AOS INVESTORS ALERT: Lieff Cabraser Announces Securities Class Action Against A.O. Smith Corporation

June 11 2019 - 1:32PM

Business Wire

The law firm of Lieff Cabraser Heimann & Bernstein, LLP

announces that class action litigation has been filed on behalf of

investors who purchased the common stock of A.O. Smith Corporation

(“A.O. Smith” or the “Company”) (NYSE: AOS) between July 26, 2016

through May 16, 2019, inclusive (the “Class Period”).

If you purchased the common stock of A.O. Smith during the Class

Period, you may move the Court for appointment as lead plaintiff by

no later than July 29, 2019. A lead plaintiff is a representative

party who acts on behalf of other class members in directing the

litigation. Your share of any recovery in the actions will not be

affected by your decision of whether to seek appointment as lead

plaintiff. You may retain Lieff Cabraser, or other attorneys, as

your counsel in the actions.

A.O. Smith investors who wish to learn more about the litigation

and how to seek appointment as lead plaintiff should click here or

contact Sharon M. Lee of Lieff Cabraser toll-free at

1-800-541-7358.

Background on the A.O. Smith Securities Class

Litigation

AOS, incorporated in Delaware and headquartered in Milwaukee,

Wisconsin, is a leading manufacturer and marketer of water heaters

and boilers. The Company has two primary operating segments, North

America and China, the latter of which accounted for one-third of

the Company’s sales in 2018, exceeding $1 billion.

The action alleges that, during the Class Period, Defendants

made repeated false statements about AOS’s earnings and sales in

China, and the prospects for future sales and earnings in that

market, artificially inflating the Company’s stock price.

On May 16, 2019, J Capital Research USA LLC (“J Capital”), a

research firm with a short interest in AOS stock, released a

well-documented, 66-page report, based on extensive interviews and

investigation in China, that AOS fueled its Chinese growth through

a previously undisclosed Chinese partner named Jiangsu UTP Supply

Chain (“UTP”). UTP is purportedly involved in almost every aspect

of AOS’s Chinese operations, and may be responsible for as much of

75% of AOS China sales, by allowing AOS to inflate its gross

margins though distributor-financed “channel stuffing.” This

channel stuffing enabled AOS to report growth that was no longer

working, by pushing UTP and distributors to take on more inventory

than they needed, which hid AOS’s sales decline. In addition, J

Capital revealed that AOS’s claim to have $539 million in

unencumbered cash balances in China is likely false, and that AOS

probably used that cash for distributor loans to prop up sales.

On the release of J Capital’s May 16, 2019 AOS report, the price

of AOS common stock declined $3.02 per share, or 6.27% from a

closing price of $48.12 on May 15, 2019, to close at $45.12 per

share on May 16, 2019, on elevated trading volume.

About Lieff Cabraser

Lieff Cabraser Heimann & Bernstein, LLP, with offices in San

Francisco, New York, and Nashville, is a nationally recognized law

firm committed to advancing the rights of investors and promoting

corporate responsibility.

The National Law Journal has recognized Lieff Cabraser as one of

the nation’s top plaintiffs’ law firms for fourteen years. In

compiling the list, the National Law Journal examines recent

verdicts and settlements and looked for firms “representing the

best qualities of the plaintiffs’ bar and that demonstrated unusual

dedication and creativity.” Law360 has selected Lieff Cabraser as

one of the Top 50 law firms nationwide for litigation, highlighting

our firm’s “laser focus” and noting that our firm routinely finds

itself “facing off against some of the largest and strongest

defense law firms in the world.” Benchmark Litigation has named

Lieff Cabraser one of the “Top 10 Plaintiffs’ Firms in

America.”

For more information about Lieff Cabraser and the firm’s

representation of investors, please visit

http://www.lieffcabraser.com.

This press release may be considered Attorney Advertising in

some jurisdictions under the applicable law and ethical rules.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190611005890/en/

Source/Contact for Media Inquiries OnlySharon M. LeeLieff

Cabraser Heimann & Bernstein, LLPTelephone: 1-800-541-7358

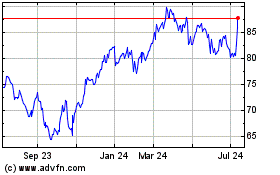

AO Smith (NYSE:AOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

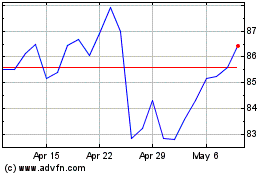

AO Smith (NYSE:AOS)

Historical Stock Chart

From Apr 2023 to Apr 2024