Current Report Filing (8-k)

October 27 2021 - 5:07PM

Edgar (US Regulatory)

0001043337

false

0001043337

2021-10-27

2021-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 27, 2021

STONERIDGE, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Ohio

|

001-13337

|

34-1598949

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

39675 MacKenzie Drive, Suite 400,

Novi, Michigan 48377

(Address of principal executive offices, and

Zip Code)

(248) 489-9300

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares, without par value

|

SRI

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

ITEM 2.02

|

Results of Operations and Financial Condition.

|

On October 27, 2021, Stoneridge, Inc. (the “Company”) issued

a press release announcing its results for the third quarter ended September 30, 2021. A copy of the press release is attached hereto

as Exhibit 99.1. On October 28, 2021, members of the Company’s management will hold a third quarter 2021 earnings conference call

to discuss the Company’s financial results and the presentation attached hereto as Exhibit 99.2, will accompany management’s

comments.

The press release and earnings conference call presentation contain

certain non-GAAP financial measures, including Adjusted Sales, Adjusted Gross Profit and Margin, Adjusted Operating Income (Loss) and

Margin, Adjusted Income (Loss) Before Tax, Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Share (“Adjusted EPS”),

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”), Adjusted EBITDA Ratio, Adjusted

EBITDA Margin, Net Debt, Adjusted Income Tax Expense (Benefit) and Adjusted Tax Rate (collectively, the “Non-GAAP Financial Measures”).

Management believes that the presentation of the Non-GAAP Financial Measures used in the press release and earnings conference call presentation

are useful to both management and investors in their analysis of the Company’s financial position, results of operations and expected

results of operations because the Non-GAAP Financial Measures facilitate a period to period comparison of operating results by excluding

significant unusual, non-recurring items in 2021 and 2020. For 2021, these items relate to the after-tax and pre-tax gain on sale of the

Canton facility, adjustment to tax impact related to sale of Canton facility, after-tax and pre-tax Brazilian indirect tax impairment,

pre-tax gain from disposal of Soot Sensor Business, pre-tax one-time sale of Soot Sensor product inventory, pre-tax environmental remediation

costs, pre-tax sales from disposed Soot Sensor Business, after-tax and pre-tax change in fair value of the earn-out consideration related

to the acquisition of the remaining 26% minority interest in Stoneridge Brazil, after-tax and pre-tax restructuring costs, after-tax and

pre-tax business realignment costs. For 2020, these items relate to the pre-tax change in fair value of the earn-out consideration related

to the acquisition of the remaining 26% minority interest in Stoneridge Brazil, pre-tax restructuring costs, pre-tax business realignment

costs, pre-tax earnings (loss) in Autotech fund investment. These non-GAAP financial measures, however, should not be considered in isolation

or as a substitute for the most comparable GAAP financial measures. Investors are cautioned that non-GAAP financial measures used by the

Company may not be comparable to non-GAAP financial measures used by other companies. Adjusted Sales, Adjusted Gross Profit and Margin,

Adjusted Operating Income (Loss) and Margin, Adjusted Income (Loss) Before Tax, Adjusted Net Income (Loss), Adjusted EPS, Adjusted EBITDA,

Adjusted EBITDA Ratio, Adjusted EBITDA Margin, Net Debt, Adjusted Income Tax Expense (Benefit) and Adjusted Tax Rate should not be considered

a substitute for Sales, Gross Profit, Operating Income (Loss), Income (Loss) Before Tax, Net Income (Loss), Earnings (Loss) per Share,

Debt, Income Tax Expense (Benefit), or Tax Rate prepared in accordance with GAAP.

|

|

ITEM 7.01

|

Regulation FD Disclosure.

|

The information set forth in Item 2.02 above is hereby incorporated

herein by reference.

The information in this report, including the press release and the

earnings conference call presentation furnished as Exhibits 99.1 and 99.2 hereto, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing. In addition, the exhibits furnished herewith contain

statements intended as “forward-looking statements” that are subject to the cautionary statements about forward-looking statements

set forth in such exhibits.

|

|

ITEM 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Stoneridge, Inc.

|

|

|

|

|

Date: October 27, 2021

|

/s/ Matthew R. Horvath

|

|

|

Matthew R. Horvath

Chief Financial Officer and Treasurer

(Principal Financial Officer)

|

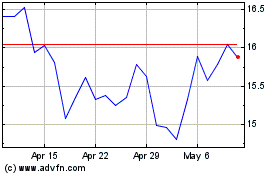

Stoneridge (NYSE:SRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

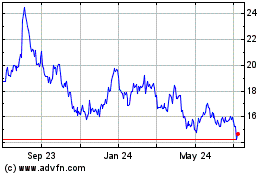

Stoneridge (NYSE:SRI)

Historical Stock Chart

From Apr 2023 to Apr 2024