SL Green Inks Sentinel Capital Partners at One Vanderbilt Avenue

June 03 2019 - 7:30AM

Business Wire

Iconic East Midtown tower is now 59% leased,

maintaining strong leasing momentum

SL Green Realty Corp., New York City’s largest office landlord,

today announced that Sentinel Capital Partners, a leading

midmarket private equity firm, has signed a 28,448 square foot,

15-year lease to occupy the entire 51st floor at One

Vanderbilt Avenue, the 1,401-foot office tower in East Midtown that

has redefined the New York City skyline.

The iconic office tower is now 59 percent leased ahead of its

planned August 2020 opening. Construction on the super structure

has reached the 73rd floor with steel construction scheduled to top

out in the summer of 2019.

“We’re proud to welcome Sentinel Capital Partners to One

Vanderbilt’s prestigious roster of tenants,” said Steven Durels,

Executive Vice President and Director of Leasing and Real Property

at SL Green. “With direct access to Grand Central Terminal,

unparalleled amenities, column free floorplates and extraordinary

views, One Vanderbilt’s leasing velocity remains robust as we

approach the one year mark from opening.”

“We are excited and thrilled to be establishing our next office

home in a brand new, state-of-the-art building, in a

super-convenient location,” said David Lobel, Founder and

Managing Partner at Sentinel Capital Partners. “We are also

highly impressed with the SL Green team, who has managed our

onboarding with the utmost professionalism,” added Lobel.

Sentinel Capital Partners joins a robust roster of top-tier

financial, banking and legal firms that have committed to

One Vanderbilt. Other tenants include: The Carlyle Group, a

leading private equity firm; TD Securities and TD Bank, a

leading banking and investment firm that provides a wide range of

capital markets products and services; prestigious law

firms, McDermott, Will & Emery and Greenberg Traurig;

private equity firm KPS Capital Partners; global German financial

firms DZ and DVB Banks; publicly traded real estate investment

trust MFA Financial Inc.; and SL Green Realty

Corp. Additionally, award-winning chef, Daniel Boulud, has

partnered with SL Green to create a signature restaurant experience

in the building.

The American Institute of Architects (AIA) recognized

One Vanderbilt and its architecture firm, Kohn Pedersen Fox

(KPF) Associates, with the prestigious 2018 AIA NY Merit Award in

Urban Design. Encompassing an entire city block, the building is

bounded by Madison and Vanderbilt Avenues to the west and

east, and East 43rd and East 42nd Streets to the north

and south. Expected to achieve both LEED Gold under version 4.0 and

WELL certification, the trophy tower will feature floor-to-ceiling

slab heights ranging from 14'6" to 24', column-free floor plates,

stunning 360-degree views through floor-to-ceiling windows and

best-in-class infrastructure. Anchoring the modernization of East

Midtown, One Vanderbilt will provide tenants with a combination of

amenities unrivaled in New York City, including a

30,000-square-foot tenant-only amenity floor with large format

meeting spaces, club style lounge and an extraordinary outdoor

terrace. Immediately adjacent to Grand Central Terminal, the

building will create direct connections to the surrounding transit

network. In addition, SL Green is investing an

unprecedented $220 million in private funds to upgrade

the transit system.

Lance Korman and Brian Waterman of Newmark Grubb Knight

Frank represented Sentinel Capital Partners. Robert

Alexander, Ryan Alexander, Emily Jones and Alex D’Amario of CBRE

represented the landlord in this transaction.

About SL Green Realty Corp.

SL Green Realty Corp., an S&P 500 company

and New York City's largest office landlord, is a fully

integrated real estate investment trust, or REIT, that is focused

primarily on acquiring, managing and maximizing value

of Manhattan commercial properties. As of March 31, 2019,

SL Green held interests in 96 Manhattan buildings totaling 46.4

million square feet. This included ownership interests in 27.7

million square feet of Manhattan buildings and 18.7 million square

feet of buildings securing debt and preferred equity investments.

In addition, SL Green held ownership interests in 7 suburban

properties comprised of 15 suburban buildings totaling 2.3 million

square feet in Brooklyn, Westchester County, and Connecticut.

SLG-LEAS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190603005423/en/

SL Green Realty Corp.slgreen@berlinrosen.com646.452.5637

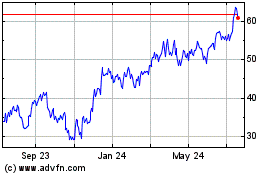

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Apr 2023 to Apr 2024