Sasol Raises Cost Estimate for Lake Charles Project Again

May 22 2019 - 2:02AM

Dow Jones News

By Adam Clark

Sasol Ltd. (SOL.JO) on Wednesday raised the cost estimate for

its troubled Lake Charles chemicals operation in Louisiana and

launched an independent review into poor controls over the

project.

The South Africa-based petrochemical and energy company said it

now expects the Lake Charles project to cost between $12.6 billion

and $12.9 billion.

The project, intended to more than triple Sasol's chemical

production capacity in the U.S, has been hit by repeated cost

increases. Sasol's previous estimate in February was for a cost of

up to $11.8 billion, compared with around $9 billion when the

project was approved in 2015.

As of the end of March, Sasol said Lake Charles is 96% completed

and that it has spent a total of $11.4 billion.

"This increase in the anticipated LCCP capital costs is

extremely disappointing. Executive management has implemented

several changes since February 2019 to further strengthen the

oversight, leadership for the project and frequency of reporting,"

Sasol said.

The company said the independent review will look at the poor

accuracy of previous cost forecasts but that it believes any issues

with underlying controls are limited to the Lake Charles

project.

Sasol cut its projections for earnings contributions from the

project to $1.0 billion in fiscal 2022 from $1.3 billion and said

its net debt levels will remain elevated for up to 24 months. Sasol

said it is seeking to conserve cash over the next 12 to 18 months

and will look to sell assets worth more than $2 billion.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

May 22, 2019 01:47 ET (05:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

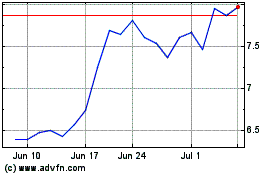

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

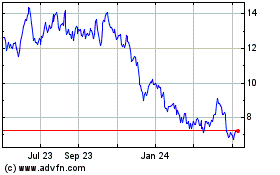

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024