By Suzanne McGee

Some mutual-fund managers will look back on 2020 as the worst of

times. Others are having the time of their lives, posting

year-to-date returns of 75% or more.

The difference between the winners and the laggards is

relatively straightforward: the extent to which portfolios were

heavily weighted with stocks of companies that stand to benefit

disproportionately from disruptive change. Some of these have

become household names, like Zoom Video Communications Inc., whose

visibility and share price have soared since the Covid-19 pandemic

lockdowns forced billions of people to reimagine their lives.

Others are less well-known, like medical genetic testing company

Invitae Corp. (up nearly 500% from its lows in March), or Coupa

Software Inc. (which delivers a cloud-based spending-management

platform to help businesses get a grip on costs), up 155% since

March's market meltdown.

"We would never have guessed that a pandemic-related recession

would have led companies to reimagine the way they do business so

rapidly," says Anthony Zackery, one of the portfolio managers

overseeing several top-performing mutual funds at Zevenbergen

Capital Management. "They had planned to execute changes slowly,

over years, but those adoption windows for new technologies have

been compressed to months."

Zevenbergen's growth-stock funds captured three of the 10 top

spots in The Wall Street Journal's third-quarter survey of the

best-performing actively managed U.S. equity funds, based on their

returns over the trailing 12 months. Of these, Zevenbergen Genea

Fund (ZVGIX) triumphed in our quarterly Winners' Circle competition

by posting a return of 121% for the 12-month period ended Sept. 30,

and a year-to-date gain of 92%.

Our quarterly survey limits its scope to the universe of

actively managed and diversified U.S. equity funds with more than

$50 million in assets and a track record of at least three years,

and draws on data provided by Morningstar Inc. Not included: sector

funds, funds that employ leverage or derivatives to boost returns

or cushion losses, blended funds including fixed income, global

funds or quantitative funds that rely on models or algorithms to

build their portfolios rather than traditional fundamental

research.

The results aren't intended to give readers a "buy" list of

mutual funds guaranteed to continue delivering stellar returns.

Some of the share classes may be less-accessible to ordinary

investors, or carry unacceptably high fees.

Narrow window

Because the survey emphasizes returns for the trailing 12

months, it can emphasize shorter-term performance, which may be

less useful for investors seeking funds able to outperform for the

next five to 10 years. Of course, this list may showcase funds that

simply aren't suitable for every investor's asset-allocation

strategy or risk tolerance. However, examining these top-performing

funds and delving into their strategies and holdings can give

investors insight into the way top-performing managers approach

specific market opportunities and evaluate potential

investments.

In 2020, argues Joe Dennison, another member of the Zevenbergen

portfolio team, "there is a scarcity of exceptional companies and

founders in which to invest," and being able to identify businesses

likely to deliver true growth in both revenues and earnings

regardless of the economic backdrop is crucial. Genea typically

owns positions in only 25 to 35 companies, compared with as many as

45 positions in Zevenbergen Growth Fund (ZVNIX), which ranked

fourth in our quarterly contest, with a trailing 12-month return of

114%.

Returns like that certainly grab an investor's attention in the

midst of a broad market environment that remains both volatile and

uncertain.

Over the 12 months ended Sept. 30, the S&P 500 index has

gained 16%. Year-to-date, while the 10 best actively managed

funds that met our criteria provided gains of at least 73%, the

S&P 500 advanced 3.25%. Moreover, as of Sept. 30, the entire

universe of actively managed, diversified U.S. equity funds with

more than $50 million in assets and a three-year track record

posted an average loss/gain for the trailing 12-month period of

8.7%, according to data from Morningstar.

True, the index's recovery from its lows in March, when the U.S.

economy was largely shut down to fight the pandemic, are

significant. But top-performing funds' emphasis on the handful of

stocks that actually seem likely to continue to benefit from

pandemic-related issues as well as longer-term secular trends has

helped them trounce the index.

"A lot of managers are focused on the question of 'how can I

beat the index?' which we think is backward-looking," says

Catherine Wood, CEO of ARK Investment and manager of American

Beacon ARK Transformational Innovation Fund (ADNIX). For Ms. Wood,

the index -- any index -- is irrelevant; she says her fund's

returns of 116% for the trailing 12 months and 85% for the year to

date -- putting her in second place for our contest -- come from

trying to imagine what the world will look like in five to 10

years. The fund then looks for companies that will profit most from

that transformation, based on a research strategy that favors

"innovation platforms" like robotics, DNA sequencing, energy

storage, blockchain technology and artificial intelligence.

Tesla's time

This approach led ARK's team to invest in Tesla Inc. about five

years ago; for the past three years, Ms. Wood says, it has been the

fund's top holding. That means that investors have benefited

handsomely from the nearly 10-fold explosion in Tesla's share price

over the last 12 months, a surge that occurred even though drivers

of Tesla's electric cars might have been expected to stay home

during a pandemic lockdown while new buyers might have postponed

purchases.

