UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of May 2023

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

São Paulo, May 4, 2023 - Assaí Atacadista

announces its results for the first quarter of 2023. All comments on adjusted EBITDA exclude other operating expenses and income

in the periods. Figures also include the effects of IFRS 16/CPC 06 (R2) – Leases, which eliminates the distinction between operating

and financial leases, except where stated otherwise.

|

SALES GROWTH OF +33%, ON STRONG COMPARISON BASIS,

WITH CONTINUED MARKET SHARE GAINS (+2.4 p.p)

ADVANCES ON EXPANSION WITH CONCLUSION OF 75%

OF CONVERSIONS PROJECT |

| “We started 2023 with the conclusion of more

than 75% of the conversions project, which performance of sales and margins, although in operation for only a few months, reinforces the

quality of the stores. The continuous gains of market share totaled 2.4 p.p. in 1Q23 and show the success of the commercial dynamics of

Assaí. We also advanced in the phygital strategy with the conclusion of the rollout of the new app “Meu Assaí”.

With the election of the new Board of Directors, formed mostly by independent members, Assaí has become a Corporation, and we will

keep improving Company’s corporate governance. |

| We will follow our strategy of delivering a good purchase

experience to our customers, consolidating the strength of our brand and the value proposition of Assaí business model, growing

with profitability, and creating value and jobs. I thank everyone who is with us in this journey.” |

Belmiro Gomes, CEO of Assaí

CONSISTENT SALES GROWTH

Net sales came to R$15.1 billion in 1Q23, increasing +31.9% and

R$ 3.7 billion in comparison with 1Q22. This performance results mainly from:

| (i) | the strong performance of the 59 stores inaugurated over the last 12 months

(+24.7%), especially the hypermarket conversions; |

| (ii) | the advance of the ‘same-store’ sales (+7.2%), even facing (a)

a macroeconomic scenario that still affects the purchasing power of the population, which, consequently, impacts the customer’s

consumption level, and, (b) a strong comparison basis, especially in March; |

| (iii) | the well-executed sales strategy that aimed to (a) balance sales growth

and a margin level suited to market competitiveness and (b) bring agility in the assortment and services adjustments to meet the customer

demands of each region; and |

| (iv) | the growing customer traffic at our stores, given the constant investments

to improve the shopping experience and the high attractiveness of Assaí business model. |

Due to these factors, the Company continued recording

market share gains, in total-store (+2.4 p.p.) and ‘same-store’ sales basis in the regions where Assaí operates.

CONTINUED

EXPANSION PLAN WITH ADVANCES IN CONVERSIONS PROJECT

Assaí

ended 1Q23 with 266 stores in operation and total sales area exceeding 1.3 million square meters. In the last 12 months, 59 new units

were inaugurated, totaling an increase of 367 thousand square meters to the sales area, an expansion of +38% in comparison with 1Q22.

After the inauguration of 3 hypermarket conversions

in the quarter, two of which in the state of São Paulo and one in Rio de Janeiro, the Company completed 50 conversions, equivalent

to more than 75% of the project and which, added up, nearly 320 thousand square meters to the network of Assaí stores. |

|

|

Presence in central and well-located commercial points,

together with the strong attractiveness of Assaí business model, provide high customer traffic. Therefore, operating only for 5

months on average, conversions, which maturation curve is more accelerated than the organic expansion, present revenues above R$ 21M/month,

higher than the Company’s average and equivalent to a sales uplift of 2.2x when compared to the total sales under the hypermarket

format and of 3.2x when considering just the food perimeter. The margins of the converted stores are nearly 5%, in line with the Company's

strategy of balancing sales growth with a margin level that suits to the market competitiveness.

Also, 28 stores are currently under construction, of which

13 hypermarket conversions and 15 organic stores

PHYGITAL STRATEGY ADVANCES WITH THE LAUNCH

OF THE APP “MEU ASSAÍ”

Available

throughout Brazil since April 2023 and supported by a robust CRM system, the new app “Meu Assaí” will provide greater

knowledge of the consumption habits of Assaí customers, and also offer better shopping experience for consumers by uniting the

experience of the physical world with the online one. The app underlines the Company’s phygital strategy through its new

functionalities, such as exclusive campaigns and customized offers to both the end customer and the B2B, aiming to customer loyalty and

incentive to consumption of new categories, as well as greater proximity to suppliers. |

|

|

|

|

The app was among the 5 most downloaded apps in

the week of its launch. The CRM basis already has more than 7 million customers registered, with 30% of identified tickets, whose average

value is 40% higher than the Company’s average.

