Sprott Inc. (NYSE/TSX: SII) (“Sprott” or the “Company”) today

announced its financial results for the three and nine months ended

September 30, 2024.

Management commentary

“Sprott’s Assets Under Management (“AUM”) was

$33.4 billion as at September 30, 2024, up 8% from June 30, 2024

and up 16% from December 31, 2023," said Whitney George, CEO of

Sprott. "This is our third consecutive quarter of record high AUM,

driven by strong gold and silver prices, as well as $589 million in

net sales during the period. Given the strength of these results

and our confidence in Sprott’s future, our Board has declared a

third quarter dividend of $0.30 per share, an increase of 20%.

Further, we now expect to repay the balance of our line of credit

by the end of this month, resulting in a debt-free balance

sheet."

"With Sprott's core positioning in precious

metals and critical materials, we retain our constructive outlook

and believe we are well positioned to navigate volatile market

conditions and continue creating value for our clients and

shareholders," continued Mr. George.

Key AUM highlights1

- AUM was $33.4

billion as at September 30, 2024, up 8% from $31.1 billion as at

June 30, 2024 and up 16% from $28.7 billion as at December 31,

2023. On a three and nine months ended basis, we primarily

benefited from strong market value appreciation in our precious

metals physical trusts. We also benefited from net inflows to our

exchange listed products and the launch of our Physical Copper

Trust in the second quarter.

Key revenue highlights

- Management fees

were $38.7 million in the quarter, up 18% from $32.9 million for

the quarter ended September 30, 2023 and $113.1 million on a

year-to-date basis, up 17% from $97 million for the nine months

ended September 30, 2023. Carried interest and performance fees

were $4.1 million in the quarter, up from $nil for the quarter

ended September 30, 2023 and $4.8 million on a year-to-date basis,

up from $0.4 million for the nine months ended September 30, 2023.

Net fees were $38.9 million in the quarter, up 31% from $29.7

million for the quarter ended September 30, 2023 and $106.1 million

on a year-to-date basis, up 21% from $87.7 million for the nine

months ended September 30, 2023. Our revenue performance on both a

three and nine months ended basis was primarily due to higher

average AUM on strong market value appreciation in our precious

metals physical trusts and continuous inflows to the majority of

our exchange listed products. We also benefited from carried

interest crystallization in a legacy fixed-term exploration LP in

our managed equities segment.

- Commission

revenues were $0.5 million in the quarter, down 8% from the quarter

ended September 30, 2023 and $4.9 million on a year-to-date basis,

down 30% from $7 million for the nine months ended September 30,

2023. Net commissions were $0.2 million in the quarter, down 31%

from $0.4 million for the quarter ended September 30, 2023 and $2.3

million on a year-to-date basis, down 42% from $3.9 million for the

nine months ended September 30, 2023. Commission revenue was lower

in the quarter due to modest ATM activity in our critical materials

physical trusts. On a year-to-date basis, the decline in commission

revenue was due to the sale of our former Canadian broker-dealer in

the second quarter of last year.

- Finance income

was $1.6 million in the quarter, down 12% from $1.8 million for the

quarter ended September 30, 2023 and $7.5 million on a year-to-date

basis, up 46% from $5.1 million for the nine months ended September

30, 2023. The decrease in the quarter was due to lower income

generation in co-investment positions we hold in our LPs managed in

our private strategies segment. The increase on a year-to-date

basis was due to higher income earned on streaming syndication

activity in the second quarter.

Key expense highlights

- Net compensation

expense was $16.9 million in the quarter, up 11% from $15.3 million

for the quarter ended September 30, 2023 and $50.3 million on a

year-to-date basis, up 9% from $46 million for the nine months

ended September 30, 2023. The increase in the quarter and on a

year-to-date basis was primarily due to increased AIP accruals on

higher net fee generation. Our net compensation ratio was 46% in

the quarter (September 30, 2023 - 50%) and 45% on a year-to-date

basis (September 30, 2023 - 50%).

