Schedule 13D

CUSIP No. 82836G 102 | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

Silverbow

Resources, Inc.

(Name of Issuer)

Common Stock,

par value $0.01 per share

(Title of Class

of Securities)

82836G 102

(CUSIP Number)

David B.

Charnin, Esq.

Strategic Value Partners, LLC

100 West Putnam Avenue

Greenwich, CT 06830

(203) 618-3500

(Name, Address

and Telephone Number of Person Authorized to

Receive Notices and Communications)

April 13,

2022

(Date of Event

Which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

Schedule 13D

CUSIP No. 82836G 102 | Page 2 of 7 |

| 1 |

NAMES OF REPORTING

PERSONS

Strategic Value

Partners, LLC

I.R.S. IDENTIFICATION

NO. OF ABOVE PERSON (VOLUNTARY) |

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

Not Applicable |

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING

POWER

0 |

| 8 |

SHARED VOTING

POWER

4,476,462 (1) |

| 9 |

SOLE DISPOSITIVE

POWER

0 |

| 10 |

SHARED DISPOSITIVE

POWER

4,476,462 (1) |

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,476,462 (1) |

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (9)

26.6% (2) |

| 14 |

TYPE OF REPORTING

PERSON

OO |

(1) Consists of 4,476,462 shares beneficially owned by Strategic

Value Partners, LLC (i) as the investment manager of Strategic Value Master Fund, Ltd., which has an ownership interest in SVMF 70

LLC, which has an ownership interest in SVMF 71 LLC, (ii) as the managing member of SVP Special Situations III LLC, which is the

investment manager of Strategic Value Special Situations Master Fund III, L.P., which has an ownership interest in SVMF 70 LLC,

which has an ownership interest in SVMF 71 LLC, and (iii) as the managing member of SVP Special Situations III-A LLC, which is the

investment manager of Strategic Value Opportunities Fund, L.P., which has an ownership interest in SVMF 71 LLC. SVMF 71 LLC directly

holds 4,476,462 shares of the Issuer. The Reporting Person disclaims beneficial ownership of the securities reported herein, and

neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by the

Reporting Person that it is the beneficial owner of any of the Common Shares held by SVMF 71 LLC or reported herein by the other

Reporting Persons for purposes of Section 13(d) of the Act, or for any other purpose, and such beneficial ownership is expressly

disclaimed by the Reporting Person.

(2) The percentage is based on 16,842,263 outstanding shares of

Common Stock of the Issuer as of April 12, 2022 as reported by the Issuer to the Reporting Persons.

Schedule 13D

CUSIP No. 82836G 102 | Page 3 of 7 |

| 1 |

NAMES OF REPORTING

PERSONS

SVP Special Situations III LLC

I.R.S. IDENTIFICATION

NO. OF ABOVE PERSON (VOLUNTARY) |

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

Not Applicable |

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING

POWER

0 |

| 8 |

SHARED VOTING

POWER

4,476,462 (1) |

| 9 |

SOLE DISPOSITIVE

POWER

0 |

| 10 |

SHARED DISPOSITIVE

POWER

4,476,462 (1) |

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,476,462 (1) |

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (9)

26.6% (2) |

| 14 |

TYPE OF REPORTING

PERSON

OO |

(1) SVP Special Situations III LLC is the investment manager of Strategic

Value Special Situations Master Fund III, L.P., which has an ownership interest in SVMF 70 LLC, which has an ownership interest in SVMF

71 LLC, which directly holds 4,476,462 shares of the Issuer. The Reporting Person disclaims beneficial ownership of the securities reported

herein, and neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by

the Reporting Person that it is the beneficial owner of any of the Common Shares held by SVMF 71 LLC or reported herein by the other Reporting

Persons for purposes of Section 13(d) of the Act, or for any other purpose, and such beneficial ownership is expressly disclaimed by the

Reporting Person.

(2) The percentage is based on 6,842,263 outstanding shares of

Common Stock of the Issuer as of April 12, 2022 as reported by the Issuer to the Reporting Persons.

