McQuay delivered a private letter to Mr. Dethy. In the letter, Mr. McQuay

rejected D.C. Capital’s request for a Board seat and stated “the Board is appropriately sized and incorporates the

right skillset to address the challenges and pursue the opportunities ahead of Superior.”

|

|

|

·

|

On December 20, 2019, Messrs. Dethy and Benvenuti had a telephone conversation with Messrs. Abulaban,

McQuay, Masanovich and Ford. During the call, Messrs. Dethy and Benvenuti reiterated their concerns as outlined in their presentation

from October 29, 2019, and once again requested a seat on the Board in order to add stockholder perspective.

|

|

|

·

|

On January 23, 2020, GAMCO filed an amended Schedule 13D disclosing that on that same day it had

submitted a stockholder notice of nomination of a director candidate for election to the Board at the Annual Meeting.

|

|

|

·

|

On January 24, 2020, D.C. Capital delivered a letter (the “Nomination Letter”) to the

Company, in accordance with its Bylaws, nominating Mr. Benvenuti for election to the Board at the Annual Meeting.

|

|

|

·

|

Also on January 24, 2020, in connection with the submission of the Nomination Letter, Mr. Dethy

sent Mr. McQuay and the Board a letter expressing D.C. Capital’s continued frustrations with the Company’s performance

and Board’s apparent unwillingness to refresh itself. Nevertheless, Mr. Dethy noted that that D.C. Capital was submitting

the Nomination Letter on a private basis in the hopes that the Board would meaningfully engage regarding a Board refreshment.

|

|

|

·

|

On January 27, 2020, Mr. McQuay sent an email to Mr. Dethy acknowledging receipt of the Nomination

Letter.

|

|

|

·

|

Also on January 27, 2020, D.C. Capital delivered a letter to the Company, within its rights as

a stockholder of the Company under Delaware law, demanding production of certain of the Company’s books and records, pursuant

to Section 220 of the Delaware General Corporation Law.

|

|

|

·

|

On January 28, 2020, Mr. Dethy sent an email to Mr. McQuay to see if the Board wished to respond

to his letter dated January 24, 2020 and engage to avoid a contested election at the Annual Meeting. In response, McQuay sent Mr.

Dethy an email informing Mr. Dethy not to expect a response by Thursday of that week.

|

|

|

·

|

On February 3, 2020, after not hearing from the Company since delivering the Nomination Letter

ten days earlier, D.C. Capital issued a press release and delivered a public letter to the Board. In the letter, D.C. Capital set

forth its intentions and efforts to engage constructively with the Company to address the many issues facing the Company including

the Company’s poor operating results, high debt balance, and depressed stock prices, however, the incumbent Board’s

lack of responsiveness and sense of urgency forced D.C. Capital’s hand to nominate Mr. Benvenuti for election to the Board,

who D.C. Capital believes will bring the necessary expertise and drive to the Board.

|

|

|

·

|

Also on February 3, 2020, D.C. Capital delivered a supplement to the Nomination Letter in accordance

with the Company’s Bylaws, disclosing that Mr. Benvenuti had been appointed to the NN, Inc. board of directors.

|

|

|

·

|

On February 4, 2020, Messrs. Dethy and Benvenuti had a telephone conversation with Mr. McQuay.

During the call, Mr. McQuay asked to interview Mr. Benvenuti, noted that the Board was looking for a female director candidate,

and also disclosed that the Company intends to interview the nominee for election to the Board submitted by GAMCO. Mr. McQuay did

not meaningfully react to the public letter or the issues raised by D.C. Capital.

|

|

|

·

|

Later on February 4, 2020, Mr. Dethy, on behalf of D.C. Capital, sent an email to Mr. McQuay following

up on the Company’s request to interview the Nominee. D.C. Capital expressed frustration that after many months of engaging

with the Company about Board refreshment, the Company only requested an interview with Mr. Benvenuti after D.C. Capital was forced

to go public with its concerns. D.C. Capital expressed concern that the Board was not acting in good faith in seeking to interview

Mr. Benvenuti. D.C. Capital indicated that if the Board desired to have discussions to avoid a contested election at the Annual

Meeting, it was prepared to engage on that basis.

|

|

|

·

|

On February 5, 2020, Mr. Dethy had a telephone conversation with Mr. McQuay. During the call Mr.

