Signet Jewelers Limited (“Signet”) (NYSE:SIG), the world's

largest retailer of diamond jewelry, today announced its results

for the 13 weeks ended November 3, 2018 (“third quarter Fiscal

2019”).

Summary:

- Same store sales ("SSS") up 1.6% versus

prior-year quarter1

- GAAP diluted earnings per share ("EPS")

of $(0.74)

- Non-GAAP diluted EPS of $(1.06)2

- Raising Fiscal 2019 SSS guidance to

flat - up 1%, and total sales of $6.26 billion-$6.31 billion

- Narrowing Fiscal 2019 GAAP EPS guidance

to $(7.40)-$(7.07) and non-GAAP EPS guidance to $4.15-$4.40

Fiscal Q3'191

Fiscal Q3'183

YTD Fiscal 20191

YTD Fiscal 20183

Revenue ($ in millions) $ 1,191.7 $ 1,156.9 $ 4,092.4 $ 3,959.9

Same store sales % change1,4 1.6 % (5.0 )% 1.0 % (5.4 )%

GAAP Operating income (loss) as % of sales (4.1 )% 0.5 %

(16.6 )% 6.5 % GAAP Diluted EPS $ (0.74 ) $ (0.20 ) $ (10.31 ) $

2.24

Non-GAAP(2) Operating income (loss) as % of

sales (3.3 )% 0.5 % 0.8 % 6.5 % Non-GAAP Diluted EPS $ (1.06 ) $

(0.20 ) $ (0.35 ) $ 2.24 (1) Fiscal Q3'19 and year to date

Fiscal 2019 same store sales % change calculated by aligning weeks

in the quarter to same weeks in prior year. (2) See non-GAAP

reconciliation page. (3) Fiscal Q3'18 and year to date Fiscal 2018

numbers are as reported with Q3'18 same store sales % change based

on Fiscal 2018 calendar. (4) Same store sales include physical

store sales and eCommerce sales, which each incorporate the year

over year growth of James Allen.

Virginia C. Drosos, Chief Executive Officer, commented, “In the

third quarter, we delivered positive same store sales growth, with

a return to positive same store sales in our Kay banner, further

momentum at Piercing Pagoda and Zales, and double-digit increases

in eCommerce sales."

"As we enter the holiday season, amid a highly competitive

market and with key selling weeks ahead, we are keenly focused on

delivering on our holiday plans and implementing the beginning

stages of our transformation initiatives in our stores and on our

websites. While still early, we believe the initiatives underway

will serve as a foundation for our future efforts as we move along

our transformation journey."

Change from previous year Third

Quarter Fiscal 2019

Same store sales

(1)

Non-samestore sales,

net

Total salesat constant

exchange rate

Exchangetranslation impact

Totalsales as

reported

Totalsales (in

millions)

Kay 0.7 % 2.7 % 3.4 % na 3.4 % $ 451.2 Zales 2.8 % 0.4

%

3.2 % na 3.2 % $ 222.7 Jared —

%

1.1

%

1.1 % na 1.1 % $ 220.5 Piercing Pagoda 16.2 %

(5.4

)

%

10.8 % na 10.8 % $ 61.4 James Allen(2) 13.6 % $ 52.5 Peoples 0.3 %

(2.0

)

%

(1.7

)

%

(4.2 )%

(5.9

)

%

$ 39.8 Regional banners (3)

(13.7

)

%

(33.7

)

%

(47.4

)

%

(0.2 )%

(47.6

)

%

$ 16.2

North America segment 2.1 % 2.2

% 4.3 % (0.2 )% 4.1

% $ 1,064.3 H.Samuel

(3.5

)

%

(1.9

)

%

(5.4

)

%

(1.3 )%

(6.7

)

%

$ 57.4 Ernest Jones

(2.8

)

%

(0.2

)

%

(3.0

)

%

(1.3 )%

(4.3

)

%

$ 63.9

International segment

(3.1

)

%

(1.1

)

%

(4.2

)

%

(1.3 )%

(5.5

)

%

$ 121.3 Other(4) $ 6.1

Signet

1.6 % 1.7 % 3.3 %

(0.3 )% 3.0 % $ 1,191.7

(1) The 53rd week in Fiscal 2018 has resulted in a

shift in Fiscal 2019, as the fiscal year began a week later than

the previous fiscal year. As such, same store sales for Fiscal 2019

are being calculated by aligning the weeks of the quarter to the

same weeks in the prior year. Total reported sales continue to be

calculated based on the reported fiscal periods. (2) Same store

sales presented for James Allen to provide comparative performance

measure. (3) Regional banners represents results for regional

stores presented in the prior year as part of the former Sterling

Jewelers and Zale Jewelry segments (including Gordon’s and

Mappins). (4) Includes sales from Signet’s diamond sourcing

initiative.

