Current Report Filing (8-k)

January 21 2020 - 4:13PM

Edgar (US Regulatory)

false 0001393311 0001393311 2020-01-17 2020-01-17 0001393311 us-gaap:CommonStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesVPreferredStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesWPreferredStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesXPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesBPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesCPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesDPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesEPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesFPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesGPreferredStockMember 2020-01-17 2020-01-17 0001393311 us-gaap:SeriesHPreferredStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesIPreferredStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesJPreferredStockMember 2020-01-17 2020-01-17 0001393311 psa:SeriesKPreferredStockMember 2020-01-17 2020-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 17, 2020

PUBLIC STORAGE

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

001-33519

|

|

95-3551121

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS. Employer

Identification No.)

|

|

|

|

|

|

701 Western Avenue,

Glendale, California

|

|

91201-2349

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(818) 244-8080

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Class

|

|

Trading

Symbol

|

|

Name of exchange

on which registered

|

|

Common Shares, $0.10 par value

|

|

PSA

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.375% Cum Pref Share, Series V, $0.01 par value

|

|

PSAPrV

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.200% Cum Pref Share, Series W, $0.01 par value

|

|

PSAPrW

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.200% Cum Pref Share, Series X, $0.01 par value

|

|

PSAPrX

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.400% Cum Pref Share, Series B, $0.01 par value

|

|

PSAPrB

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.125% Cum Pref Share, Series C, $0.01 par value

|

|

PSAPrC

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.950% Cum Pref Share, Series D, $0.01 par value

|

|

PSAPrD

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.900% Cum Pref Share, Series E, $0.01 par value

|

|

PSAPrE

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.150% Cum Pref Share, Series F, $0.01 par value

|

|

PSAPrF

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.050% Cum Pref Share, Series G, $0.01 par value

|

|

PSAPrG

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 5.600% Cum Pref Share, Series H, $0.01 par value

|

|

PSAPrH

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.875% Cum Pref Share, Series I, $0.01 par value

|

|

PSAPrI

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.700% Cum Pref Share, Series J, $0.01 par value

|

|

PSAPrJ

|

|

New York Stock Exchange

|

|

Depositary Shares Each Representing 1/1,000 of a 4.750% Cum Pref Share, Series K, $0.01 par value

|

|

PSAPrK

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

On January 17, 2020, Public Storage (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”), among the Company and J.P. Morgan Securities plc and Morgan Stanley & Co. International plc, as representatives of the several underwriters named therein (the “Underwriters”), for the sale of €500 million aggregate principal amount of Senior Notes due 2032 (the “Notes”). The Notes will bear interest at an annual rate of 0.875%, will be issued at 99.502% of par value and will mature on January 24, 2032. The Underwriting Agreement is filed as Exhibit 1.1 hereto and is incorporated herein by reference.

The offering of the Notes was made pursuant to a shelf registration statement on Form S-3 (File No. 333-231510) filed by the Company with the Securities and Exchange Commission (“SEC”) on May 15, 2019. A preliminary prospectus supplement, dated January 17, 2020, relating to the Notes and supplementing the prospectus was filed with the SEC pursuant to Rule 424(b)(5) under the Securities Act of 1933, as amended.

The Underwriters have performed investment banking and advisory services for the Company from time to time for which they have received customary fees and expenses. The Underwriters may, from time to time, engage in transactions with and perform services for the Company in the ordinary course of their business.

The lenders under the Company’s revolving credit facility include, among other financial institutions from time to time as lenders party thereto, JP Morgan Chase Bank B.A., an affiliate of J.P. Morgan Securities plc; Morgan Stanley Bank, N.A., an affiliate of Morgan Stanley & Co. International plc; and UBS AG, Stamford Branch, an affiliate of UBS AG London Branch.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PUBLIC STORAGE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Nathaniel A. Vitan

|

|

Date: January 21, 2020

|

|

|

|

|

|

Nathaniel A. Vitan

Senior Vice President, Chief Legal Officer &

Corporate Secretary

|

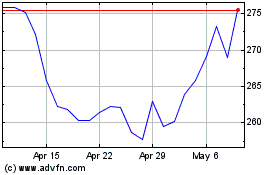

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024