- SG&A expense

was $4.6 million in the quarter, up 21% from $3.8 million for the

quarter ended September 30, 2023 and $13.8 million on a

year-to-date basis, up 10% from $12.6 million for the nine months

ended September 30, 2023. The increase in the quarter and on a

year-to-date basis was due to higher technology and professional

services costs.

Earnings summary

- Net income for

the quarter was $12.7 million ($0.50 per share), up 87% from $6.8

million ($0.27 per share) for the quarter ended September 30, 2023

and was $37.6 million ($1.48 per share) on a year-to-date basis, up

17% from $32.1 million ($1.27 per share) for the nine months ended

September 30, 2023. Our earnings benefited from higher management

fees on strong market valuations of our precious metals physical

trusts and good inflows to our exchange listed products. We also

benefited from carried interest crystallization in our managed

equities funds and market value appreciation of our

co-investments.

- Adjusted base

EBITDA was $20.7 million ($0.81 per share) in the quarter, up 16%

from $17.9 million ($0.71 per share) for the quarter ended

September 30, 2023 and $62.8 million ($2.47 per share) on a

year-to-date basis, up 18% from $53.1 million ($2.10 per share) for

the nine months ended September 30, 2023. Adjusted base EBITDA on

both a three and nine months ended basis benefited from higher

management fees on strong market valuations of our precious metals

physical trusts and good inflows to our exchange listed

products.

1 See “non-IFRS financial measures” section in

this press release and schedule 2 and 3 of "Supplemental financial

information"

Subsequent events

-

Subsequent to quarter-end, on November 1, 2024, AUM was $34.2

billion, up 2% from $33.4 billion at September 30, 2024.

-

On November 5, 2024, the Sprott Board of Directors announced a

quarterly dividend of $0.30 per share.

Supplemental financial

information

Please refer to the September 30, 2024

quarterly financial statements of the Company and the related

management discussion and analysis filed earlier this morning for

further details into the Company's financial position as at

September 30, 2024 and the Company's financial performance for

the three and nine months ended September 30, 2024.

