Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 23 2022 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of December 2022

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes: o

No: ý

(Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes: o No: ý

SENDAS DISTRIBUIDORA S.A.

Public-Held Company

Brazilian Taxpayer’s

Registry No. 06.057.223/0001-71

Board of Trade Registry No. 33.300.272.909

NOTICE TO SHAREHOLDERS

Sendas

Distribuidora S.A. (“Company”) hereby informs its shareholders and the market in general that the Board

of Directors approved, on this date, ad referendum of the Company’s Annual General Shareholders’ Meeting to be held

in 2023, destined to appreciate the financial statements referred to the fiscal year ending on December 31st, 2022, the payment

of interest on equity referred to the period between January 1st, 2021 and December 31st 2022, in the gross amount

of R$50,000,000.00 (fifty million reais), corresponding to R$ 0.037059948485456 per common share (“Interest on Equity”), from

which the amount related to withholding taxes (“IRRF” – “Imposto de Renda Retido na Fonte”) will

be deducted, pursuant to the law in force, except with respect to shareholders that are immune and/or exempt. The Interest on Equity will

be charged to the amount of the minimum mandatory dividend related to the fiscal year ended on December 31st, 2022.

The payment of Interest on Equity

to the shares traded on B3 S.A. - Brasil, Bolsa, Balcão, as well as other shares registered

with Itaú Corretora de Valores S.A., shall occur on February 21st, 2023, based on the shareholders’ position of

December 28th, 2022 (including such date). The shares issued by the Company shall be traded ex-interest as from December 29th,

2022.

With respect to the American Depositary

Receipts representing the Company's common shares traded on the New York Stock Exchange – NYSE (“ADR”), the payment

shall be one by JPMorgan Chase Bank, N.A., the depositary bank of the ADRs. Holders of ADRs can obtain information regarding the payment

of Interest on Equity at https://adr.com.

São Paulo, December 23th,

2022.

SENDAS DISTRIBUIDORA S.A.

Gabrielle Helú Investor

Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 23, 2022

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

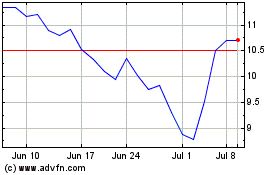

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

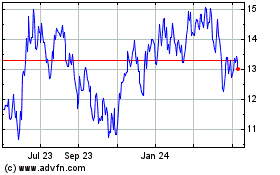

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024