Third quarter Fiscal 2019 Third

quarter Fiscal 2018 GAAP Operating income/(loss) in

millions $ % of sales $ %

of sales North America segment $

(19.5

)

(1.8

)

%

$ 53.8 5.3 % International segment

(4.4

)

(3.6

)

%

(1.7

)

(1.3

)

%

Other

(24.9

)

nm

(46.6

)

nm Total GAAP operating income / (loss) $

(48.8

)

(4.1

)

%

$ 5.5 0.5 %

Third quarter Fiscal 2019 Third

quarter Fiscal 2018 Non-GAAP Operating income/(loss) in

millions $ % of sales $ % of sales

North America segment $

(19.5

)

(1.8

)

%

$ 53.8 5.3 % International segment

(4.4

)

(3.6

)

%

(1.7

)

(1.3

)

%

Other

(15.0

)

nm

(46.6

)

nm Total Non-GAAP operating income / (loss) $

(38.9

)

(3.3

)

%

$ 5.5 0.5 %

Third Quarter 2019 Financial Highlights

Signet's total sales were $1.19 billion, up 3.0%, in the 13

weeks ended November 3, 2018 on a reported basis and up 3.3%

from the prior year quarter on a constant currency basis. Total

same store sales performance was 1.6% versus the prior year

quarter, inclusive of a 75 bps unfavorable impact due to planned

shifts in timing of promotions at Zales and Peoples. Same store

sales also reflected a 50 bps unfavorable impact related to a

timing shift of service plan revenue recognized as a result of the

historical claims experience shifting away from the earlier years

of the service plans to later years of the coverage period.

Incremental clearance sales to make room for new product as we

refocus our assortment had a positive impact on same store sales of

165 bps. Transition issues related to the October 2017 credit

outsourcing had an immaterial impact on same store sales in the

third quarter.

The increase in total sales of $34.8 million from the prior year

quarter was positively impacted by 1) same store sales growth; 2)

new revenue recognition accounting standards; and 3) the addition

of James Allen (acquired in September 2017). These factors were

partially offset by net store closures, the negative impact of a

calendar shift due to the 53rd week in Fiscal 2018 and unfavorable

foreign exchange translation.

eCommerce sales in the third quarter including James Allen were

$125.0 million, up 54.9% on a reported basis. James Allen sales

were $52.5 million in the quarter, up 13.6% compared to the prior

year quarter, and had a positive 50 bps impact on total company

same store sales. eCommerce sales increased across all segments and

accounted for 10.5% of third quarter sales, up from 7.0% of total

sales in the prior year third quarter.

By operating segment:

North America

- Same store sales increased 2.1%,

including the impact of initiatives across banners to increase

newness and refocus the product assortment and James Allen sales

growth which contributed 55 bps. Average transaction value ("ATV")

increased 4.5% while the number of transactions declined 1.1%.

Incremental clearance sales positively impacted same store sales by

approximately 190 bps, and a planned shift in timing of promotions

at Zales and Peoples unfavorably impacted same store sales by 85

bps. Same store sales also reflected a 55 bps unfavorable impact

related to the shift of service plan revenue recognized as

discussed above.

- Same store sales increased at Piercing

Pagoda by 16.2%, Zales by 2.8% and Kay by 0.7%. Zales results were

unfavorably impacted by 360 bps due to a planned shift in the

timing of promotions. Jared same store sales were flat.

- Fashion, bridal and watch sales

increased in the quarter on a same store sales basis, benefiting

from a greater percentage of newness in the core product assortment

and higher clearance sales. This increase was partially offset by

declines in the Other product category driven by a strategic

reduction of owned brand beads, as well as declines in other

branded beads. Bridal performance was driven by strength in

solitaires, the Enchanted Disney Fine Jewelry® collection and the

Love's Destiny collection, partially offset by declines in the Ever

Us® collection and the Tolkowsky collection. Fashion performance

was primarily driven by gold, particularly chains and bracelets,

and diamond earrings and pendants.

International

- International same store sales

decreased 3.1%, with ATV flat with the prior year and the number of

transactions decreasing 2.7%.

- The same store sales decline was

impacted by unfavorable traffic trends and a difficult consumer

environment. Higher sales in prestige watches were offset by lower

sales in diamond jewelry and fashion watches.

Gross margin was $371.2 million, or 31.1% of sales, up 330 basis

points. Factors impacting gross margin rate include 1) a positive

350 bps impact related to no longer recognizing bad debt expense

and late charge income; 2) a negative 40 bps impact related to the

discontinuation of credit insurance; 3) a negative 30 bps impact

related to James Allen, which carries a lower gross margin rate; 4)

a negative 30 bps impact related to a timing shift of revenue

recognized on service plans; and 5) a positive 20 bps impact

related to adopting new revenue recognition accounting standards,

including higher revenue share payments associated with the prime

credit outsourcing arrangement. The residual factors impacting

gross margin include unfavorable mix including higher clearance

inventory sales offset by transformation cost savings and lower

store occupancy costs due to store closures.

SGA was $410.3 million, or 34.4% of sales, compared to $375.9

million, or 32.5% of sales in the prior year. Prior year SGA

included $8.1 million in transaction costs related to the

acquisition of R2Net. SGA increased primarily due to 1) a $26

million increase in credit costs related to the transition to an

outsourced credit model; 2) a $16 million increase in advertising

expense; and 3) a $5 million increase in incentive compensation

expense. Increases in SGA were partially offset by transformation

cost savings, net of investments.

Other operating income was $0.2 million compared to $72.5

million in the prior year third quarter. The decrease is primarily

due to the sale of the prime accounts receivable in the third

quarter of Fiscal 2018, which resulted in less interest income

earned from a reduced receivable portfolio.