Schedule 1 - AUM continuity

| 3 months

results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In millions $) |

AUMJun. 30, 2024 |

Net inflows (1) |

Market value changes |

Othernet inflows (1) |

AUM Sep. 30, 2024 |

|

Net management fee rate (2) |

|

|

|

|

|

|

|

|

|

| Exchange listed

products |

|

|

|

|

|

|

|

|

- Precious metals physical trusts and ETFs |

|

|

|

|

|

|

|

- Physical Gold Trust |

7,283 |

361 |

|

973 |

|

— |

8,617 |

|

0.35 |

% |

|

- Physical Silver Trust |

4,994 |

224 |

|

348 |

|

— |

5,566 |

|

0.45 |

% |

|

- Physical Gold and Silver Trust |

4,710 |

— |

|

515 |

|

— |

5,225 |

|

0.40 |

% |

|

- Precious Metals ETFs |

355 |

(11 |

) |

60 |

|

— |

404 |

|

0.33 |

% |

|

- Physical Platinum & Palladium Trust |

143 |

7 |

|

1 |

|

— |

151 |

|

0.50 |

% |

|

|

17,485 |

581 |

|

1,897 |

|

— |

19,963 |

|

0.39 |

% |

| |

|

|

|

|

|

|

|

|

- Critical materials physical trusts and ETFs |

|

|

|

|

|

|

|

- Physical Uranium Trust |

5,615 |

23 |

|

(230 |

) |

— |

5,408 |

|

0.32 |

% |

|

- Critical Materials ETFs |

2,408 |

56 |

|

(157 |

) |

— |

2,307 |

|

0.55 |

% |

|

- Physical Copper Trust |

98 |

2 |

|

3 |

|

— |

103 |

|

0.32 |

% |

|

|

8,121 |

81 |

|

(384 |

) |

— |

7,818 |

|

0.38 |

% |

|

|

|

|

|

|

|

|

|

|

Total exchange listed products |

25,606 |

662 |

|

1,513 |

|

— |

27,781 |

|

0.39 |

% |

|

|

|

|

|

|

|

|

|

| Managed

equities (3)(4) |

2,962 |

(55 |

) |

369 |

|

— |

3,276 |

|

0.90 |

% |

| |

|

|

|

|

|

|

|

| Private

strategies (4) |

2,485 |

(18 |

) |

(85 |

) |

— |

2,382 |

|

0.80 |

% |

|

|

|

|

|

|

|

|

|

|

Total AUM (5) |

31,053 |

589 |

|

1,797 |

|

— |

33,439 |

|

0.47 |

% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| 9 months

results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In millions $) |

AUMDec. 31, 2023 |

Net inflows (1) |

Market value changes |

Othernet inflows (1) |

AUM Sep. 30, 2024 |

|

Net management fee rate (2) |

|

|

|

|

|

|

|

|

|

| Exchange listed

products |

|

|

|

|

|

|

|

|

- Precious metals physical trusts and ETFs |

|

|

|

|

|

|

|

- Physical Gold Trust |

6,532 |

316 |

|

1,769 |

|

— |

8,617 |

|

0.35 |

% |

|

- Physical Silver Trust |

4,070 |

256 |

|

1,240 |

|

— |

5,566 |

|

0.45 |

% |

|

- Physical Gold and Silver Trust |

4,230 |

(161 |

) |

1,156 |

|

— |

5,225 |

|

0.40 |

% |

|

- Precious Metals ETFs |

339 |

(14 |

) |

79 |

|

— |

404 |

|

0.33 |

% |

|

- Physical Platinum & Palladium Trust |

116 |

42 |

|

(7 |

) |

— |

151 |

|

0.50 |

% |

|

|

15,287 |

439 |

|

4,237 |

|

— |

19,963 |

|

0.39 |

% |

|

|

|

|

|

|

|

|

|

|

- Critical materials physical trusts and ETFs |

|

|

|

|

|

|

|

- Physical Uranium Trust |

5,773 |

266 |

|

(631 |

) |

— |

5,408 |

|

0.32 |

% |

|

- Critical materials ETFs |

2,143 |

294 |

|

(130 |

) |

— |

2,307 |

|

0.55 |

% |

|

- Physical Copper Trust |

— |

2 |

|

(9 |

) |

110 |

103 |

|

0.32 |

% |

|

|

7,916 |

562 |

|

(770 |

) |

110 |

7,818 |

|

0.38 |

% |

|

|

|

|

|

|

|

|

|

|

Total exchange listed products |

23,203 |

1,001 |

|

3,467 |

|

110 |

27,781 |

|

0.39 |

% |

|

|

|

|

|

|

|

|

|

| Managed

equities (3)(4) |

2,874 |

(167 |

) |

569 |

|

— |

3,276 |

|

0.90 |

% |

| |

|

|

|

|

|

|

|

| Private

strategies (4) |

2,661 |

(172 |

) |

(107 |

) |

— |

2,382 |

|

0.80 |

% |

|

|

|

|

|

|

|

|

|

|

Total AUM (5) |

28,738 |

662 |

|

3,929 |

|

110 |

33,439 |

|

0.47 |

% |

|

(1) See "Net inflows" and "Other net inflows" in the key

performance indicators and non-IFRS and other financial measures

section of the MD&A. |

|

(2) Management fee rate represents the weighted average fees for

all funds in the category, net of fund expenses. |

|

(3) Managed equities is made up of primarily precious metal

strategies (57%), high net worth managed accounts (35%) and U.S.

value strategies (8%). |

|

(4) Prior period figures have been reclassified to conform with

current presentation. |

|

(5) No performance fees are earned on exchange listed products.

Performance fees are earned on certain of our managed equities

products and are based on returns above relevant benchmarks.