Schedule 13D

CUSIP No. 82836G 102 | Page 4 of 7 |

| 1 |

NAMES OF REPORTING

PERSONS

SVP Special Situations III-A LLC

I.R.S. IDENTIFICATION

NO. OF ABOVE PERSON (VOLUNTARY) |

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

Not Applicable |

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING

POWER

0 |

| 8 |

SHARED VOTING

POWER

4,476,462 (1) |

| 9 |

SOLE DISPOSITIVE

POWER

0 |

| 10 |

SHARED DISPOSITIVE

POWER

4,476,462 (1) |

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,476,462 (1) |

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (9)

26.6% (2) |

| 14 |

TYPE OF REPORTING

PERSON

OO |

(1) SVP Special Situations III-A LLC is the investment manager of Strategic

Value Opportunities Fund, L.P., which has an ownership interest in SVMF 71 LLC, which directly holds 4,476,462 shares of the Issuer. The

Reporting Person disclaims beneficial ownership of the securities reported herein, and neither the filing of this Statement on Schedule

13D nor any of its contents shall be deemed to constitute an admission by the Reporting Person that it is the beneficial owner of any

of the Common Shares held by SVMF 71 LLC or reported herein by the other Reporting Persons for purposes of Section 13(d) of the Act, or

for any other purpose, and such beneficial ownership is expressly disclaimed by the Reporting Person.

(2) The percentage is based on 6,842,263 outstanding shares of

Common Stock of the Issuer as of April 12, 2022 as reported by the Issuer to the Reporting Persons.

CUSIP No. 82836G 102

| 1 |

NAMES OF REPORTING PERSONS

Victor Khosla

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (VOLUNTARY)

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

Not Applicable

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

4,476,462 (1)

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

4,476,462 (1)

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

4,476,462 (1)

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(9)

26.6% (2)

|

| 14 |

TYPE OF REPORTING PERSON

OO

|

(1) Strategic Value Partners, LLC (i) is the investment manager

of Strategic Value Master Fund, Ltd., which has an ownership interest in SVMF 70 LLC, which has an ownership interest in SVMF 71

LLC, (ii) is the managing member of SVP Special Situations III LLC, which is the investment manager of Strategic Value Special

Situations Master Fund III, L.P., which has an ownership interest in SVMF 70 LLC, which has an ownership interest in SVMF 71 LLC,

and (iii) is the managing member of SVP Special Situations III-A LLC, which is the investment manager of Strategic Value

Opportunities Fund, L.P., which has an ownership interest in SVMF 71 LLC. SVMF 71 LLC directly owns 4,476,462 shares of the Issuer.

Mr. Khosla is the sole member of Midwood Holdings, LLC, which is the managing member of Strategic Value Partners, LLC and is also

the indirect majority owner and control person of Strategic Value Partners, LLC, SVP Special Situations III LLC and SVP Special

Situations III-A LLC. The Reporting Person disclaims beneficial ownership of the securities reported herein, and neither the filing

of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by the Reporting Person that it

is the beneficial owner of any of the Common Shares held by SVMF 71 LLC or reported herein by the other Reporting Persons for

purposes of Section 13(d) of the Act, or for any other purpose, and such beneficial ownership is expressly disclaimed by the

Reporting Person.

(2) The percentage is based on 16,842,263 outstanding shares of

Common Stock of the Issuer as of April 12, 2022 as reported by the Issuer to the Reporting Persons.

CUSIP No. 82836G 102

AMENDMENT NO. 6 TO SCHEDULE 13D

Reference is hereby made to the

statement on Schedule 13D filed with the Securities and Exchange Commission on behalf of the Reporting Persons with respect to the Common

Stock of Silverbow Resources, Inc. (the “Issuer”) on May 2, 2016, as amended by Amendment No. 1 thereto filed on January

24, 2021, Amendment No. 2 thereto filed on February 16, 2021, Amendment No. 3 thereto filed on September 8, 2021, Amendment No. 4 thereto

filed on October 12, 2021, and Amendment No. 5 thereto filed on December 8, 2021 (as so amended, the “Schedule 13D”).

Terms defined in the Schedule 13D are used herein as so defined.

Item 4. Purpose of Transaction

Item 4 is hereby amended and supplemented as follows:

Item 6 is incorporated by reference into this Item 4.

