Sun Communities, Inc.

Name of Registrant as Specified in its Charter

Name of Person(s) Filing Proxy Statement if other than the Registrant:

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| þ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)

(2)

(3)

(4)

(5) | Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)

(2)

(3)

(4) | Amount Previously Paid:

Form, Schedule or Registration Statement No.:

Filing party:

Date filed: |

VISION

We are an inspired, engaged and collaborative team committed to providing extraordinary service to our residents, customers and each other.

CULTURE | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Live the Golden Rule | | | Do the right thing | | | We over me |

| | | | | | |

| | | | | | | | | |

| Treat others the way you want to be treated – we don’t just practice it, we live it. The exceptional experiences we deliver wouldn’t be possible without understanding our impact on others. We operate with respect, empathy and consideration at all times. It’s not a suggestion, it’s our moral obligation. | | | We choose honesty and integrity in all our actions, making the best, most educated decisions we can. Sometimes the right thing is the easy thing, or the popular thing. Other times it isn’t. We don’t get sidetracked when things go wrong, and we don’t shy away from doing what is right. | | | We work as a collaborative and collective unit. No one person operates alone, and we keep the wider team in mind when making decisions about individual work. We know we need each other to produce an unmatched experience for our residents and guests. What’s more, we trust each other enough to sacrifice our own goals for those of the team. |

| | | | | | | | | |

| Nothing changes if nothing changes | | | Mindset is everything | | | Keep it simple |

| | | | | |

| | | | | | | |

| | Mindset is the guiding force behind all our actions. We can’t always decide what happens to us, but we can always decide how to handle it. Bad experiences don’t bring down our whole day. We learn, we grow and we become resilient. We are successful because we choose to be, every day and every step of the way. | | | Let’s not overcomplicate things. Can a clearer word explain your point? Use it. Can fewer steps streamline your work? Do it. We lead with what is most important, shedding complexity as we go. Simplicity isn’t effortless, but it does make things a bit easier. |

| | | | | |

| | | | | |

| We don’t sit still for long. We are constantly transforming both our industry and our Company. That means we are open and flexible, using what works now to develop what works next. Even if it ain’t broke, we still make it better. Lots of folks will say it hasn’t been done – we say it hasn’t been done yet. | | | | |

| | | | | | | | | |

| | | | Be yourself & thrive | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | Inclusion, diversity, equity and accessibility are at the heart of who we are and what we do. Our biggest competitive advantage is the variety of individual perspectives we all bring to Sun. We support and celebrate what makes us unique, creating a space where all can succeed. | | | | |

| | | | | | | | | |

Dear Fellow Shareholders,

2021 was a year of meaningful growth and evolution at Sun Communities. Sun is the largest owner and operator of Manufactured Housing communities, RV resorts and Marinas, and our strong results reflect the resilience, desirability and favorable positioning of our best-in-class portfolio. While the pandemic and its related impact brought many unprecedented challenges to the world, it also illuminated several sustaining tailwinds for us that we believe will continue for years to come. The demand for attainable housing and outdoor vacationing and leisure activities have become abundantly clear, and Sun is uniquely positioned to meet these customer needs across all of our platforms.

Our portfolio continues to deliver stable earnings growth, as demonstrated by our 11.2 percent growth in same community net operating income (NOI) in 2021. We also benefited from the contribution of our strategic acquisitions and growth initiatives. During the year, we expanded our portfolio to include more than 204,000 sites, wet slips and dry storage spaces across 602 properties, representing 9 percent growth from the end of the prior year. The net result was an incredibly strong 27.9 percent year over year increase in Core Funds from Operations (Core FFO) per share.

This performance reflects the successful execution of our investment strategy, built on our proven platform that we have continually refined and improved. Today, the number of investment opportunities available to Sun and its shareholders is more exciting than ever. Our four core investment priorities include: 1) pursuing accretive acquisitions; 2) reinvesting in our communities; 3) completing highly profitable community expansions; and 4) selective greenfield developments. During the year, we successfully executed on each of these as we completed $1.4 billion of high-quality acquisitions across our manufactured housing communities, RV resorts and marinas, as well as opening four new ground-up development properties. We also continued to grow our pipeline for future growth with land purchases for greenfield development and site expansions.

We reached another exciting milestone as we announced the acquisition of Park Holidays UK for approximately $1.3 billion which we expect to close in April 2022. Park Holidays is the second largest owner and operator of holiday parks in the UK, with 40 owned, and two managed, communities. With a nearly identical business model to Sun’s manufactured housing platform, this transaction allows us to apply our proven expertise and track record to a fragmented market, further expanding our opportunities and accelerating our growth potential.

Sun has a strong cycle-tested record of operating, expanding and acquiring MH and RV communities dating back to 1975. Throughout our history, we have maintained an unparalleled focus on delivering the best customer experience and on optimizing our operating platform. To achieve this, we have assembled an incomparable team and have established a culture of accountability and empowerment. Our team takes pride in providing the highest level of service by executing on a playbook which serves our customers, guests and residents in a way that creates a sticky customer base. Across each of our platforms, demand is at record levels from applications to live in a Sun Community to new RV bookings to marina slip and storage demand. We aspire to create additional value using our proprietary technologies and building scale with our marketing and booking platforms including Campspot. We are excited about the launch of our new branding for our RV resorts, Sun Outdoors, which invites guests to “explore their sunnier side” and encourages interactions with both returning and new Sun customers in much deeper and more engaging ways.

Letter from the Chairman and Lead Independent Director

Our operational performance was complemented by Sun’s strategic balance sheet management. In addition to completing equity raises to secure capital to fund our growing acquisition pipeline and other opportunities, in 2021, we also completed a well-received inaugural unsecured bond issuance where we received investment grade ratings from both S&P and Moody’s. Going forward, we will look for opportunities to enhance our credit metrics. With our solid investment grade ratings, we now have greater access to the bond market, providing us with enhanced financial flexibility and an additional tool to fund our investment activities. We have a healthy pipeline of internal and external opportunities, and our priority is to maintain a strong balance sheet to support continued growth across all Sun platforms.

In 2021, we also accelerated our commitment to promoting ESG principles throughout all areas of our business. Sun’s core success attributes of Commitment, Intensity, Empowerment, Accountability and Service, have always been a foundational piece of Sun, and we are pleased with the strong steps taken to formalize this commitment. A few highlights include: the launch of a new partnership with the National Park Foundation in support of the Foundation’s Outdoor Exploration program to connect people with the social, mental, and physical health benefits of national parks and outdoor discovery; a broad assessment of the current state of inclusion, diversity, equity and accessibility at Sun and developing an organization-wide strategy to create positive change; and the enhancement of our ESG disclosures and the establishment of a baseline from which to demonstrate improvements. We recently published our annual ESG report, where we outlined three voluntary frameworks we undertook in 2021. Sun is committed to continual improvement in these areas and we look forward to providing ongoing updates on our progress.

For more than 20 years, Sun has delivered consistent and cycle-tested organic cash flow growth, supported by favorable demand drivers, high barriers to entry, and Sun’s investment and operational prowess. We are proud that, in every individual year, or rolling 4-quarter period, over this same time period, we have recorded positive same community NOI growth. This is an exceptional track record and one that could not have been achieved without the extraordinary commitment of each and every Sun team member. And finally, we, at Sun, want to thank all of our stakeholders for their ongoing support.