Private strategies LPs primarily earn

carried interest calculated as a predetermined net profit over a

preferred return. |

|

|

Schedule 2 - Summary financial information

|

(In thousands $) |

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q42023 |

Q32023 |

Q22023 |

Q12023 |

Q42022 |

|

Summary income statement |

|

|

|

|

|

|

|

|

| Management fees (1) |

38,693 |

|

38,065 |

|

36,372 |

|

34,244 |

|

32,867 |

|

32,940 |

|

31,170 |

|

28,152 |

|

|

Fund expenses (2), (3) |

(2,385 |

) |

(2,657 |

) |

(2,234 |

) |

(2,200 |

) |

(1,740 |

) |

(1,871 |

) |

(1,795 |

) |

(1,470 |

) |

|

Direct payouts |

(1,483 |

) |

(1,408 |

) |

(1,461 |

) |

(1,283 |

) |

(1,472 |

) |

(1,342 |

) |

(1,187 |

) |

(1,114 |

) |

| Carried interest and

performance fees |

4,110 |

|

698 |

|

— |

|

503 |

|

— |

|

388 |

|

— |

|

1,219 |

|

|

Carried interest and performance fee payouts - internal |

— |

|

(251 |

) |

— |

|

(222 |

) |

— |

|

(236 |

) |

— |

|

(567 |

) |

|

Carried interest and performance fee payouts - external (3) |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(121 |