Also, revenues from online sales using last milers

applications, which are available in 60 cities and 17 states, grew significantly, with the best quarterly performance since the beginning

of operations. Sales increased +96% compared to 1Q22 and +16% compared to 4Q22. |

OPERATING RESULTS

Gross profit achieved R$2.4 billion in 1Q23, up 33.0% on 1Q22

and in line with the sales growth for the period, with margin of 16.1%. The advance is mainly due to:

| (i) | the initial performance of hypermarkets conversions, which presents record

of customers traffic and high margins, especially when considering the few months of operations; and |

| (ii) | the commercial strategy to cope with the strong advance of the expansion

and the macroeconomic scenario that puts pressure on the purchasing power of the population. |

This result, together with the market share gains in total-store

and ‘same-store’ sales basis during the last quarters, proves the efficiency of Assaí business model and the success

of the Company’s strategy to keep the equilibrium between sales grow and margin level adequate to the competitiveness of the market.

|

|

Selling, general and administrative expenses represent

10.0% of the quarterly net sales, which is mainly due to the 59 stores inaugurated in the last 12 months that still in the beginning of

the maturation curve.

Equity income from Assaí’s participation

of approximately 18% in the capital of FIC came to R$12 million in 1Q23, an increase of R$ 4 million on 1Q22 due to lower default than

expected. Passaí cards issued totaled 2.3 million at the end of the period and represents 4.4% of sales. |

Adjusted EBITDA reached R$951 million in 1Q23, an increase of

R$200 million on 1Q22, a growth equivalent to 26.5%. The margin of 6.3% was affected by expansion-related pre-operating expenses (-0.1

p.p.) and by the strong advance of the expansion in 4Q22, with the opening of 37 new stores that are still in the early stage of maturation.

FINANCIAL RESULT DIRECTLY AFFECTED BY

HIGHER INTEREST RATES

The net financial result post-IFRS16 was R$ 630 million

at the quarter-end, equivalent to 4.2% of net sales. Net financial expenses excluding the effects from interest on lease liabilities amounted

to R$ 428 million, corresponding to 2.8% of net sales. This is the result of the effect of increased interest rates, with CDI growth from

2.43% in 1Q22 to 3.25% in 1Q23, and the higher volume of gross debt resulting from the Company’s strong expansion.

NET INCOME AFFECTED BY A CHALLENGING

MACRO SCENARIO

Net income reached R$72 million in the quarter, with a 0.5% margin,

due to the high interest rate scenario, which significantly affected the financial result in the period.

INVESTMENTS LEVEL REFLECTS ADVANCE IN

EXPANSION

Total quarterly investments amounted to R$ 450 million.

This level mainly reflects the inauguration of 3 new conversions in 1Q23 and the advance in the Company’s expansion process, with

28 stores under construction, of which 13 are hypermarket conversions and 15 are organic stores.

INDEBTEDNESS IN LINE WITH THE STRONG

ADVANCE IN EXPANSION

The net debt/Adjusted EBITDA ratio reached 2.78x in 1Q23 and

is within the Company’s expectations in the context of high investments. The current level is explained by (i) payments related

to the acquisition of hypermarket commercial points; (ii) investments in 59 stores in the last 12 months; and (iii) continuity of the

expansion project, with 28 stores under construction, of which 13 conversions and 15 organics.

Net Debt / EBITDA is in line with the previous quarters, excluding

the seasonality of 4Q22, due to the investment in the conversion project:

CASH GENERATION OF R$ 2.9 BILLION IN

1Q23

Operating cash generation reached R$ 2.9 billion in the

last 12 months. The result is in line with the Company's expectations, given the expansion progress, with 59 stores opened in the last

12 months that are in the maturation phase, in addition to the 28 stores under construction.