In the third quarter, Signet's GAAP operating income/(loss) was

$(48.8) million or (4.1)% of sales, compared to $5.5 million, or

0.5% of sales in the prior year third quarter. The operating income

margin decline was driven by a $46 million unfavorable impact

related to the outsourcing of credit, unfavorable banner mix,

higher advertising, the unfavorable impact of the timing shift on

revenue recognized on service plans, higher incentive compensation

expense and $9.5 million in restructuring charges due to store

closure costs, severance and professional fees related to the Path

to Brilliance transformation plan. These declines were partially

offset by transformation cost savings.

Non-GAAP operating loss was $(38.9) million, or (3.3)% of sales,

compared to $5.5 million, or 0.5% of sales in prior year third

quarter. Non-GAAP operating loss excluded $9.5 million in

restructuring charges related to the Path to Brilliance

transformation plan and $0.4 million in transaction costs related

to the non-prime credit outsourcing.

Income tax benefit was $29.2 million compared to income tax

benefit of $7.2 million in the prior year third quarter. The

current quarter GAAP effective tax rate was driven primarily by

pre-tax earnings mix by jurisdiction in the quarter. On a non-GAAP

basis, income tax benefit was $2.8 million for an effective tax

rate of 5.7%, driven by pre-tax earnings mix by jurisdiction.

GAAP diluted earnings per share ("EPS") of $(0.74) includes an

income tax benefit recognized in connection with the charges

associated with the Path to Brilliance transformation plan and

transaction costs related to the sale of non-prime

receivables. Using a normalized effective tax rate, our

non-GAAP loss per share was ($1.06).

GAAP and non-GAAP EPS in the quarter is based on net loss

available to common shareholders as the preferred shares are

anti-dilutive and excluded from the ending share count due to the

level of third quarter net loss.

Balance Sheet and Statement of Cash Flows

Net cash provided by operating activities was $313.5 million

year to date and free cash flow was $220.1 million, including

$445.5 million in proceeds from the sale of the non-prime

receivables. Excluding these proceeds, adjusted year to date free

cash flow was $(225.4) million. Cash and cash equivalents were

$130.7 million, compared to $113.4 million at the prior year

quarter-end.

Net accounts receivable, including accounts receivable held for

sale, were $14.1 million as of November 3, 2018, compared

to $640.1 million at the prior year quarter-end. The decrease in

receivables was primarily driven by the sale of the non-prime

portfolios.

Net inventories were $2.65 billion, up 7.3% compared to $2.47

billion at the prior year quarter-end. Our inventory balance

reflects our strategy to exit low-priced owned branded beads and

increase investments in bridal and certain fashion collections. The

increase in inventory was primarily due to investments in bridal

merchandise, particularly at Kay, as well as new on-trend designs

in fashion. The bridal investments include an increase in larger

carat weight and premium diamonds and fancy shapes as well as core

assortment including branded collections.

Short-term debt was $322.6 million, an increase of $30.8

million, compared to $291.8 million in the prior year quarter end.

Current year quarter short-term debt includes $282 million of

revolver borrowings. Prior year short-term debt included $256

million in borrowings on the revolver. Long-term debt was $660.4

million, down $36.4 million, compared to $696.8 million in the

prior year quarter end.

Fiscal year to date, Signet has repurchased 8.8 million shares

at an average cost per share of $55.06 or $485 million. As of

November 3, 2018, there was $165.6 million remaining under

Signet’s share repurchase authorization.

Signet Path to Brilliance Expected Savings and Restructuring

Costs

In March of 2018, the Company announced a three-year Signet Path

to Brilliance transformation plan to reposition the Company to be a

share gaining, OmniChannel jewelry category leader. The Company

continues to expect its transformation plan to deliver $200 million

- $225 million of net cost savings over the next three fiscal

years. The Company's estimates for pre-tax charges over the next

three fiscal years is a range of $170 million - $190 million, of

which $80 million - $95 million are expected to be cash

charges.

In Fiscal 2019, the Company expects net costs savings of $85

million - $100 million, with further incremental net cost savings

of $115 million - $125 million by the end of the three-year

program. Approximately two thirds of the Fiscal 2019 cost savings

have been achieved year to date. In Fiscal 2019, the Company's

preliminary estimates for pre-tax charges related to cost reduction

activities and inventory charges ranges from $129 million - $134

million, of which $40 million - $45 million are expected to be cash

charges.

Fiscal 2019 Financial Guidance

Fiscal 2019 Current Guidance Prior Guidance

Same store sales (excludes impact

ofrevenue recognition accounting standardchange)

flat - up 1.0% down 1.5% - flat Total sales $6.26 billion - $6.31

billion $6.2 billion - $6.3 billion GAAP diluted EPS $(7.40) -

$(7.07) $(7.47) - $(7.09) Non-GAAP diluted EPS $4.15 - $4.40 $4.05

- $4.40 Weighted average common shares - basic 55 million 55

million Weighted average common shares - diluted 62 million 62

million Capital expenditures $165 million - $185 million $165

million - $185 million Net selling square footage Approximately -5%

-4% - -5%

The above current Fiscal 2019 GAAP guidance reflects the

following assumptions:

- Same store sales guidance now includes

an unfavorable impact of 20 bps related to a timing shift of

service plan revenue recognized as a result of historical claims

experience shifting away from the earlier years of the service

plans to later years of the coverage period

- Impact of previously closed stores,

which had annual sales of $150 million in Fiscal 2018

- Application of new revenue recognition

accounting standard results in an increase to sales revenue of

approximately $111 million for amounts previously reflected as an

offset to operating expenses. Prior year will not be adjusted for

comparative purposes

- The Company plans to close more than

200 stores in Fiscal 2019 and open approximately 30 stores for a

net selling square footage decline of approximately 5%

- Transformation program net savings goal

of $85 million - $100 million. Approximately two-thirds of the

savings goal was achieved year-to-date

- Operating profit impact of negative

$134 million - $138 million due to the outsourcing of prime and

non-prime accounts receivable

- One-time pre-tax charges of $129

million - $134 million related to the transformation plan

- Pre-tax charge associated with the

credit transaction of $167 million

- Capital expenditures driven largely by

Kay off-mall stores, store remodeling and IT initiatives

- Expected GAAP tax benefit in the range

of $103 million - $109 million including the impact of impairment

charges, the loss associated with the sale of the non-prime

receivables, inclusive of the servicing fee and related transaction

costs, and restructuring charges

- Interest expense of approximately $40

million

- Share repurchases of $485 million

completed in the first half of Fiscal 2019

- For purposes of calculating both GAAP

and non-GAAP EPS, the Company expects to apply a share count that

excludes the preferred shares for the full year and a share count

including the preferred shares for the fourth quarter

Non-GAAP EPS guidance of $4.15 - $4.40 excludes restructuring

charges associated with the transformation plan, the loss

associated with the sale of the non-prime receivables and the

goodwill and intangible impairment charge. Non-GAAP EPS is computed

using a normalized tax rate of approximately 3% - 4%. The

revaluation of deferred tax assets associated with the United

States tax reform may result in discrete adjustments within

subsequent quarters which are excluded from the calculation of

non-GAAP EPS in Fiscal 2019.

Fourth Quarter Fiscal 2019 Financial

Guidance:

Fourth Quarter Fiscal 2019

Same store sales (excludes impact of

revenue recognition accountingstandard change)

down 1.5% - up 1.0% Total sales $2.17 billion - $2.22 billion GAAP

diluted EPS $ 3.02 - $3.33 Non-GAAP diluted EPS $ 4.35 - $4.59

Weighted average common shares - diluted 58.9 million

The above fourth quarter Fiscal 2019 GAAP guidance reflects the

following assumptions:

- Same store sales guidance now includes

an unfavorable impact of 30 bps related to a timing shift of

service plan revenue recognized as a result of historical claims

experience shifting away from the earlier years of the service

plans to later years of the coverage period

- Impact of previously closed stores,

which had annual sales of $52 million in the fourth quarter of

Fiscal 2018

- Application of new revenue recognition

accounting standard results in an increase to sales revenue of

approximately $36 million for amounts previously reflected as an

offset to operating expenses. Prior year will not be adjusted for

comparative purposes

- Lack of a 53rd week in the current year

fourth quarter. The 53rd week contributed $84 million in sales in

the fourth quarter of Fiscal 2018

- An operating profit impact of

approximately a negative $2 million to a positive $2 million as

compared to the fourth quarter of Fiscal 2018 related to the credit

outsourcing. This impact includes: 1) no finance or late charge

income; 2) no bad debt expense; 3) credit outsourcing expenses and

4) higher revenue sharing related to the prime outsourcing

arrangement

- Restructuring charges of approximately

$30 - $35 million related to Signet Path to Brilliance

restructuring program

- GAAP and non-GAAP EPS guidance is

calculated using net income before preferred dividend and applying

fully diluted share count

Non-GAAP EPS guidance of $4.35 - $4.59 excludes restructuring

charges associated with the transformation. Non-GAAP EPS is

computed using a normalized tax rate of approximately 3% - 4%. The

revaluation of deferred tax assets associated with the United

States tax reform may result in discrete adjustments within

subsequent quarters which are excluded from the calculation of

non-GAAP EPS in Fiscal 2019.

Conference Call:

A conference call is scheduled today at 8:30 a.m. ET and a

simultaneous audio webcast is available at www.signetjewelers.com.

The call details are:

Toll Free Dial-in: 833-245-9657

International Dial-in: +1 647-689-4229

Access code: 8682929

A replay and transcript of the call will be posted on Signet's

website as soon as they are available and will be accessible for

one year.

Holiday Sales Press Release Timing:

Signet Jewelers intends to announce its holiday sales results

via a press release before market open on Thursday, January 17,

2019. In light of the 53rd week in Fiscal 2018, this holiday

release will be distributed one week later versus prior year. As

previously announced, the company will not be hosting a holiday

sales results conference call.

About Signet and Safe Harbor Statement:

Signet Jewelers Limited is the world's largest retailer of

diamond jewelry. Signet operates nearly 3,500 stores primarily

under the name brands of Kay Jewelers, Zales, Jared The Galleria Of

Jewelry, H.Samuel, Ernest Jones, Peoples, Piercing Pagoda, and

JamesAllen.com. Further information on Signet is available at

www.signetjewelers.com. See also www.kay.com, www.zales.com,

www.jared.com, www.hsamuel.co.uk, www.ernestjones.co.uk,

www.peoplesjewellers.com, www.pagoda.com, and

www.jamesallen.com.

