Amended Statement of Beneficial Ownership (sc 13d/a)

May 05 2023 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Super Group (SGHC) Limited

(Name of Issuer)

Ordinary Shares, no par value

(Title of Class of

Securities)

G8588X103

(CUSIP Number)

Alexander McNee

2nd Floor, St. Mary’s Court

20 Hill Street

Douglas

Isle of Man IM1 1EU

+44 1624 692930

(Name, Address

and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 5, 2023

(Date of Event Which

Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out

for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. G8588X103 |

| 1. |

Names of Reporting Persons

Knutsson Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

WC |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Isle of Man |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

|

| 8. |

Shared Voting Power

229,515,092 shares |

| 9. |

Sole Dispositive Power

|

| 10. |

Shared Dispositive Power

229,515,092 shares |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

229,515,092 shares |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

46.1% (2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

| (1) | This Schedule 13D is filed by Knutsson Limited (“Knutsson”), Alea Holdings Limited (“Alea”),

Alea Trust (the “Trust”), Ridgeway Associates Limited (“Ridgeway”) and Boston Limited (“Boston” and,

with Knutsson, Alea, Trust and Ridgeway, collectively, the “Reporting Persons”). The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13D. |

| (2) | This percentage is calculated based upon 497,887,721 Ordinary Shares outstanding as of December 31,

2022, as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 27, 2023. |

| CUSIP No. G8588X103 |

| 1. |

Names of Reporting Persons

Alea Holdings Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Isle of Man |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

|

| 8. |

Shared Voting Power

229,515,092 shares (2) |

| 9. |

Sole Dispositive Power

|

| 10. |

Shared Dispositive Power

229,515,092 shares (2) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

229,515,092 shares (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

46.1% (3) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Shares are directly held by Knutsson, Alea is the sole shareholder of Knutsson, the Trust is the sole

shareholder of Alea, Ridgeway is the trustee of the Trust and Boston is the sole shareholder of Ridgeway. Each of Alea, the Trust, Ridgeway

and Boston shares voting and investment authority over the shares held by Knutsson. |

| (3) | This percentage is calculated based upon 497,887,721 Ordinary Shares outstanding as of December 31,

2022, as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 27, 2023. |

| CUSIP No. G8588X103 |

| 1. |

Names of Reporting Persons

Alea Trust |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Isle of Man |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

|

| 8. |

Shared Voting Power

229,515,092 shares (2) |

| 9. |

Sole Dispositive Power

|

| 10. |

Shared Dispositive Power

229,515,092 shares (2) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

229,515,092 shares (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

46.1% (3) |

| 14. |

Type of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Shares are directly held by Knutsson, Alea is the sole shareholder of Knutsson, the Trust is the sole

shareholder of Alea, Ridgeway is the trustee of the Trust and Boston is the sole shareholder of Ridgeway. Each of Alea, the Trust, Ridgeway

and Boston shares voting and investment authority over the shares held by Knutsson. |

| (3) | This percentage is calculated based upon 497,887,721 Ordinary Shares outstanding as of December 31,

2022, as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 27, 2023. |

| CUSIP No. G8588X103 |

| 1. |

Names of Reporting Persons

Ridgeway Associates Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Isle of Man |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

|

| 8. |

Shared Voting Power

229,515,092 shares (2) |

| 9. |

Sole Dispositive Power

|

| 10. |

Shared Dispositive Power

229,515,092 shares (2) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

229,515,092 shares (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

46.1% (3) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Shares are directly held by Knutsson, Alea is the sole shareholder of Knutsson, the Trust is the sole

shareholder of Alea, Ridgeway is the trustee of the Trust and Boston is the sole shareholder of Ridgeway. Each of Alea, the Trust, Ridgeway

and Boston shares voting and investment authority over the shares held by Knutsson. |

| (3) | This percentage is calculated based upon 497,887,721 Ordinary Shares outstanding as of December 31,

2022, as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 27, 2023. |

| CUSIP No. G8588X103 |

| 1. |

Names of Reporting Persons

Boston Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Isle of Man |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

|

| 8. |

Shared Voting Power

229,515,092 shares (2) |

| 9. |

Sole Dispositive Power

|

| 10. |

Shared Dispositive Power

229,515,092 shares (2) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

229,515,092 shares (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

46.1% (3) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Shares are directly held by Knutsson, Alea is the sole shareholder of Knutsson, the Trust is the sole

shareholder of Alea, Ridgeway is the trustee of the Trust and Boston is the sole shareholder of Ridgeway. Each of Alea, the Trust, Ridgeway

and Boston shares voting and investment authority over the shares held by Knutsson. |

| (3) | This percentage is calculated based upon 497,887,721 Ordinary Shares outstanding as of December 31,

2022, as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 27, 2023. |

Explanatory

Note: This Amendment No. 1 (the “Amendment”), which amends the Schedule 13D filed with the Securities and

Exchange Commission (the “SEC”) on December 13, 2022 (the “Original Schedule 13D”) filed on behalf of Knutsson

Limited (“Knutsson”), Alea Holdings Limited (“Alea”), Alea Trust (“Trust”), Ridgeway Associates Limited

(“Ridgeway”) and Boston Limited (“Boston” and, with Knutsson, Alea, Trust and Ridgeway, collectively, the “Reporting

Persons”), relates to the ordinary shares, no par value (“Ordinary Shares”) of Super Group (SGHC) Limited, a non-cellular

company limited by shares incorporated and registered under the laws of the Island of Guernsey, (the “Issuer” and also “SuperGroup”).

