UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of December 2022

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes: o

No: ý

(Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes: o No: ý

SENDAS DISTRIBUIDORA S.A.

PUBLICLY-HELD COMPANY

CNPJ No. 06.057.223/0001- 71

NIRE 33.3.002.7290-9

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON DECEMBER 14, 2022

1. DATE,

TIME AND VENUE: on December 14, 2022, at 10 a.m. at the headquarter of Sendas Distribuidora S.A. (“Company”), at

Avenida Ayrton Senna, No. 6.000, Lot 2, Pal 48959, Anexo A, Jacarepaguá, Zip Code 22775-005, City of Rio de Janeiro, State of Rio

de Janeiro.

2. BOARD:

Chairman: Mr. Jean Charles Henri Naouri; Secretary: Mrs. Aline Pacheco Pelucio.

3. CALL NOTICE

AND ATTENDANCE: The call notice was waived due to the presence of all members of the Company’s Board of Directors attended the

meeting: Mr. Jean-Charles Henri Naouri, Mr. Belmiro de Figueiredo Gomes, Mrs. Josseline Marie-José Bernadette de Clausade, Mr.

David Julien Emeric Lubek, Mr. Philippe Alarcon, Mr. Christophe José Hidalgo, Mr. Luiz Nelson Guedes de Carvalho, Mr. José

Flávio Ferreira Ramos and Mr. Geraldo Luciano Mattos Júnior.

4. AGENDA:

To resolve on (i) the conduction, as well as on the terms and conditions, of the 2nd (second) issuance of book-entry commercial

notes, without guarantee, single series, of the Company, in the total amount of R$400,000,000.00 (four hundred million reais) (“Commercial

Notes” and “Issuance”, respectively), for public distribution with restricted efforts under the terms of

the Instruction of the Brazilian Securities Commission (“CVM”) No. 476, of January 16, 2009, as amended (“Restricted

Offering” and “CVM Instruction 476”, respectively) and of article 45 onwards of Law No. 14,195, of August

26, 2021 (“Law No. 14,195”) and of other applicable legal and regulatory provisions;

(ii) the execution, by the Company, of all and any instruments

necessary and/or convenient to carry out the Issuance, assume the obligations under the Commercial Notes and implement the Restricted

Offering;

(iii) the authorization and ratification to the Board

of Executive Officers and other legal representatives of the Company for them to carry out all the acts and adopt all the measures necessary

and/or convenient for formalization of the Issuance, including, without limitation, the execution of the Issuance Deed (as defined below),

of the contract of distribution of the Restricted Offering, and of all the other Issuance-related documents, as well as any amendments

to such instruments; and

(iv) the authorization to the Board of Executive Officers

of the Company to contract, among other, the service providers, necessary to the Issuance of the Commercial Notes and Restricted Offering,

including, without limitation (1) to the financial institutions forming the system of distribution of marketable securities responsible

for the structuring, coordination and intermediation of the distribution of the Commercial Notes, (2) to the legal advisors, (3) to the

settlement bank and to the bookkeeper, (4) to the Trustee and (5) to any other institutions, with definition of the respective fees.

5. RESOLUTION:

The Board of Directors’ members analyzed the Agenda and resolved, by unanimous decision, without any exception:

| (i) | To authorize the conduction of the Issuance by the Company, with the following

main characteristics, which are detailed and regulated within the scope of the “Issuance Deed of the 2nd (Second) Issuance of

Book-Entry Commercial Notes, Without Guarantee, Single Series, for Public Distribution with Restricted Efforts, of Sendas Distribuidora