Dethy explained D.C. Capital’s view that the Board undertake efforts to refresh itself, including Mr. McQuay stepping down

as Chairman. Mr. McQuay responded that he thought the Board would be naturally refreshed as directors began to hit the mandatory

retirement age of 75. He also noted that he had tried to pass the baton as Chairman to other directors, but none were willing to

take the baton.

|

|

|

·

|

Also on February 5, 2020, Mr. Benvenuti had a telephone conversation with Mr. Giromini. During

the call Mr. Benvenuti expressed D.C. Capital’s desire to engage to avoid a contested election at the Annual Meeting, but

would like to understand if the Board was prepared to meaningfully refresh itself. Mr. Giromini indicated he would discuss this

with the Board further.

|

|

|

·

|

On February 7, 2020, counsel to Superior contacted counsel to D.C. Capital to understand the viewpoints of D.C. Capital to

avoid a contested election at the Annual Meeting. Counsel to D.C. Capital explained the need to agree on a meaningful refreshment

of the Board and leadership change at the Chairman level. To date, no representative from the Company has reached out to D.C. Capital.

|

|

|

·

|

On

February 20, 2020, D.C. Capital’s counsel received from the Company’s counsel,

a draft term sheet for settlement discussion purposes. The proposal contemplated expanding

the Board by one member to allow Mr. Benvenuti to join the Board immediately, but fixing

the size of the Board at 11 members through the proposed standstill period, presumably

to allow a new independent director to join the Board without having to cause any incumbent

director to step down. The term sheet also did not contemplate any leadership change

at the Board. In addition, the term sheet contemplated a standstill period that could

be automatically extended for so long as Mr. Benvenuti remained on the Board.

|

|

|

·

|

On

February 21, 2020, D.C. Capital sent a letter to the independent members of the Board

expressing its belief that the Company’s settlement proposal would not result in

any meaningful change regarding the composition of the Board. Instead, Superior’s

proposal sought to create a more expansive and bloated Board, with no change in leadership,

which is the opposite of what D.C. Capital believes needs to happen for the Company to

execute on a successful turnaround strategy. The letter concluded that D.C. Capital remained

open to having discussions to avoid a proxy contest if the Board was prepared to meaningfully

refresh itself. Shortly after the letter was sent, Mr. Benvenuti had a telephone conversation

with Mr. Giromini in which Mr. Benvenuti discussed the inadequacy of the Company’s

proposal. The call concluded with Messrs. Benvenuti and Giromini agreeing to consult

with their respective affiliates to see if settlement discussions could progress.

|

|

|

·

|

On

February 23, 2020, Messrs. Benvenuti and Giromini had a telephone conversation in which

Mr. Giromini requested that D.C. Capital put forward a counterproposal for settlement

discussions.

|

|

|

·

|

On

February 24, 2020, D.C. Capital sent a counterproposal in which the Board would be expanded

from nine to 10 to permit Mr. Benvenuti to join the Board immediately, Mr. Benvenuti

would be appointed to the Nominating Committee, the Board would agree to include Mr.

Benvenuti on its slate for election at the Annual Meeting, the Board would be resized

to nine directors immediately following the Annual Meeting and the Board would elect

a new Chairman no later than the Annual Meeting.

|

|

|

·

|

On

February 28, 2020, Mr. McQuay sent a letter to D.C. Capital on behalf of the Board indicating

that it did not believe D.C Capital’s proposal provided a suitable framework to

negotiate a cooperation agreement. Mr. McQuay argued that it was clear the Board and

D.C. Capital have very different views as to the appropriate next steps for the Company.

In the letter, Mr. McQuay claimed the Company was showing “strong financial results”

and “have taken decisive action to better position our business to create sustainable

shareholder value.” Mr. McQuay concluded that the Board was receptive to adding

new directors but did not provide any counterproposal.

|

REASONS FOR THE SOLICITATION

We Believe That Superior’s Board

Needs New Leadership and the Addition of a New Independent Director with a Stockholder Results-Oriented Mindset

For many months leading

up to this solicitation, we sought to engage with the Company to address our concerns with the Company’s underperformance

and persistently low stock price. In our view, the Board’s poor decisions and oversight have materially and adversely affected

the Company’s operating results, led the Company to be highly leveraged, and depressed its stock price. While we had hoped

to keep our discussions with the Company private and avoid engaging in any public campaign, the Board, led by Chairman Timothy

C. McQuay, seems too complacent with the status quo. Even in the face of two separate stockholder nominations of director candidates,

the Board has continued to argue that significant Board change is unnecessary. We disagree. To date, the Board has yet to engage

with us in any meaningful discussion to refresh the Board.

