UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of February 2023

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes: o

No: ý

(Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes: o No: ý

São Paulo, February 15, 2023 - Assaí Atacadista

announces its results for the fourth quarter of 2022. All comments on adjusted EBITDA exclude other operating expenses and income in the

periods. Figures also include the effects of IFRS 16/CPC 06 (R2) – Leases, which eliminates the distinction between operating and

financial leases, except where stated otherwise.

OPENING RECORD OF 60 STORES IN 2022,

REACHING 263 STORES IN OPERATION: +36% IN SALES AREA

ROBUST SALES GROWTH WITH INCREASING MARKET

SHARE GAINS THROUGHOUT THE YEAR

HIGHER-THAN-EXPECTED PROFITABILITY: EBITDA

MARGIN OF 7.2% IN 2022

|

| · | Gross Sales amounted R$59.7 billion, up R$14.1

billion on 2021, which represents a significant growth of +31%, while ‘same-store’ sales increased more than

+10%; |

| · | Adjusted EBITDA of R$3.9 billion, up +25%¹, with

margin of 7.2%, 0.2 p.p. above expectations, and expenses stable even with the business model evolution and opening

of 60 stores in the year, surpassing the initial guidance of 52 stores; |

| · | Net income attained R$1.2 billion, consistent level

and in line² with 2021, even considering investments to implement the hypermarket conversion project and the high interest rates; |

| · | Investments reached R$ 4.5 billion, a historic level,

with significant job creation, consolidating the Company as one of the 6th largest private employers in the Brazil; |

| · | Record cash generation of R$ 4.2 billion in the last

12 months, which represents an increase of R$ 1.8 billion on the prior-year period, driven by the Company's strong growth and efficient

working capital management; |

| · | Gross sales reached R$17.4 billion, a significant

increase of +38% on 4Q21, mainly driven by the great performance of new stores, especially hypermarket conversions, and

by the resilient same-store sales growth of 10.5%; |

| · | Gross margin of 17.2%, stable in comparison to 4Q21,

supported by initial performance of converted stores and by a commercial strategy that suits to the competitive environment, which resulted

in the yearly highest market share gain on both total-store and same-store basis; |

| · | Record Adjusted EBITDA of R$

1.2 billion, up +29% on 4Q21, with margin of 7.3%, driven by the

more resilient stores portfolio, with the rapid maturation of converted stores; |

| · | Net income of R$ 406 million in 4Q22, +7.3%² compared

to 4Q21, confirming the success of the business model even facing a scenario of higher interest rates and strong Company’s expansion; |

| · | Store openings beat guidance: 60 new stores in the year,

of which 47 conversions and 13 organic, reaching 1.3 million sqm of sales area; |

| - | 37 store openings in 4Q22: 33 conversions and 4 organics |

| · | Stores converted in 2022 are among the top performers:

|

| |

- |

Rapid maturation of sales in line with expectations: with an average of around 2 months of operation,

converted stores sales are between 2x and 2.5x higher than the hypermarket format; |

| |

- |

High attractiveness of stores with intense customer traffic leveraged by the brand strength, differentials

of Assaí business model and exceptional location of commercial points; |

| · | Conclusion of hypermarket conversion project and continuity

of the organic expansion, with around 40 stores in 2023; |

| · | Focus on the deleveraging process supported by continuous

cash generation, with the objective of a Net Debt/Adjusted EBITDA ratio nearly 2x by the end of 2023 and around 1.5x in 2024. |

1Excluding Fiscal Credits (as detailed

on page 4)

2For comparison purposes, variation

considers only recurring effects of investment subsidies for the periods and excludes fiscal credits effects (as detailed on page 4).

MESSAGE FROM MANAGEMENT

2022 was a historic year for Assaí, with record

gross sales and market share gains in important regions, while beating the expectations for profitability even facing the challenges imposed

by the macroeconomic scenario.

With an investment of R$ 4.5 billion in 2022, the

highest level in Company’s history, Assaí inaugurated 60 stores, of which 13 are organic and 47 are conversions of hypermarkets,

beating its initial guidance of 52 new stores for the year and setting a new record for openings not only for the Company, but also for

the national retail and wholesale food segment. We ended the year with 263 stores in operation in 23 states and the Federal District,

with total sales area of over 1.3 million square meters, a 36% growth compared to 2021. Additionally, investments in the period were aimed

at enhancing the shopping experience, with the improvement of the product assortment (such as Wine Cellars) and the implementation of

services (Cold Cuts Emporiums and Butcheries, for example), allowing us to conquer new customers and generate incremental sales.

