RYMAN HOSPITALITY PROPERTIES, INC. PROVIDES ADDITIONAL UPDATE ON IMPACT OF CORONAVIRUS

March 15 2020 - 2:00PM

hareholders informed, we have outlined below the most recent

impacts and actions we are taking with regards to COVID-19.

“For the two weeks ended March 14, 2020, our hospitality

business has experienced total attrition and cancellations of

approximately 268,000 net room nights (which is inclusive of the

net room nights disclosed in our March 8, 2020 release),

representing approximately $132 million of revenue. This represents

approximately seven annual occupancy points, or approximately 16%,

of the contracted group room nights for the March through December

time period on the books as of January 1, 2020. Approximately 55%

of this impact is for March 2020, approximately 34% is for April

2020 and approximately 11% is for May-July 2020. The total

estimated amount of attrition and cancellation fees currently owed

to the Company for the attrited/cancelled groups is approximately

$63 million. In addition, we have seen decreased levels of

booking pace in our hospitality segment’s leisure business for the

remainder of March.

“In light of the decreased occupancy levels we expect over the

coming weeks, we have been working closely with our operator,

Marriott, to implement aggressive cost reduction and capital

preservation initiatives across our hotel portfolio. We have

significantly reduced expense levels at each of our properties by

closing portions of the hotel to match expected occupancy. Salaried

employees at each hotel are now performing functions normally

performed by hourly and part-time staff, and the hotels are

utilizing reduced levels of hourly and part-time staffing to match

expected occupancy.

“As in previous periods of elevated group cancellations and

attrition, we are cooperating with Marriott and our group customers

to accommodate re-bookings, including applying all or a portion of

the fees owed as either an advance deposit or credit for a future

meeting at one of our hotel properties. To provide some

historic context, in the 2009 economic downturn, we collected

approximately 60% of cancellation and attrition fees owed in cash,

approximately 30% were collected as advanced deposits or credits

for a future meeting, and approximately 10% were

uncollectable. Our ability to ultimately recover such fees

depends on a number of factors, including each customer’s financial

status, their willingness to rebook at our hotel properties,

patterns of availability, and the actions of governmental

authorities to limit or otherwise restrict meetings or other

gatherings over a certain size. When applicable, we will pursue

claims available under our business interruption coverage, but

given the nature of this pandemic, the pooled nature of coverage

available to our hospitality business, and the applicable

sub-limits and other coverage terms under these policies, we do not

anticipate material recoveries from business interruption

insurance.

Mr. Reed continued, “On Friday, we announced that we would

temporarily suspend publicly attended performances of the Grand Ole

Opry through April 4, 2020. We also announced that all concerts

scheduled at the Ryman Auditorium have been postponed or cancelled

through April 4, 2020, and we are currently working with show

promoters to reschedule these events. The Ryman Auditorium plans to

remain open to the public for tours. We plan to operate our Ole Red

entertainment venues with regular business hours. We have delayed

the opening of our Ole Red Orlando venue, which had been scheduled

for April 14, 2020. We have also undertaken aggressive

measures in our entertainment business and corporate functions to

reduce operating costs and preserve capital during this period of

disruption.

“Our Company enters this challenging time on solid

footing. Through the end of February 2020 our operating

results exceeded our expectations and were significantly ahead of

prior year results, both in terms of revenue and

profitability. In addition, our liquidity position remains

strong and is supported by commitments from a group of banks with

which we have had long-standing relationships. We currently have

approximately $285 million of available cash and $700 million of

availability under our revolving credit facility.

Mr. Reed concluded, “In addition to the interests of our

shareholders, the well-being of our employees, the hotel personnel

employed by Marriott, our guests and our artist partners is a

priority, and we will continue making decisions with these

priorities in mind. We are working hard to manage our

business during this challenging time. We will continue to

update our shareholders on the impact of COVID-19 periodically

based on the information available to us at that time.”