In our view, the

Board lacks the requisite leadership to drive the changes necessary to restore value for the shareholders of the company’s

common stock. Accordingly, we felt compelled to take the step of nominating our own candidate, Raynard D. Benvenuti, for election

to the Board at the Annual Meeting. We strongly believe that Mr. Benvenuti, who possesses over 30 years of experience as a senior

executive and advisor to various aerospace, automotive and manufacturing companies, including in turnaround situations, will bring

a stockholder results-oriented mindset to the Board to change the moribund Boardroom dynamics that we believe have hampered Superior’s

progress. We believe our Nominee will inject the Board with a sense of urgency to adopt the much needed changes to realize the

synergies promised from the Uniwheels Acquisition, aggressively reduce costs in order to improve cash flow and reduce debt, and

proactively refresh the Board further.

We are Deeply Concerned by Superior’s

Disastrous Stock Price Performance

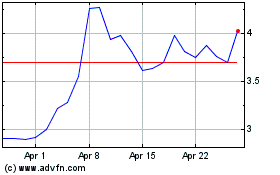

As indicated in the

chart below, over a five-year period ending January 31, 2020, Superior’s stock has delivered a negative 79% total return

to investors. The Nasdaq Composite and Russell 2000, by comparison, have delivered positive returns of 110% and 48% over the

same period.

|

|

|

|

|

|

Source: Bloomberg

|

|

This decline in Superior’s

stock price suggests that stockholders are increasingly disillusioned with the Company’s prospects.

Superior’s stock

performance over one- and three-year periods paints a similar picture, as summarized below.

One hundred dollars

invested in Superior since January 31, 2015, is now worth $21, while $100 invested in the Nasdaq Composite or Russell 2000 would

be worth $210 or $148, respectively. Superior has also significantly underperformed its own proxy peer group over one-, three-

and five-year periods.

We are Deeply Concerned with the Poor

Execution at Superior Following the Uniwheels Acquisition and the Severe Consequences that Have Resulted

While Superior

has underperformed over the past five years, the focal point for the Company’s precipitous stock price decline can be traced

to May 2017, when, led by the Company’s former CEO, Don Stebbins, and Chairman of the Board, Timothy C. McQuay, the Company

completed the acquisition of Uniwheels, a European aluminum wheel manufacturer, essentially doubling the size of the Company to

$1.4 billion in revenue. The acquisition price was approximately $766 million. At the end of the transaction, Superior went from

being a company with no net debt to one having approximately $800 million of debt and preferred equity to repay. Management promised

that significant operational and revenue synergies would be harvested from the combination and that U.S. operations were poised

for a significant increase in revenues and profitability given recently received contract awards, a strategic focus on larger,

higher value-added wheels, and output from a new PVD coating facility then under construction. This increase in North America

profitability and deal synergies were a key part of making the deal financeable, and were expected and necessary to pay down the

acquisition debt.

Regrettably, this expected

increase in profitability has not materialized. In 2016, before the Uniwheels Acquisition, the Company reported gross margins of

11.8% on $733 million of revenue. For the last nine months of 2019, the Company reported $1.1 billion of revenue, at a disappointing

8.4% gross margin. Shortly after the Uniwheels deal was announced in 2017, Superior had released a 2020 EBITDA goal in excess of

$230 million. In comparison, as part of the Company’s last quarterly release, the Company provided 2019 EBITDA guidance of

$165-175 million, over $50 million short of the 2020 original target.

This profitability

shortfall amounts to approximately $1 million per week or $2 per common share (pre-tax) per year since the acquisition. Most significantly,

unless reversed, the Company has essentially no ability to make any meaningful repayment from operating cash flow before its term

loan facility matures in May 2024 or in advance of its revolver facility maturity (“currently undrawn”) in May 2022.

Accordingly, if urgent measures are not taken to reduce operating costs and realize the aforementioned synergies following the

Uniwheels Acquisition, we believe Superior will not be able to significantly reduce its debt before these debt facilities mature.