This release contains statements which are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements, based upon management’s

beliefs and expectations as well as on assumptions made by and data

currently available to management, appear in a number of places

throughout this document and include statements regarding, among

other things, Signet’s results of operation, financial condition,

liquidity, prospects, growth, strategies and the industry in which

Signet operates. The use of the words “expects,” “intends,”

“anticipates,” “estimates,” “predicts,” “believes,” “should,”

“potential,” “may,” “forecast,” “objective,” “plan,” or “target,”

and other similar expressions are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to a number of

risks and uncertainties, including, but not limited to, our ability

to implement Signet's transformation initiative, the effect of US

federal tax reform and adjustments relating to such impact on the

completion of our quarterly and year-end financial statements,

changes in interpretation or assumptions, and/or updated regulatory

guidance regarding the US federal tax reform, the benefits and

outsourcing of the credit portfolio sale including technology

disruptions, future financial results and operating results, the

impact of weather-related incidents on Signet’s business, the

benefits and integration of R2Net, general economic conditions,

potential regulatory changes or other developments following the

United Kingdom’s announced intention to negotiate a formal exit

from the European Union, a decline in consumer spending, the

merchandising, pricing and inventory policies followed by Signet,

the reputation of Signet and its banners, the level of competition

in the jewelry sector, the cost and availability of diamonds, gold

and other precious metals, regulations relating to customer credit,

seasonality of Signet’s business, financial market risks,

deterioration in customers’ financial condition, exchange rate

fluctuations, changes in Signet’s credit rating, changes in

consumer attitudes regarding jewelry, management of social, ethical

and environmental risks, the development and maintenance of

Signet’s omni-channel retailing, security breaches and other

disruptions to Signet’s information technology infrastructure and

databases, inadequacy in and disruptions to internal controls and

systems, changes in assumptions used in making accounting estimates

relating to items such as extended service plans and pensions,

risks related to Signet being a Bermuda corporation, the impact of

the acquisition of Zale Corporation on relationships, including

with employees, suppliers, customers and competitors, an adverse

decision in legal or regulatory proceedings, deterioration in the

performance of individual businesses or of the Company's market

value relative to its book value, resulting in impairments of fixed

assets or intangible assets or other adverse financial

consequences, including tax consequences related thereto,

especially in view of the Company’s recent market valuation and our

ability to successfully integrate Zale Corporation’s operations and

to realize synergies from the transaction.

For a discussion of these and other risks and uncertainties

which could cause actual results to differ materially from those

expressed in any forward-looking statement, see the "Risk Factors"

section of Signet's Fiscal 2018 Annual Report on Form 10-K filed

with the SEC on April 2, 2018 and quarterly reports on Form 10-Q

filed with the SEC. Signet undertakes no obligation to update or

revise any forward-looking statements to reflect subsequent events

or circumstances, except as required by law.

GAAP to Non-GAAP Reconciliations

The following information provides reconciliations of the most

comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

U.S. (“GAAP”) to presented non-GAAP financial measures. The company

believes that non-GAAP financial measures, when reviewed in

conjunction with GAAP financial measures, can provide more

information to assist investors in evaluating historical trends and

current period performance. For these reasons, internal management

reporting also includes non-GAAP measures. Items may be excluded

from GAAP financial measures when the company believes this

provides greater clarity to management and investors.

These non-GAAP financial measures should be considered in

addition to, and not superior to or as a substitute for the GAAP

financial measures presented in this earnings release and the

Company’s financial statements and other publicly filed reports. In

addition, our non-GAAP financial measures may not be the same as or

comparable to similar non-GAAP measures presented by other

companies.

In discussing financial results, the Company refers to free cash

flow which is not in accordance with GAAP and is defined as the net

cash provided by operating activities less purchases of property,

plant and equipment. Management considers adjusted free cash flow,

defined as free cash flow excluding proceeds from the sale of the

non-prime receivables, as helpful in understanding how the business

is generating cash from its operating and investing activities that

can be used to meet the financing needs of the business. Adjusted

free cash flow is an indicator used by management frequently in

evaluating its overall liquidity and determining appropriate

capital allocation strategies. Free cash flow and adjusted free

cash flow do not represent the residual cash flow available for

discretionary expenditure.

39 weeks ended (in millions)

November 3, 2018

October 28, 2017 Net cash provided by operating activities

$313.5 $1,482.3 Purchase of property, plant and equipment (93.4 )

(166.1 ) Free cash flow $220.1 $1,316.2

39 weeks ended (in millions)

November 3, 2018

October 28, 2017 Free cash flow $220.1 $1,316.2 Proceeds

from sale of prime receivables — (960.2 ) Proceeds from sale of

non-prime receivables (445.5 ) — Adjusted free cash

flow $(225.4 ) $356.0

13 weeks ended

39 weeks ended November 3, 2018 October 28,

2017 November 3, 2018 October 28, 2017 Gross

margin $371.2 $321.1 $1,283.0 $1,270.2 Restructuring charges - cost

of sales — — 63.2 — Non-GAAP gross

margin $371.2 $321.1 $1,346.2 $1,270.2

13 weeks ended 39 weeks ended November 3,

2018 October 28, 2017 November 3, 2018 October

28, 2017 Total GAAP operating income/ (loss) $(48.8 ) $5.5

$(681.1 ) $256.4 Charges related to transformation plan 9.5 — 98.8

— Loss related to goodwill and intangible impairment — — 448.7 —

Loss related to sale of non-prime receivables 0.4 —

167.4 — Total non-GAAP operating income / (loss)

