Thomson Reuters Plans to Slash 3,200 Jobs in Next Two Years

December 04 2018 - 1:17PM

Dow Jones News

By Kimberly Chin

Thomson Reuters Corp. plans to shed 3,200 jobs over the next two

years as part of a pivot toward providing software services over

producing content.

Thomson Reuters, which provides tools for corporate, legal and

tax professionals and operates Reuters News, said Tuesday it would

reduce its global staff by about 12% from current levels and its

global office footprint by 30% by 2020. The planned head count

would bring its staff to 23,800 from 27,000 currently. The company

didn't say where the cuts would be made.

It also plans to shrink its number of offices to 133, from the

2012 count of 517.

Shares in the company were up 2.1% to $50.87 in midday trading

after the company made the announcement during an investor

event.

The company said that the workforce reduction is part of a plan

to run a leaner organization following the roughly $20 billion sale

of a majority stake of its Financial & Risk business, which

includes the financial-services terminal Eikon, to private-equity

firm Blackstone Group LP.

About 87% of Thomson Reuters's revenue is delivered

electronically or from its software and services business. Thomson

Reuters said it sees an opportunity to expand its share in a

content and software services market that is expected to grow to

about $44 billion annually from about $32 billion today.

Reuters News, whose roots date to 1851, makes up a small share

of Thomson Reuters's total revenue. Last year, the unit accounted

for about $300 million in revenue, or less than 6% of the 2017

total of $5.3 billion.

Reuters News competes with Dow Jones, publisher of The Wall

Street Journal, in providing financial news and information.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

December 04, 2018 13:02 ET (18:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

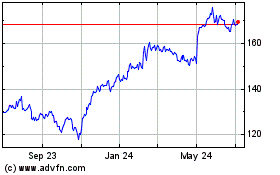

Thomson Reuters (NYSE:TRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

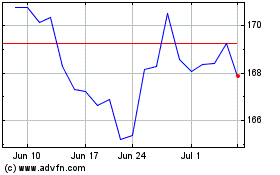

Thomson Reuters (NYSE:TRI)

Historical Stock Chart

From Apr 2023 to Apr 2024