) |

|

Net fees |

38,935 |

|

34,447 |

|

32,677 |

|

31,042 |

|

29,655 |

|

29,879 |

|

28,188 |

|

26,099 |

|

|

|

|

|

|

|

|

|

|

|

| Commissions |

498 |

|

3,332 |

|

1,047 |

|

1,331 |

|

539 |

|

1,647 |

|

4,784 |

|

5,027 |

|

|

Commission expense - internal |

(147 |

) |

(380 |

) |

(217 |

) |

(161 |

) |

(88 |

) |

(494 |

) |

(1,727 |

) |

(1,579 |

) |

|

Commission expense - external (3) |

(103 |

) |

(1,443 |

) |

(312 |

) |

(441 |

) |

(92 |

) |

(27 |

) |

(642 |

) |

(585 |

) |

|

Net commissions |

248 |

|

1,509 |

|

518 |

|

729 |

|

359 |

|

1,126 |

|

2,415 |

|

2,863 |

|

|

|

|

|

|

|

|

|

|

|

| Finance income (2) |

1,574 |

|

4,084 |

|

1,810 |

|

1,391 |

|

1,795 |

|

1,650 |

|

1,655 |

|

1,738 |

|

| Gain (loss) on

investments |

937 |

|

1,133 |

|

1,809 |

|

2,808 |

|

(1,441 |

) |

(1,950 |

) |

1,958 |

|

(930 |

) |

| Co-investment income (2) |

418 |

|

416 |

|

274 |

|

170 |

|

462 |

|

1,327 |

|

93 |

|

370 |

|

|

Total net revenues (2) |

42,112 |

|

41,589 |

|

37,088 |

|

36,140 |

|

30,830 |

|

32,032 |

|

34,309 |

|

30,140 |

|

|

|

|

|

|

|

|

|

|

|

| Compensation (2) |

18,547 |

|

19,225 |

|

17,955 |

|

17,096 |

|

16,939 |

|

21,468 |

|

19,556 |

|

17,148 |

|

|

Direct payouts |

(1,483 |

) |

(1,408 |

) |

(1,461 |

) |

(1,283 |

) |

(1,472 |

) |

(1,342 |

) |

(1,187 |

) |

(1,114 |

) |

|

Carried interest and performance fee payouts - internal |

— |

|

(251 |

) |

— |

|

(222 |

) |

— |

|

(236 |

) |

— |

|

(567 |

) |

|

Commission expense - internal |

(147 |

) |

(380 |

) |

(217 |

) |

(161 |

) |

(88 |

) |

(494 |

) |

(1,727 |

) |

(1,579 |

) |

|

Severance, new hire accruals and other |

(58 |

) |

— |

|

— |

|

(179 |

) |

(122 |

) |

(4,067 |

) |

(1,257 |

) |

(1,240 |

) |

|

Net compensation |

16,859 |

|

17,186 |

|

16,277 |

|

15,251 |

|

15,257 |

|

15,329 |

|

15,385 |

|

12,648 |

|

| Net

compensation ratio |

46 |

% |

44 |

% |

47 |

% |

47 |

% |

50 |

% |

48 |

% |

52 |

% |

44 |

% |

|

|

|

|

|

|

|

|

|

|

| Severance, new hire accruals

and other |

58 |

|

— |

|

— |

|

179 |

|

122 |

|

4,067 |

|

1,257 |

|

1,240 |

|

| Selling, general and

administrative ("SG&A") (2) |

4,612 |

|

5,040 |

|

4,173 |

|

3,963 |

|

3,817 |

|

4,752 |

|

4,026 |

|

3,814 |

|

| SG&A recoveries from funds

(1) |

(275 |

) |

(260 |

) |

(231 |

) |

(241 |

) |

(249 |

) |

(282 |

) |

(264 |

) |

(253 |

) |

| Interest expense |

933 |

|

715 |

|

830 |

|

844 |

|

882 |

|

1,087 |

|

1,247 |

|

1,076 |

|

| Depreciation and

amortization |

502 |

|

568 |

|

551 |

|

658 |

|

731 |

|

748 |

|

706 |

|

710 |

|

| Foreign exchange (gain) loss

(2) |

1,028 |

|

122 |

|

168 |

|

1,295 |

|

37 |

|

1,440 |

|

440 |

|

(484 |

) |

| Other

(income) and expenses (2) |

— |

|

(580 |

) |

— |

|

3,368 |

|

4,809 |

|

(18,890 |

) |

1,249 |

|

1,686 |

|

|

Total expenses |

23,717 |

|

22,791 |

|

21,768 |

|

25,317 |

|

25,406 |

|

8,251 |

|

24,046 |

|

20,437 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

12,697 |

|

13,360 |

|

11,557 |

|

9,664 |

|

6,773 |

|

17,724 |

|

7,638 |

|

7,331 |

|

|

Net income per share |

0.50 |

|

0.53 |

|

0.45 |

|

0.38 |

|

0.27 |

|

0.70 |

|

0.30 |

|

0.29 |

|

|

Adjusted base EBITDA |

20,675 |

|

22,375 |

|

19,751 |

|

18,759 |

|

17,854 |

|

17,953 |

|

17,321 |

|

18,083 |

|

|

Adjusted base EBITDA per share |

0.81 |

|

0.88 |

|

0.78 |

|

0.75 |

|

0.71 |

|

0.71 |

|

0.68 |

|

0.72 |

|

|

|

|

|

|

|

|

|

|

|

|

Summary balance sheet |

|

|

|

|

|

|

|

|

|

Total assets |

412,477 |

|

406,265 |

|

389,784 |

|

378,835 |

|

375,948 |

|

381,519 |

|

386,765 |

|

383,748 |

|

|

Total liabilities |

82,198 |

|

90,442 |

|

82,365 |

|

73,130 |

|

79,705 |

|

83,711 |

|

108,106 |

|

106,477 |

|

|

|

|

|

|

|

|

|

|

|

|

Total AUM |

33,439,221 |

|

31,053,136 |

|

29,369,191 |

|

28,737,742 |

|

25,398,159 |

|

25,141,561 |

|

25,377,189 |

|

23,432,661 |

|

|

Average AUM |

31,788,412 |

|

31,378,343 |

|

29,035,667 |

|

27,014,109 |

|

25,518,250 |

|

25,679,214 |

|

23,892,335 |

|

22,323,075 |

|

(1) Previously, management fees within the above

summary financial information table included SG&A recoveries

from funds consistent with IFRS 15. For management reporting

purposes, these recoveries are now shown next to their associated

expense as management believes this will enable readers to

transparently identify the net economics of these recoveries.

However, SG&A recoveries from funds are still shown within the

"Management fees" line on the consolidated statement of operations.