Item 5. Interests in Securities of the Issuer

Item 5 of the Schedule 13D is hereby amended and supplemented as follows:

(a) – (b) The information requested by this paragraph is incorporated

herein by reference to the information provided on the cover pages to this Schedule 13D.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

Item 6 is hereby amended and supplemented with the following:

Voting Agreement

On April 14, 2022, the Issuer announced that it and its operating subsidiary,

SilverBow Resources Operating LLC, entered into a purchase and sale agreement (the “Sundance Purchase Agreement”) with Sundance

Energy, Inc., Armadillo E&P, Inc. and SEA Eagle Ford, LLC (collectively, the “Sundance Sellers”), pursuant to which the

Issuer will acquire oil and gas assets in the Eagle Ford formation for consideration of approximately $354 million, subject to customary

adjustments, approximately $225 million to be paid as cash and the rest to be paid with 4,148,472 shares of the Issuer’s Common

Stock, subject to customary adjustments (the “Sundance Transaction”). The Issuer announced that the Sundance Transaction is

expected to close on or before July 19, 2022, subject to shareholder approval and satisfaction or waiver of certain customary closing

conditions.

In connection with the Sundance Purchase Agreement, on April 13, 2022,

SVMF 71 LLC (the “Holder”), the record holder of the shares of Common Stock reported on this Schedule 13D, entered into an

agreement with the Issuer (the “Voting Agreement”) pursuant to which, among other things, it agreed to vote (or cause to be

voted) all shares of Common Stock beneficially owned by it at any meeting of stockholders or action by written consent of the stockholders

of the Issuer undertaken as contemplated by the Sundance Purchase Agreement in favor of (i) the issuance of shares of Common Stock in

the Sundance Transaction as described above and (ii) any other proposals reasonably agreed by the Issuer and the Sundance Sellers to be

necessary or appropriate in connection with the transactions contemplated by the Sundance Purchase Agreement (each, a “Transaction

Proposal”), and against any other transaction, proposal or agreement in opposition to the adoption of a Transaction Proposal and

any other action, if any, that would reasonably be expected to prevent any of the transactions contemplated by the Sundance Purchase Agreement

or the Voting Agreement, subject to the conditions specified therein. Each of the Sundance Sellers is a third party beneficiary of the

Voting Agreement with respect to the Holder’s performance thereunder.

This description of the Voting Agreement is qualified in its entirety

by reference to the full text of the Voting Agreement, a copy of which is filed hereto as Exhibit G, and is incorporated by reference

into this Item 6.

Item 7. Materials to be Filed as Exhibits.

Item 7 is hereby amended and supplemented with the following information:

Exhibit G — Voting Agreement, dated April 13, 2022, between SilverBow

Resources, Inc. and SVMF 71 LLC (incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on Form 8-K filed on April

14, 2022).

CUSIP No. 82836G 102

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: April 14, 2022

| |

STRATEGIC VALUE PARTNERS, LLC |

| |

|

| |

By: |

/s/ James Dougherty |

| |

|

Name: |

James Dougherty |

| |

|

Title: |

Fund Chief Financial Officer |

| |

|

|

|

| |

SVP SPECIAL SITUATIONS III LLC |

| |

|

| |

By: |

/s/ James Dougherty |

| |

|

Name: |

James Dougherty |

| |

|

Title: |

Fund Chief Financial Officer |

| |

|

|

|

| |

SVP SPECIAL SITUATIONS III-A LLC |

| |

|

| |

By: |

/s/ James Dougherty |

| |

|

Name: |

James Dougherty |

| |

|

Title: |

Fund Chief Financial Officer |

| |

|

|

|

| |

By: |

/s/ Victor Khosla |

| |

|

Victor Khosla |

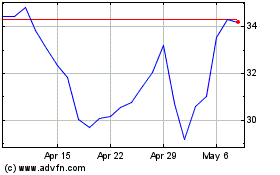

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

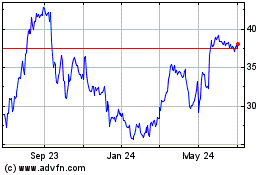

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Apr 2023 to Apr 2024