Amended Statement of Beneficial Ownership (sc 13d/a)

March 10 2021 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 2)

Under the Securities Exchange Act of

1934

Skillz Inc.

(Name of Issuer)

Class A common stock, par value $0.0001

per share

Class B common stock, par value $0.001

per share

(Title of Class of Securities)

Class A common stock: 83067L 109

Class B common stock: Not Applicable

(CUSIP Number)

P.O. Box 445

San Francisco, CA 94104

(415) 762-0511

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications)

March 5, 2021

(Date of Event Which Requires Filing

of this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box: ¨

The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

1

|

NAME OF REPORTING PERSONS

Andrew Paradise

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ¨ (b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

84,028,622 Shares of Class B common stock and 0 shares of Class

A common stock(1)(2)

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

84,028,622 Shares of Class B common stock and 0 shares of Class

A common stock (1)(2)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

84,028,622 Shares of Class B common stock and 0 shares of Class

A common stock (1)(2)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions) ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% of the Class A common stock and 98.7% of the Class B common

stock(2)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

The number of shares reported as beneficially owned as of March 5, 2021 by the Reporting Person were acquired in connection with the Business Combination (defined below) and include (i) 75,596,878 shares of Class B common stock, (ii) options to acquire 7,024,488 Class B common stock, and (iii) 1,407,256 shares Class B common released from escrow pursuant to the Earnout Escrow Agreement to the Reporting Person.

|

|

(2)

|

Calculated based on 291,746,159 shares of Class A common stock and 85,115,151 shares of Class B common stock issued and outstanding as of December 16, 2020 as reported in the Issuer’s Form 8-K filed with the U.S. Securities and Exchange Commission on December 21, 2020.

|

This Amendment No. 2 (this “Amendment

No. 2”) amends and supplements the Statement on Schedule 13D first filed with the Securities and Exchange Commission

on December 21, 2020 (as amended by Amendment No. 1 filed December 23, 2020, the “Original Schedule 13D”), and

is filed by the Reporting Person with respect to the Class A common stock and Class B common stock of the Issuer. Capitalized terms

used herein but not otherwise defined herein have the meanings given to them in the Original Schedule 13D.

This Amendment No. 2 amends the Original

Schedule 13D as specifically set forth herein. Except as set forth herein, all other information in the Original Schedule 13D remains

the same.

|

Item 4.

|

Purpose of the Transaction

|

Item 4 of the

Original Schedule 13D is hereby amended and supplemented by adding the following paragraph:

On March 5, 2021 the escrow agent released

from escrow the earnout shares according to the terms of the Earnout Escrow Agreement. Pursuant to which, 5,000,000 shares in the

form of either Class A common stock or Class B common stock were released to the Old Skillz stockholders who received shares of

New Skillz common stock as a result of the Business Combination, as described further in the Merger Agreement. The Class A common

stock held in escrow was released to the Old Skillz stockholders who received shares of New Skillz common stock as a result of

the Business Combination, other than the Reporting Person and a trust for the benefit of his family members. The 1,407,256 shares

of Class B common stock held in escrow were released to the Reporting Person. As a result of the release of the earnout shares,

the Reporting Person was issued 1,407,256 shares of Class B common stock and the Reporting Person no longer has voting control

over the 3,572,888 shares of Class A common stock released from escrow. This Amendment No. 2 updates the current holdings of the

Reporting Person.

|

Item 5.

|

Interest in Securities of the Issuer

|

(a) See responses

to Item 13 on the cover page.

(b) See responses

to Items 7, 8, 9 and 10 on the cover page.

(c) The Reporting

Person was involved in the Business Combination as the founder and Chief Executive Officer of Old Skillz. Except as set forth in

this Amendment No. 2, the Reporting Person has not, to the best of his knowledge, engaged in any transaction with respect to the

Class A common stock and Class B common stock during the sixty days prior to the date of filing this Amendment No. 2.

(d) Except as

described in Item 3, no person other than the Reporting Person is known to have the right to receive or the power to direct the

receipt of dividends from, or the proceeds from the sale of, the shares of the Class A common stock and the Class B common stock

of the issuer beneficially owned by the Reporting Person as reported in this Amendment No. 2.

(e) Not applicable.

|

Item 7.

|

Material to be Filed as Exhibits

|

|

Exhibit 99.1

|

Power of Attorney

|

Signature

After reasonable inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete, and correct.

Dated: March 9, 2021

Andrew Paradise

|

|

|

|

|

|

|

|

|

By:

|

/s/ Charlotte Edelman, Attorney-in-Fact

|

|

|

Name: Andrew Paradise

|

|

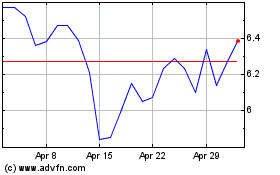

Skillz (NYSE:SKLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Skillz (NYSE:SKLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024