We created 16,000 new jobs, placing Assaí among

the six largest private employers in Brazil. This robust growth was accompanied by advances in the ESG agenda: we donated 1,800 tons of

produce to the partner organizations of the program Destino Certo (+44% more than in 2021) and increased the number of Blacks in executive

positions by 45%, maintaining our permanent commitment to diversity and inclusion.

Reflecting these actions, the Company was included

in leading stock indexes focusing on sustainability: Corporate Sustainability Index of B3 (ISE B3); Carbon Efficient Index (ICO2); Great

Place to Work Index (IGPTW B3), that recognizes companies as an excellent place to work; and the Bloomberg Gender Equality Index. Also,

we made progress in corporate governance with the approval of changes in the Bylaws, which established limits for related parties transactions.

The consistent performance of expansion combined with

the successful commercial strategy resulted in gross sales growth of 31%, reaching nearly R$ 60 billion in 2022. EBITDA margin reached

7.2%, even after the inauguration of more stores than expected initially, attesting once again to the exceptional operational and commercial

efficiency of Assaí. Net income amounted R$ 1.2 billion even in the context of higher interest rates and large investments.

The phygital strategy continues to advance rapidly,

offering customers greater convenience through the strengthening of last milers partnerships and the "Meu Assaí" app,

which is in rollout across the country.

Over the coming months, we will deliver the remaining

conversions and will continue with the organic expansion, opening around 40 new stores in 2023. On the innovation agenda, we will continue

improving and investing in digital initiatives and other growth avenues.

In closing, we once again thank our employees, investors,

suppliers and other stakeholders for their trust and dedication during 2022 and remain firm in our purpose of offering a transformational

experience to our customers.

The Management.

INCOME STATEMENT

For comparison purposes, all figures and comments below exclude

the following effects from tax credits:

| (i) | R$ 216 million in the net income of 4th quarter of 2021, related to investments

subsidies in prior periods; |

| (ii) | R$ 372 million in the net income of 2021 fiscal year, which are related to: |

| a. | exclusion of ICMS from the PIS and COFINS tax calculation base in 2021, which amounted to R$ 175 million

in net sales and R$ 115 million in net income; |

| b. | unconstitutionality of the levying of Corporate Income Tax (IRPJ) and Social Contribution on Net Income

(CSLL) on the income pegged to the SELIC rate received by the taxpayer on the repetition of undue tax payments in the total amount of

R$ 81 million (affecting the income tax and social contribution and net income lines) |

| c. | inflation adjustments of the aforementioned tax credits in the amount of R$ 45 million in financial result

and R$30 million in net income; and |

| d. | investments subsidies related to periods prior to fiscal year, which impacted net income in 2021 in the

amount of R$ 146 million. |

| (iii) | R$ 72 million in net income for the 4th quarter of 2022 and fiscal year 2022, referring

to inflation adjustments, in the amount of R$ 109 million, related to the reimbursement of ICMS-ST. |

STRONG COMPANY’S EXPANSION

RESULTS IN RECORD SALES

Net sales in the quarter reached R$16.0 billion, a quarterly

record, representing a growth of +38.1% and an increase of R$ 4.4 billion on 4Q21. The solid performance is mainly due to:

| (i) | the strong contribution from the expansion project (+27.8%), especially the conversions of hypermarkets,

whose performance is in line with expectations; |

| (ii) | the resilient “same-store” sales performance (+10.5%), which confirms the high attractiveness

of the business model, even in a scenario of high inflation that continues to pressure consumer purchasing power; |

| (iii) | the effective commercial strategy, which drove high customer traffic and market share gains; and |

| (iv) | the constant enhancements to the shopping experience, with fast adaptation of assortment and services. |

In 2022, net sales came to R$ 54.5 billion, increasing +30.7%

and R$ 12.8 billion in relation to 2021, demonstrating once again the Company's top notch operational management and execution capacity.