S.A.” (“Issuance Deed”), as well as the execution of the Issuance Deed, other Issuance documents and any

amendments to such documents, by the Company’s directors and/or appointed proxies, pursuant to article 17, letter (h) of its Bylaws,

regardless of additional approval to that effect at Shareholders’ Meeting. |

| (a) | Issuance Total Amount: the total amount

of the Issuance will be R$ 400.000.000,00 (four hundred million), on the Issuance Date (as defined below); |

| (b) | Issuance Date: for all legal effects,

the issuance date of the Commercial Notes shall be defined in the Issuance Deed (“Issuance Date”); |

| (c) | Issuance Number: the Issuance represents

the 2nd (second) issuance of the Company’s Commercial Notes; |

| (d) | Unit Par Value: the unit par value of

Commercial Notes, on Issuance Date, shall be R$1,000.00 (one thousand Reais) (“Unit Par Value”); |

| (e) | Series Number: the Issuance will be

carried out in a single series; |

| (f) | Quantity of Commercial Notes: shall

be issued 400.000 (four hundred thousand) Commercial Notes; |

| (g) | Guarantees: the Commercial Notes

will not be secured by real or personal guarantees; |

| (h) | Term and Maturity Date: the Commercial

Notes will be effective for 3 (three) years from the Issuance Date, and will expire on the date prescribed in the Issuance Deed (“Maturity

Date”); |

| (i) | Form, Type and Proof of Ownership

of Commercial Notes: the Commercial Notes shall be issued in book-entry form, without issuance of certificates, and for all legal

purposes, the ownership of the Commercial Notes will be evidenced by the savings account statement issued by the Bookkeeper (as defined

below) and, also, in relation to the Commercial Notes that are electronically held in custody at B3 S.A. – Brasil, Bolsa, Balcão

– Balcão B3 (“B3”), by statement issued on behalf of the holder of the Commercial Notes that will serve

as evidence of ownership of such Commercial Notes; |

| (j) | Use of Proceeds: the proceeds

from the Restricted Offering will be used for general purposes, including cash reinforcement; |

| (k) | Settlement Bank and Bookkeeper:

the functions of settlement bank and authorized bookkeeper will be exercised by Vórtx Distribuidora de Títulos e Valores

Mobiliários Ltda., financial institution headquartered in the City of São Paulo, State of São Paulo, at Alfredo Gilberto

Sabino St., 215, enrolled with CNPJ under the No. 22.610.500/0001-88 (“Settlement Bank” and “Bookkeeper”).

The Bookkeeper shall be responsible for carrying out the bookkeeping of the Commercial Notes, among other responsibilities defined in

the rules issued by CVM and B3. The aforementioned definitions include

any other institutions that may succeed the Settlement Bank and/or the Bookkeeper in the provision of services related to the Commercial

Notes; |

| (l) | Trustee: Company shall appoint

Vórtx Distribuidora de Títulos e Valores Mobiliários Ltda., financial institution headquartered in the City of São

Paulo, State of São Paulo, at Rua Gilberto Sabino, 215, 4th floor, Pinheiros, CEP 05425-020, enrolled with CNPJ under the No. 22.610.500/0001-88

(“Trustee”); |

| (m) | Adjustment for Inflation and Compensation:

the Unit Par Value of the Commercial Notes will not be object of adjustment for inflation. The Unit Par Value of the Commercial Notes

or balance of the Unit Par Value of the Commercial Notes will be subject to interest remuneration corresponding to accumulated variation

of 100% (one hundred percent) of the daily average rates of DI – one-day Interbank Deposits, “over extra group”,

expressed as percentage per year, base 252 (two hundred and fifty-two) Business Days (“DI Rate”), calculated and disclosed

daily by B3, in the daily newsletter available on its webpage (http://www.b3.com.br), plus spread up to 0.93% (zero point ninety three

percent) per year, base 252 (two hundred and fifty-two) Business Days (“Compensation”). The Compensation will be calculated

on exponential and cumulative basis pro rata temporis per elapsed Business Days, levied on the Unit Par Value of the Commercial

Notes, from the Issuance Date or immediately prior Compensation Payment Date (as defined in the Issuance Deed) (including), to the respective

