Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 20 2025 - 1:51PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities

Exchange Act of 1934

| For the month of |

February |

|

2025 |

| Commission File Number |

001-39298 |

|

|

| Sprott Inc. |

| (Translation of registrant’s name into English) |

| |

|

Suite 2600, 200 Bay Street

Royal Bank Plaza, South Tower

Toronto, Ontario, Canada M5J 2J1 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F

¨ Form 40-F

x

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Sprott Inc. |

| |

|

(Registrant) |

| |

|

|

| Date: |

February 20, 2025 |

|

By: |

/s/

Kevin Hibbert |

| |

|

Name: Kevin Hibbert |

| |

|

Title: Senior Managing Partner and

Chief Financial Officer |

Exhibit 99.1

Sprott Launches Active Gold & Silver

Miners ETF

The Only* Active ETF Focused on Gold and Silver

Miners, the ETF Leverages Sprott‘s Specialized Leadership in Precious Metals and Mining Investments

TORONTO,

February 20, 2025 – Sprott Inc. (“Sprott”) (NYSE/TSX: SII) today announced the launch of the Sprott

Active Gold & Silver Miners ETF (Nasdaq: GBUG) (the “Fund” or “GBUG”), an actively managed ETF that aims

to provide long-term capital appreciation by investing in shares of gold- and silver-focused companies that are engaged in exploring,

developing and mining; or royalty and streaming companies engaged in the financing of gold and silver assets. GBUG’s investment

strategy is value-oriented and contrarian.

“Gold and silver mining stocks have historically

been correlated to bullion, but in recent years, they’ve lagged the price of the physical metals,” said John Hathaway, CFA,

Managing Partner, Sprott and Senior Portfolio Manager, Sprott Asset Management USA, Inc. “Gold and silver mining stocks could

offer significant catch-up potential.”

GBUG is Sprott’s first active ETF, which

offers the opportunity to invest in miners with the potential advantage of active stock picking from a global leader with over four decades

of specialized expertise in precious metals and mining investments. “Given the operational complexities of mining, investors may

benefit from an active ETF strategy focused on long-term business fundamentals and growth potential,” said Whitney George, Chief

Executive Officer of Sprott. “The Fund’s investment team is experienced. The team has more than 100 years of collective experience

in metals and mining, and it conducts more than 200 management meetings annually, along with periodic site visits to mining operations

around the globe.”

GBUG combines the expertise of active management

with the flexibility of an ETF, which includes daily transparency, liquidity and potential tax efficiency. GBUG is one of four Sprott

Precious Metals ETFs:

| Sprott Active Gold & Silver Miners ETF |

Nasdaq: GBUG |

An actively managed ETF that aims to provide long-term capital appreciation by investing in shares of gold- and silver-focused companies that are engaged in exploring, developing and mining; or royalty and streaming companies engaged in the financing of gold and silver assets. The investment strategy of the Fund is value-oriented and contrarian. |

| Sprott Gold Miners ETF |

NYSE Arca: SGDM |

Seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT). The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges. |

| Sprott Junior Gold Miners ETF |

NYSE Arca: SGDJ |

Seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the Solactive Junior Gold Miners Custom Factors Index (Ticker: SOLJGMFT). The Index aims to track the performance of small-capitalization gold companies whose stocks are listed on regulated exchanges. |

| Sprott Silver Miners & Physical Silver ETF |

Nasdaq: SLVR |

Seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, Nasdaq Sprott Silver Miners™ Index (NSLVR™), by investing at least 80% of its total assets in securities of NSLVR. The Nasdaq Sprott Silver Miners Index is designed to track the performance of a selection of securities in the silver industry, including silver producers, developers and explorers, and physical silver. |

* Based on Morningstar’s universe of Precious

Metals Sector Equity ETFs as of 2/19/2025.

About Sprott Inc.

Sprott is

a global asset manager focused on precious metals and critical materials investments. We are specialists. We believe our in-depth knowledge,

experience and relationships separate us from the generalists. Our investment strategies include Exchange Listed Products, Managed Equities

and Private Strategies. Sprott has offices in Toronto, New York, Connecticut and California, and the company’s common shares are

listed on the New York Stock Exchange and the Toronto Stock Exchange under the symbol (SII). For more information, please visit www.sprott.com.

Contact:

Glen Williams

Managing Partner

Investor and Institutional Client Relations

Direct: (416) 943-43945

gwilliams@sprott.com

Dan Gagnier

Gagnier Communications

Direct: (646) 569-5897

sprott@gagnierfc.com

Important Disclosures

An investor should consider the investment objectives,

risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other

information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have

continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and

result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater

portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which

may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline

risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations.

Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors

buy and sell shares of the funds on a secondary market. Only market makers or “authorized participants” may trade directly

with the fund, typically in blocks of 10,000 shares.

The Sprott Active Gold & Silver Miners and

Sprott Silver Miners & Physical Silver ETFs are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment

Adviser to the Sprott Active Gold & Silver Miners ETF. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs

and is a registered broker-dealer and FINRA Member.

ALPS Distributors, Inc. is not affiliated with

Sprott Asset Management USA, Inc.

© 2025 Sprott Inc. All rights reserved.

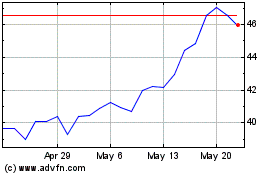

Sprott (NYSE:SII)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sprott (NYSE:SII)

Historical Stock Chart

From Feb 2024 to Feb 2025