60 NEW STORES IN 2022, WITH CONVERSIONS MATURING RAPIDLY

Assaí ended 2022 with 263 stores in operation,

with total a sales area of 1.3 million square meters and an increase of 36% in comparison to 2021. The Company’s expansion in 2022

surpassed the initial opening guidance of 52 new stores and set a new opening record for a single year, increasing the built-up area by

around 1 million square meters.

The expansion in the period was driven by the intense

acceleration in the hypermarket conversion calendar, with 47 stores opened in the second half of 2022, which added to the store network

around 300,000 square meters in sales area and 30,000 new parking spaces.

In addition, 13 organic stores were opened in 8 states,

further helping to strengthen and consolidate the Assaí brand nationwide.

Another highlight was the performance of converted

stores, with an average of 2 months of operation, already are among the Company's top performers in sales and customer traffic, reflecting

mainly the highly attractive business model of Assaí, the brand's strength and the exceptional locations of commercial points.

Converted stores delivered between 2x to 2.5x the sales of the hypermarket format, reinforcing the expectations of the conversion project.

STRENGTHENING PARTNERSHIPS WITH

LAST MILERS

AND ROLLOUT OF THE APP “MEU ASSAÍ”

Assaí continues advancing in the Phygital environment,

offering greater convenience and a better shopping experience for customers through partnerships with last-mile operators, which currently

is available in 60 cities and over 160 stores. Online sales continue to evolve and increase sequentially boosted mainly by the Company’s

presence in more central regions, with the opening of converted stores.

Additionally, the rollout of "Meu Assaí"

app, with new features that include exclusive and personalized offers, is being implemented in 6 Brazilian states, improving the customer's

shopping journey by combining the experience of the physical world with the online one.

OPERATIONAL PERFORMANCE ABOVE EXPECTATIONS

DUE TO ACCELERATED EXPANSION

Quarterly gross profit amounted to R$ 2.7 billion, with

margin of 17.2%, stable in relation to 4Q21. The result was driven mainly by the excellent commercial dynamics and initial performance

of converted stores, which present fast maturation. The solid market share gains in the quarter on both a total-store and same-store basis

demonstrate once again the Company's operational efficiency and the consistency of Assaí's business model, which, through investments

in the modernization of its store network, continues to offer continuous improvement in the shopping experience and conquering new customers.

In 2022, gross profit was R$ 9.0 billion, with margin of 16.4% (vs. 16.7% in 2021) mainly due to the effective commercial strategy amid

increased competition and the historic Company’s expansion.

Selling, general and administrative expenses corresponded

to 10.0% of net sales in the quarter mainly reflecting the effects of the pre-operating expenses related to the expansion project, with

the historic opening of 37 stores in the period. In 2022, selling, general and administrative expenses corresponded to 9.5% of sales,

similar to 2021, chiefly due to strict expenses control carried out throughout the year in a context of strong expansion.

Equity income came to R$ 10 million in the quarter and R$

44 million in the year and reflects Assaí's interest of approximately 18% in the capital of FIC. The Passaí card surpassed

2.2 million cards issued and enjoys excellent growth potential given the advances in the expansion project.

Other operating expenses amounted to R$ 13 million in 4Q22

and refers mainly to asset write-offs related to the conclusion of the sale of assets announced in a material fact published in July 2021.

In 2022, other operating expenses totaled R$ 72 million and include, mainly, the provision for the write-off of assets from closed stores

due to the hypermarket conversion project.

Adjusted EBITDA in the quarter was a record R$ 1.2 billion with

margin of 7.3%. In 2022, adjusted EBITDA was R$ 3.9 billion, with margin of 7.2%. The result beat expectations, even after the higher

number of stores opened in 2022, confirming once again the Company's excellent execution capacity and commitment to meeting results.

FINANCIAL RESULT AFFECTED BY HIGHER

INTEREST RATES

In the quarter, the net financial expense post-IFRS16

stood at R$ 445 million, representing 2.8% of net sales. Excluding the effect from interest on lease liabilities, the net financial expense

was R$ 269 million, equivalent to 1.7% of net sales, similar to 4Q21. Excluding effects of inflation adjustments related to the reimbursement

of ICMS-ST recognized in 2022 (as detailed on page 4), net financial expenses represents 2.4% of net sales. The result was affected by

high interest rates, with the CDI 1.7x higher than 4Q21, increasing from 1.9% to 3.2%, and the higher gross debt balance related to the

record investments in Company’s expansion.