Compensation payment date, date of declaration of early maturity, on the date of any Optional Early Redemption or on the date of Early

Redemption Offering, whichever occurs first (excluded). The Compensation shall be calculated according to the formula provided in the

Issuance Deed; |

| (n) | Capitalization Period: the Capitalization

Period of the Compensation (“Capitalization Period”) is, for the first Capitalization Period, the time gap commencing

on the Profitability Start Date, which will correspond to the Issuance Date, including, and ending on the first Compensation Payment Date,

excluding, and, for the other Capitalization Periods, the time gap commencing on the immediately prior Compensation Payment Date, including,

and ending on the subsequent Compensation Payment Date, excluding.

Each Capitalization Period succeeds the previous one without interruption, until the Maturity Date; |

| (o) | Amortization of Unit Par Value: the

Unit Par Value of the Commercial Notes will be amortized on a single date, that is, on the Maturity Date (“Date of Amortization

of the Commercial Notes”); |

| (p) | Placement Plan: the Commercial

Notes shall be subject to the Restricted Offering directed exclusively to Professional Investors, as set forth in article 11, of CVM Resolution

30, of May 11, 2021 (“CVM Resolution 30”), in conformity with the placement plan previously agreed between the Company,

the intermediary institution of the Restricted Offering (“Lead Underwriter”). The Lead Underwriter shall organize the

placement of the total Commercial Notes under the firm guarantee of placement system; |

| (q) | Distribution, Trading and Electronic

Custody: the Commercial Notes will be deposited for (i) primary distribution through Module of Distribution of Assets (“MDA”),

managed and operated by B3; and (ii) trading in the secondary market through CETIP21 – Títulos e Valores Mobiliários

(“CETIP21”), being the distribution and trading financially settled, and the Commercial Notes electronically held in

custody at B3; |

| (r) | Subscription Price and Means of Payment:

the Commercial Notes will be subscribed and paid in cash, in national currency, upon subscription, at the Unit Par Value, according to

the payment standards applicable to B3. When the payment can be made in more than one date, the Commercial Note to be paid on another

date subsequent to the first payment date, shall be paid considering its Unit Par Value plus Compensation, calculated on pro rata temporis

basis from the Profitability Start Date to the actual payment date. The Commercial Notes can be paid with goodwill or negative goodwill,

to be defined, when appropriate, at the time of subscription of the Commercial Notes, pursuant to the Issuance Deed; |

| (s) | Early Maturity: the Commercial

Notes and all the obligations in the Issuance Deed are subject to automatic early maturity and to non-automatic early maturity, as prescribed

in the Issuance Deed, being the Company immediately required to pay the Unit Par Value, as appropriate, plus respective

Compensation due, calculated on pro rata temporis basis, and Default Charges (as defined below) and fines, if any, up to the date

of actual payment, observing the respective cure periods, regardless of any warning, interpellation or judicial or extrajudicial notification

to the Company or consultation with the holders of Commercial Notes, upon occurrence of Events of Automatic Early Maturity and Events

of Non-Automatic Early Maturity, as prescribed in the Issuance Deed (“Events of Automatic Early Maturity” and “Events

of Non-Automatic Early Maturity”, respectively); |

| (t) | Optional Early Redemption: the

Company may, as of the date defined in the Issuance Deed, make the Optional Early Redemption of all the Commercial Notes (“Optional

Early Redemption”). Upon the Optional Early Redemption, the amount due by the Company will be equivalent to the (a) Unit Par

Value of the Commercial Notes to be redeemed, plus (b) Compensation and other charges due and not paid until the Optional Early Redemption

date, calculated on pro rata temporis basis from the Profitability Start Date, or date of payment of the former compensation, as

appropriate, to the date of actual Optional Early Redemption, levied on the Unit Par Value and (c) premium, to be calculated according

to the Issuance Deed (“Optional Early Redemption Premium”). The Optional Early Redemption of the Commercial Notes will

only be made through communication sent to the holders of the Commercial Notes with copy to B3, 10 (ten) Business Days prior to the date

intended to make the Optional Early Redemption (“Communication of Redemption”), and such communication shall: (a) inform

the date of Optional Early Redemption; (b) mention that the amount corresponding to the payment will be the Unit Par Value of the Commercial

