Current Report Filing (8-k)

May 09 2022 - 2:14PM

Edgar (US Regulatory)

0000092122FALSE00000921222022-05-092022-05-090000092122us-gaap:CommonStockMember2022-05-092022-05-090000092122so:Series2017B5.25JuniorSubordinatedNotesDue2077Member2022-05-092022-05-090000092122so:Series2019ACorporateUnitsMember2022-05-092022-05-090000092122so:Series2020A4.95JuniorSubordinatedNotesDue2080Member2022-05-092022-05-090000092122so:Series2020C420JuniorSubordinatedNotesDue2060Member2022-05-092022-05-090000092122so:Series2021B1875FixedToFixedResetRateJuniorSubordinatedNotesDue2081Member2022-05-092022-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

| Date of Report (Date of earliest event reported) | May 9, 2022 |

| | | | | | | | | | | | | | | | | | | | |

| Commission

File Number | | Registrant,

State of Incorporation,

Address and Telephone Number | | I.R.S. Employer

Identification No. | |

| | | | | | | | | | | | | | | | | | | | |

| 1-3526 | | The Southern Company | | 58-0690070 | |

(A Delaware Corporation)

30 Ivan Allen Jr. Boulevard, N.W.

Atlanta, Georgia 30308

(404) 506-5000

The name and address of the registrant have not changed since the last report.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Registrant | Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| The Southern Company | Common Stock, par value $5 per share | SO | New York Stock Exchange |

| The Southern Company | Series 2017B 5.25% Junior Subordinated Notes due 2077 | SOJC | New York Stock Exchange |

| The Southern Company | 2019 Series A Corporate Units | SOLN | New York Stock Exchange |

| The Southern Company | Series 2020A 4.95% Junior Subordinated Notes due 2080 | SOJD | New York Stock Exchange |

| The Southern Company | Series 2020C 4.20% Junior Subordinated Notes due 2060 | SOJE | New York Stock Exchange |

| The Southern Company | Series 2021B 1.875% Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2081 | SO 81 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 9, 2022, The Southern Company (the “Company”) completed the optional remarketing (the “Remarketing”) of $862,500,000 aggregate principal amount of its Series 2019A Remarketable Junior Subordinated Notes due August 1, 2024 (the “Series 2019A JSNs”) and $862,500,000 aggregate principal amount of its Series 2019B Remarketable Junior Subordinated Notes due August 1, 2027 (the “Series 2019B JSNs” and, together with the Series 2019A JSNs, the “Junior Subordinated Notes”), originally issued as components of its 2019 Series A Corporate Units (the “Corporate Units”) on August 16, 2019. The Remarketing was registered under the Securities Act of 1933, as amended, pursuant to the shelf registration statement (Registration No. 333-253286) of the Company.

In connection with the Remarketing, the Company entered into a Remarketing Agreement, dated as of April 13, 2022, as supplemented by the Supplemental Remarketing Agreement, dated as of May 5, 2022 (as supplemented, the “Remarketing Agreement”), among the Company and Goldman Sachs & Co. LLC, Barclays Capital Inc., Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC, as remarketing agents (the “Remarketing Agents”), and U.S. Bank Trust Company, National Association, solely in its capacity as purchase contract agent and as attorney-in-fact of the holders of the purchase contracts (the “Purchase Contracts”) issued as components of the Corporate Units. In connection with the Remarketing, the interest rate on the Series 2019A JSNs was reset to 4.475% per annum and the interest rate on the Series 2019B JSNs was reset to 5.113% per annum.

The Company did not receive any proceeds from the Remarketing. The proceeds were used to purchase a portfolio of treasury securities maturing on or before August 1, 2022. The Company expects that a portion of the funds generated upon maturity of the portfolio will be used to settle with the Company, on August 1, 2022, the Purchase Contracts.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| 1.7(a) | |

| |

| 1.7(b) | |

| |

| 4.4(a) | |

| |

| 4.4(b) | |

| |

| 4.8(a) | Form of the Series 2019A JSN (included in Exhibit 4.4(a) above). |

| |

| 4.8(b) | Form of the Series 2019B JSN (included in Exhibit 4.4(b) above). |

| |

| 5.1 | |

| |

| 8.1 | |

| |

| 23.1 | Consent of Troutman Pepper Hamilton Sanders LLP (included in Exhibit 5.1 above). |

| |

| 23.2 | Consent of Troutman Pepper Hamilton Sanders LLP (included in Exhibit 8.1 above). |

| |

| 104 | Cover Page Interactive Data File – The cover page iXBRL tags are embedded within the inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: May 9, 2022 | THE SOUTHERN COMPANY

|

| By | /s/Melissa K. Caen |

| | Melissa K. Caen

Assistant Secretary |

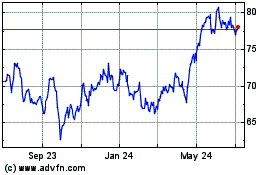

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

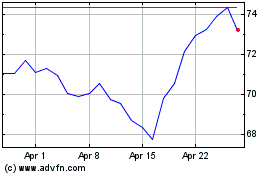

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024