Q4 2019 and Year-End Disclosures

Appear to Directly Contradict the Board’s Assertion that the Company Will Generate Sufficient Cash Flow to Meaningfully

Reduce Its Debt

Superior recently

released its Q4 2019 results and filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019

10-K”). The Company’s financial results suggest continued market share loss in North America and reports underperforming

margins and EBITDA. While the Company boasted of record cash flow generation, it appears fiscal year 2019 cash flow was bolstered

by one-time items which we believe are unlikely to repeat in fiscal year 2020, and the Company still has not detailed plans to

significantly improve operating cash flow in order to substantially reduce debt. We note the following:

|

|

1.

|

Superior continues to lose market

share in North America. While North American Auto production was down 4% from fiscal

2018 to fiscal 2019, Superior’s value-added sales were down 11%.

|

|

|

2.

|

Superior’s financial results

continue to decline year over year. Q4 2019 EBITDA of $37.5 million declined 18% from

Q4 EBITDA of $45.6 million. Gross Margins declined from 10.9% for fiscal 2018 to 8.5%.

Value added sales per wheel in North America declined 4% in Q4 2019 vs. Q4 2018, from

$35.57 to $34.41.

|

|

|

3.

|

In a February 28, 2020 letter

to D.C. Capital, Superior’s Chairman highlights that the Company has “record

cash flow from operations of $163 million and net debt reduction of $84 million.”

This net debt reduction was due in a very large part to one-time improvements

in receivables, payables, and inventory, temporary reductions in capital spending, and

asset sales.

|

Source: Company

filings

Superior continues

to factor receivables ($50 million as of December 31, 2019) to reduce outstanding debt and extended terms with some suppliers

in 2019. Additionally, capital expenditures were reduced by $9 million, to $65 million in fiscal 2019 vs. an average of $74 million

for fiscal 2018 and 2017, and a Company estimate of $75 million in fiscal 2020. The Company also sold assets generating $10 million

of cash in fiscal 2019. Without these one-time cash improvement items, net debt would only have been reduced $26 million in fiscal

2019.

More importantly,

without these one-time debt reduction actions, the Company’s 2020 EBITDA forecast of $170-$190 million (vs. 2019 EBITDA

of $169 million) again suggests meager debt reduction for fiscal 2020. The Company, in its 2019 10-K states “We do

not expect to generate sufficient cash to repay all of our indebtedness (including the Term Loan Facility and Notes) or obligations

relating to the redeemable preferred stock by the respective maturity dates and may be forced to take other actions to satisfy

these obligations, which may not be successful.”

The Board that Approved the

$766 Million Uniwheels Acquisition and the Associated $150 Million Issuance of the Series A Redeemable Preferred Stock is for

the Most Part Unchanged

While the CEO

who promoted and executed the Uniwheels Acquisition is no longer with the Company, we believe the Board and, in particular, Chairman

McQuay, needs to be held accountable. In fact, Superior, in its year-end 2019 earnings release, recorded a $102 million write

down in goodwill associated with this acquisition. The write down, less than three years since the acquisition, amounts to 14.5

percent of the Uniwheels’ purchase price and a loss of over $4 per common share of Superior. Notwithstanding the write down,

the Series A Redeemable Preferred Stock issued to fund the acquisition continues to receive a cash dividend of $13.5 million per

year and, in addition, its redemption value accretes every year on its path to its full redemption value of $300 million. The

combination of cash dividend and accretion totaled $30 million in 2019, or $1.20 per common share. This amount will only continue

to grow as the Series A Redeemable Preferred Stock further accretes.

We Are Concerned that the Board

is Not Adequately Aligned with Common Stockholders and Lacks a Sense of Urgency to Undertake the Aggressive Steps Needed to Turnaround

the Company

We firmly believe

that the Board needs to be refreshed with new, independent and objective perspectives, including the addition of a stockholder

representative on the Board that is aligned with the common stockholders of Superior. In our view, the Company’s independent

directors lack a meaningful vested financial interest in the common shares of the Company. Based on Superior’s proxy statement

relating to the Company’s 2019 annual meeting of stockholders (the “2019 Annual Meeting”), the independent members

of the Board, excluding the Preferred Stock Director, beneficially own a mere 0.66% of the outstanding shares of Common Stock,

a substantial portion of which are represented by equity awards. While TPG, which owns $150 million (initial value) of Series

A Redeemable Preferred Stock, and approximately 17.6% of the outstanding voting power of the Company, has a representative on

the Board, its economic interest is senior to that of the common stockholders and we are concerned that its interests are diverging

as the common share price sits far below the conversion price of its preferred. Accordingly, we believe that Board representation

for common stockholders is not adequate.

