Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 23 2021 - 4:48PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

Filed Pursuant to Rule 433

|

|

Registration No. 333-253286

|

|

February 23, 2021

|

|

PRICING TERM SHEET

|

|

(To Preliminary Prospectus Supplement dated February 23, 2021)

|

|

|

|

|

Issuer:

|

The Southern Company

|

|

Security:

|

Series 2021A 0.60% Senior Notes due February 26, 2024

|

|

Expected Ratings:*

|

Baa2 (Stable)/BBB+ (Negative)/BBB+ (Stable) (Moody’s/Standard & Poor’s/Fitch)

|

|

Principal Amount:

|

$600,000,000

|

|

Initial Public Offering Price:

|

99.991%

|

|

Maturity Date:

|

February 26, 2024

|

|

Treasury Benchmark:

|

0.125% due February 15, 2024

|

|

Benchmark Treasury Yield:

|

0.223%

|

|

Spread to Treasury:

|

+38 basis points

|

|

Re-offer Yield:

|

0.603%

|

|

Optional Redemption:

|

|

|

Make-Whole Call:

|

T+10 basis points

|

|

Par Call:

|

On or after January 26, 2024 at 100%

|

|

Coupon:

|

0.60%

|

|

Interest Payment Dates:

|

February 26 and August 26 of each year, beginning on August 26, 2021

|

|

Format:

|

SEC Registered

|

|

Denominations:

|

$2,000 and integral multiples of $1,000 in excess thereof

|

|

CUSIP/ISIN:

|

842587 DG9/US842587DG96

|

|

Trade Date:

|

February 23, 2021

|

|

Expected Settlement Date:

|

February 26, 2021 (T+3)

|

|

Joint Book-Running Managers:

|

Morgan Stanley & Co. LLC

Scotia Capital (USA) Inc.

Truist Securities, Inc.

U.S. Bancorp Investments, Inc.

Wells Fargo Securities, LLC

|

|

Co-Managers:

|

BBVA Securities Inc.

CIBC World Markets Corp.

Commerz Markets LLC

Intesa Sanpaolo S.p.A.

Cabrera Capital Markets LLC

CastleOak Securities, L.P.

Drexel Hamilton, LLC

Siebert Williams Shank & Co., LLC

|

|

Concurrent Offering:

|

$400,000,000 Series 2021B 1.75% Senior Notes due March 15, 2028, expected to be issued on February 26, 2021. The closing of the offering of the Series 2021A 0.60% Senior Notes due February 26, 2024 is not contingent on the closing of the concurrent offering.

|

|

|

|

|

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

|

|

|

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling The Southern Company collect at 1-404-506-0727, Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, Scotia Capital (USA) Inc. toll free at 1-800-372-3930, Truist Securities Inc. toll free at 1-800-685-4786, U.S. Bancorp Investments, Inc. toll free at 1-877-558-2607 or Wells Fargo Securities, LLC toll free at 1-800-645-3751.

|

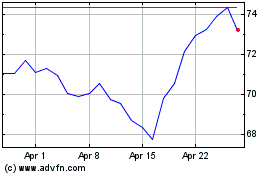

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

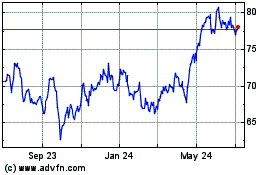

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024