That conventional analysis of Tesla as no more than an

automotive company misses the point, Ms. Wood says. "That's the

most narrow way of looking at it," she says."It's actually a

robotics company, it's an energy storage company because of its

emphasis on battery technology, and it's an artificial intelligence

company because of the evolution of autonomous vehicles." The icing

on the cake? Tesla is expanding its global footprint, she says,

while also taking steps toward making its vehicles more affordable

for the mass market.

Tesla also is a top holding in the three Zevenbergen funds in

our survey, and was the single-largest holding for the Genea Fund.

"No, it's not a company that benefits from pandemic-related

trends," Mr. Dennison acknowledges. Rather, he believes that it

will emerge as a long-term beneficiary of the transformation that

Covid-19 is causing.

"Once the virus hit, more investors started recognizing that the

world had just changed," says Ms. Wood, who agrees with the

Zevenbergen analysis. "Now, the question is how we capitalize on

that change."

Many of this quarter's top-performing funds in our survey are

benefiting from companies that they and others believe will

dominate the post-pandemic business and market landscape. The

Zevenbergen and ARK funds all include Square Inc. in their top

holdings, as do several funds overseen by Dennis Lynch, head of the

Counterpoint Global team at Morgan Stanley Investment Management,

including our third-place finisher, Morgan Stanley Institutional

Discovery Portfolio (MPEGX). The latter recorded a gain of 115% for

the 12 months ended Sept. 30, while two other Morgan Stanley growth

funds -- Morgan Stanley Insight (CPODX) and Morgan Stanley

Institutional Growth (MSEQX) also showed up in the list of the 10

best-performing funds for the period yet again, with returns of

105% and 99%, respectively.

Square, whose share price has nearly tripled in the past 12

months, is a provider of a contactless payment system used by

retailers. Its allure for Ms. Wood and other investors goes beyond

its ability to offer contactless transactions. The company is

morphing into a new breed of financial services company that Ms.

Wood believes will be a long-term threat to commercial banks, with

their high fixed costs and a relative lack of innovation. "Square

helped deliver PPP [Paycheck Protection Program] funds to small

businesses, and it has calculated that 60% of the small businesses

who used it to get those funds were new to Square and have now

adopted its platform" for other uses, she says.

Three-part market

Mr. Lynch, for his part, says he believes that the stock market

this year has split into three parts. The smallest of the three

consists of stocks like Square, Tesla, Zoom, Spotify Technology SA

and Twilio Inc., companies at the leading edge of innovation and

post-pandemic transformation. By far the largest group, he argues,

is made up of businesses that Covid-19 has affected in

unpredictable ways and that have little visibility in terms of

earnings or revenue growth as they try to navigate the recession.

Then there's the third group: companies whose revenues and profits

rely on people getting together in person, like travel businesses,

some commercial real estate and restaurants. "Many of these have

suffered significant [stock-]price shrinkage," says Mr. Lynch.

"That seems logical to me."

This "trifurcation" of U.S. equities, Mr. Lynch says, means that

more investors likely will seek out just the kind of stocks in

which our top-performing mutual-fund managers have been investing

for years. Already, valuations for many are soaring, prompting Mr.

Lynch and others to wonder "whether some of the beneficiaries have

come too far, too fast" and whether at least some of the businesses

in the largest group have seen share prices tumble enough to make

them interesting value investments.

For now, at least, Mr. Lynch says that he doesn't see many

compelling alternatives to his current portfolio holdings, and that

he's happy with what he owns. "Many of them are still early in

their life cycle; many have founders or management teams with a lot

of skin in the game." If he is tempted to take some of his profits

off the table, he has to consider where else to put that money --

and those options are relatively few.

Other top-performing managers don't worry much about climbing

price-to-earnings ratios and other metrics, especially in light of

the astonishing low interest rates and forecasts of lower GDP

growth. Ms. Wood suggests that "with a new normalized growth rate

[including inflation] of 2% to 3%, the new normal for earnings

multiples for true growth companies could be 33 to 50 times,"

instead of 25 times earnings, as it was in the pre-pandemic

market.

In Ms. Wood's view, the soaring values of stocks in companies

that benefit from pandemic-accelerated transformation simply means

that innovation is being valued more appropriately by the market.

She thinks these businesses are capable of delivering sustained

growth of 25% a year, even if the overall economy and market are

stuck in the doldrums.

If these top-performing fund managers are correct in their

assessment of what lies ahead, the real longer-term winners will be

those investors able to accurately winnow out those resilient

companies capable of thriving in tough times by solving problems

for both consumers and businesses. Index investing may be less

costly, but this kind of active stock-picking is the strategy most

likely to deliver above-average returns consistently, they contend.

Especially if pandemic-related economic struggles re-emerge and

continue.

"There's a tendency to think that we're at the end point of the

crisis," says Mr. Lynch. "But I think we're still in the middle of

it."

Ms. McGee is a writer in New England. She can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

October 04, 2020 20:52 ET (00:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

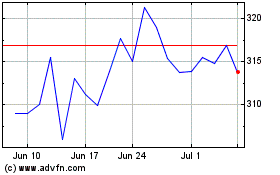

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

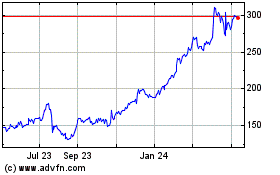

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024