$(38.9 ) $5.5 $33.8 $256.4

13 weeks

ended

39 weeks ended

November 3, 2018 October 28, 2017 November 3,

2018 October 28, 2017

North America segment GAAP operating

income /(loss)

$(19.5 ) $53.8 $(561.0 ) $350.2 Charges related to transformation

plan — —

53.7

— Loss related to goodwill and intangible impairment — — 448.7 —

Loss related to sale of non-prime receivables — —

160.4 —

North America segment non-GAAP operating

income/ (loss)

$(19.5 ) $53.8 $101.8 $350.2

13

weeks ended 39 weeks ended November 3, 2018

October 28, 2017 November 3, 2018 October 28,

2017

International segment GAAP operating

income /(loss)

$(4.4 ) $(1.7 ) $(18.1 ) $(1.9 ) Charges related to transformation

plan — — 3.8 —

International segment non-GAAP operating

income /(loss)

$(4.4 ) $(1.7 ) $(14.3 ) $(1.9 )

13 weeks ended 39

weeks ended November 3, 2018 October 28, 2017

November 3, 2018 October 28, 2017 Other segment GAAP

operating income / (loss) $(24.9 ) $(46.6 ) $(102.0 ) $(91.9 )

Charges related to transformation plan 9.5 — 41.3 — Loss related to

sale of non-prime receivables 0.4 — 7.0 —

Other segment non-GAAP operating income / (loss) $(15.0 )

$(46.6 ) $(53.7 ) $(91.9 )

13 weeks ended

November 3, 2018

October 28, 2017

GAAP effective tax rate 49.4 % 64.9 % Charges related to

transformation plan (4.0 )% — Loss related to sale of non-prime

receivables (0.2 )% — GAAP quarterly impact of annual tax benefit1

(39.5 )% — Non-GAAP effective tax rate 5.7 % 64.9 %

13 weeks ended

November 3, 2018 October 28, 2017

GAAP Diluted EPS $(0.74 ) $(0.20 )

Charges related to transformation plan1 0.14 — Loss related to sale

of non-prime receivables1 0.01 — GAAP quarterly impact of annual

tax benefit1 (0.47 )

—

Non-GAAP Diluted EPS $(1.06 ) $(0.20 )

Fiscal Q4'19Guidance LowEnd

Fiscal Q4'19Guidance HighEnd

Q4 GAAP Diluted EPS $3.02 $3.33 Charges related to transformation

plan1 0.48 0.41 GAAP quarterly impact of annual tax benefit1 0.85

0.85 Q4 Non-GAAP Diluted EPS $4.35 $4.59

Fiscal 2019Guidance LowEnd

Fiscal 2019Guidance HighEnd

2019 GAAP Diluted EPS $(7.40 ) $(7.07 ) Charges related to

transformation plan1 1.90 1.83 Loss related to goodwill and

intangible impairment1 7.59 7.56 Loss related to sale of non-prime

receivables1 2.06 2.08 2019 Non-GAAP Diluted EPS

$4.15 $4.40

1Reconciliation of GAAP and non-GAAP charges and losses includes

related tax impact.

Additional Information Regarding Credit

Outsourcing

From a financial perspective, Signet received nearly $1.4

billion due to the combined sale of its prime and non-prime

receivables portfolios. While the outsourcing of our credit

portfolio lowers our operating profit, it also lowers share count

and interest expense as proceeds from the sale transactions have

been used to pay down debt and repurchase shares. Additionally, the

transactions result in lower working capital requirements going

forward as Signet has no need for funding accounts receivable for

future sales to its prime customers and will only hold non-prime

receivables temporarily for two business days.

From an earnings perspective, after the prime and non-prime

portfolio of receivables were reclassified to held for sale and

subsequently sold, Signet no longer earns finance or late charge

income on those accounts and no longer incurs bad debt expense.

Signet will continue to pay some minimal fees directly to Genesis

for new account originations, while all other servicing costs are

included in the discount on forward receivables sold to investment

funds managed by CarVal and Castlelake. The discount on forward

receivables will be partially offset by the elimination of the

costs related to our former in-house credit operations.

In Fiscal 2018 there was a reduction in operating income of $21

million in the fourth quarter solely reflecting the impact of the

initial credit outsourcing of prime receivables to ADS and

servicing of non-prime receivables to Genesis. Our Fiscal 2019

non-GAAP guidance embeds an approximately $152 - $156 million

incremental year-over-year reduction in operating income reflecting

a combination of (1) an additional 8 months of impacts of the prime

outsourcing; (2) 2 months of servicing costs on the non-prime

portfolio receivables; and (3) 7 months of the impacts from the

future discount rate associated with new credit sales that

investment funds managed by CarVal Investors and Castlelake will

purchase. For Fiscal 2020, we expect a zero - $5 million positive

year-over-year impact on operating income. The 2020 estimate is

based on a contractual step up in revenue share profit percentage

associated with the prime outsourcing and an assumed discount rate

for the CarVal and Castlelake arrangement, and could change if the

discount rate were to reset higher or lower under certain review

provisions in the agreement.