In addition, we are

concerned that the Board is stale. Five members on the current Board have an average tenure of eight years and all five presided

over the Uniwheels Acquisition and the Company’s subsequent decline as the synergies promised from the acquisition have failed

to materialize. When we discussed with Chairman McQuay the need to refresh the Board, he suggested that the Board would naturally

refresh itself as members reached the Board’s mandatory retirement age (which only one director is currently approaching

that age and not for another three years). Board refreshment should not be tied to a mandatory retirement age, but rather the evolving

needs of the Company. In our view, the Board is not taking the necessary steps to aggressively improve operating performance to

substantially reduce excess debt and should be proactively refreshed.

The Company’s Executive Compensation

Practices Have Been Questioned by a Leading Proxy Advisory Firm

In December 2018, the

Board granted former CEO Donald Stebbins an approximately $1.75 million cash severance payment despite his significant missteps

and voluntary retirement from the Company. In light of his role in the Uniwheels Acquisition and failure to realize the synergies

promised from the acquisition, we are puzzled by the Board’s decision to grant Mr. Stebbins’ this payment. Institutional

Shareholder Services (“ISS”), a leading proxy advisory firm, also found this decision troubling and recommended that

stockholders vote against the Company’s advisory vote to ratify the Company’s named executive officers’ compensation

at the 2019 Annual Meeting. In making its recommendation, ISS noted that “[t]he company granting this severance pay for

a voluntary retirement, especially amid poor stock performance, should concern shareholders, as severance upon a voluntary termination

is not a common market practice.”

D.C. Capital’s Nominee Possesses

the Expertise, Qualifications and Commitment to Bring Much-Needed Change to the Board

We have nominated Raynard

Benvenuti for election to the Board because we believe the Board needs a renewed sense of urgency to address the operational and

stock price performance issues facing the Company. We believe Mr. Benvenuti will bring outstanding qualities of intellect, judgment,

experience and drive to the Board.

|

|

·

|

Mr. Benvenuti is the founder of Concord Investment Partners, an investment and advisory firm focused

on making private and public investments in aerospace, automotive and industrial companies, including in undermanaged and distressed

situations.

|

|

|

·

|

Previously,

Mr. Benvenuti served as a Managing Partner and an operational practice leader for the

aerospace and automotive/truck sectors at Greenbriar Equity Group. For Greenbriar, Mr.

Benvenuti served on five boards, three as Chairman, and as interim CEO of an aerospace

portfolio company. Earlier, as President and CEO, Ray led the award-winning turnaround

of Stellex Aerostructures Inc., a manufacturer of large structural components for commercial

and military aircraft, culminating in a successful sale to GKN, plc.

|

|

|

·

|

Mr. Benvenuti previously worked at Forstmann Little & Co., a private equity firm, and

McKinsey & Company, a global management consulting firm.

|

|

|

·

|

Mr. Benvenuti was recently appointed to the board of NN, Inc., a NASDAQ-traded industrial manufacturer

of high-precision metal and plastic components and assemblies.

|

|

|

·

|

Mr. Benvenuti’s senior executive and advisor experience make him highly qualified to provide

valuable strategic, financial, operational, turnaround and corporate governance expertise to the Board.

|

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board currently

is currently composed of nine (9) directors, each with a term expiring at the Annual Meeting. D.C. Capital has nominated one (1)

independent, highly-qualified Nominee for election to the Board to replace one (1) incumbent director. If elected, our Nominee

will constitute a minority of the Board and there can be no guarantee that the Nominee will be able to implement the actions that

he believes are necessary to unlock stockholder value. However, we believe the election of our Nominee is an important step in

the right direction for enhancing long-term value at the Company.

According to the Company’s

proxy statement for the Annual Meeting, the current Board intends to nominate nine (9) candidates for election as directors at

the Annual Meeting with terms expiring at the 2021 Annual Meeting. This Proxy Statement is soliciting proxies to elect our Nominee

as a director in opposition to one of the incumbent directors. Stockholders who vote on the enclosed WHITE proxy card will

also have the opportunity to vote for the candidates who has been nominated by the Company other than [_____]. Stockholders will

therefore be able to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications

of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

[We are aware that

GAMCO has notified the Company of its intention to nominate the GAMCO Nominee for election to the Board at the Annual Meeting.