Prior year figures have been reclassified to conform with current

presentation.

(2) Current and prior period figures on the

consolidated statements of operations include the following

adjustments: (1) trading costs incurred in managed accounts are now

included within "Fund expenses" (previously included within

"SG&A"); (2) interest income earned on cash deposits are now

included within "Finance income" (previously included within "Other

income"); (3) co-investment income and income attributable to

non-controlling interest are now included as part of "Co-investment

income" (previously included within "Other income"); (4) expenses

attributable to non-controlling interest is now included within

"Co-investment income" (previously included within "Other

expenses"); (5) the mark-to-market expense of DSU issuances are now

included within "Compensation" (previously included within "Other

expenses"); (6) foreign exchange (gain) loss is now shown

separately (previously included within "Other expenses"); and (7)

shares received on a previously unrecorded contingent asset in Q2

2023 are now included within "Other (income) and expenses"

(previously included within "Other income"). Prior year figures

have been reclassified to conform with current presentation.

(3) These amounts are included in the "Fund expenses" line on

the consolidated statements of operations.

Schedule 3 - EBITDA reconciliation

|

|

3 months ended |

9 months ended |

|

|

|

|

|

|

| (in

thousands $) |

Sep. 30, 2024 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

|

Net income for the period |

12,697 |

|

6,773 |

|

37,614 |

|

32,135 |

|

| Net income margin (1) |

27 |

% |

20 |

% |

28 |

% |

29 |

% |

| Adjustments: |

|

|

|

|

|

Interest expense |

933 |

|

882 |

|

2,478 |

|

3,216 |

|

|

Provision for income taxes |

5,698 |

|

(1,349 |

) |

14,899 |

|

7,333 |

|

|

Depreciation and amortization |

502 |

|

731 |

|

1,621 |

|

2,185 |

|

|

EBITDA |

19,830 |

|

7,037 |

|

56,612 |

|

44,869 |

|

| Adjustments: |

|

|

|

|

|

(Gain) loss on investments (2) |

(937 |

) |

1,441 |

|

(3,879 |

) |

1,433 |

|

|

Stock-based compensation (3) |

4,806 |

|

4,408 |

|

13,829 |

|

12,447 |

|

|

Foreign exchange (gain) loss (4) |

1,028 |

|

37 |

|

1,318 |

|

1,917 |

|

|

Severance, new hire accruals and other (4) |

58 |

|

122 |

|

58 |

|

5,446 |

|

|

Revaluation of contingent consideration (4) |

— |

|

— |

|

(580 |

) |

(2,254 |

) |

|

Costs relating to exit of non-core business (4) |

— |

|

3,615 |

|

— |

|

4,987 |

|

|

Non-recurring regulatory, professional fees and other (4) |

— |

|

1,194 |

|

— |

|

3,023 |

|

|

Shares received on recognition of contingent asset (4) |

— |

|

— |

|

— |

|

(18,588 |

) |

|

Carried interest and performance fees |

(4,110 |

) |

— |

|

(4,808 |

) |

(388 |

) |

|

Carried interest and performance fee payouts - internal |

— |

|

— |

|

251 |

|

236 |

|

|

Carried interest and performance fee payouts - external |

— |

|

— |

|

— |

|

— |

|

|

Adjusted base EBITDA |

20,675 |

|

17,854 |

|

62,801 |

|

53,128 |

|

|

Adjusted base EBITDA margin (5) |

58 |

% |

56 |

% |

58 |

% |

57 |

% |

(1) Calculated as IFRS net income divided by

IFRS total revenue.

(2) This adjustment removes the income effects

of certain gains or losses on short-term investments,

co-investments, and digital gold strategies to ensure the reporting

objectives of our EBITDA metric as described below are met.

(3) In prior years, the mark-to-market expense

of DSU issuances were included with "other (income) and expenses".

In the current period, these costs are included as part of "stock

based compensation". Prior year figures have been reclassified to

conform with current presentation.