(in millions) Fiscal 2018 Fiscal 2019E Fiscal

2020E Operating profit impact $ 18 $ (134 )-$(138) $ (129 )-$(138)

Operating profit impact year-over-year change $ (21 ) $ (152

)-$(156) $ 0-$5 Proceeds from sale of prime and non-prime

receivables $ 952 $ 445.5 — Note: Proceeds are

shown pre-transaction costs. Estimated operating profit impact is

based on anticipated levels of credit sales and accounts

receivable. (in millions) Fiscal Q1'19

Fiscal Q2'19 Fiscal Q3'19 Fiscal Q4'19 Operating profit impact year

over year change $ (69 ) $ (39 ) $ (46 ) $ 2-$(2 )

Note: Q4 estimated operating profit impact

is based on anticipated levels of credit sales and accounts

receivable.

Condensed Consolidated Income

Statements (Unaudited)

13 weeks ended 39 weeks ended (in

millions, except per share amounts)

November 3, 2018

October 28, 2017

November 3, 2018

October 28, 2017

Sales

$ 1,191.7 $ 1,156.9

$ 4,092.4 $

3,959.9 Cost of sales

(820.5 ) (835.8 )

(2,746.2 ) (2,689.7 ) Restructuring charges - cost of

sales

— —

(63.2 ) — Gross

margin

371.2 321.1

1,283.0 1,270.2 Selling, general

and administrative expenses

(410.3 ) (375.9 )

(1,337.9 ) (1,237.7 ) Credit transaction, net

(0.4 ) (12.2 )

(167.4 ) 2.6

Restructuring charges

(9.5 ) —

(35.6 )

— Goodwill and intangible impairments

— —

(448.7

) — Other operating income, net

0.2 72.5

25.5 221.3 Operating income (loss)

(48.8 ) 5.5

(681.1 ) 256.4 Interest

expense, net

(10.6 ) (16.6 )

(28.9 )

(42.7 ) Other non-operating income

0.3 —

1.4 — Income (loss) before income taxes

(59.1 ) (11.1 )

(708.6 ) 213.7 Income

taxes

29.2 7.2

159.1 (45.7 ) Net

income (loss)

$ (29.9 ) $ (3.9 )

$

(549.5 ) $ 168.0 Dividends on redeemable convertible

preferred shares

(8.2 ) (8.2 )

(24.6 )

(24.6 ) Net income (loss) attributable to common shareholders

$ (38.1 ) $ (12.1 )

$ (574.1

) $ 143.4 Earnings (loss) per common share:

Basic

$ (0.74 ) $ (0.20 )

$

(10.31 ) $ 2.24 Diluted

$ (0.74

) $ (0.20 )

$ (10.31 ) $ 2.24 Weighted

average common shares outstanding: Basic

51.5 60.1

55.7 64.0 Diluted

51.5 60.1

55.7 64.1

Dividends declared per common share

$ 0.37 $ 0.31

$ 1.11 $ 0.93

Condensed Consolidated Balance Sheets

(Unaudited)

(in millions, except par value per share

amount)

November 3, 2018

February 3, 2018

October 28, 2017

Assets Current assets: Cash and cash equivalents $ 130.7 $

225.1 $ 113.4 Accounts receivable, held for sale 4.8 — — Accounts

receivable, net 9.3 692.5 640.1 Other receivables 58.3 87.2 80.3

Other current assets 159.9 158.2 145.0 Income taxes — 2.6 17.3

Inventories 2,647.1 2,280.5 2,466.1 Total

current assets

3,010.1 3,446.1 3,462.2 Non-current assets:

Property, plant and equipment, net of

accumulated depreciation of $1,283.4,$1,197.6 and $1,162.7,

respectively

810.4 877.9 855.1 Goodwill 509.0 821.7 867.1 Intangible assets, net

340.2 481.5 410.4 Other assets 168.6 171.2 169.1 Deferred tax

assets 36.2 1.4 1.3 Retirement benefit asset 33.0 39.8

35.5 Total assets

$ 4,907.5 $

5,839.6 $ 5,800.7

Liabilities and Shareholders’

equity Current liabilities:

Loans and overdrafts

$ 322.6 $ 44.0 $ 291.8 Accounts payable 339.6 237.0 324.9 Accrued

expenses and other current liabilities 431.3 448.0 430.5 Deferred

revenue 253.1 288.6 270.3 Income taxes 19.1 19.6 —

Total current liabilities

1,365.7 1,037.2 1,317.5

Non-current liabilities: Long-term debt 660.4 688.2 696.8 Other

liabilities 233.2 239.6 244.4 Deferred revenue 671.7 668.9 646.1

Deferred tax liabilities 12.7 92.3 143.8 Total

liabilities

2,943.7 2,726.2 3,048.6

Commitments and contingencies

Series A redeemable convertible preferred

shares of $.01 par value:authorized 500 shares, 0.625 shares

outstanding (February 3, 2018 andOctober 28, 2017: 0.625 shares

outstanding)

614.8 613.6 613.1 Shareholders’ equity:

Common shares of $0.18 par value:

authorized 500 shares, 51.9 sharesoutstanding (February 3, 2018:

60.5 outstanding; October 28, 2017: 60.4outstanding)