Sincerely,

| | | | | |

| |

Gary A. Shiffman Chairman and Chief Executive Officer | Clunet R. Lewis Lead Independent Director |

| |

| | | | | | | | |

| | |

| Date and Time | Location | Record Date |

Online Wednesday, May 17, 2022, 11:00 a.m. EDT | Shareholders may only participate online by logging in at www.virtualshareholdermeeting.com/SUI2022 | Close of business March 21, 2022 |

| | | | | | | | | | | |

| Items of Business | Board Recommendation | For Further Details |

1 | Elect eight directors to serve until our 2023 annual meeting of shareholders or until their successors shall have been duly elected and qualified | FOR each director nominee | |

2 | Conduct a non-binding advisory vote on executive compensation | FOR | |

3 | Ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for 2022 | FOR | |

4 | Approval of first amendment to the Sun Communities Inc. 2015 Equity Incentive Plan | FOR | |

Consider any other business properly brought before the Annual Meeting.

Who Can Vote

If you were a holder of record of the Company’s common stock at the close of business on March 21, 2022 (the “Record Date”), you are entitled to notice of, and to vote at, the Annual Meeting or any adjournments.

How to Cast Your Vote

YOUR VOTE IS IMPORTANT TO US. Please vote as promptly as possible.

| | | | | | | | |

| | |

| Internet | Call | Mail |

Before the Annual Meeting - www.proxyvote.com

During the Annual Meeting - www.virtualshareholdermeeting.com/SUI2022 | (800) 690-6903 | Mail your proxy card or voter instruction form based on the instructions provided |

Thank you for your interest in Sun Communities, Inc.

By Order of the Board of Directors

Karen J. Dearing

Secretary

| | |

|

This Proxy Statement and our Annual Report to shareholders for the year ended December 31, 2021, are available at www.proxyvote.com. |

|

| | | | | |

| Board | Sun Communities, Inc. Board of Directors |

| CDC | Centers for Disease Control and Prevention |

| CNOI | Controllable Net Operating Income |

Core FFO(1) | Core Funds From Operations |

Core FFO(1) per Share | Core Funds From Operations Attributable To Sun Communities, Inc. Common Shareholders and Dilutive Convertible securities Per Share Fully Diluted |

| DEI | Diversity, Equity, and Inclusion |

| EBITDA | Earnings Before Interest, Taxes, Depreciation and Amortization |

| EDT | Eastern Daylight Time |

| ERM | Enterprise Risk Management |

| ESG | Environmental, Social and Governance |

| Exchange Act | Securities Exchange Act of 1934 |

| FFO | Funds From Operations |

| GAAP | United States Generally Accepted Accounting Principles |

| IDEA | Inclusion, Diversity, Equity and Accessibility |

| MH | Manufactured Housing |

| MH Finance Committee | Manufactured Housing Finance Committee of the Board |

| NAREIT | National Association of Real Estate Investment Trusts |

| NCG Committee | Nominating and Corporate Governance Committee of the Board |

| NEO | Named Executive Officers identified in this Proxy Statement: Gary A. Shiffman, John B. McLaren, Karen J. Dearing, Bruce D. Thelen and Aaron Weiss |

NOI(1) | Net Operating Income |

| NYSE | New York Stock Exchange |

| OP Unit | Unit representing an ownership interest in the Operating Partnership |

| Operating Partnership | Sun Communities Operating Limited Partnership |

Recurring EBITDA(1) | Recurring Earnings Before Interest, Taxes, Depreciation and Amortization |

| REIT | Real Estate Investment Trust |

| RPS | Revenue Producing Site |

| RV | Recreational Vehicle |

| Same Community NOI | Net Operating Income of properties that we have owned and operated continuously since January 1, 2020 |

| SEC | Securities and Exchange Commission |

| |

| SHS | Sun Home Services, Inc. |

| TSR | Total Shareholder Return |

| UK | The United Kingdom |

| WHO | World Health Organization |

(1)Definitions of Core FFO, Recurring EBITDA and NOI are detailed in the Non-GAAP Financial Measures discussion in Appendix A, which also presents the reconciliation of these non-GAAP financial measures to GAAP measures.

This page intentionally left blank.

Sun Communities, Inc., a Maryland corporation, and all wholly-owned or majority-owned and controlled subsidiaries, including Sun Communities Operating Limited Partnership, a Michigan limited partnership (the “Operating Partnership”), Sun Home Services, Inc., a Michigan corporation (“SHS”) and Safe Harbor Marinas, LLC, a Delaware limited liability company (“Safe Harbor”), are referred to herein as the “Company,” “us,” “we” and “our.” We are a fully integrated real estate investment trust (“REIT”).

COMPANY OVERVIEW(1)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Sun Communities is the nation’s premier owner and operator of manufactured housing communities. | | | Sun Outdoors offers recreational vehicle sites, vacation rentals, and tent camping with world-class amenities throughout the U.S. and Ontario, Canada. | | | Safe Harbor is the largest and most diversified marina owner and operator in the United States. |

| | | | | | |

| | | | | | |

33 Hybrid MH and RV properties | | | 125 Marinas 45,155 wet slips & dry storage spaces

|

284 MH Communities | | | 160 RV Resorts | | |

| 98,621 MH sites | | | 30,540 annual RV sites 29,847 transient RV sites | | |

| | | | | | | | | | | |

| Property Count | | | Rental Revenue Breakdown(3) |

602 properties across 39 states, Ontario, Canada and Puerto Rico | | | |

| | |

(1)Data as of December 31, 2021.

(2)Does not include five marinas managed for third parties.

(3)Represents percentage of rental revenue from the leasing of sites, homes, wet slips, dry storage spaces and commercial leases.

2021 REVIEW

In 2021, despite the continued impact of COVID-19 on our people and the operations of our MH communities, RV resorts and marinas, we continued our track record of delivering industry-leading results for our shareholders. We outperformed many of the leading real estate and market indices, while further expanding our platform for growth.

Performance Highlights

During 2021, we continued our trend of outperforming many of the leading real estate and market indices. We have delivered industry-leading and sustained earnings growth as well as meaningful value creation with our strategic acquisitions. Highlights of our performance include:

| | | | | | | | | | | |

| | | |

27.9% Increase in Core FFO per diluted share and OP unit over 2020 | 11.2% 2021 Same Community NOI growth vs. 9.0% REIT average(1) | 2,483 Revenue producing sites gained in 2021 | 42.6% Increase in home sales volume over 2020 |

| | | |

| | | |

| | | |

| | | |

$2.3 billion Total revenues for 2021 (an increase of 62.5% from 2020) | $1.4 billion Acquisitions of properties $173.0 million Acquisitions of land for development | $1.3 billion Announced planned acquisition of Park Holidays UK, the 2nd largest owner and operator of holiday parks in the UK | $1.1 billion equity raised, and additional +4.0 million shares under forward Sale agreements |

| | | |

| | | |

| | | |

| | | |

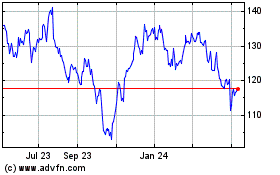

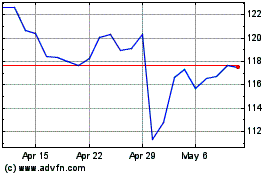

$1.2 billion Senior unsecured notes BBB & Baa3 rating by S&P Global and Moody's | 40.8% 1-year TSR vs. 28.7% 1-year TSR (S&P 500)(2) | 73rd percentile 3-year TSR among MSCI US REIT Index (RMS)(3) | 16.5% Safe Harbor contribution to real property NOI. Successful Integration of Safe Harbor. |

(1) Source: Citi Investment Research, December 31, 2021.

(2) Source: S&P Global as of December 31, 2021.

(3) Source: KeyBanc “The Leaderboard” publication.

Financial Highlights

As a reflection of our performance and our ability to generate industry-leading results, we have raised our dividend each year since 2017. Concurrently, our stock price has increased on average 38.2 percent per year over the five years ended December 31, 2021, delivering industry leading value to our shareholders as our Core FFO per Share has grown on average 12.2 percent over the same five years.

| | | | | | | | |

| Annual Dividend Per Share* | Core FFO Per Share* | Stock Price* |

| | |

* As of December 31st of the year.

