Report of Foreign Issuer (6-k)

November 12 2019 - 4:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for November, 2019

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 20-F __X__ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-

T Rule 101(b)(1):

Yes _____ No __X__

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-

T Rule 101(b)(7):

Yes _____ No __X__

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also

thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes _____ No __X__

Enclosures: SASOL LIMITED | DEALINGS IN SECURITIES BY A DIRECTOR OF

SASOL AND A MAJOR SUBSIDIARY OF SASOL

Sasol Limited

(Incorporated in the Republic of South Africa)

(Registration number 1979/003231/06)

Sasol Ordinary Share codes: JSE: SOL

NYSE: SSL

Sasol Ordinary ISIN codes ZAE000006896

US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

(“Sasol” or “Company”)

DEALINGS IN SECURITIES BY A DIRECTOR OF SASOL AND A MAJOR SUBSIDIARY

OF SASOL

In compliance with paragraph 3.63 to 3.66 of the JSE Limited Listings Requirements

(“Listings Requirements”), Sasol hereby announces that a former director of Sasol Limited

and a major subsidiary was, in terms of the Sasol Long-Term Incentive (LTI) Plan (“Plan”),

issued securities in terms of previously accepted LTI awards made to him in 2016 that have

partly vested on the achievement of corporate performance targets at 47%. The balance of

the award made in 2016 will vest in 2021, subject to the rules of the Plan. Participants have

the option on vesting to elect to receive securities only, to sell sufficient securities to cover

their tax liability and to retain the balance of the securities or to sell all the securities. The

dealings are as set out below.

Vesting date:

30 October 2019

Transaction date:

7 November 2019

Class of securities:

Sasol American Depositary Receipts (ADR) each representing

one Sasol ordinary share

Initial issue price per right:

USD0,00

Nature of Transaction:

Retention of vested shares off-market

Nature and extent of interest:

Direct beneficial

Surname and

initials

Designation

Company

Number

of

securities

Selling

Price

per

security

(USD)

Total value

of the

transaction

(USD)

Cornell, S R

1

Director

Director

Sasol Limited

Sasol (USA) Corporation

17 470

18,72

327 038,40

1

Resigned effective 31 October 2019

In terms of paragraph 3.66 of the Listings Requirements, the necessary clearance to deal

has been obtained for all the transactions set out above.

12 November 2019

Sandton

Sponsor: Merrill Lynch South Africa Proprietary Limited

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant, Sasol Limited, has

duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: 12 November 2019

By:

/s/ V D Kahla

Name: Vuyo Dominic Kahla

Title:

Company Secretary

This regulatory filing also includes additional resources:

securities.pdf

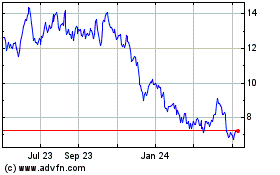

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

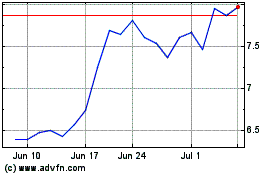

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024