15.7 15.7 15.7 Additional paid-in capital 294.2 290.2 285.6 Other

reserves 0.4 0.4 0.4

Treasury shares at cost: 35.3 shares

(February 3, 2018: 26.7 shares;October 28, 2017: 26.8 shares)

(2,418.0 ) (1,942.1 ) (1,945.2 ) Retained earnings 3,763.5 4,396.2

4,074.9 Accumulated other comprehensive loss (306.8 ) (260.6 )

(292.4 ) Total shareholders’ equity

1,349.0 2,499.8

2,139.0

Total liabilities, redeemable convertible

preferred shares and shareholders’equity

$ 4,907.5 $ 5,839.6 $ 5,800.7

Condensed Consolidated Statements of

Cash Flows (Unaudited)

39 weeks ended (in millions)

November 3, 2018

October 28, 2017

Cash flows from operating activities Net income (loss)

$ (549.5 ) $ 168.0 Adjustments to reconcile

net income (loss) to net cash provided by operating activities:

Depreciation and amortization

138.4 147.1 Amortization of

unfavorable leases and contracts

(5.9 ) (10.8 )

Pension benefit

(0.7 ) (3.6 ) Share-based

compensation

15.5 11.0 Deferred taxation

(113.2

) 41.7 Credit transaction, net

160.4 (30.9 ) Goodwill

and intangible impairments

448.7 — Restructuring charges

80.2 — Amortization of debt discount and issuance costs

1.5 3.2 Other non-cash movements

(4.1 ) 1.5

Changes in operating assets and liabilities: Decrease in accounts

receivable held for investment

37.6 286.1 Decrease in

accounts receivable held for sale

17.5 — Proceeds from sale

of in-house finance receivables

445.5 960.2 Decrease in

other assets and other receivables

31.9 17.1 (Increase)

decrease in inventories

(456.6 ) 4.6 Increase in

accounts payable

106.5 39.7 Decrease in accrued expenses and

other liabilities

(7.3 ) (5.4 ) Decrease in deferred

revenue

(31.8 ) (29.5 ) Increase (decrease) in income

taxes payable

2.0 (115.3 ) Pension plan contributions

(3.1 ) (2.4 ) Net cash provided by operating

activities

313.5 1,482.3

Investing

activities Purchase of property, plant and equipment

(93.4 ) (166.1 ) Proceeds from sale of assets

5.5 — Purchase of available-for-sale securities

(0.6

) (1.7 ) Proceeds from sale of available-for-sale securities

9.0 0.9 Acquisition of R2Net Inc., net of cash acquired

— (332.4 ) Net cash used in investing activities

(79.5 ) (499.3 )

Financing activities

Dividends paid on common shares

(59.8 ) (57.7 )

Dividends paid on redeemable convertible preferred shares

(23.4 ) (26.9 ) Repurchase of common shares

(485.0 ) (460.0 ) Proceeds from term loans

—

350.0 Repayments of term loans

(22.3 ) (365.7 )

Proceeds from securitization facility

— 1,745.9 Repayments

of securitization facility

— (2,345.9 ) Proceeds from

revolving credit facility

698.0 605.0 Repayments of

revolving credit facility

(416.0 ) (405.0 )

Repayments of bank overdrafts

(10.1 ) (5.9 ) Other

financing activities

(2.1 ) (4.5 ) Net cash used in

financing activities

(320.7 ) (970.7 ) Cash and cash

equivalents at beginning of period

225.1 98.7 (Decrease)

increase in cash and cash equivalents

(86.7 ) 12.3

Effect of exchange rate changes on cash and cash equivalents

(7.7 ) 2.4 Cash and cash equivalents at end of

period

$ 130.7 $ 113.4

Real Estate Portfolio:

Signet has a diversified real estate portfolio. On

November 3, 2018, Signet had 3,478 stores totaling 4.9 million

square feet of selling space. In the third quarter, store count

decreased by 15 and square feet of selling space decreased 0.3%.

Compared to year end Fiscal 2018, store count decreased by 78 and

square feet of selling space decreased 1.9%.

Store count by banner

February 3, 2018 Openings Closures

November 3, 2018

Kay 1,247 30 (31 ) 1,246 Zales 704 3 (24 ) 683 Peoples 129 1 (6 )

124 Jared 274 1 (5 ) 270 Piercing Pagoda 598 — (16 ) 582 Regional

banners 100 — (21 ) 79

North America segment

3,052 35 (103 ) 2,984 H.Samuel 301 — (6 ) 295 Ernest

Jones 203 3 (7 ) 199

International segment 504

3 (13 ) 494

Signet 3,556 38 (116

) 3,478

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181206005257/en/

Investors:Randi AbadaSVP Corporate Finance Strategy &

Investor Relations+1-330-668-3489randi.abada@signetjewelers.com

Media:David BouffardVP Corporate

Affairs+1-330-668-5369david.bouffard@signetjewelers.com

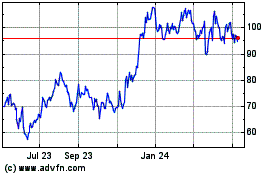

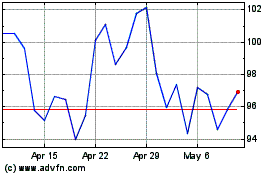

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024