Current Report Filing (8-k)

February 19 2021 - 8:36AM

Edgar (US Regulatory)

false

0000315852

0000315852

2021-02-16

2021-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2021 (February 16, 2021)

RANGE RESOURCES CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

001-12209

|

34-1312571

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

100 Throckmorton Street, Suite 1200

Fort Worth, Texas

|

|

76102

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (817) 870-2601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

RRC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 4.02. Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

(a) On February 16, 2021, the Audit Committee of the Board of Directors (the “Audit Committee”) of Range Resources Corporation (the “Company”), after discussion with management and Ernst & Young LLP, the Company’s independent registered public accounting firm, concluded that the Company’s previously issued unaudited consolidated financial statements for each of the quarters and the year-to-date periods ended March 31, 2020, June 30, 2020 and September 30, 2020 (collectively, the “Non-Reliance Periods”) should no longer be relied upon.

In connection with the preparation of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, management became aware that the consolidated financial statements for the Non-Reliance Periods contained an error related to the accounting for deferred income taxes. This matter is the result of an error in management’s conclusions regarding the realizability of deferred tax assets resulting from changes to the tax law under the Coronavirus Aid, Relief and Economic Security Act (also known as the CARES Act) and has resulted in a change to deferred tax expense (benefit). Accordingly, the Company will restate its consolidated financial statements for the Non-Reliance Periods in its Annual Report on Form 10-K for the year ended December 31, 2020, which it expects to file the week of February 22, 2021. The impact of this change is to decrease deferred tax expense by $21.2 million in first quarter 2020, increase deferred tax expense by $21.0 million in second quarter 2020 and decrease deferred tax benefit by $68.7 million in third quarter 2020 with an associated decrease or increase to net deferred tax liabilities, as applicable. For the nine months ended September 30, 2020, the adjustment is to decrease deferred tax benefit by $68.5 million with an associated increase to net deferred tax liabilities. There was no impact on our net cash flows from operating activities, investing activities or financing activities. As of December 31, 2020, the Company has $3.2 billion of federal net operating loss carryforwards.

The Company has not filed and does not intend to file amendments to the Company’s previously filed Quarterly Reports on Form 10-Q for the periods affected by the restatement and correction of the Company’s consolidated financial statements as described above. Investors and others should rely on the financial information and other disclosures regarding the Non-Reliance Periods as disclosed in the upcoming 2020 Form 10-K and in future filings with the SEC (as applicable).

Management of the Company has concluded the control deficiency that resulted in the failure to detect the accounting error described above is a material weakness in the Company’s internal control over financial reporting as of December 31, 2020 relating to the design and maintenance of internal controls over the completeness and accuracy of the accounting for changes in tax law. Specifically, management has concluded the Company did not design controls to adequately assess new tax laws and accurately apply any necessary modifications to our calculations.

The Company’s management and the Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, Ernst & Young LLP.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

RANGE RESOURCES CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ MARK S. SCUCCHI

|

|

|

Mark S. Scucchi

|

|

|

Senior Vice President-Chief Financial Officer

|

|

|

|

Date: February 19, 2021

3

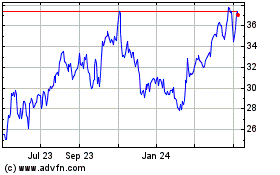

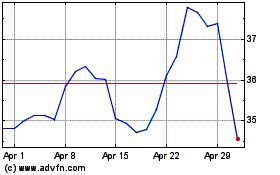

Range Resources (NYSE:RRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Range Resources (NYSE:RRC)

Historical Stock Chart

From Apr 2023 to Apr 2024