In the year, the net financial expense post-IFRS16

amounted to R$ 1.5 billion, representing 2.8% of net sales. Net financial expenses pre-IFRS16, excluding interest on lease liabilities,

came to R$1.0 billion, corresponding to 1.8% of net sales (vs. 1.0% in 2021), mainly reflecting the strong increase in interest rates.

NET INCOME HIGHER THAN R$ 1 BILLION

IN A YEAR OF STRONG EXPANSION

Net income in the quarter was R$ 406 million, +7.3% in comparison

to 4Q21, when considering only the comparable fiscal credit effects of each period (as detailed on page 4), with margin of 2.5%.

In 2022, net income totaled R$ 1.2 billion, with a margin

of 2.2%. Excluding effects of tax credits detailed on page 4, the net income in 2022 (R$ 1.1 billion) remains similar to 2021 level (R$

1.2 billion), which confirms the resilience of the business model even with the efforts to implement the hypermarket conversion project

and the challenging scenario marked by higher interest rates.

HIGH LEVEL OF INVESTMENTS REFLECTS ACCELERATED

EXPANSION

Investments in 4Q22 amounted to R$1.3 billion, 58%

higher than in 4Q21, reflecting the record expansion in the period, with 37 store openings, as well as the other stores under construction

that will be opened in 2023.

In 2022, investments reached R$ 4.5 billion, an amount

twice as high as in 2021, mainly as a result of the opening of 60 stores in 2022, a number more than twice the expansion of 2021. Assaí

continues to invest in modernizing its store network and improving customers' shopping experience by expanding services, such butcheries

and cold cuts emporiums.

EFFICIENT FINANCIAL MANAGEMENT GIVEN THE HIGH INVESTMENTS

CONTEXT

The Company ended the quarter with a net debt/Adjusted EBITDA

ratio of 2.19x. This leverage ratio is in accordance with expectations given the intense investments in expansions with (i) the acquisition

of hypermarket commercial points, (ii) the 60 new stores opened in 2022 and (iii) the continuation of the conversion project, with around

20 conversions planned for 2023.

In 4Q22, the Company placed a R$ 400 million issue of commercial

notes to refinance a portion of liabilities coming due in 2023, which amounts to gross debt of R$ 12.4 billion. The issue's cost, whose

spread in relation to the CDI is less than 1%, is below the average cost of the Company's debt, which currently stands at CDI+1.45%, with

an average term of 3.5 years.

DIVIDENDS AND INTEREST ON EQUITY

Management proposed the distribution of dividends for the

year ended December 31, 2022, in the amount of R$ 111 million, equivalent to 25% of the balance available for the distribution of dividends,

which excludes the tax incentive reserve related to the credits from investment subsidies and legal reserve of 5%. Also, during the year,

the payment of interest on equity was approved in the net amount of R$ 43 million to be paid on February 17, 2023, as per the Notice to

Shareholders dated January 13th, 2023. Therefore, the amount referring to the remaining portion of dividends is R$ 68 million,

calculated as follows.

The proposal for the distribution of dividends for fiscal

year 2022 will be submitted to the Annual Shareholders Meeting, to be held on April 27th, 2023. Shareholders of record on April

27th, 2023 will be entitled to the dividends. As of April 28th, 2023, the shares will trade ex-dividends. The dividends

will be paid by June 26th, 2023, i.e., 60 days as from the date of the Annual Shareholders Meeting.

For the American Depositary Receipts (ADRs) traded on the

NYSE, payment will be made via the depositary bank JPMorgan Chase Bank. ADR holders can find information on dividends at the website

https://adr.com.

EFFICIENCY ON WORKING CAPITAL MANAGEMENT

Company's working capital before receivables amounted

to R$ 2.6 billion, equivalent to a term of 20 days, which represents an improvement of 5 days compared to 2021. This result was mainly

driven by the expansion, which generated scale gains. Days of receivables are not significant due to the nature of Assaí's business

model, with mostly cash sales.

CASH GENERATION OF R$ 4.2 BILLION,

R$ 1.8 BILLION HIGHER

The Company's accelerated expansion contributed to

significant gains in Working Capital management in the year, resulting in a 75% increase in operating cash generation, to R$ 4.2 billion

in 2022.

