Current Report Filing (8-k)

April 25 2022 - 4:16PM

Edgar (US Regulatory)

0000093556

false

0000093556

2022-04-22

2022-04-22

0000093556

swk:CommonStock250ParValuePerShareMember

2022-04-22

2022-04-22

0000093556

us-gaap:CapitalUnitsMember

2022-04-22

2022-04-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

April 22, 2022

Stanley

Black & Decker, Inc.

(Exact Name of Registrant as Specified in its

Charter)

Connecticut

(State or other jurisdiction

of incorporation) |

1-5224

(Commission

File Number) |

06-0548860

(I.R.S. Employer

Identification No.) |

1000 Stanley Drive, New Britain,

Connecticut

(Address of principal executive offices) |

06053

(Zip Code) |

Registrant’s telephone number including area code: (860) 225-5111

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock - $2.50 Par Value per Share |

|

SWK |

|

New York Stock Exchange |

| Corporate Units |

|

SWT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On April 22, 2022, Stanley Black & Decker, Inc.

(the “Company”) held its Annual Meeting of Shareholders. The shareholders approved the adoption of the 2022 Omnibus Award

Plan (the “2022 Plan”). The 2022 Plan was previously adopted by the Board of Directors of the Company (the “Board”)

on February 16, 2022. The 2022 Plan authorizes the Board (or a committee thereof) to award equity-based compensation in the form

of (i) stock options, including incentive stock options, (ii) stock appreciation rights, (iii) restricted stock and restricted

stock units, (iv) performance awards, (v) dividend equivalents, and (vi) other awards valued in whole or in part by reference

to or otherwise based on the Company’s common stock. Subject to adjustment as provided in the 2022 Plan, up to an aggregate of 9,800,000

shares of the Company’s common stock may be issued in connection with awards under the 2022 Plan, plus any shares that become available

for awards under the 2018 Omnibus Award Plan (the “2018 Plan”), the 2013 Long-Term Incentive Plan, or the 2009 Long-Term Incentive

Plan in accordance with the terms of those plans and the 2022 Plan. Upon the approval of the 2022 Plan by the Shareholders, no future

awards will be made under the 2018 Plan.

Each share with respect to which an option or stock-settled stock appreciation

right is granted under the 2022 Plan will reduce the aggregate number of shares that may be delivered under the 2022 Plan by one share,

and each share with respect to which any other award denominated in shares is granted under the 2022 Plan will reduce the aggregate number

of shares that may be delivered under the 2022 Plan by 2.55 shares.

The foregoing summary of the 2022 Plan does not purport to be complete

and is qualified in its entirety by reference to the full text of the 2022 Plan attached as Appendix B to the Company’s Definitive

Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on March 9, 2022.

Item 5.07 Submission of Matters to a Vote of Security Holders

Proposal 1: The Company’s shareholders elected each of the

following 11 directors based on the following votes:

| Nominee | |

For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| Andrea J. Ayers | |

| 125,450,730 | | |

| 2,419,489 | | |

| 384,870 | | |

| 8,460,541 | |

| Patrick D. Campbell | |

| 105,892,864 | | |

| 21,970,581 | | |

| 391,744 | | |

| 8,460,541 | |

| Carlos M. Cardoso | |

| 123,376,731 | | |

| 4,447,434 | | |

| 431,024 | | |

| 8,460,541 | |

| Robert B. Coutts | |

| 120,882,868 | | |

| 6,950,519 | | |

| 421,802 | | |

| 8,460,541 | |

| Debra A. Crew | |

| 125,481,708 | | |

| 2,380,887 | | |

| 392,594 | | |

| 8,460,541 | |

| Michael D. Hankin | |

| 124,924,660 | | |

| 2,922,039 | | |

| 408,490 | | |

| 8,460,541 | |

| James M. Loree | |

| 126,404,416 | | |

| 1,438,651 | | |

| 412,122 | | |

| 8,460,541 | |

| Adrian V. Mitchell | |

| 127,218,633 | | |

| 628,220 | | |

| 408,336 | | |

| 8,460,541 | |

| Jane M. Palmieri | |

| 126,628,512 | | |

| 1,221,785 | | |

| 404,892 | | |

| 8,460,541 | |

| Mojdeh Poul | |

| 126,021,354 | | |

| 1,832,296 | | |

| 401,539 | | |

| 8,460,541 | |

| Irving Tan | |

| 126,046,773 | | |

| 1,814,531 | | |

| 393,885 | | |

| 8,460,541 | |

Proposal 2: The shareholders approved, on a nonbinding advisory

basis, the compensation of the Company’s named executive officers based on the following votes:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 113,706,492 | | |

| 14,017,277 | | |

| 531,420 | | |

| 8,460,541 | |

Proposal 3: The shareholders approved Ernst & Young LLP

as the Company’s registered independent public accounting firm for the 2022 fiscal year based on the following votes:

| For | | |

Against | | |

Abstain |

|

| | 120,239,182 | | |

| 16,141,134 | | |

| 335,414 |

|

Proposal 4: The shareholders approved the 2022 Omnibus Award Plan

based on the following votes:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 121,890,206 | | |

| 5,684,958 | | |

| 680,025 | | |

| 8,460,541 | |

Proposal 5: The shareholders did not approve the shareholder proposal

regarding the ownership threshold required to call for a special shareholder meeting based on the following votes:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 61,463,714 | | |

| 66,331,432 | | |

| 460,043 | | |

| 8,460,541 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

STANLEY BLACK & DECKER, INC. |

| |

|

|

| |

|

|

| Date: April 25, 2022 |

By: |

/s/ Janet M. Link |

| |

Name: |

Janet M. Link |

| |

Title: |

Senior Vice President,

General Counsel and Secretary |

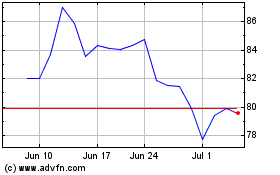

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

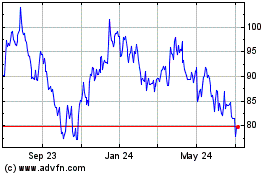

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Apr 2023 to Apr 2024