SL Green Realty Corp. Announces $500 Million Increase to Share Repurchase Program

November 30 2018 - 7:40AM

Business Wire

Total Authorization of $2.5 billion

SL Green Realty Corp. (NYSE: SLG), New York City’s largest

office landlord, today announced that the Company’s Board of

Directors has authorized an increase to the size of its share

repurchase program by an additional $500 million of the

Company’s common stock, bringing the program to a total

of $2.5 billion.

To date, the Company has repurchased 18,087,322 shares under the

program. In addition, the Company has redeemed 445,517 units of the

Company’s Operating Partnership in connection with real estate

transactions.

“The expansion of our stock repurchase program is in response to

the significant discrepancy that persists between our share price

and the underlying value of our assets,” said Marc Holliday,

Chief Executive Officer of SL Green. “We are pleased with the

results of this program to date, as we’ve been able to monetize

assets that were ripe for harvesting and reinvest those proceeds in

a way that is accretive to earnings and net asset value, as well as

being sensitive to our investment grade balance sheet. We believe

this is a program that creates tremendous value for our

investors.”

About SL Green Realty

Corp.

SL Green Realty Corp., an S&P 500 company

and New York City's largest office landlord, is a fully

integrated real estate investment trust, or REIT, that is focused

primarily on acquiring, managing and maximizing value

of Manhattan commercial properties. As

of September 30, 2018, SL Green held interests in 106

Manhattan buildings totaling 46.4 million square feet. This

included ownership interests in 28.2 million square feet

of Manhattan buildings and 18.2 million square feet of

buildings securing debt and preferred equity investments. In

addition, SL Green held ownership interests in 15 suburban

buildings totaling 2.3 million square feet

in Brooklyn, Westchester County,

and Connecticut.

Forward-looking Statement

This press release includes certain statements that may be

deemed to be "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995 and are intended

to be covered by the safe harbor provisions thereof. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and we caution you not to

place undue reliance on such statements. Forward-looking statements

are generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press release are

subject to a number of risks and uncertainties, many of which are

beyond our control, that may cause our actual results, performance

or achievements to be materially different from future results,

performance or achievements expressed or implied by forward-looking

statements made by us. Factors and risks to our business that could

cause actual results to differ from those contained in the

forward-looking statements are described in our filings with the

Securities and Exchange Commission. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of future events, new information or otherwise.

SLG- FIN

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181130005189/en/

Investors:Matt DiLibertoChief Financial OfficerSL Green Realty

Corp.(212) 594-2700

Press:BerlinRosenslgreen@berlinrosen.com646.452.5637

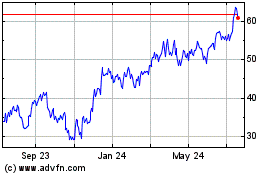

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Apr 2023 to Apr 2024