In the last 12 months, the net amount referring to the

acquisition of commercial points of hypermarket totaled R$ 70 million, since it considers the reimbursements received referring to the

owned properties that were sold to the real estate fund.

ESG STRATEGY

Assaí, as an inherent part of its business model, implements

initiatives to foster a more responsible and inclusive society based on five strategic pillars:

1.

Combating Climate Change: innovating and enhancing environmental management;

2.

Integrated Management and Transparency: improving ESG practices through ethical and transparent

relationships;

3.

Transforming the Value Chain: co-building value chains committed to the environment and people;

4.

Engaging with Society: acting as an agent of change to promote fair and inclusive opportunities;

5.

Valuing our People: being a reference in fostering diversity, inclusion and sustainability

through our employees.

ESG highlights of 1Q23 include:

·

Donation of 35.4 tons of food and hygiene and cleaning items to families in situations of

vulnerability affected by the heavy rains in Bahia, Acre, Maranhão, North Coast of São Paulo and the Yanomami Indigenous

populations.

| · | Increase of 78% in combatting waste of food in the stores. In line

with the social strategy of Combating Food Insecurity, the Company became signatory of the Everyone around the Table Movement,

a Brazilian coalition of companies and organizations that join to reduce the impacts of hunger in Brazil and to work in the reduction

of food waste. |

| · | Advances in the commitment to increase diversity and equal opportunities

for everyone: |

| o | 25.5% of women in leadership positions (manager and above) (+1.2 p.p. vs.

1Q22); |

| o | Increase of 41% (vs. 1Q22) in the transgender work force; |

| o | 64.1% of employees self-declared black or brown, with an increase of almost 10 thousand employees; |

| o | 5th Woman’s Week – approaching themes such as Career, Combating

Violence Against Women, Sisterhood and Women’s Empowerment – 23,236 employees attended it, 153% higher than in 1Q22; and |

| o | Recognition in two categories in the Great Place to Work (GPTW) Diversity

Ranking: among the 10 best companies to work for people above 50 and for inclusion of persons with disabilities. |

Also, Assaí disclosed in April

the Company’s Annual and Sustainability Report on its performance in 2022. (Click here to access

the document). In the report, we reinforce our commitments on ESG fronts, such as the goal of reducing emissions by 38% by

2030 (base year 2015).

ABOUT SENDAS S.A.

Assaí is a cash and carry wholesaler serving small and

midsized merchants as well as consumers in general seeking unit items as well as large volumes. With gross sales of around R$ 60 billion

in 2022, Assaí is the 2nd largest Brazilian retail company and one of the 10 best Brazilian companies to work for in

its segment (“Super Large” category, according to the GPTW 2022). Present in the five regions of the country, Assaí

has more than 260 stores distributed in 23 states (in addition to the Federal District) and has more than 70 thousand employees.

Since 2021, Assaí shares have been traded both on the

São Paulo Stock Exchange (B3) - under the ticker ASAI3 - and on the New York Stock Exchange (NYSE), being the only one in its segment

listed on both. In 2022, the Company was considered Top of Mind in the “Wholesale” category in a survey carried out by the

Datafolha Institute; and elected the best company in the “Retail Trade” branch of Valor 1000. Assaí is among the 20

most valuable brands in the country in an annual ranking promoted by Interbrand, being the 1st in food retail.

INVESTOR RELATIONS CONTACTS

Gabrielle Castelo Branco Helú

Investor Relations Officer

Ana Carolina Silva

Beatris Atilio

Daniel Magalhães

E-mail: ri.assai@assai.com.br

Website: www.ri.assai.com.br

APPENDICES

OPERATIONAL INFORMATION

I – Number of stores and sales area

FINANCIAL INFORMATION

II – Income Statement

III – Balance Sheet

IV – Cash Flow

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 4, 2023

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

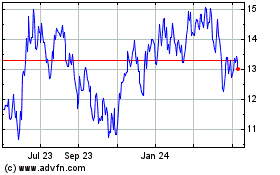

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

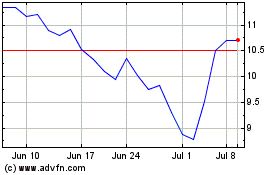

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024