ENVIRONMENT, SOCIAL AND

GOVERNANCE HIGHLIGHTS

Sun Communities’ ESG Initiatives

We believe that environmental, social and governance, or ESG, initiatives are a vital part of corporate responsibility and support our goal of increasing shareholder value. For additional information, please read our third annual ESG Report on our website at https://www.suncommunities.com/investor-relations/. The following reflects some of our 2021 achievements.

We are committed to sustainable business practices to benefit all stakeholders: our continuous engagement with our team members, residents and guests, shareholders and local communities is paramount to our success.

We will continue to enhance Sun’s sustainability program through the formal adoption of additional environmental policies, establishing a data baseline for utility usage, expanding the ESG team, and consulting with vital stakeholders to identify key ESG considerations and solutions.

ESG Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Environmental | | | | Social | | | | Governance |

| | | | | | | | | |

Climate Risk Assessment Conducted climate risk analysis on nearly 600 properties | | | Sun Unity Sun’s social responsibility program: Nearly 5,700 volunteer hours logged in 2021 | | | Board Nominating and Corporate Governance Committee formally oversees all ESG initiatives |

| | | | | | | | | |

| | | | | | | | | |

ESG Reporting Framework Voluntarily reported on three ESG frameworks: GRESB, DJSI and CDP | | | Sun University +100 courses offered to team members Two programs launched to support growth accelerated career experience (ACE) | | | Board Composition 38 percent female and 75 percent independent |

| | | | | | | | | |

| | | | | | | | | |

Solar Project Invested $35M+ in solar energy construction projects at 32 properties | | | Executive Manager Certification Development program for community & resort managers to support career growth | | | Enterprise Risk Management Committee identifies, monitors and mitigates risks |

| | | | | | | | | |

| | | | | | | | | |

National Park Foundation (NPF) Launched new partnership with NPF to support outdoor exploration program | | | IDEA Launched Inclusion, Diversity, Equity and Accessibility Initiative | | | Comprehensive Policies and Procedures Foster sound corporate governance |

| | | | | | | | | |

Human Capital Matters

Human capital management is key to our success and focuses on DEI, employee retention and talent development practices. We are committed to building an equitable and inclusive culture that inspires and supports the growth of our employees, serves our communities and shapes a more sustainable business. The most significant measures and objectives that we focus on in managing our business and our related human capital initiatives include the following:

We are taking deliberate actions to foster a growth culture that is grounded in our vision and culture statements. We are an inspired, engaged and collaborative team committed to providing extraordinary service to our residents, customers and team members. Together, as one team, we embrace the following seven key behaviors that make our Company a great place to work:

•Live the Golden Rule: Treat others the way you want to be treated;

•Do the right thing;

•We over me;

•Nothing changes if nothing changes;

•Mindset is everything;

•Keep it simple; and

•Be yourself and thrive.

| | | | | |

| Leadership, Talent, Training and Development |

We expect our leaders to be role models and lead in a way that enables our organization to achieve success. Our strategy is anchored in promoting the right internal talent and hiring the right external talent for career opportunities across our organization. We are focused on hiring and developing talent that mirrors the markets we serve, and investing in learning opportunities and capabilities that equip our workforce with the skills they need while improving engagement and retention.

•Our internal training program, Sun University, offers over 100 courses to our MH and RV team members on a range of topics, including leadership, communications, inclusion and diversity, software and operations. Our internal training program has led to increased knowledge and accountability for daily operations and policies and procedures. In 2021, team members logged 52,506 learning hours;

•We hold mandatory ongoing training sessions for all property management personnel to ensure that policies and procedures are executed effectively, professionally and consistently; and

•New team members are required to complete information security training, and safety and compliance-related training, with routine refreshers at least annually on critical topics.

We are dedicated to the attraction, development and retention of our talent, focusing our efforts on ensuring that the returning seasonal team member pipeline remains robust each year and our annual talent management processes focus on the professional development of salaried team members. As of December 31, 2021, nearly 10 percent of our employees had over 10 year's tenure.

Our compensation philosophy, aimed to apply merit-based, equitable compensation practices, is designed to attract and retain top talent. For eligible team members, we offer competitive salary, health, welfare, retirement and pet insurance benefits, tuition reimbursement and rent / vacation discounts at our properties.

| | | | | |

| Inclusion, Diversity, Equity and Accessibility ("IDEA") |

We make it a priority to recognize and appreciate the diverse characteristics that make individuals unique in an atmosphere that promotes and celebrates individual and collective achievement. We believe it's not just about gender or race, but about being diverse in thoughts, life and work experiences. Our inclusive environment challenges, inspires, rewards and transforms our team to be the best. We do not tolerate harassing, discriminatory or retaliatory conduct, as such conduct is inconsistent with our policies, practices and philosophy. We continue to put our resources and energy into strategies and initiatives to create a more equitable environment.

| | | | | |

We are committed to providing a total compensation package that is market-based, performance driven, fair and internally equitable. Our goal is to be competitive both within the general employment market as well as with our competitors in the real estate industry, with our strongest performers being paid more. •Compensation for each position is determined by utilizing reliable third-party compensation surveys to obtain current market data. Additionally, position descriptions and compensation are routinely reviewed for market competitiveness. •On an annual basis, the performance of all team members is evaluated and merit increases are allocated based on performance. This process ensures equitable performance review and corresponding pay practices that attract, retain and reward top talent. •In 2021, we analyzed data related to open positions, retention, market compensation pay gaps, and internal equity, and remediated any identified pay gaps. A total of 3,300 team members received some level of pay increase apart from their normal merit-based increase. | 2021 Results of Pay Equity Analysis 3,300 team members received some level of pay increase apart from their normal merit-based increase. |

Our Code of Conduct and Business Ethics is grounded in our commitment to do the right thing. It serves as the foundation of our approach to ethics and compliance. Our anti-corruption compliance program is focused on conducting business in a fair, ethical and legal manner.

| | | | | |

| Workplace Health And Safety |

We actively seek opportunities to minimize health, safety and environmental risks to our team members, residents, and guests we serve in our communities and resorts by utilizing safe operating procedures and practices:

•As part of our commitment to safety, We oversee annual safety training programs for all employees to provide tools and safeguards for accident prevention. Our managers are responsible for ensuring that team members receive the appropriate training to perform their jobs safely;

•All team members participate in safety training during the onboarding process, and thereafter, team members in the field complete an annual safety training course;

•We work hard to uphold a safe workplace by complying with safety and health laws and regulations, maintaining internal requirements and remediating risks. Each community is regularly inspected to ensure safety standards are being met, with comprehensive safety inspections completed annually; and

•Our COVID-19 Response and Action Plan continues to serve as a guideline for the safe operation of our communities, resorts, marinas and main office.

2021 NOTABLE ACCOLADES

| | | | | | | | |

| | |

We were certified a Great Place to Work by Great Place to Work® in 2021 | We were named Central Florida Top Workplace by the Orlando Sentinel in 2021 | For the eleventh consecutive year, we were named a Detroit Free Press Top Place to Work |

Our people and culture agendas are also key priorities of the Board. Through the NCG Committee, the Board provides oversight of the Company’s policies and strategies relating to talent, leadership and culture, including diversity, equity and inclusion. See Role of the Board of Directors section on page 30 for information regarding the Board’s oversight of Human Capital. Spotlight on IDEA

Inclusion, diversity, equity and accessibility is one of our Company’s shared culture statements.