This Amendment is being filed by the Reporting Persons to report Knutsson’s entry into the Option Agreement (as defined herein),

as described in Items 4 and 6 below.

Items 4 and 6 of the Original Schedule 13D are

hereby amended and supplemented to the extent hereinafter expressly set forth and, except as amended and supplemented hereby, the Original

Schedule 13D remains in full force and effect. All capitalized terms used in this Amendment but not defined herein shall have the meanings

ascribed thereto in the Original Schedule 13D.

| Item 4. | Purpose of Transaction |

Item 4 of the Original Schedule 13D is hereby

amended and supplemented by adding the following paragraph at the end of Item 4:

On April 14, 2023, Knutsson transferred 7,191,657

Ordinary Shares to Bellerive Trust Limited as Trustee of the SGHC Shares Trust (the “SGHC Shares Trust”) as a contribution

to the SGHC Shares Trust for no consideration. The SGHC Shares Trust is independent of Knutsson and, accordingly, such shares are no longer

beneficially owned by the Reporting Persons.

On May 5, 2023, Knutsson and Chivers Limited

(“Chivers”), another shareholder of the Issuer, entered into a Put and Call Share Option Agreement (the “Option Agreement”),

with respect to 60,000,000 ordinary shares (the “Option Shares”) owned by Chivers, as described in greater detail in Item

6 below.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 of the Original Schedule 13D is hereby

amended and supplemented by adding the following paragraph at the end of Item 6:

Put and Call Share Option Agreement

On May 5, 2023, Knutsson and Chivers entered

into the Option Agreement. Under the Option Agreement, Chivers has granted Knutsson an option (the “Call Option”) to purchase

from Chivers the Option Shares, from time to time, during the ten year period beginning June 30, 2024 (the “Option Period”)

at purchase prices per share ranging from $5.20 per share to $7.41 per share. The Call Option generally may only be exercised, at Knutsson’s

election, either in full or in multiples of 100,000 Option Shares. Under the Option Agreement, Knutsson granted Chivers an option (the

“Put Option”) to sell to Knutsson the Option Shares, from time to time, during the Option Period at a sale price of $4 per

share. The Put Option generally may only be exercised, at Chivers’ election: (i) once in any rolling six month period; (ii) in

respect of up to a maximum of 15,000,000 Option Shares per calendar year; and (iii) in respect of not less than 100,000 Option Shares.

In certain circumstances, Knutsson will have the option to elect to settle the exercise of an option under the Option Agreement by cash

payment equal to the difference between the trading price of the ordinary shares subject to the exercise and the purchase price of the

Option Shares under the relevant option being exercised. The Call Option and Put Option shall automatically lapse and be of no further

force and effect on completion of a Change of Control (as defined in the Option Agreement) of the Issuer.

The description of the Option Agreement is qualified

in its entirety by reference to the full text of the Option Agreement, which is filed as an exhibit hereto and incorporated by reference

herein.

| Item 7. | Material to be Filed as Exhibits |

Item 7 of the Original Schedule 13D is hereby

amended and supplemented by adding the following paragraph at the end of Item 7:

| E. | Put and Call Share Option Agreement, dated May 5, 2023, by and between Knutsson Limited and Chivers

Limited. |

Signature

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 5, 2023

| Knutsson Limited |

|

| |

|

|

| By: |

/s/ Alexander McNee |

|

| |

Name: |

Alexander McNee |

|

| |

Title: |

Director |

|

| |

|

|

| Alea Holdings Limited |

|

| |

|

|

| By: |

/s/ Alexander McNee |

|

| |

Name: |

Alexander McNee |

|

| |

Title: |

Director |

|

| |

|

|

| Alea Trust |

|

| |

|

|

| By: Alea Holdings Limited |

|

| Its: Trustee |

|

| |

|

|

| By: |

/s/ Alexander McNee |

|

| |

Name: |

Alexander McNee |

|

| |

Title: |

Director |

|

| |

|

|

| Ridgeway Associates Limited |

|

| |

|

|

| By: |

/s/ Alexander McNee |

|

| |

Name: |

Alexander McNee |

|

| |

Title: |

Director |

|

| |

|

|

| Boston Limited |

|

| |

|

|

| By: |

/s/ Alexander McNee |

|

| |

Name: |

Alexander McNee |

|

| |

Title: |

Director |

|

| |

ATTENTION |

|

| Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

Exhibit(s):

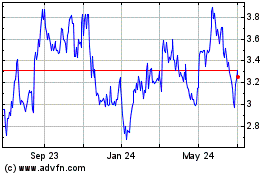

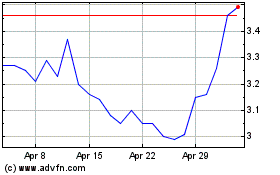

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Nov 2023 to Nov 2024