Neither this proxy statement nor the enclosed WHITE proxy card is soliciting votes to elect the GAMCO Nominee. We make no

recommendation with respect to the GAMCO Nominee.]

THE NOMINEE

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions,

offices, or employments for the past five (5) years of the Nominee. The nomination was made in a timely manner and in compliance

with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes

and skills that led us to conclude that the Nominee should serve as a director of the Company are set forth above in the section

entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominee. The Nominee

is a citizen of the United States of America.

Raynard D. Benvenuti,

age 63, is the founder of Concord Investment Partners, an investment and advisory firm he founded in 1996 focused on making

private and public investments in aerospace, automotive and industrial companies. Through Concord Investment Partners, Mr. Benvenuti

advises various private equity investment firms, D.C. Capital and certain other firms and companies. From 2007 to January 2016,

Mr. Benvenuti served in various capacities at Greenbriar Equity Group, including as a Managing Director and operational practice

leader for the aerospace and automotive/truck sectors from 2007 to December 2012 and Managing Partner from December 2012 to January

2016. Mr. Benvenuti subsequently became a senior advisor to Greenbriar from March 2016 to June 2019. Mr. Benvenuti also served

as Chairman and Interim CEO of Align Aerospace LLC, an aerospace hardware distribution company servicing commercial and military

aerospace manufacturers, from Greenbriar’s acquisition of the company, in 2011 to 2012. From 2002 to 2006, Mr. Benvenuti

served as the President of Stellex Aerostructures Inc., a manufacturer of large structural components for commercial and military

aircraft, became its CEO and a director in 2003, and led the company from bankruptcy to profitability and its ultimate sale to

GKN plc. Mr. Benvenuti previously worked at Forstmann Little & Co., a private equity firm, and McKinsey & Company, a global

management consulting firm. Mr. Benvenuti currently serves on the board of directors of NN, Inc. (NASDAQ: NNBR), an industrial

manufacturer of high-precision metal and plastic components and assemblies, as well as at The Whitcraft Group, an aircraft engine

components manufacturer. Previously, Mr. Benvenuti served on the boards of directors of EDAC Technologies Inc., an aircraft engine

components manufacturer, Muth Mirror Systems, an automotive blind spot detection lighting manufacturer, and AmSafe Partners, an

aviation passenger and cargo restraint manufacturer, where he also served as Chairman. Mr. Benvenuti holds a B.E. in Mechanical

Engineering from Manhattan College, an M.S. in Mechanical and Aerospace Engineering from Princeton University, and an M.B.A. from

the Harvard Graduate School of Business Administration, where he graduated as a Baker Scholar.

D.C. Capital believes

that Mr. Benvenuti’s extensive experience as a senior executive and advisor to various aerospace, automotive and manufacturing

companies, including in turnaround situations, and experience serving on boards make him highly qualified to provide valuable strategic,

financial, operational and corporate governance expertise to the Board.

D.C. Capital believes

that the Nominee presently is, and if elected as a director of the Company, the Nominee would be, an “independent director”

within the meaning of (i) applicable New York Stock Exchange listing standards applicable to board composition and (ii) Section

301 of the Sarbanes-Oxley Act of 2002. The Nominee is not a member of the Company’s compensation, nominating or audit committee

that is not independent under any such committee’s applicable independence standards.

The principal business

address of Mr. Benvenuti is 100 Main Street, Suite 320 Concord, MA 01742.

As of the date hereof,

the Nominee beneficially owns 32,500 shares of Common Stock, which are beneficially owned through the Raynard D. Benvenuti Trust-2009

(the “Benvenuti Trust”), which the Nominee controls. The shares of Common Stock beneficially owned by Mr. Benvenuti

were purchased with personal funds in open market purchases.

The Nominee may be

deemed to be a member of a “group” with the D.C. Capital Group (the “Group”) for the purposes of Section

13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and accordingly, the Group may be

deemed to beneficially own, in the aggregate, the 1,232,500 shares of Common Stock. For information regarding purchases and sales

during the past two (2) years by the members of the Group of securities of the Company, see Schedule I.

The Nominee, through

Concord Investment Partners LLC, a single member limited liability company that he controls, has entered into an agreement (the

“Consulting Agreement”) with D.C. Capital Advisors, pursuant to which the Nominee provides advisory services to D.C.