Workforce Diversity

We believe we are a stronger organization when our workforce represents a diversity of ideas and experiences. We value and embrace diversity in our employee recruiting, hiring and development practices. As of December 31, 2021, 41 percent of our employees were female, 21 percent of our employees were racially or ethnically diverse, and 47 percent of our employees were aged 50 years and older, with approximately 24 percent being aged 60 years and older.

Training and Resources

We offer trainings and resources on IDEA to our employees. Diversity education and training programs for our team focus on unconscious bias, gender identity and transitions, generational differences, religion in the workplace and self-awareness and self-assessments.

•We launched our formal initiative for IDEA focused on enhancing diversity through education, awareness and outreach throughout our Company, communities and resorts;

•We engaged a third-party DEI consultant who conducted a company-wide training on DEI-related key foundational terms and helped develop a framework for an organization-wide IDEA strategy for Sun; and

•We set the foundation with senior leaders at our 2021 Elevate conference where we held break out sessions on allyship with inclusion and belonging, continuing the IDEA conversation, inclusive leadership, introduction to IDEA, and workplace microaggressions and unconscious bias.

In order to implement and sustain this initiative, in 2021:

•We created our IDEA council to help implement Sun's IDEA Strategy;

•Our Chief Executive Officer signed the CEO Action for Diversity & Inclusion pledge, a commitment to advance diversity and inclusion within the workplace;

•We made Juneteenth an annual company holiday to celebrate the end of slavery in the United States;

•We launched an anti-racism resource center for employees inclusive of videos, podcasts, articles, books, films and television series; and

•We implemented a "Job Analyzer" in our applicant tracking system to proactively identify and address gender bias in job postings.

| | |

|

The NCG Committee reviewed inclusivity, diversity, equity and accessibility topics at four formal meetings in 2021, effectively overseeing this important initiative. |

|

Commitment To a Sustainable Future

While the pandemic has been the defining issue of the last two years, climate change is the challenge of our lifetime. Climate change poses a clear threat and challenge to the real estate sector, as buildings contribute up to 30 percent of global annual greenhouse gas (“GHG”) emissions. Climate change impacts are material to our overall value as well as our ability to serve our residents, guests, employees, investors and other stakeholders. We are committed to reducing our GHG emissions and working to improve upon the environmental performance of the communities and properties within our portfolio. We are at the very beginning of this process with a focus on expanding our climate analysis to be more comprehensive and integrated into our overall business strategy. Some of our accomplishments include:

Climate Risk Assessment

In 2021, we performed an analysis of the climate risk impact on our properties. Various models were used to determine risks related to sea-level rise, flooding, wildfire, water scarcity, cold waves and heat waves across three timeframes (2020, 2030 and 2050). We reviewed the results of this assessment and are using them to develop our risk mitigation and resilience (climate change adaptation) strategies. We are now integrating a climate risk analysis in our due diligence process during acquisitions of properties.

Greenhouse Gas Emissions

We created a framework to track the GHG emissions across our portfolio. We are implementing GHG emissions-reduction strategies where feasible to reduce emissions and their negative impact on climate change. The framework allows us to track, monitor and evaluate current performance and make adjustments to our GHG emissions-reduction strategies.

Governance

A robust governance approach reinforces our commitment and accountability for integrating inclusive diversity and equity into day-to-day operations.

Commitment to ESG Reporting

We are committed to being open, transparent and listening to the views of our stakeholders as we move forward in sustainable development. In 2020, in partnership with a third-party consultant, we conducted an in-depth materiality assessment to determine factors of most significance to our internal and external stakeholders to implement strategies for improvement against critical reporting entities.

| | | | | |

Materiality A materiality assessment was conducted by the Company through multiple engagements. These engagements comprise a wide range of stakeholders that include our team members, investors, residents and guests. We also evaluated industry trends and expectations by consumers regarding housing and recreational activities. The Company has opted to group material issues by common topic, allowing for a more strategic management approach. By looking at and addressing multiple items within the topic, we can create sustainable, integrated responses and approaches to these material issues. | |

Our goal is to further the Company’s commitment to our ESG initiative and continue to be more transparent about our actions.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| GOVERNANCE | | | ENVIRONMENTAL | | | SOCIAL |

2021 Goals •Complete at least two voluntary Framework reports •Increase leadership around core ESG topics (sustainability, IDEA, Safety, Supply Chain) •Increase proactive outreach to investors surrounding ESG topics and concerns | | 2021 Goals •Establish baselines for key environmental topics, including GHG emissions, energy usage, water consumption and waste •Set quantitative targets for key environmental topics with a minimum five-year achievement period •Evaluate climate risk impact on Sun's portfolio | | 2021 Goals •Continue to expand our partnerships to align with charitable organizations with shared missions for impact •Enhance education, awareness and programming around IDEA |

| | | | |

To achieve this, we are participating in a number of voluntary ESG frameworks and initiatives. In 2021 we submitted responses to the Global ESG Benchmark for Real Assets (GRESB), Dow Jones Sustainability Index (DJSI) and Carbon Disclosure Project (CDP) for the first time. We also made public commitments to initiatives aimed at global ESG efforts. This includes alignment of our activities to the UN Sustainable Development Goals, and signing onto the CEO Action for Diversity & Inclusion. Joining these global initiatives is a way for Sun to demonstrate our commitments in these areas and become a leader within the REIT industry.

This Proxy Statement contains information related to the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Sun Communities, Inc. Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our shareholders, the Annual Meeting will be conducted in a virtual meeting only format on Tuesday, May 17, 2022, at 11:00 a.m. EDT. Shareholders will be able to listen, vote, and submit questions from their home or any remote location with Internet connectivity by logging in at www.virtualshareholdermeeting.com/SUI2022. Information on how to participate in this year’s meeting can be found on page 100. On or about April 4, 2022 we began mailing a notice containing instructions on how to access these proxy materials to all shareholders of record at the close of business on the Record Date.

This summary highlights information contained elsewhere in the Proxy Statement. It does not contain all the information that you should consider. Please read the entire Proxy Statement carefully before voting.

PROPOSAL ROADMAP

| | | | | | | | | | | | | | | | | | | | |

| | | |

1 | Election of Eight Directors | | The Board recommends a vote FOR each nominee for Director. See page 21. |

| | | |

| | | |

At the Annual Meeting, eight directors will be elected. The NCG Committee evaluated each nominee in accordance with the committee’s charter and our Corporate Governance Guidelines and submitted the nominees to the full Board for approval. The Board, acting upon the recommendation of the NCG Committee, has nominated the eight directors currently serving for re-election to the Sun Communities Board of Directors. |

|

Gary A. Shiffman Tonya Allen | Meghan G. Baivier Stephanie W. Bergeron | Brian M. Hermelin Ronald A. Klein | Clunet R. Lewis Arthur A. Weiss |

| | | |

| | | | | | | | | | | |

| | | |

2 | Non-binding Advisory Vote on Executive Compensation | | The Board recommends a vote FOR this proposal. See page 47. |

| | | |

| | | |

Section 14A of the Exchange Act requires us to allow shareholders an opportunity to cast a non-binding advisory vote on executive compensation as disclosed in this Proxy Statement. The following proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to approve, reject or abstain from voting with respect to our fiscal 2021 executive compensation programs and policies and the compensation paid to our NEOs listed in the Summary Compensation Table. Your non-binding advisory vote will serve as an additional tool to guide the Board and the Compensation Committee in continuing to improve the alignment of our executive compensation programs with our interests and the interests of our shareholders, and is consistent with our commitment to high standards of corporate governance. |

| | | |

| | | | | | | | | | | |

| | | |

3 | Ratification of Selection of Grant Thornton LLP | | The Board recommends a vote FOR this proposal. See page 90. |

| | | |

| | | |

The Audit Committee has selected and appointed Grant Thornton LLP as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2022. Grant Thornton LLP has audited our consolidated financial statements since 2003. |

