Allstate, Chubb Profits Rise on Disaster Claim Decline, Premium Growth -- Update

February 05 2020 - 5:46PM

Dow Jones News

By Leslie Scism

Property-and-casualty insurance giants Chubb Ltd. and Allstate

Corp. posted strong profit gains in the fourth quarter, thanks to

fewer catastrophe claims and premium volume growth.

For U.S. property-casualty insurers, the most-recent quarter

included Texas tornadoes and California wildfires, but the damage

was light compared with the fourth quarter of 2018. Then, Hurricane

Michael landed near Mexico Beach, Fla., and California blazes

caused historic devastation.

Across the insurance industry, investors are looking closely at

movement in prices to gain comfort that years of price competition

may finally be ending.

Prudential Financial Inc., one of the nation's biggest life

insurers by assets, reported a jump in net income, too. But it

posted declines in sales of certain bread-and-butter life-insurance

policies and retirement-income products to individuals in results

reflecting tough conditions across the U.S. life-insurance

industry.

Ultralow interest rates are hurting yields on life insurers'

bondholdings, driving up the prices they charge to consumers and

leading to less-generous benefits.

Chubb's bottom line more than tripled, to $1.17 billion, while

Allstate reversed a year-earlier loss to post $1.71 billion in net

income. Chubb is one of the nation's biggest insurers of businesses

and is a leading seller of property insurance to wealthy people, as

measured by premium. Allstate is a top issuer of car and home

policies.

Shares of all three insurers, which reported their results after

the close of trading Tuesday, were up sharply, led by Chubb with a

7.2% gain. Allstate shares rose 4%.

Chubb's catastrophe losses totaled $353 million, down from $506

million the prior-year period, while Allstate's dropped to $295

million from $963 million. Chubb has a global business, and its

most-recent results also were weighed down by Typhoon Hagibis in

Japan and civil unrest in Hong Kong and Chile.

Chubb's results provided a strong indication for investors of

diminished price competition across business insurers. Chief

Executive Evan Greenberg said in an earnings call Wednesday morning

that premium rates are "improved and improving." He cited

percentage increases ranging from the mid single digits to more

than 20% across different types of coverage.

Chubb's property-casualty "net premiums written," an industry

term for revenue, grew 9% in the quarter to $7.4 billion, lifted by

new sales and rate increases.

In contrast, car insurers like Allstate have won approval from

many state insurance departments for rate increases on a fairly

steady basis since 2015, when a spike in traffic deaths caught the

industry by surprise.

At that time, more drivers were suddenly on the road with

increased mileage amid the economic recovery and distracted driving

was growing as a concern. An overall jump in claims contributed to

widespread profit declines, as did higher costs of repairing new

vehicles due to sophisticated safety equipment

Allstate's overall premiums grew 4.4% to $8.74 billion. The

company said the average premium in auto is up 3%.

"The personal-lines pricing environment has been more consistent

than the ups and downs in the commercial space," Chief Executive

Tom Wilson said in an interview.

Mr. Wilson credited an expense-reduction campaign for part of

the company's profit surge. It has been deploying additional

technology to wring out costs.

Chubb said earnings improved even as its U.S.

agriculture-insurance business posted an underwriting loss due to

crop-yield shortfalls resulting from poor growing conditions. The

company insures more than 100 crops over some 65 million acres.

Prudential posted fourth-quarter net income of $1.13 billion, up

from $842 million, in the year-earlier quarter. But its "adjusted

operating income," which analysts follow closely because it

excludes nonrecurring items, fell 8.2% to $950 million from $1.04

billion.

Prudential's investment-management arm, on the other hand,

reported higher asset-management fees from an increase in average

assets under management, driven by market appreciation and

fixed-income net flows, the company said.

After the market closed Wednesday, life insurer MetLife Inc.

posted a 73% drop in net income to $536 million, as results were

affected by $1.47 billion of mark-to-market losses on derivatives

used for hedging against low interest rates.

The hedges lost value in the fourth quarter as interest rates

rose. The New York company's "adjusted earnings" rose 37% to $1.83

billion. Profit in the insurer's U.S. operations declined 1%, as

earnings rose sharply in its group-benefits unit but fell in its

auto-insurance business because of unfavorable underwriting

results. Its large Asian life-insurance operations posted higher

profit too, driven by volume growth.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

February 05, 2020 17:31 ET (22:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

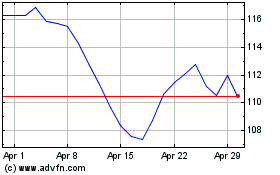

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

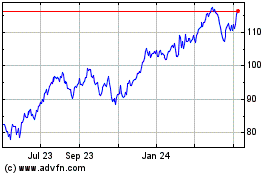

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024