By Paul Vigna and Alexander Osipovich

Stocks surged Tuesday on optimism about economies reopening and

the potential development of a coronavirus vaccine, extending a

rally that has pushed major U.S. indexes up more than 30% since

late March.

The Dow Jones Industrial Average climbed more than 500 points

after the three-day holiday weekend and flirted with the 25000 mark

for the first time since early March. The rally was driven by

economically sensitive shares in the financials and industrials

sectors. Goldman Sachs rose 9%, Raytheon Technologies gained 7.5%

and Dow rose 7.4%.

Investors cheered signs of economic activity resuming faster

than expected across parts of the U.S. and elsewhere in the world.

Restaurant bookings and spending on hotels and airlines appears to

be picking up in the U.S., coinciding with a decline in the daily

number of new infections.

The U.K. has laid out plans to reopen retail stores next month,

while Italy, one of the hardest-hit countries, saw people return to

bars and restaurants over the weekend.

Stocks have quickly recaptured a level of euphoria usually seen

at market tops, said Peter Boockvar, chief investment officer at

Bleakley Advisory Group. That's because stock traders are looking

only at the direction of the recovery, while bond markets are more

concerned with the degree of the recovery, he said.

"As long as things are reopening, the economic data don't

matter," Mr. Boockvar added.

The New York Stock Exchange's famed trading floor also reopened

Tuesday -- incidentally, the 124th anniversary of the start of the

Dow Jones Industrial Average. The floor had only around one-quarter

of its usual number of traders and new social-distancing rules to

limit the spread of Covid-19.

Ahead of the open, floor traders queued up outside the NYSE's

historic building in lower Manhattan, standing on blue markers on

the sidewalk to ensure they maintained a six-foot distance from one

another, before submitting to a temperature check. A mask-wearing

New York Gov. Andrew Cuomo rang the opening bell, facing a largely

vacant trading floor.

The governor flubbed a NYSE tradition under which visitors are

expected to ring the opening bell for 10 seconds, letting the bell

go quiet after just a few seconds. That prompted NYSE President

Stacey Cunningham, standing at his side in her own mask, to urge

him to ring it again. He did so.

Several banks including Bank of America Merrill Lynch, JPMorgan

Chase and Morgan Stanley declined to send their representatives

back to the NYSE floor Tuesday as they were still hashing out a

dispute over the exchange's efforts to shield itself from liability

for coronavirus-related lawsuits, people familiar with the matter

said.

The NYSE is seeking to make the banks and other firms that

employ floor brokers agree to compensate the exchange for certain

lawsuits arising from a Covid-19 outbreak, The Wall Street Journal

reported Monday. Although most floor brokerages have signed the

NYSE's agreement, some banks have balked at it, the people

said.

Another exchange operator, Cboe Global Markets, said Tuesday it

would reopen its options-trading floor in Chicago on June 8. Cboe,

whose floor has been closed since March, said it expected around

50% of its traders to return to the facility, which is being

reconfigured to help them abide by new social-distancing rules.

Tuesday's rally sent the blue-chip index up 529.95 points, or

2.2%, to 24995.11. The S&P 500 rose 36.32 points, or 1.2%, to

2991.77. The technology-heavy Nasdaq Composite rose 15.63 points,

or 0.2%, to 9340.22.

Investors are betting that one of at least 10 coronavirus

vaccines under development will eventually come to market, halting

the spread of the coronavirus and allowing normal business and

social activity to resume.

Novavax said Monday that it started the first human study of its

experimental vaccine. Drugmakers including Pfizer and Moderna are

also racing to develop a vaccine. Novavax shares rose 4.5% to

$48.17, after rising as high as $54.50 earlier in the session.

Moderna fell 16% to $57.71. Pfizer slipped a penny to

$37.49.

"It looks like we have several shots on goal," said Hani Redha,

a multiasset portfolio manager at PineBridge Investments. Although

manufacturing a vaccine and disseminating it to the wider

population will take time, the number of potential candidates has

buoyed markets.

"Any kind of glimmer of hope about any trial going well or any

trial starting is going to be good," he said.

In another sign investors are embracing risk, a range of assets

typically considered safe declined. Gold futures dropped 1.7% to

$1,704.80 a troy ounce, while the WSJ Dollar Index declined 0.9% as

investors favored riskier areas of the market like commodities and

emerging markets.

It's unusual for gold and the dollar to be down at the same time

because a weaker dollar makes gold and other dollar-denominated

assets cheaper for overseas buyers. The synchronous drop

underscored the strength of Tuesday's "risk-on" move.

Treasury yields also ticked higher as investors retreated from

safe assets. The yield on 10-year Treasurys rose to 0.697% from

0.659% Friday as bond prices fell.

In oil markets, the main U.S. crude gauge advanced 3.3% to

$34.35 a barrel, rising for seven of the past eight sessions.

Despite the recent stock rally, many investors remain concerned

about how to value shares when earnings have fallen so sharply and

many companies have withdrawn their future forecasts.

The market rebound has pushed the S&P 500's forward-looking

price-to-earnings ratio to 23.36, its highest level since 2002. But

corporate profits are expected to remain under pressure until next

year as sales tumble and expenses rise.

"It's safe to say it's going to be a couple of years," before

earnings recover, said Mr. Boockvar of Bleakley Advisory.

After S&P 500 operating earnings hit $157 a share in 2019,

they are projected to fall to $111 this year and rise to $162 in

2021, according to estimates from Howard Silverblatt, the senior

index analyst at S&P Dow Jones Indices.

"If we see the upward turn in earnings, then the current levels

may be justified," Mr. Silverblatt said. "If not, the Street will

need to reprice."

Caitlin Ostroff and Joanne Chiu contributed to this article.

Write to Paul Vigna at paul.vigna@wsj.com and Alexander

Osipovich at alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

May 26, 2020 17:30 ET (21:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

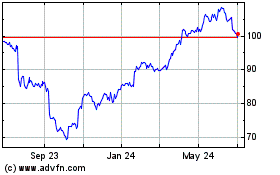

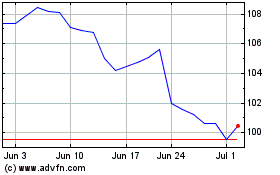

RTX (NYSE:RTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

RTX (NYSE:RTX)

Historical Stock Chart

From Apr 2023 to Apr 2024