| | | |

| | | | | | | | | | | |

| | | |

4 | Approval of the First Amendment to the Sun Communities, Inc. 2015 Equity Incentive Plan | | The Board recommends a vote FOR this proposal. See page 93. |

| | | |

| | | |

The First Amendment to the Sun Communities, Inc. 2015 Equity Incentive Plan, (the "First Incentive Plan Amendment"), amends the Company's 2015 Equity Incentive Plan to increase the aggregate number of shares of our common stock issuable under the 2015 Equity Incentive Plan from 1,750,000 to 4,750,000. As of March 21, 2022, there were 320,233 shares of common stock available for issuance under the 2015 Equity Incentive Plan. The Board believes that the First Incentive Plan Amendment will provide the flexibility that we need to keep pace with our competitors and effectively recruit, motivate and retain the caliber of employees essential for the achievement of our operational and financial goals. The 2015 Equity Incentive Plan has served a critical role in attracting and retaining valuable employees that have been, and will be, essential to our continued success. |

| | | |

BOARD AND CORPORATE GOVERNANCE HIGHLIGHTS

Director Nominees

| | | | | | | | | | | | | | | | | | | | |

A | Audit Committee | N | NCG Committee | M MH Finance Committee | | Chair |

| C | Compensation Committee | E | Executive Committee | | | Member |

Board Snapshot

| | | | | | | | | | | |

| | | |

Gender Diversity | Racial / Ethnic Diversity | Age | Tenure |

| | | Average tenure was 15 years in 2021 |

| | | |

Governance Best Practices

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Processes and Policies | | | | Shareholder Engagement | |

| | | | | | |

| | | | | | |

| The Board is responsible to our stakeholders for the oversight of the Company. They are also involved in guiding the strategic direction, objectives, and risk management activities of the organization. We believe in maintaining transparency and strong governance based on the highest ethical standards and have adopted the following strategies to achieve this goal: •Our bylaws give shareholders the authority to amend our bylaws by the affirmative vote of a majority of all votes entitled to be cast on a particular matter •Terminated our shareholder’s rights agreement (Poison Pill) •75 percent of directors are independent •All of our directors are elected annually •Our Anti-Hedging Policy prohibits stock hedging by directors or executive officers •We maintain a Code of Business Conduct and Ethics, and a Financial Code of Ethics for senior financial officers •We maintain an executive compensation “clawback” policy | | | | We engage with our shareholders and conduct shareholder outreach throughout the year. In 2021, key topics discussed with shareholders during outreach included: •ESG priorities and expectations •Diversity, equity and inclusion initiatives •Board diversity Our Board receives a shareholder and investor update at each regularly scheduled meeting | |

| | | | | | |

EXECUTIVE COMPENSATION HIGHLIGHTS

Philosophy and Objectives

Our executive officer compensation program supports our commitment to provide superior shareholder value. This program is designed to:

•Attract, retain and reward executives who have the motivation, experience and skills necessary to lead us effectively and encourage them to make career commitments to us;

•Base executive compensation levels on our overall financial and operational performance and the individual contribution of an executive officer to our success;

•Create a link between the performance of our stock and executive compensation; and

•Position executive compensation levels to be competitive with other similarly situated public companies, especially those in the real estate industry.

Elements of Compensation

The elements of 2021 executive compensation, as well as the compensation mix for our CEO, is shown below:

| | | | | | | | | | | | | | | | | |

| Element | CEO Compensation Mix | Form | | Purpose |

| | | | | |

| Base Salary | | Cash | | Base level of competitive cash to attract and retain executive talent. |

| | | | |

| | | | | |

Annual Incentive Award | | Cash | | Motivate the executive officers to maximize our annual operating and financial performance and reward participants based on annual performance. |

| | | | |

| | | | | |

Time Restricted Stock Units | | Equity | | Increase our executive officers' personal stake in our success and motivate them to enhance our long-term value while better aligning their interests with those of other shareholders. |

| | | |

| | | | |

Performance Restricted Stock Units | | Equity | |

| | | | | |

Compensation Best Practices

| | | | | | | | | | | | | | | | | | | | |

| What We Do | | | | What We Don't Do | |

| | | | | | |

| •Pay for Performance: Majority of pay is performance based and not guaranteed. •Clawback Policy: We maintain a clawback policy that provides for recovery of incentive compensation in the event of a financial restatement due to material non-compliance with federal securities law. •Stock Ownership Guidelines: Executives must comply with stock ownership requirements (6x multiple of salary for Chairman and CEO; 4x multiple of salary for other executives). •Annual Compensation Risk Review: Annually assess risk in compensation programs. •Challenging Performance Objectives: Set challenging performance objectives for annual incentives. •Double Trigger Change of Control Agreements: An executive is entitled to severance only if, within a specified period following a change of control, he or she is terminated without cause or for good reason, or the successor company does not expressly assume his or her employment agreement. •Use of Independent Consultant: The Compensation Committee has retained an independent compensation consultant that performs no other consulting services for the Company and has no conflicts of interest. | | | | •No Hedging: Directors and executive officers are prohibited from hedging their ownership of the Company's stock. •Pledging: Directors and executive officers are prohibited from pledging any of the Company’s securities as collateral for indebtedness unless the NCG Committee has first reviewed and approved the terms of the pledge. •No Excise Tax Gross Ups: The Company will not enter into any new agreements, or materially amend any existing employment agreements, with its executives that provide excise tax gross-ups in the event of a change of control of the Company. | |

Additional details about each of our executive officers can be found on pages 22 and 84. Refer to the Compensation Discussion and Analysis section beginning on page 49 for additional information regarding our executive officer compensation program.

SUMMARY

What Am I Voting On?

Eight directors will be elected at the Annual Meeting. The NCG Committee evaluated each nominee in accordance with the committee’s charter and our Corporate Governance Guidelines and submitted the nominees to the Board for approval. All of the nominees were elected to the Board at the 2021 annual meeting. Each of the directors has served continuously from the date of his or her election or appointment to the present time.

The term of each of our directors expires at the Annual Meeting, or when his or her successor is duly elected and qualified or upon his or her earlier resignation or removal. Each director elected at the Annual Meeting will serve for a term commencing on the date of the Annual Meeting and continuing until our 2023 annual meeting of shareholders or until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. In the absence of directions to the contrary, proxies will be voted in favor of the election of the eight nominees named below.

Vote Required

A majority of the votes cast at the Annual Meeting is required for the election of each director. Abstentions will not be counted in determining which nominees received a majority of votes cast since abstentions do not represent votes cast for or against a candidate. Brokers are not empowered to vote on the election of directors without instruction from the beneficial owner of the shares and thus broker non-votes likely will result. Because broker non-votes are not considered votes cast for or against a candidate, they will not be counted in determining which nominees receive a majority of votes cast. Although we know of no reason why any nominee would not be able to serve, if any nominee should become unavailable for election, the persons named as proxies will vote your shares of common stock to approve the election of any substitute nominee proposed by the Board.

| | | | | |

| The Board unanimously recommends that you vote “FOR” each of the eight nominees. |

Proposal No. 1: Election of Directors

DIRECTOR BIOGRAPHICAL SUMMARY

| | | | | | | | |

| | Gary A. Shiffman Chairman, Chief Executive Officer and Director, Sun Communities, Inc.