Notes, plus (1) Compensation, calculated as prescribed in the Issuance Deed and (2) Optional Early Redemption Premium; and (c) disclose

any other information necessary to make the Optional Early Redemption; |

| (u) | Extraordinary Optional Amortization:

the extraordinary optional amortization of the Commercial Notes will not be allowed; |

| (v) | Optional Acquisition: the Company

may, at any time, acquire Commercial Notes, in the secondary market, as long as accepted by the respective selling holder of Commercial

Notes for amount equal to or lower than the Unit Par Value. The Company shall disclose these acquisitions in

the financial statements of the Company. The Commercial Notes purchased by the Company may, at Company's discretion, (a) be canceled;

(b) held in treasury or (c) be placed on the market again. The Commercial Notes purchased by the Company to be held in treasury, if and

when restored to the market, shall be entitled to the same Compensation applicable to other Commercial Notes. |

| (w) | Early Redemption Offering: the

Company may, at its sole discretion, at any time, carry out Early Redemption Offering of all the Commercial Notes, addressed to all the

holders of the Commercial Notes, being assured to all the holders of the Commercial Notes equal conditions to accept the redemption of

the Commercial Notes held by them (“Early Redemption Offering”). The Company will carry out the Early Redemption Offering

through communication sent to the holders of the Commercial Notes, as prescribed in the Issuance Deed. The Company will carry out the

Early Redemption Offering through communication sent to the holders of the Commercial Notes, pursuant to the provisions in the Issuance

agreement (“Communication of Early Redemption Offering”), with copy to the Trustee, 10 (ten) Business Days prior to

the date intended to make the Early Redemption Offering, and such communication shall inform: (1) the amount of redemption, making it

clear if there is premium and its calculation formula, which shall not be negative; (2) how the Company will be notified by the holder

of the Commercial Notes that accepts the Early Redemption Offering; (3) the date for redemption of the Commercial Notes and payment to

holders of the Commercial Notes, which shall be a Business Day; (4) the place of payment of the Commercial Notes object of the Early Redemption

Offering; and (5) other information necessary for decision making and operation by the holders of the Commercial Notes. After the communication

of the terms of the Early Redemption Offering, the holders of the Commercial Notes who elect to accept such offering must notify the Company,

with copy to the Trustee, within the period and in the form established in the Communication of Early Redemption Offering, which will

take place on a single date for all the Commercial Notes object of the Early Redemption Offering, and the Company will only be able to

make the early redemption of the number of Commercial Notes defined by their respective holders upon acceptance of the Early Redemption

Offering. The Company may condition the Early Redemption Offering to the acceptance of a minimum percentage of Commercial Notes, to be

defined by the Company at the time of the Early Redemption

Offering. This percentage shall be defined in the Communication of the Early Redemption Offering. The amount due to the holders of the

Commercial Notes may correspond to the Unit Par Value of the Commercial Notes to be redeemed, (1) plus Compensation and other charges

due and not paid until the date of the Early Redemption Offering, calculated on pro rata temporis basis from the Profitability

Start Date, or date of payment of the prior Compensation, as appropriate, to the date of actual redemption of the Commercial Notes object

of the Early Redemption Offering, and (2) if appropriate, by applying on the total amount a premium informed in the Communication of Early

Redemption Offering, which shall not be negative. The Commercial Notes redeemed by the Company will be cancelled. The Partial or Total

Early Redemption resulting from the Early Redemption Offering for Commercial Notes electronically held in custody at B3 will follow the

settlement procedures adopted by it. If the Commercial Notes are not electronically held in custody at B3, it will be made through the