(4) Foreign exchange (gain) and loss, severance,

new hire accruals and other; revaluation of contingent

consideration; costs relating to exit of non-core business;

non-recurring regulatory, professional fees and other; and shares

received on recognition of contingent asset were previously

included with "other (income) and expenses" and are now shown

separately in the reconciliation of adjusted base EBITDA above.

Prior year figures have been reclassified to conform with current

presentation.

(5) Prior year figures have been restated to

remove the adjustment of depreciation and amortization.

Conference Call and Webcast

A webcast will be held today, November 6, 2024

at 10:00 am ET to discuss the Company's financial results.

To listen to the webcast, please register

at: https://edge.media-server.com/mmc/p/7nbc4pms

Please note, analysts who cover the Company should

register

at: https://register.vevent.com/register/BIecf4c3c925374bf19a6ce5051f64dd6d

This press release includes financial terms

(including AUM, net commissions, net fees, expenses, adjusted base

EBITDA, adjusted base EBITDA margin and net compensation) that the

Company utilizes to assess the financial performance of its

business that are not measures recognized under International

Financial Reporting Standards (“IFRS”). These non-IFRS measures

should not be considered alternatives to performance measures

determined in accordance with IFRS and may not be comparable to

similar measures presented by other issuers. Non-IFRS financial

measures do not have a standardized meaning prescribed by IFRS and

are therefore unlikely to be comparable to similar measures

presented by other issuers. Our key performance indicators and

non-IFRS and other financial measures are discussed below. For

quantitative reconciliations of non-IFRS financial measures to

their most directly comparable IFRS financial measures please see

schedule 2 and schedule 3 of the "Supplemental financial

information" section of this press release.

Net fees

Management fees, net of fund expenses and direct

payouts, and carried interest and performance fees, net of carried

interest and performance fee payouts (internal and external), are

key revenue indicators as they represent the net revenue

contribution after directly associated costs that we generate from

our AUM.

Net commissions

Commissions, net of commission expenses

(internal and external), arise primarily from purchases and sales

of critical materials in our exchange listed products segment and

transaction-based service offerings by our broker dealers.

Net compensation & net compensation

ratio

Net compensation excludes commission expenses

paid to employees, other direct payouts to employees, carried

interest and performance fee payouts to employees, which are all

presented net of their related revenues in this MD&A, and

severance, new hire accruals and other which are non-recurring. Net

compensation ratio is calculated as net compensation divided by net

revenues.

EBITDA, adjusted base EBITDA and adjusted base

EBITDA margin

EBITDA in its most basic form is defined as

earnings before interest expense, income taxes, depreciation and

amortization. EBITDA (or adjustments thereto) is a measure commonly

used in the investment industry by management, investors and

investment analysts in understanding and comparing results by

factoring out the impact of different financing methods, capital

structures, amortization techniques and income tax rates between

companies in the same industry. While other companies, investors or

investment analysts may not utilize the same method of calculating

EBITDA (or adjustments thereto), the Company believes its adjusted

base EBITDA metric results in a better comparison of the Company's

underlying operations against its peers and a better indicator of

recurring results from operations as compared to other non-IFRS

financial measures. Adjusted base EBITDA margins are a key

indicator of a company’s profitability on a per dollar of revenue

basis, and as such, is commonly used in the financial services

sector by analysts, investors and management.

Forward Looking Statements

Certain statements in this press release contain

forward-looking information and forward-looking statements

(collectively referred to herein as the "Forward-Looking

Statements") within the meaning of applicable Canadian and U.S.

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" and similar expressions are

intended to identify Forward-Looking Statements. In particular, but

without limiting the forgoing, this press release contains

Forward-Looking Statements pertaining to: (i) our constructive

outlook in precious metals and critical materials; (ii) our

expectation to repay the balance of our line of credit by the end

of this month, resulting in a debt-free balance sheet at that time;

and (iii) the declaration, payment and designation of dividends and

confidence that our business will support the dividend level

without impacting our ability to fund future growth

initiatives.

