Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 12 2021 - 8:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of April 2021

Commission File Number: 001-35135

Sequans Communications S.A.

(Translation of Registrant’s name into English)

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone : +33 1 70 72 16 00

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F R Form 40-F £

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes £ NoR

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes £ NoR

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

The information in this report, furnished on Form 6-K, shall be incorporated by reference into each of the following Registration Statements under the Securities Act of 1933, as amended, of the registrant: Form S-8 (File Nos. 333-177919, 333-180487, 333-187611, 333-194903, 333-203539, 333-211011, 333-214444, 333-215911, 333-219430, 333-226458, 333-233473 and 333-239968) and Form F-3 (File No. 333-250122).

Issuance of Equity and Convertible Debt in a Private Placement

On April 6, 2021, Sequans Communications S.A. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Lynrock Lake Master Fund LP, as Purchaser, providing for the issuance to the Purchaser of an unsecured convertible note (the “Note”) in an aggregate principal amount of $40 million and 7,272,724 ordinary shares in the form of 1,818,181 American Depositary Shares (“ADSs”) for $10 million. The transaction closed on April 9, 2021.

The Note shall accrue interest at 6.0% per annum if paid in kind and at 5.0625% per annum if paid in cash. The Note is due April 9, 2024 and is convertible at the option of the Purchaser at any time at a conversion price of $7.66 per ADS. After April 9, 2022, in the event that the market price of Company’s ADS exceeds 130% of the Note conversion price for 20 out of any 30 consecutive days, the Company has the right to redeem the Note at an amount equal to the accreted principal amount plus accrued but unpaid interest, plus a cash amount equal to the interest that would otherwise be payable to October 9, 2023, or the Purchaser may elect to convert and receive the ADSs plus a cash amount equal to the interest that would otherwise be payable to October 9, 2023. The Purchaser also has the right to require the Company to redeem the Note in the event of a change of control at an amount equal to the accreted principal amount plus accrued but unpaid interest, plus a cash amount equal to the interest that would otherwise be payable to April 9, 2024. If the Purchaser elects to convert the Note in connection with a change of control, the Purchaser will also receive a cash amount equal to the interest that would otherwise be payable to April 9, 2024. The Purchaser’s right to convert is limited such that Purchaser does not own directly more than 9.99% of the outstanding shares of the Company.

The Company also entered into a registration rights agreement (the “Registration Rights Agreement”) with the Purchaser pursuant to which the Company shall file a registration statement to register the resale of the 1,818,181 ADSs and the ADSs issuable upon the conversion of the Note.

The above description is qualified in its entirety by the terms of the Purchase Agreement, the Note and the Registration Rights Agreement, which are filed as Exhibits 4.1, 4.2 and 4.3 to this Form 6-K, which is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEQUANS COMMUNICATIONS S.A.

(Registrant)

|

|

|

Date: April 12, 2021

|

By:

|

/s/ Deborah Choate

|

|

|

|

|

Deborah Choate

|

|

|

|

|

Chief Financial Officer

|

|

|

|

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

Exhibit Description

4.1 Securities Purchase Agreement, dated April 6, 2021, between Sequans Communications S.A. and Lynrock Lake Master Fund LP

4.2 Convertible Promissory Note, dated April 9, 2021, between Sequans Communications S.A. and Lynrock Lake Master Fund LP

4.3 Registration Rights Agreement, dated April 9, 2021, between Sequans Communications S.A. and Lynrock Lake Master Fund LP

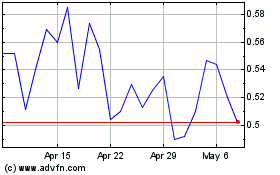

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

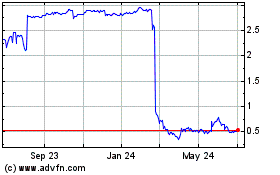

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024