Current Report Filing (8-k)

December 18 2019 - 7:13AM

Edgar (US Regulatory)

PRUDENTIAL FINANCIAL INC false 0001137774 0001137774 2019-12-18 2019-12-18 0001137774 us-gaap:CommonStockMember 2019-12-18 2019-12-18 0001137774 pru:M5.75JuniorSubordinatedNotes2Member 2019-12-18 2019-12-18 0001137774 pru:M5.70JuniorSubordinatedNotes1Member 2019-12-18 2019-12-18 0001137774 pru:A5.625JuniorSubordinatedNotesMember 2019-12-18 2019-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2019

PRUDENTIAL FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New Jersey

|

|

001-16707

|

|

22-3703799

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

751 Broad Street

|

|

Newark, New Jersey 07102

|

|

(Address of principal executive offices and zip code)

|

(973) 802-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, Par Value $.01

|

|

PRU

|

|

New York Stock Exchange

|

|

5.75% Junior Subordinated Notes

|

|

PJH

|

|

New York Stock Exchange

|

|

5.70% Junior Subordinated Notes

|

|

PRH

|

|

New York Stock Exchange

|

|

5.625% Junior Subordinated Notes

|

|

PRS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

Prudential Financial, Inc. (“Prudential” or the “Company”) announced programs during its Investor Day in June 2019 to enhance the customer experience and competitive positioning of its businesses, including through the transformation of technology, processes, and talent. These programs were expected to result in run-rate margin expansion of $500 million by 2022 and included implementation costs of $600 to $700 million.

Today, the Company announced an acceleration of these programs which is expected to bring forward a portion of the implementation costs resulting in faster realization of projected margin expansion. Implementation costs in the fourth quarter of 2019 are expected to be approximately $360 million, including a charge related to the Company’s previously announced voluntary separation program offered to certain eligible U.S.-based employees. The Company expects total implementation costs of approximately $400 million for the full year 2019, approximately $175 million in 2020, approximately $75 million in 2021, and approximately $50 million in 2022.

The Company also updated the cumulative run-rate margin improvement related to these programs to be as follows:

|

|

•

|

approximately $50 million by the end of 2019;

|

|

|

•

|

between approximately $250 million and $300 million by the end of 2020, up from $100 million, with approximately $140 million of margin improvement realized in 2020 pre-tax earnings;

|

|

|

•

|

between approximately $400 million and $450 million by the end of 2021, up from $175 million; and

|

|

|

•

|

a cumulative $500 million by the end of 2022.

|

The Company is furnishing Exhibit 99.1 as an update of the margin expansion and implementation costs provided during its Investor Day on June 5, 2019.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

Forward-Looking Statements

Certain of the statements included in this Current Report on Form 8-K (including in Exhibit 99.1), such as those regarding the expected timing and amounts of the prospective implementation costs and related margin expansion, constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements. Certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements can be found in the “Risk Factors” and “Forward-Looking Statements” sections included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. The expected timing and amounts of the prospective implementation costs and related margin expansion are subject to the risks that we will be unable to execute these programs because of economic, market or competitive conditions or other factors.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 18, 2019

|

|

|

|

|

PRUDENTIAL FINANCIAL, INC.

|

|

|

|

|

|

By:

|

|

/s/ Andrew Hughes

|

|

Name:

|

|

Andrew Hughes

|

|

Title:

|

|

Vice President and Assistant Secretary

|

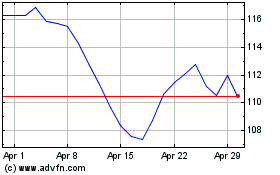

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

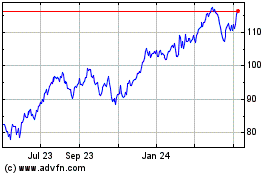

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024