Age: 67 Director since: 1993 Committee: Executive |

| | |

|

| Directorship Experience |

|

•Executive officer and director of SHS |

|

| Career Highlights and Qualifications |

|

•Actively involved in the management, acquisition, rezoning, expansion, marketing, construction and development of MH communities and RV resorts for over 30 years •Extensive network of industry relationships developed over the past 30 years •Significant direct holdings through family-related interests in various real estate asset classes (office, multi-family, industrial, residential and retail) |

|

| | | | | | | | |

| | Tonya Allen Director, Sun Communities, Inc. President of the McKnight Foundation

Age: 49 Director since: 2021 Committee: NCG |

| | |

|

| Directorship Experience |

|

•Chair Emeritus of the Board of Directors at Oakland University •Chair of the Council on Foundations •Board Member, Alumni Association of the University of Michigan •Board Member, Detroit Children's Fund •Board Member, Greater MSP |

|

| Career Highlights and Qualifications |

|

•Institutional investment experience with public and private endowments, with large public and private equity holdings •ESG leadership in diversity and inclusion, climate and energy and education and workforce development •Current Advisor to General Motors on its Inclusion Advisory Board and serves or served as an advisor to Quicken Loans, CMS Energy, Huntington and PNC Banks, and DTE Energy regarding inclusion efforts •Demonstrated track record of devising corporate responsibility strategies that have received national accolades and regulatory approvals •Former President and CEO of The Skillman Foundation •Founded the Detroit Parent Network •Fellowships with the German Marshall Fund, Aspen Institute and American Enterprise Institute •Strategic impact lauded by Detroit News (Michiganian of the Year), Crain's Detroit Business (News Makers of the Year & 100 Most Influential Women), Chronicles of Philosophy (Five Innovators to Watch) and Twin Cities Business (Top 100) •Master’s in Public Health, Master’s in Social Work and Bachelor’s in Sociology from the University of Michigan |

|

Proposal No. 1: Election of Directors

| | | | | | | | |

| | Meghan G. Baivier Director, Sun Communities, Inc. Executive Vice President, Chief Financial Officer and Chief Operating Officer of Easterly Government Properties, Inc.

Age: 42 Director since: 2017 Committees: NCG Chair, Audit |

| | |

| | |

|

| Directorship Experience |

|

•Sun Communities, Inc. |

|

| Career Highlights and Qualifications |

|

•Financial advisory and capital markets transaction experience as former Vice President of Citigroup’s Real Estate and Lodging Investment Banking group •Former Equity Research Associate with Chilton Investment Company and High Yield Research Associate at Fidelity Management •MBA from Columbia Business School, awarded the prestigious Feldberg Fellowship and BA from Wellesley College |

|

| | | | | | | | |

| | Stephanie W. Bergeron, CPA, CGMA Director, Sun Communities, Inc. President and Chief Executive Officer of Bluepoint Partners, LLC

Age: 68 Director since: 2007 Committees: Audit Chair, NCG |

| | |

| | |

|

| Directorship Experience |

|

•Serves on Henry Ford Health System Board of Trustees as member of the Finance and Audit Committees •Served on Audit Committees of several publicly traded companies (including as chair) and a number of not for profit organizations |

|

| Career Highlights and Qualifications |

|

•Financial consulting, accounting, treasury, investor relations and tax matters experience •Former President and Chief Executive Officer of Walsh College and named President Emerita •Former Senior Vice President - Corporate Financial Operations of The Goodyear Tire & Rubber Company •Former Vice President and Assistant Treasurer of DaimlerChrysler Corporation •Named one of Crain’s Detroit Business’ “Most Influential Women” in 1997 and in 2007 •BBA from the University of Michigan, MBA from the University of Detroit, licensed CPA in the state of Michigan |

|

Proposal No. 1: Election of Directors

| | | | | | | | |

| | Brian M. Hermelin Director, Sun Communities, Inc. Co-founder and Managing Partner of Rockbridge Growth Equity LLC Co-founder and General Partner of Detroit Venture Partners, LLC

Age: 56 Director since: 2014 Committees: Compensation Chair, Audit |

| | |

| | |

|

| Directorship Experience |

|

•Serves as Board Member, Compensation Committee member, and Chair of numerous private portfolio companies of Rockbridge Growth Equity, LLC •Member of the Compensation Committee of Intersection Holdings •Member of Audit Committee of Cranbrook Educational Community •Former Audit committee chair of a regional gaming company •Former Chairman of Active Aero Group / USA Jet Airlines Inc. |

|

| Career Highlights and Qualifications |

|

•Private equity and venture capital experience focusing on companies in the business services, financial services, sports, media and entertainment and consumer direct marketing industries •Former Chief Executive Officer of Active Aero Group / USA Jet Airlines Inc. •MBA from the Wharton School at the University of Pennsylvania, BBA from the University of Michigan |

|

| | | | | | | | |

| | Ronald A. Klein Director, Sun Communities, Inc. Principal of JK Ventures LLC

Age: 64 Director since: 2015 Committees: MH Finance Chair, NCG, Compensation, Executive |

| | |

| |

|

| Directorship Experience |

|

•Chairman of Verge.io, a software defined data center company •Former Director of TCF Financial Corporation, formerly a public traded bank holding company (Chairman of the NCG, ESG and Strategic Committees and a member of the Finance, Risk and Technology Committees) •Actively involved with closely-held companies in the real estate industry and the technology industry and Board Member of several non-profit organizations •Former Director of Origen Financial, Inc., formerly a publicly traded mortgage REIT that originated, securitized and serviced, and managed manufactured home loan portfolios |

|

| Career Highlights and Qualifications |

|

•Extensive real estate acquisition, finance and capital markets experience •Former CEO of Origen Financial, Inc. •Graduate of the University of Michigan Law School |

|

Proposal No. 1: Election of Directors

| | | | | | | | |

| | Clunet R. Lewis Lead Independent Director, Sun Communities, Inc. Retired attorney and businessman

Age: 75 Director since: 1993 Committees: Audit, Compensation |

| | |

| | |

|

| Directorship Experience |

|

•Served as a Board Member, General Counsel, Chief Financial Officer, President and Managing Director of other public and private companies |

|

| Career Highlights and Qualifications |

|

•Retired commercial lawyer specializing in mergers and acquisitions, debt financings, issuances of equity and debt securities and corporate governance and control issues •Former Chief Financial Officer and General Counsel at Eltrax Systems, Inc. •Extensive experience working with independent auditors and the SEC |

|

| | | | | | | | |

| | Arthur A. Weiss Director, Sun Communities, Inc. Attorney and Chairman, Jaffe, Raitt, Heuer & Weiss, Professional Corporation

Age: 73 Director since: 1996 Committees: Executive, MH Finance |

| | |

| | |

|

| Directorship Experience |

|

•Chairman of Jaffe, Raitt, Heuer & Weiss, Professional Corporation •Former Director of TCF Financial Corporation (Chairman of the Compensation Committee, member of the Credit Administration Committee and TCF Strategic Committee) •Director of several closely held companies in the real estate, technology and banking industries •Director and officer of a number of closely held public and private nonprofit corporations, including the Detroit Symphony Orchestra (Executive Committee Member, Treasurer and Board Member) •Jewish Federation & United Jewish Foundation of Metropolitan Detroit Financial and Best Business Practice Committees member |

|

| Career Highlights and Qualifications |

|

•Practices law in the areas of business planning, mergers and acquisitions, taxation, estate planning and real estate •MBA in finance and a post graduate LLM degree from New York University in taxation •Previously recognized as one of the nation’s Top 100 Attorneys by Worth magazine and has been chosen over the last ten years as one of the Super Lawyers •Former Adjunct Professor of Law at Wayne State University and the University of Detroit |

| | |

| Relationship to Aaron Weiss |

| Aaron Weiss, our Executive Vice President Corporate Strategy and Business Development, is Arthur A. Weiss' son. |

