SL Green Signs TD Securities to 171,000 Square Feet at One Vanderbilt Avenue and 125 Park Avenue

December 03 2018 - 7:30AM

Business Wire

119,000 Square Foot Lease at One Vanderbilt

Brings TD Bank’s Total Commitment to 312,000 Square Feet

TD Securities Also Leases 52,000 Square Feet at

Adjacent 125 Park Avenue

SL Green Realty Corp. (NYSE:SLG), New York City’s largest office

landlord, today announced that TD Securities, a leading investment

bank and financial services provider, signed leases totaling

171,322 square feet in two SL Green owned office buildings. TD

Securities will take 118,872 square feet on the entire 10th and

12th floors plus a portion of the 11th floor, joining its affiliate

TD Bank, which previously committed to 193,159 square-feet of

office space at One Vanderbilt Avenue. The cutting edge new office

tower has already reaffirmed the Grand Central office market as the

center of Manhattan and is set to change the New York City skyline

in 2020. With this transaction, the office portion of One

Vanderbilt is now 52 percent leased, nearly two years ahead of

construction completion. TD Securities will also take an additional

52,450 square feet of office space on floors 19 and 20 at SL

Green’s neighboring 125 Park Avenue.

“We’re delighted to welcome TD Securities to One Vanderbilt and

expand our relationship with TD Bank,” said Steven Durels,

Executive Vice President, Director of Leasing and Real Property for

SL Green who added, “Leasing velocity at One Vanderbilt has

been extraordinary this year as tenants begin to see the building’s

exceptional architectural design and experience its amazing ceiling

heights, column free floors and sweeping views.”

"Over the last decade, TD Securities has grown significantly in

the U.S., including in the New York region,” says Glenn Gibson,

Vice Chair, TD Securities. “Our new premises at One Vanderbilt

and 125 Park Avenue reflect our commitment to our clients,

colleagues and ongoing US growth strategy, and will also continue

to strengthen our alignment with TD Bank, AMCB.”

TD Securities joins a distinguished roster of industry leading

firms which have committed to One Vanderbilt Avenue including TD

Bank; global alternative asset manager, The Carlyle Group; one of

the nation’s largest law firms, Greenberg Traurig; leading

international law firm McDermott Will & Emery; residential REIT

MFA Financial; and global German financial firms DZ and DVB Banks.

Additionally, award-winning chef Daniel Boulud has partnered with

SL Green to create a premier restaurant experience in the

building.

Earlier this year, the American Institute of Architects (AIA)

recognized One Vanderbilt and its architecture firm, Kohn Pedersen

Fox (KPF) Associates, with the prestigious AIA NY Merit Award in

Urban Design. Encompassing an entire city block, the building is

bounded by Madison and Vanderbilt Avenues to the west and east, and

East 43rd and East 42nd Streets to the north and south. Expected to

achieve both LEED Gold under version 4.0 and WELL certification,

the trophy tower will feature floor-to-ceiling slab heights ranging

from 14'6" to 24', column-free floor plates, stunning 360-degree

views through floor-to-ceiling windows and best-in-class

infrastructure. Anchoring the modernization of East Midtown, One

Vanderbilt will provide tenants with a combination of amenities

unrivaled in New York City, including a 30,000-square-foot

tenant-only amenity floor with large format meeting spaces, club

style lounge and extraordinary outdoor terrace. Immediately

adjacent to Grand Central Terminal, the building will create direct

connections to the surrounding transit network. SL Green is

investing an unprecedented $220 million in private funds to upgrade

the transit system.

TD Securities was represented by the CBRE brokerage team of

Robert Alexander, Ryan Alexander, Doug Lehman and Christopher

Hogan.

About SL Green Realty

Corp.

SL Green Realty Corp., an S&P 500 company

and New York City's largest office landlord, is a fully

integrated real estate investment trust, or REIT, that is focused

primarily on acquiring, managing and maximizing value

of Manhattan commercial properties. As

of September 30, 2018, SL Green held interests in 106

Manhattan buildings totaling 46.4 million square feet. This

included ownership interests in 28.2 million square feet

of Manhattan buildings and 18.2 million square feet of

buildings securing debt and preferred equity investments. In

addition, SL Green held ownership interests in 15 suburban

buildings totaling 2.3 million square feet

in Brooklyn, Westchester County,

and Connecticut.

Forward-looking Statement

This press release includes certain statements that may be

deemed to be "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995 and are intended

to be covered by the safe harbor provisions thereof. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and we caution you not to

place undue reliance on such statements. Forward-looking statements

are generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press release are

subject to a number of risks and uncertainties, many of which are

beyond our control, that may cause our actual results, performance

or achievements to be materially different from future results,

performance or achievements expressed or implied by forward-looking

statements made by us. Factors and risks to our business that could

cause actual results to differ from those contained in the

forward-looking statements are described in our filings with the

Securities and Exchange Commission. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of future events, new information or otherwise.

SLG- LEAS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181203005255/en/

Investors:Matt DiLibertoChief Financial OfficerSL Green Realty

Corp.(212) 594-2700

Press:BerlinRosenslgreen@berlinrosen.com646.452.5637

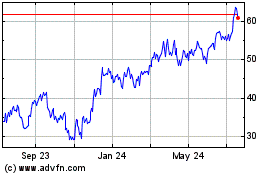

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Apr 2023 to Apr 2024