Capital Advisors, including with respect to the Company. Pursuant to the Consulting Agreement, the Nominee is paid $30,000 per

calendar quarter and is entitled to a discretionary bonus based on the overall performance of the underlying investments. The Consulting

Agreement will terminate March 31, 2020.

On January 24, 2020,

the Participants entered into a Group Agreement in which, among other things, (a) the Participants agreed, to the extent required

by applicable law, to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of

the Company, (b) they agreed to solicit proxies or written consents for the election of the Nominee, or any other person(s) nominated

by D.C. Capital (the “Solicitation”), (c) they agreed to provide notice to the Participants’ legal counsel of

all trading in the securities of the Company, and (d) the D.C. Capital Group agreed to bear all expenses incurred in connection

with the activities of the Participants, including approved expenses incurred by any of the parties in connection with the Solicitation,

subject to certain limitations.

On January 24, 2020,

D.C. Capital Partners entered into a letter agreement with the Nominee pursuant to which D.C. Capital Partners agreed to indemnify

the Nominee against claims arising from the Solicitation and any related transactions. For the avoidance of doubt, such indemnification

does not apply to any claims made against the Nominee in his capacity as a director of the Company, if so elected.

Other than as stated

herein, there are no arrangements or understandings between the members of the Group or any other person or persons pursuant to

which the nomination of the Nominee described herein is to be made, other than the consent by the Nominee to be named in this Proxy

Statement and to serve as a director of the Company if elected as such at the Annual Meeting. The Nominee is not a party adverse

to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material

pending legal proceeding.

We have no reason

to believe that the Nominee will be unable to stand for election, but, in the event the Nominee is unable to serve or will

not serve for good cause, the shares of Common Stock represented by the enclosed WHITE proxy card will be voted for

substitute nominee(s), to the extent this is not prohibited under the Company’s Bylaws (the “Bylaws”) and

applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any

changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of

disqualifying the Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we

would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock

represented by the enclosed WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to

nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company

increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual

Meeting.

WE URGE YOU TO VOTE “FOR”

THE ELECTION OF THE NOMINEE ON THE ENCLOSED WHITE PROXY CARD.

PROPOSAL NO. 2

NON-BINDING ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

As discussed in further

detail in the Company’s proxy statement, the Company is asking stockholders to cast an annual advisory vote on the compensation

of the Company’s executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended

to address any specific item of compensation, but rather the overall compensation of the Company’s executive officers and

the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders

to vote for the following resolution:

“RESOLVED,

that the stockholders approve the compensation of Superior’s named executive officers as disclosed pursuant to the SEC’s

compensation disclosure rules, including the “Compensation Discussion and Analysis,” the compensation tables and narrative

discussion.”

As disclosed in the

Company’s proxy statement, the say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation and

Benefits Committee or the Board. The stockholders’ advisory vote will not overrule any decision made by the Board or the

Compensation and Benefits Committee or create or imply any additional fiduciary duty by the Company’s directors. However,

the Company has disclosed that The Compensation and Benefits Committee will continue to consider the results of future Say-on-Pay

votes when making future compensation decisions for Superior’s named executive officers.

FOR THE REASONS SET

FORTH ABOVE, WE RECOMMEND VOTING, AND INTEND TO VOTE OUR SHARES, “[______]” THIS RESOLUTION.

PROPOSAL NO. 3

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further

detail in the Company’s proxy statement, the Audit Committee of the Board has selected Deloitte & Touche LLP as the Company’s

independent registered public accounting firm to audit and report upon the consolidated financial statements of the Company for

the fiscal year ending December 31, 2020 and is proposing that stockholders ratify such appointment. The Company is submitting

the appointment of Deloitte & Touche LLP for ratification of the stockholders at the Annual Meeting.

As disclosed in the

Company’s proxy statement, stockholder ratification of the appointment of Deloitte & Touche LLP as the Company’s

independent registered public accounting firm is not required, but the Company is submitting the selection of Deloitte & Touche

LLP to stockholders for ratification at the Annual Meeting with a view toward soliciting the stockholders’ opinions, which

the Audit Committee will take into consideration in future deliberations. If the appointment of Deloitte & Touche LLP is not

ratified at the Annual Meeting, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the

Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at

any time during the year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’

best interests.

