Raytheon Shrinks to Fit Jet Downturn

October 27 2020 - 1:32PM

Dow Jones News

By Doug Cameron

Raytheon Technologies Corp., the biggest aerospace supplier by

sales, said it is cutting 20,000 jobs this year as it adjusts to

the shrinking airline industry and the sharp drop in jetliner

orders and deliveries.

The company, which supplies engines, aircraft seats and other

parts to airlines and plane makers, said the cuts include a 20%

reduction in its commercial arm. It is also reducing its office and

factory space by as much as a quarter in response to

pandemic-driven changes in demand and working conditions.

Raytheon had previously disclosed around 15,000 job cuts at its

Collins Aerospace and Pratt & Whitney engine arms. It said

Tuesday that contractor hiring had been halved to 4,000, while

corporate staff was reduced by 1,000.

Aerospace suppliers are shedding thousands of jobs in response

to the collapse of airline traffic, though Raytheon has been able

to fall back on military sales such as engines for the F-35 combat

jet and Patriot missiles.

Defense rivals in recent days have flagged slowing growth in

Pentagon spending because of the soaring federal budget

deficit.

"Defense business also gives us the ability to continue to

invest through this cycle and to make sure that we have the right

technologies for the future," Chief Executive Greg Hayes said on an

investor call as Raytheon reported a 77% drop in quarterly

profit.

Its shares were recently down more than 4.5%.

Raytheon didn't provide financial guidance for 2020, but

analysts forecast sales of around $64 billion that would surpass

those of Airbus SE and Boeing Co. for the second year in a row.

Sales at Raytheon's Pratt & Whitney jet engine unit fell by

a third in the quarter, while revenue from aircraft parts halved as

manufacturers reduced production and airline flying remained

subdued.

Raytheon expects its sales of parts and engines to Airbus and

Boeing to be down about 40% this year and in 2021 compared with

last year, with minimal shipments of parts for the Boeing 737

MAX.

Mr. Hayes said he didn't expect 2019 levels of flying to return

before 2023 at the earliest, and the main airline trade group on

Tuesday also tempered expectations for an industry recovery.

The International Air Transport Association forecast global

airline revenues would be about $400 billion next year compared

with an estimated $350 billion in 2019. It pared previous estimates

from August because of rising coronavirus cases and pushed back

when it expects a vaccine to be widely available.

Airlines have cut back sharply on maintenance spending as they

have cut flying, hitting large and small suppliers. Raytheon Chief

Financial Officer Toby O'Brien said the health of its own supply

chain had improved over the quarter. He said the company had

concerns about only some 50 of its 13,000 suppliers.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 27, 2020 13:17 ET (17:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

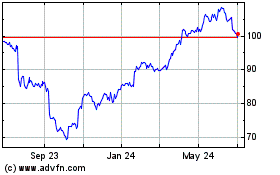

RTX (NYSE:RTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

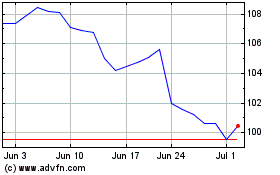

RTX (NYSE:RTX)

Historical Stock Chart

From Apr 2023 to Apr 2024