Although the Company believes that the

Forward-Looking Statements are reasonable, they are not guarantees

of future results, performance or achievements. A number of factors

or assumptions have been used to develop the Forward-Looking

Statements, including: (i) the impact of increasing competition in

each business in which the Company operates will not be material;

(ii) quality management will be available; (iii) the effects of

regulation and tax laws of governmental agencies will be consistent

with the current environment; (iv) the impact of public health

outbreaks; and (v) those assumptions disclosed under the heading

"Critical Accounting Estimates, Judgments and Changes in Accounting

Policies" in the Company’s MD&A for the period ended September

30, 2024. Actual results, performance or achievements could vary

materially from those expressed or implied by the Forward-Looking

Statements should assumptions underlying the Forward-Looking

Statements prove incorrect or should one or more risks or other

factors materialize, including: (i) difficult market conditions;

(ii) poor investment performance; (iii) failure to continue to

retain and attract quality staff; (iv) employee errors or

misconduct resulting in regulatory sanctions or reputational harm;

(v) performance fee fluctuations; (vi) a business segment or

another counterparty failing to pay its financial obligation; (vii)

failure of the Company to meet its demand for cash or fund

obligations as they come due; (viii) changes in the investment

management industry; (ix) failure to implement effective

information security policies, procedures and capabilities; (x)

lack of investment opportunities; (xi) risks related to regulatory

compliance; (xii) failure to manage risks appropriately; (xiii)

failure to deal appropriately with conflicts of interest; (xiv)

competitive pressures; (xv) corporate growth which may be difficult

to sustain and may place significant demands on existing

administrative, operational and financial resources; (xvi) failure

to comply with privacy laws; (xvii) failure to successfully

implement succession planning; (xviii) foreign exchange risk

relating to the relative value of the U.S. dollar; (xix) litigation

risk; (xx) failure to develop effective business resiliency plans;

(xxi) failure to obtain or maintain sufficient insurance coverage

on favorable economic terms; (xxii) historical financial

information being not necessarily indicative of future performance;

(xxiii) the market price of common shares of the Company may

fluctuate widely and rapidly; (xxiv) risks relating to the

Company’s investment products; (xxv) risks relating to the

Company's proprietary investments; (xxvi) risks relating to the

Company's private strategies business; (xxvii) those risks

described under the heading "Risk Factors" in the Company’s annual

information form dated February 20, 2024; and (xxviii) those risks

described under the headings "Managing Financial Risks" and

"Managing Non-Financial Risks" in the Company’s MD&A for the

period ended September 30, 2024. In addition, the payment of

dividends is not guaranteed and the amount and timing of any

dividends payable by the Company will be at the discretion of the

Board of Directors of the Company and will be established on the

basis of the Company’s earnings, the satisfaction of solvency tests

imposed by applicable corporate law for the declaration and payment

of dividends, and other relevant factors. The Forward-Looking

Statements speak only as of the date hereof, unless otherwise

specifically noted, and the Company does not assume any obligation

to publicly update any Forward-Looking Statements, whether as a

result of new information, future events or otherwise, except as

may be expressly required by applicable securities laws.

About Sprott

Sprott is a global asset manager focused on

precious metals and critical materials investments. We are

specialists. We believe our in-depth knowledge, experience and

relationships separate us from the generalists. Our investment

strategies include Exchange Listed Products, Managed Equities and

Private Strategies. Sprott has offices in Toronto, New York,

Connecticut and California and the company’s common shares are

listed on the New York Stock Exchange and the Toronto Stock

Exchange under the symbol (SII). For more information, please visit

www.sprott.com.

Investor contact

information:

Glen WilliamsManaging PartnerInvestor and

Institutional Client Relations(416)

943-4394gwilliams@sprott.com

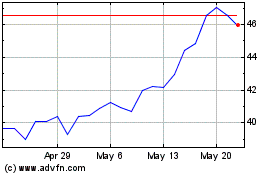

Sprott (NYSE:SII)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Nov 2023 to Nov 2024