WE MAKE NO RECOMMENDATION WITH RESPECT

TO THE RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders

of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their Shares

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of

record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares

after the Record Date. Based on publicly available information, D.C. Capital believes that the outstanding classes of securities

of the Company entitled to vote at the Annual Meeting are the Common Stock and the Series A Redeemable Preferred Stock. Each holder

of Common Stock and Series A Redeemable Preferred Stock as of the Record Date will be entitled to one vote on each matter for

each share of Common Stock held, or into which such holder’s Series A Redeemable Preferred Stock is convertible, on the

Record Date.

Shares represented

by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions,

will be voted FOR the election of our Nominee, [______] the approval of the non-binding advisory vote on the compensation

of the Company’s named executive officers and FOR the ratification of the selection of Deloitte & Touche LLP as

the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020, as described herein

According to the Company’s

proxy statement for the Annual Meeting, the current Board intends to nominate nine (9) candidates for election as directors at

the Annual Meeting with terms expiring at the 2021 Annual Meeting. This Proxy Statement is soliciting proxies to elect our Nominee

as a director in opposition to one of the incumbent directors. Stockholders who vote on the enclosed WHITE proxy card will

also have the opportunity to vote for the candidates who has been nominated by the Company other than [_____]. Stockholders will

therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules

we are required either to solicit proxies only for our Nominee, which could result in limiting the ability of stockholders to fully

exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominee while also allowing stockholders

to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our Nominee to

also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees,

and other information about them, can be found in the Company’s proxy statement.

[We are aware that

GAMCO has notified the Company of its intention to nominate the GAMCO Nominee for election to the Board at the Annual Meeting.

Neither this proxy statement nor the enclosed WHITE proxy card is soliciting votes to elect the GAMCO Nominee. We make no

recommendation with respect to the GAMCO Nominee.]

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct

business at the meeting. According to the Company’s proxy statement, a majority of the Shares entitled to vote, represented

in person or by proxy at the Annual Meeting, shall constitute a quorum.

Votes withheld

from director nominees, abstentions and broker non-votes will be counted as Shares present for the purpose of determining a quorum

but will not be counted in determining the number of shares voted “FOR” director nominees or treated as votes cast

on any other proposal According to the Company’s proxy statement, abstentions and broker non-votes will not affect the outcome

of the vote on any of the proposals presented at the Annual Meeting.

A broker non-vote occurs

when a bank, broker or other nominee who holds shares for another person returns a proxy but does not vote on a particular item,

usually because the nominee does not have discretionary voting authority for that item and has not received instructions from the

owner of the shares.

If you are a stockholder of record, you

must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to

be counted in the determination of a quorum.

If your Shares are held in the name of your

broker, a bank or other nominee, that party will give you instructions for voting your Shares. If you do not give instructions

to your bank or brokerage firm, it will not be allowed to vote your Shares with respect to any of the proposals to be presented

at the Annual Meeting. In the absence of voting instructions, Shares subject to such so-called broker non-votes will not be counted

as voted on those proposals and so will have no effect on the vote, but will be counted as present for the purpose of determining

the existence of a quorum. Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting.

VOTES REQUIRED FOR APPROVAL

Election of Directors

─ The election of directors requires a plurality of the votes cast at the Annual Meeting. As a result of our nomination of

the Nominee, the nine (9) nominees receiving the greatest number of “for” votes will be elected as directors. Proxy

cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer

votes but will not count as a vote against the nominees. Neither a withhold vote nor a broker non-vote will count as a vote cast

“FOR” or “AGAINST” a director nominee. Therefore, withhold votes and broker non-votes will have no direct

effect on the outcome of the election of directors.

Other Proposals

─ According to the Company’s proxy statement, approval of the non-binding, advisory resolution to approve the compensation

of the Company’s named executive officers and the ratification of the appointment of Deloitte & Touche LLP as the Company’s

independent registered public accounting firm each require the Shares voted “for” the proposal to exceed the number

of Shares voted “against” the proposal at the Annual Meeting. Abstentions and broker non-votes will be counted as Shares

present for the purpose of determining a quorum but will not be treated as votes cast on any other proposal and, therefore, will

not affect the outcome of these other proposals.

REVOCATION OF PROXIES

Stockholders of the

Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although,

attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice

of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier

proxy. The revocation may be delivered either to D.C. Capital in care of Saratoga at the address set forth on the back cover of

this Proxy Statement or to the Company at 26600 Telegraph Rd., Southfield, MI 48033 or any other address provided by the Company.

Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all