|

Proposal No. 1: Election of Directors

QUALIFICATIONS, EXPERTISE AND ATTRIBUTES

In addition to each director’s qualifications, experience and skills outlined above and the minimum Board qualifications set forth below under “Consideration of Director Nominees,” our NCG Committee looked for certain attributes in each director and based on these attributes, and the mix of attributes of the other incumbent directors, determined that each director should serve on our Board. The NCG Committee does not require that each director possess all of these attributes but rather that the Board is comprised of directors that, taken together, provide us with a variety and depth of knowledge, judgment and experience necessary to provide effective oversight and vision. These attributes include: (a) significant leadership skills as a chief executive officer and / or relevant Board Member experience, (b) real estate industry experience, (c) transactional experience, especially within the real estate industry, (d) relevant experience in property operations, (e) financial expertise, (f) legal or regulatory experience, (g) capital markets experience, (h) marketing and / or investor relations experience, (i) executive leadership and talent development experience, (j) corporate governance experience, and (k) experience in ESG initiatives and implementation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | Shiffman | Allen | Baivier | Bergeron | Hermelin | Klein | Lewis | Weiss |

| Board and Executive Experience is critical to our Board’s role in overseeing the risks facing the Company, and provides essential comparison points for operations and governance. | | | | | | | | |

| Real Estate Industry is helpful for understanding the Company’s strengths and challenges specific to the REIT and real estate industries. | |

| | | | | | |

| Mergers and Acquisitions is critical in overseeing and providing insights on the Company’s acquisition activities. | |

| | | | | | |

| Property Operations Is valuable in understanding and overseeing management of the Company’s properties. | |

| |

|

|

|

|

|

| Financial Expertise and / or Literacy is valuable in understanding and overseeing the Company’s financial reporting and internal controls. | |

| | | | | | |

| Legal / Regulatory is relevant for ensuring oversight of management’s compliance with the SEC, the NYSE and other regulatory requirements. |

|

|

|

|

| | | |

| Capital Markets is valuable in understanding how capital markets work and overseeing the Company’s capital raising efforts. | | | | | | | | |

| Marketing / Investor Relations is relevant in overseeing how the Company manages communication between corporate management and its investors. | |

| | | | |

|

|

| Executive Leadership and Talent Development is valuable in helping the Company attract, motivate and retain high-performing employees. | | | | | | | | |

| Corporate Governance Is critical in overseeing the structure of rules, practices, and processes used to direct and manage our Company. | | | | |

| | |

|

| ESG Is valuable in overseeing the Company's ESG initiatives. | | | | | | | | |

| Gender Diversity |

| | | |

|

|

|

|

| Racial / Ethnic Diversity |

| |

|

|

|

|

|

|

Proposal No. 1: Election of Directors

CONSIDERATION OF DIRECTOR NOMINEES

Board Membership Criteria

The Board has established criteria for Board membership. These criteria include the following specific, minimum qualifications that the NCG Committee believes must be met by an NCG Committee-recommended director nominee for a position on the Board:

•the candidate must have experience at a strategic or policy making level in a business, government, non-profit or academic organization of high standing,

•the candidate must be highly accomplished in his or her field, with superior credentials and recognition,

•the candidate must be well regarded in the community and must have a long-term reputation for high ethical and moral standards,

•the candidate must have sufficient time and availability to devote to our affairs, particularly in light of the number of boards on which the candidate may serve, and

•the candidate’s principal business or occupation must not be such as to place the candidate in competition with us or conflict with the discharge of a director’s responsibilities to us or to our shareholders.

In addition to the minimum qualifications for each nominee set forth above, the NCG Committee will recommend director candidates to the full Board for nomination, or present director candidates to the full Board for consideration, to help ensure that:

•a majority of the Board shall be “independent” as defined by the NYSE rules,

•each of its Audit, Compensation, and NCG Committees shall be comprised entirely of independent directors, and

•at least one member of the Audit Committee shall have such experience, education and qualifications necessary to qualify as an “audit committee financial expert” as defined by the rules of the SEC.

Identifying and Evaluating Nominees

The NCG Committee may solicit recommendations for director nominees from any or all of the following sources: non-management directors, executive officers, third-party search firms or any other source it deems appropriate. The NCG Committee will review and evaluate the qualifications of any proposed director candidate that it is considering or that has been recommended to it by a shareholder in compliance with the NCG Committee’s procedures, and conduct inquiries it deems appropriate into the background of these proposed director candidates. In evaluating proposed director candidates, the NCG Committee considers the following qualifications that it believes nominees should have:

•proven real estate and / or REIT experience,

•track record of strong management and leadership capabilities at a successful organization,

•sufficient time to devote to Board responsibilities, and

•independence from the Company and its current directors and employees.

When nominating a sitting director for re-election, the NCG Committee will consider the director’s performance on the Board and the director’s qualifications in respect to the criteria set forth above. Other than circumstances in which we are legally required by contract or otherwise to provide third parties with the ability to nominate directors, the NCG Committee will evaluate all proposed director candidates based on the same criteria and in substantially the same manner, with no regard to the source of the initial recommendation of the proposed director candidate.

Proposal No. 1: Election of Directors

Shareholder Proposals and Director Nominations for 2023 Annual Meeting of Shareholders

Requirements for Proposals to be Considered for Inclusion in Proxy Materials

Shareholder proposals that are intended to be presented at our 2023 Annual Meeting of shareholders and included in our proxy materials for such meeting must comply with the procedural and other requirements set forth in Rule 14a-8 of the Exchange Act. To be eligible for inclusion in our proxy materials, shareholder proposals must be received by our Secretary at our principal executive offices no later than December 5, 2022, which is 120 calendar days prior to the first anniversary of the date this Proxy Statement was released to shareholders in connection with the Annual Meeting. If we change the date of the 2023 annual meeting of shareholders by more than 30 days from the date of this year’s Annual Meeting, your written proposal must be received by our Secretary at our principal executive offices a reasonable time before we begin to print and mail our proxy materials for our 2023 Annual Meeting of shareholders.

Requirements for Proposals Not Intended for Inclusion in Proxy Materials and for Nomination of Director Candidates.

A shareholder who wishes to nominate one or more persons for election to our Board of Directors at the 2023 annual meeting of shareholders or present a proposal at the 2023 annual meeting of shareholders, but whose shareholder proposal will not be included in the proxy materials we distribute for such meeting, must deliver written notice of the nomination or proposal to our Secretary at our principal executive offices not earlier than December 5, 2022 (the 120th day prior to the first anniversary of the date of this Proxy Statement for the Annual Meeting), nor later than 5:00 p.m. Eastern Time on January 4, 2023 (the 90th day prior to the first anniversary of the date of this Proxy Statement for the Annual Meeting); provided, however, that in the event that the date of the 2023 annual meeting of shareholders is advanced or delayed by more than 30 days from the first anniversary of the date of this year’s Annual Meeting, in order for notice by the shareholder to be timely, such notice must be so delivered no earlier than the 120th day prior to the date of the 2023 annual meeting of shareholders and not later than 5:00 p.m., Eastern Time, on the later of the 90th day prior to the date of the 2023 annual meeting of shareholders, as originally convened, or, if the first public announcement of the date of the 2023 annual meeting is less than 100 days prior to the date of the 2023 annual meeting, the 10th day following the day on which public announcement of the date of the 2023 annual meeting of shareholders is first made. The public announcement of a postponement or adjournment of the 2023 annual meeting of shareholders shall not commence a new time period for the giving of a shareholder’s notice as described above.

The NCG Committee’s current policy is to review and consider any director candidates who have been recommended by shareholders in compliance with the procedures established from time to time by the NCG Committee. All shareholder recommendations for director candidates must include the following information:

•the shareholder’s name, address, number of shares owned, length of period held and proof of ownership,

•the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the proposed director candidate,

•a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership as approved by the Board from time to time,

•a description of all arrangements or understandings between the shareholder and the proposed director candidate,

•the consent of the proposed director candidate to (1) be named in the proxy statement relating to our annual meeting of shareholders and (2) serve as a director if elected at such annual meeting, and

•any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the SEC.