Bookkeeper. B3 shall be notified by the Company about the Partial or Total Early Redemption resulting from the Early Redemption Offering

at least 3 (three) Business Days prior to the date of redemption, through correspondence with the consent of the Trustee. |

| (x) | Charges in Arrears: in the event

of late payment by the Company of any amount due to the holders of Commercial Notes, debts overdue and not paid by the Company will be

subject to, regardless of notice, notification or judicial or extrajudicial summons (i) conventional, irreducible and non-compensatory

fine of 2% (two percent); and (ii) interest on arrears at the rate of 1% (one percent) per month, from the default date until the date

of effective payment; both calculated on the amount owed and unpaid (“Charges in Arrears”); |

| (y) | Place of Payment: The payments

to which the Commercial Notes are entitled will be made by the Company at their respective maturity using, as the case may be: (1) the

procedures adopted by B3 for the Commercial Notes held in electronic custody therein; and/or (2) the procedures adopted by the Bookkeeper,

for Commercial Notes that are not held in electronic custody at B3; |

| (z) | Extension of Terms: the terms

for payment of any obligation will be automatically extended to the 1st (first) subsequent Business Day, when the maturity date falls

on a day in which banks are not open in the place

of payment of the Commercial Notes, except when such payments shall be made through B3, in such case the terms will be extended only when

the payment date falls in a national holiday, Saturday or Sunday. |

| (ii) | To execute all and any instruments necessary and/or convenient to carry

out the Issuance, assume the obligations under the Commercial Notes and implement the Restricted Offering; |

| (iii) | To authorize and ratify to the Board of Executive Officers and other legal

representatives of the Company for them to carry out all the acts and adopt all the measures necessary and/or convenient for formalization

of the Issuance, including, without limitation, the execution of the Issuance Deed, of the contract of distribution of the Restricted

Offering, and of all the other Issuance-related documents, as well as any amendments to such instruments; and |

| (iv) | To authorize the Board of Executive Officers and other legal representatives

of the Company to contract service providers, necessary to the Issuance of the Commercial Notes and Restricted Offering, including, the

Trustee, the settlement agent, the bookkeeper, the Lead Underwriter, and all other service providers for the Restricted Offering, such

as legal advisors and B3, among other, being for such purpose authorized to trade, sign the respective contracts and define their respective

fees. |

6. APPROVAL

AND SIGNATURE OF THE MINUTES: Nothing else to be discussed, the work was suspended for the drawing up of these minutes. After reopening

the work, the present minutes was read and approved, having been signed by all attendees. São Paulo, December 14, 2022. Chairman:

Mr. Jean Charles Henri Naouri; Secretary: Mrs. Aline Pacheco Pelucio. Attending members of the Board of Directors: Mr. Jean-Charles

Henri Naouri, Mr. Belmiro de Figueiredo Gomes, Mrs. Josseline Marie-José Bernadette de Clausade, Mr. David Julien Emeric Lubek,

Mr. Philippe Alarcon, Mr. Christophe José Hidalgo, Mr. Luiz Nelson Guedes de Carvalho, Mr. José Flávio Ferreira Ramos

and Mr. Geraldo Luciano Mattos Júnior.

I hereby certify, for the legal purposes, that the present

document has been drafted in its own books, under the terms of paragraph 3, article 130 of Law No. 6,404/76, as amended.

__________________________________

Aline Pacheco Pelucio

Secretary

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 14, 2022

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

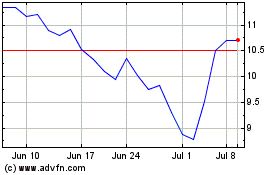

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

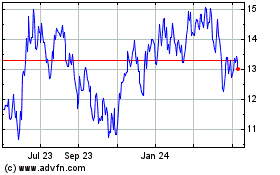

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024