SiriusPoint announces first partnership with advisory firm Hestia Capital

April 26 2021 - 7:00AM

SiriusPoint Ltd. (“SiriusPoint” or the “Company”) (NYSE: SPNT), an

international specialty insurer and reinsurer, has today announced

a partnership with Hestia Capital, the first since SiriusPoint

launched in February 2021 as a top 20 global (re)insurer with over

$3 billion in capital.

Hestia is a Texas-based advisory start-up established by

industry executives Jean Francois Bahier and Peter Norris. The

company will focus on sourcing and developing structured speciality

insurance and reinsurance transactions and insurance-related

investments in underserved or specialized markets.

SiriusPoint has made an investment in the company and can

provide (re)insurance paper and capacity for the new venture.

Dan Malloy, President, Global Distribution at

SiriusPoint said: “Our partnership with Hestia expands

SiriusPoint’s ability to access alternative markets. Hestia’s focus

on the creation of new products to answer clients’ risk

management and capital needs is a valuable service in the

current market. We look forward to working with them on a

pipeline of innovative projects, including the complementary

healthcare product we have recently launched together in

Poland.”

Bahier and Norris most recently headed up the Unique Risk

Underwriting (“URU”) division at AmTrust Financial Services,

building a highly profitable non-cat exposed diversified book of

structured insurance and reinsurance deals. Both worked at AmTrust

from 2009, Bahier, as president of the URU and Norris as a

London-based underwriter of the division. The pair joined AmTrust

from the Imagine Group.

Bahier said: “I am pleased to announce the establishment of

Hestia in Texas and delighted to have SiriusPoint as a partner. We

look forward to working with the entrepreneurial and innovative

SiriusPoint team helping them to create risk management solutions

for their clients.”

Norris added: “Our relationship with SiriusPoint solidifies our

participation in the (re)insurance market. We will shortly announce

a partnership on the alternative asset side of our business”

International law firm McDermott Will & Emery represented

SiriusPoint in this transaction.

Hestia has said it aims to open additional offices in Europe as

its operations grow.

About SiriusPointSiriusPoint Ltd. (SiriusPoint)

is a top 20 global insurer and reinsurer providing solutions to

clients and brokers in almost 150 countries. Bermuda-headquartered

with offices around the world, we are listed on the New York Stock

Exchange (SPNT). We write a global portfolio of Accident and

Health, Property, Liability and Specialty business, combining data

and creative thinking to underwrite risks with skill and

discipline. With over $3 billion total capital, SiriusPoint’s

operating companies have a financial strength rating of A-

(Excellent) from AM Best, S&P and Fitch. For more information,

please visit www.siriuspt.com About HestiaHestia

is a Texas, USA incorporated reinsurance broker and advisory group.

The company is focused on sourcing and developing structured

speciality insurance and reinsurance transactions, and on

insurance-related investments in underserved or specialized

markets. Peter Norris

- peternorris@hestiacapital.netJean Francois

Bahier – jfbahier@hestiacapital.net

SiriusPoint Contacts

Investor RelationsClare Kerrigan,

SiriusPointclare.kerrigan@siriuspt.com+44 7970 685959

MediaSarah Hills,

Rein4cesarah.hills@rein4ce.co.uk +44 7718882011

Forward-Looking Statements

We make statements in this report that are forward-looking

statements within the meaning of the federal securities laws,

including the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about

SiriusPoint Ltd.’s (“SiriusPoint”) intentions in relation to the

new partnership with Hestia Capital. The forward-looking statements

are based on the current expectations of the management of

SiriusPoint and speak only as of the date of this document and are

subject to significant risks and uncertainties outside of our

control. You can identify forward-looking statements by the use of

forward-looking terminology such as “plan,” “believe,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “target,” “continue,” “could,” “may,” “might,” “will,”

“possible,” “potential,” “predict,” “should,” “would,” “seeks,”

“likely,” and other similar words and expressions, but the absence

of these words does not mean that a statement is not

forward-looking. Among the risks and uncertainties that could cause

actual results to differ from those described in the

forward-looking statements are the following: fluctuation in the

results of operations; pandemic or other catastrophic event, such

as the ongoing COVID-19 outbreak; the costs, expense and

difficulties of the integration of the operations of Third Point

Reinsurance Ltd. and Sirius International Insurance Group, Ltd.;

loss and loss adjustment expense reserves may be inadequate to

cover SiriusPoint’s ultimate liability for losses and as a result

its financial results could be adversely affected; SiriusPoint’s

investment portfolio may suffer reduced returns or losses; adverse

changes in interest rates, foreign currency exchange rates, equity

markets, debt markets or market volatility could result in

significant losses to SiriusPoint’s investment portfolio; legal

restrictions on certain of SiriusPoint’s insurance and reinsurance

subsidiaries’ ability to pay dividends and other distributions to

SiriusPoint; SiriusPoint has significant deferred tax assets, which

may become devalued if either SiriusPoint does not generate

sufficient future taxable income or applicable corporate tax rates

are reduced; lack of availability of capital; future strategic

transactions such as acquisitions, dispositions, mergers or joint

venture; technology breaches; SiriusPoint’s lack of control over

the TP Fund and the allocation and performance of TP Fund’s

investment portfolio; SiriusPoint’s dependence on Third Point LLC

to implement TP Fund’s investment strategy; and Arcadian Risk

Capital Ltd.’s ability to, and success at, writing the business

indicated, its expansion plans and the Company’s ability to place

quota share reinsurance on the portfolio. Discussions of additional

risks and uncertainties are contained in SiriusPoint’s filings with

the Securities and Exchange Commission (the “SEC”), including risks

identified in SiriusPoint’s (f/k/a Third Point Reinsurance Ltd.)

Annual Report on Form 10-K for the year ended December 31, 2020,

and other filings with the SEC. Should one or more of these risks

or uncertainties materialize, or should any of the assumptions made

by the management of SiriusPoint prove incorrect, actual results

may vary in material respects from those projected in these

forward-looking statements. Except as required by applicable law or

regulation, we disclaim any obligation to publicly update or revise

any forward-looking statement to reflect changes in underlying

assumptions or factors, or new information, data or methods, future

events or other circumstances after the date of this report.

Source: SiriusPoint Ltd.

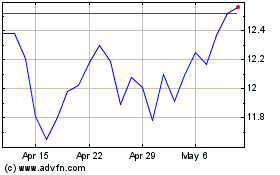

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

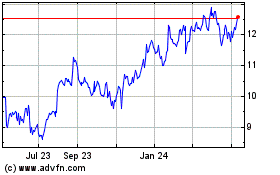

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Apr 2023 to Apr 2024