The efficient cash management, given the context

of high interest rates, large investments and the converted stores in the early phase of their maturation curve, resulted in free cash

generation in line with expectations for the period.

CONTINUOUS PROGRESS IN ESG LEAD

TO INCLUSION IN

IMPORTANT STOCK INDEXES

Assaí, as an inherent part of its business model,

implements initiatives to foster a more responsible and inclusive society based on five strategic pillars:

1.

Combating Climate Change: innovating and enhancing environmental management;

2.

Integrated Management and Transparency: improving ESG practices through ethical and transparent relationships;

3.

Transforming the Value Chain: co-building value chains committed to the environment and people;

4.

Engaging with Society: acting as an agent of change to promote fair and inclusive opportunities;

5.

Valuing Our People: being a reference in fostering diversity, inclusion and sustainability through our employees.

ESG highlights in 4Q22 include:

| · | Inclusion in ISE B3 (Corporate Sustainability Index), effective in January, 2023. This is the first

time the Company has been included in the index since its listing registration. The Company also was included in the ICO2 B3 –

Carbon Efficient Index and the IGPTW B3 Index, which includes companies recognized as an excellent place to work, as recognized and

certified by the Great Place to Work (GPTW). Also, in January 2023, the Company became part of the Bloomberg Gender Equality

Index. |

| · | Improvement in the CDP evaluation, one of the main measurement and disclosure programs for efficient

management of carbon emissions and climate change risks. |

| · | Ongoing efforts to promote and increase diversity in the work environment: |

| o | Training on diversity administered to over 49,000 employees, 4% more than in 2021 |

| o | 45% increase vs. 2021 in the number of Blacks in executive positions and adherence to

the Business Initiative for Racial Equality. |

| · | Through the Assaí Institute, the Company's social arm launched in 2022, the ‘’Food

is for Sharing’’ campaign collected 378 tons of food donated by customers, which represents 750,000 meals for families

in situations of vulnerability (+31% vs. 2021). |

| · | Advances in the treatment of solid waste through composting and reducing food waste. Through the Right

Destination program, Assaí donated 1,800 tons of fresh produce (not proper for sale but adequate for consumption) to partner

organizations, an increase of +44% compared to 2021. Consequently, the amount of waste sent to landfills avoided enabled the

reduction of gas emissions, such as methane, by approximately 31,490 tons of carbon equivalent. |

| · | Decrease of 12% in scope 1(1) and 2(2) emissions compared to 2021, in line

with the strategy to fight climate change and the target to reduce emissions by 38% by 2030 (base: 2015). |

(1) Company's own emissions.

(2) Emissions from electricity consumption

ABOUT SENDAS S.A.

Assaí is a cash and carry wholesaler serving small

and midsized merchants as well as consumers in general seeking unit items as well as large volumes. With gross sales of around R$ 60 billion

in 2022, Assaí operates more than 260 stores in all 23 states of Brazil, as well as the Federal District. Assaí has over

76,000 employees and welcomes 30 million customers to its stores every month.

In 2022, Assaí was elected the best wholesaler in

two surveys conducted by Instituto Datafolha: “Best of São Paulo - Services” (for the seventh straight year); and “Best

of the Internet in Brazil." Assaí also was named Best Retailer by “Valor 1000,” the yearbook compiled by Valor

Econômico, and received certification from Great Place to Work. Assaí is one of the 15th most valuable brands

in Brazil according to the annual ranking compiled by Brand Finance.

INVESTOR RELATIONS CONTACTS

Gabrielle Castelo Branco Helú

Investor Relations Officer

Ana Carolina Silva

Beatris Atilio

Daniel Magalhães

E-mail: ri.assai@assai.com.br

Website: www.ri.assai.com.br

APPENDICES

OPERATIONAL INFORMATION

I – Number of stores and sales

area

FINANCIAL INFORMATION

II - Income Statement

III - Balance Sheet

IV - Cash Flow

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 15, 2023

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

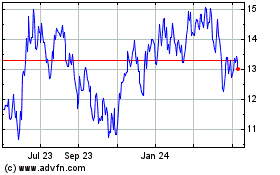

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

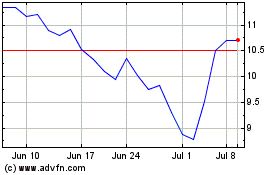

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024