Shareholder proposals must be in writing and should be addressed to our corporate Secretary, at our principal executive offices at 27777 Franklin Road, Suite 200, Southfield, MI 48034. It is recommended that shareholders submitting proposals direct them to our corporate Secretary and utilize certified mail, return receipt requested in order to provide proof of timely receipt. The Chairman of the Annual Meeting reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

In reviewing director candidates, the NCG Committee takes into consideration feedback received from the Board’s annual evaluations. See page 40 for information on the Board’s evaluation process.

Effective corporate governance is essential for maximizing long-term value creation for our shareholders. Our beliefs have been grounded in a values-based ethically led organization; this foundation continues to guide our decisions and leadership.

Our governance structure is set forth in our Corporate Governance Guidelines and other key governance documents. These guidelines are reviewed at least annually and updated as appropriate in response to evolving best practices, regulatory requirements, feedback from our annual Board evaluations, and recommendations made by our shareholders and proxy advisors, all with the goal of supporting and effectively overseeing our ongoing strategic growth.

The Company is governed by the Board and Committees of the Board that meet throughout the year.

You may find each of the following documents in the Governance section of our website at: suncommunities.com/investor-relations/

•Committee Charters

•Corporate Governance Guidelines

•Code of Business Conduct and Ethics

In addition, we will send print copies of any of these documents to any shareholder who requests them.

BOARD OF DIRECTORS

Our current directors are Gary A. Shiffman, Tonya Allen, Meghan G. Baivier, Stephanie W. Bergeron, Brian M. Hermelin, Ronald A. Klein, Clunet R. Lewis and Arthur A. Weiss. Under our charter, each of our directors serves for a one-year term or until his or her successor is duly elected and qualified.

The Board is elected by our shareholders to oversee and provide guidance on the Company’s business and affairs. It is the ultimate decision-making body of the Company except for those matters reserved for shareholders by law or pursuant to the Company’s governing documents. The Board oversees management’s activities in connection with proper safeguarding of the assets of the Company, maintenance of appropriate financial and other internal controls, compliance with applicable laws and regulations and proper governance. The Board is committed to sound corporate governance policies and practices that are designed and routinely assessed to enable the Company to operate its business responsibly, with integrity, and to position the Company to compete more effectively, sustain its success and build long-term shareholder value.

Board Meetings and Attendance

The Board meets quarterly, or more often as necessary.

| | | | | | | | |

| | |

The Board met 8 times during 2021 and took various actions by written consent. | All directors attended at least 75% of the Board and each committee on which they served. | All of our then-serving Board Members attended the 2021 annual meeting. |

| | |

Beyond the BoardroomThe Board of Directors attend training sessions on diverse topics on an annual basis, which have included:

| | | | | | | | | | |

| | | | |

| | | | |

| Governance | Shareholder Activism | Sustainability in Real Estate | | |

| | | | |

Role of the Board of Directors

Board Role in Oversight of Strategy

Strategic planning and oversight of management’s execution of the Company’s strategic vision is a primary responsibility of the Board. At least quarterly, management and the Board review and discuss the Company's detailed strategic plans, including changes from previous strategic positions, market and economic projections, industry and regulatory trends, areas of focus for each functional area, expected financial statement and shareholder investment impacts, resource requirements, human capital development, risk and stress test scenarios, among other topics.

Throughout the year, the Board and its committees receive updates from management and actively engage in discussions regarding execution of the strategy, variables impacting results and changes to the strategic plan.

In addition to its regular Board and committee meetings, the Board visits several properties representing different aspects of the Company’s strategy. The Board believes these on-site visits provide additional insight into the Company’s markets, operations, resident base, human capital management, technology usage and allocation of capital investments, and allow for better oversight of the Company’s strategies.

As a result of Board oversight, and to further enhance our corporate strategy, we created a new executive position in 2021, the Executive Vice President of Corporate Strategy and Business Development, and entered into an employment agreement with Aaron Weiss to fill the role. This new position reports to the Chairman and Chief Executive Officer, Gary A. Shiffman, and President and Chief Operating Officer, John B. McLaren. Aaron is responsible for coordinating our corporate strategy, planning and business development.

Board’s Role in Oversight of Risk Management

While management is responsible for the day-to-day management of our risk exposures, both the Board as a whole and its respective committees serve active roles in overseeing the management of the risks to our business. Our Board and its committees regularly review, with members of our senior management and outside advisors, information regarding our strategy and key areas of the Company including operations, investment transactions, development, finance, information technology, human capital, legal and regulatory, as well as the risks associated with each. In addition, the Board periodically reviews the results of our enterprise risk management ("ERM") efforts and receives legal and operational updates from executive management at every meeting and on a more frequent ad hoc basis, if necessary.

Senior management as well as outside advisors, from time to time, periodically meet with Board's committees and make presentations associated with their respective risk oversight responsibilities as outlined below.

ERM Committee

•Includes senior management and executive management teams.

•Identifies, consolidates and prioritizes risks facing the Company annually.

•Formalizes risk mitigation activities to prevent, mitigate or monitor key risks and plans response activities in the event certain risk events occur.

•Presents to the full Board, who takes an active role in risk oversight.

Board

•Oversees and implements its risk management function.

•Discusses the general risks we face, the risk factors disclosed in our annual and periodic reports and our risk management policies with our executive management team throughout the year.

•Reviews risk mitigation activities and planned response activities in the event a risk event occurs.

Committees of the Board

Each Committee of the Board plays an active role in oversight of risk management as follows:

Audit Committee

•Directs our financial risk assessment policies with the Chief Financial Officer and other senior accounting staff, our internal auditor and our independent accountants in conjunction with its review of our financial statements.

•Discusses with senior management the Company’s risk appetite and strategies, risk culture and risk-related business processes.

Compensation Committee

•Oversees Overall compensation practices and policies for all associates.

•Reviews and approves executive compensations.

•Recommends non-employee Director compensation to the full Board.

NCG Committee

•Develops and recommends the corporate governance guidelines to the Board and periodically reviews and recommends any necessary changes to mitigate new risks to our business.

•Reviews conflicts of interest and approves related party transactions to preserve the best interests of the Company and our shareholders.

•Ensures Board nominees qualify to provide proper guidance and oversees evaluation of the Board.

•Oversees succession planning for the Board, CEO, executive and senior management positions to protect the continuity of our business.

•Reviews the ESG strategy, initiatives and policies developed by management, and receives updates on significant ESG activities.

MH Finance Committee

•Reviews potential sources of financing for manufactured homes and oversees negotiations of the terms and conditions of any such financing.

Executive Committee

•Reviews and approves all acquisitions and / or financings (including refinancing of existing debt) up to a maximum purchase price or loan amount of $300.0 million per transaction to ensure that the Company's strategic goals are met within boundaries of our risk profile.

Risk Areas

| | | | | | | | | | | | | | | | | |

| Macroeconomic | | Strategic | | Operational |

| | |

•Economic Conditions or Access to Capital Markets | •Acquisitions or Regulatory Changes | •Succession Planning •Data Recovery and Cybersecurity •Privacy / Identity Management •Human capital •Climate Change / transition risk |

| | |

In the event that a specific risk is identified, the Board or the Audit Committee directs management to assess, evaluate and provide remedial recommendations to the Board or the Audit Committee. These efforts have included formalizing the Company’s succession planning for executives and key employees, documenting and reviewing cyber-security risk mitigation plans and emergency preparedness plans to facilitate rapid response to a range of threats.

| | |

|