About Ryman Hospitality Properties,

Inc.

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading

lodging and hospitality real estate investment trust that

specializes in upscale convention center resorts and country music

entertainment experiences. The Company’s core holdings* include a

network of five of the top 10 largest non-gaming convention center

hotels in the United States based on total indoor meeting space.

These convention center resorts operate under the Gaylord Hotels

brand and are managed by Marriott International. The Company also

owns two adjacent ancillary hotels and a small number of

attractions managed by Marriott International for a combined total

of 10,110 rooms and more than 2.7 million square feet of total

indoor and outdoor meeting space in top convention and leisure

destinations across the country. The Company’s Entertainment

segment includes a growing collection of iconic and emerging

country music brands, including the Grand Ole Opry; Ryman

Auditorium, WSM 650 AM; Ole Red and Circle, a country lifestyle

media network the Company owns in a joint-venture partnership with

Gray Television. The Company operates its Entertainment segment as

part of a taxable REIT subsidiary.

*The Company is the sole owner of Gaylord Opryland Resort &

Convention Center; Gaylord Palms Resort & Convention Center;

Gaylord Texan Resort & Convention Center; and Gaylord National

Resort & Convention Center. It is the majority owner and

managing member of the joint venture that owns Gaylord Rockies

Resort & Convention Center.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains statements as to the Company’s

beliefs and expectations of the outcome of future events that are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

the fact that they do not relate strictly to historical or current

facts. Examples of these statements include, but are not limited

to, statements regarding the anticipated impact of COVID-19 on

travel, transient and group demand, the suspension or cancellation

of performances or operations at our entertainment venues, the

anticipated impact of COVID-19 on our results of operations, the

amount of cancellation and attrition fees and cost containment

efforts. These forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from the statements made. These risks and uncertainties include,

but are not limited to, the effects of COVID-19, including on the

demand for travel, transient and group business (including

government-imposed travel or meeting restrictions), and levels of

consumer confidence in the safety of travel and group gatherings as

a result of COVID-19; the length and severity of the COVID-19

pandemic in the United States; the pace of recovery following the

COVID-19 pandemic; our ability to implement cost containment

strategies; and the adverse effects of COVID-19 on our business or

the market price of our common stock. Other factors that could

cause results to differ are described in the filings made from time

to time by the Company with the U.S. Securities and Exchange

Commission and include the risk factors and other risks and

uncertainties described in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2019 and its Quarterly

Reports on Form 10-Q and subsequent filings. Except as required by

law, the Company does not undertake any obligation to release

publicly any revisions to forward-looking statements made by it to

reflect events or circumstances occurring after the date hereof or

the occurrence of unanticipated events.

Source: Ryman Hospitality Properties, Inc.

|

Investor Relations Contacts: |

Media Contacts: |

|

Mark Fioravanti, President & Chief Financial Officer |

Shannon Sullivan, Vice President Corporate and Brand

Communications |

|

Ryman Hospitality Properties, Inc. |

Ryman Hospitality Properties, Inc. |

|

(615) 316-6588 |

(615) 316-6725 |

|

mfioravanti@rymanhp.com |

ssullivan@rymanhp.com |

|

~or~ |

~or~ |

|

Todd Siefert, Vice President Corporate Finance & Treasurer |

Robert Winters |

|

Ryman Hospitality Properties, Inc. |

Alpha IR Group |

|

(615) 316-6344 |

(929) 266-6315 |

|

tsiefert@rymanhp.com |

robert.winters@alpha-ir.com |

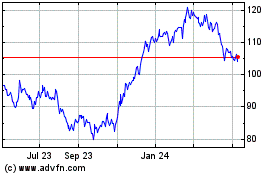

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

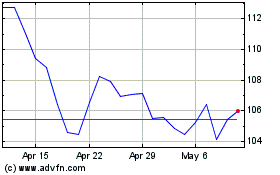

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Apr 2023 to Apr 2024