Revenue of $113.5 million, an increase of 5%

over Q1 2018

Unique Product Developers served increased

9% over Q1 2018

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the first quarter ended March 31,

2019.

First Quarter 2019 Highlights include:

- Revenue for the first quarter of 2019

was $113.5 million, representing a 5.3 percent increase over

revenue of $107.7 million for the first quarter of 2018.

- The number of unique product developers

and engineers served through our web-based customer interface

totaled 20,573 in the first quarter of 2019, an increase of 9.3

percent over the first quarter of 2018.

- Net income for the first quarter of

2019 was $15.5 million, or $0.57 per diluted share.

- Non-GAAP net income was $18.8 million,

or $0.69 per diluted share. See “Non-GAAP Financial Measures”

below.

“Protolabs reported another quarter of top-line growth with

record revenue in our 3D printing and injection molding services,”

said Vicki Holt, President and Chief Executive Officer. “We had

strong growth in Europe and Japan; however, we had some challenges

with our sheet metal service and expanded CNC offering acquired

with the Rapid Manufacturing transaction.”

Additional First Quarter 2019 highlights include:

- Gross margin was 51.9 percent of

revenue for the first quarter of 2019, compared with 53.7 percent

for the first quarter of 2018.

- GAAP operating margin was 17.1 percent

of revenue for the first quarter of 2019, compared to 20.2 percent

for the first quarter of 2018.

- Non-GAAP operating margin was 20.6

percent of revenue for the first quarter of 2019, compared to 23.0

percent for the first quarter of 2018. See “Non-GAAP Financial

Measures” below.

- Adjusted EBITDA was $29.8 million, or

26.3% of revenue, for the first quarter of 2019.

- The Company repurchased $17.3 million,

or 157,716 shares, of common stock.

- Cash and investments balance was $138.7

million at March 31, 2019.

- Recognized by the National Association

of Manufacturers for outstanding achievement in engineering and

production technology.

- Announced partnership with Wohlers and

Associates to offer a new immersive course on Design for Additive

Manufacturing.

“In the first quarter of 2019, the headwinds described in our Q1

outlook were greater than anticipated, including a decline in our

acquired services,” said John Way, Chief Financial Officer. “The

organization is focused on actions to improve the performance of

this business, delivering differentiated services to our

customers.”

Non-GAAP Financial Measures

The company has included non-GAAP revenue growth that excludes

the impact of changes in foreign currency exchange rates.

Management believes these metrics are useful in evaluating the

underlying business trends and ongoing operating performance of the

company.

The company has included earnings before interest, taxes,

depreciation and amortization (“EBITDA”) and EBITDA, adjusted for

stock-based compensation expense and unrealized loss on foreign

currency (collectively, “EBITDA and Adjusted EBITDA”), in this

press release to provide investors with additional information

regarding the company’s financial results.

The company has included non-GAAP operating margin, adjusted for

stock-based compensation expense and amortization expense

(collectively, “non-GAAP operating margin”), in this press release

to provide investors with additional information regarding the

company’s financial results.

The company has included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, and

unrealized loss on foreign currency (collectively, “non-GAAP net

income”), in this press release to provide investors with

additional information regarding the company’s financial

results.

The company has provided below reconciliations of GAAP to

non-GAAP net income, operating margin, revenue growth and EBITDA,

the most directly comparable measures calculated and presented in

accordance with GAAP. These non-GAAP measures are used by the

company’s management and board of directors to understand and

evaluate operating performance and trends and provide useful

measures for period-to-period comparisons of the company’s

business. Accordingly, the company believes that these non-GAAP

measures provide useful information to investors and others in

understanding and evaluating operating results in the same manner

as our management and board of directors.

Conference Call

The company has scheduled a conference call to discuss its first

quarter 2019 financial results and second quarter outlook today,

April 25, 2019 at 8:30 a.m. ET. To access the call in the U.S.

please dial 877-709-8150 or outside the U.S. dial 201-689-8354 at

least five minutes prior to the 8:30 a.m. start time. No

participant code is required. A presentation containing information

on the company’s first quarter financial results and second quarter

outlook will be available prior to the call. A simultaneous webcast

of the call and slide presentation will be available via the

investor relations section of the Protolabs website and the

following link: https://edge.media-server.com/m6/p/25uxfqee. A

replay will be available for 14 days following the call on the

investor relations section of the Protolabs website.

About Protolabs

Protolabs is the world's fastest digital manufacturing source

for rapid prototyping and on-demand production. The

technology-enabled company produces custom parts and assemblies in

as fast as one day with automated 3D printing, CNC machining, sheet

metal fabrication, and injection molding processes. Its digital

approach to manufacturing enables accelerated time to market,

reduces development and production costs, and minimizes risk

throughout the product life cycle. Visit protolabs.com for more

information.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Protolabs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Protolabs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Protolabs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Protolabs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs,

Inc. Condensed Consolidated Balance Sheets (In

thousands) March 31,

December 31, 2019 2018

(Unaudited) Assets Current assets Cash

and cash equivalents $ 85,350 $ 85,046 Short-term marketable

securities 35,045 46,750 Accounts receivable, net 61,535 59,155

Inventory 9,356 10,087 Income taxes receivable 2,852 5,757 Prepaid

expenses and other current assets 8,613 8,567 Total

current assets 202,751 215,362 Property and equipment, net

234,211 228,001 Goodwill 128,752 128,752 Other intangible assets,

net 18,979 19,850 Long-term marketable securities 18,262 23,579

Operating lease assets 11,965 - Other long-term assets 3,676

3,441 Total assets $ 618,596 $ 618,985

Liabilities

and shareholders' equity Current liabilities Accounts payable $

16,672 $ 17,411 Accrued compensation 10,129 18,130 Accrued

liabilities and other 11,027 16,702 Current operating lease

liabilities 3,021 - Income taxes payable 594 491

Total current liabilities 41,443 52,734 Long-term operating

lease liabilities 9,107 - Long-term deferred tax liabilities 20,549

20,162 Other long-term liabilities 4,702 4,592 Shareholders'

equity 542,795 541,497 Total liabilities and

shareholders' equity $ 618,596 $ 618,985

Proto Labs, Inc. Condensed

Consolidated Statements of Operations (In thousands, except

share and per share amounts) (Unaudited) Three

Months Ended March 31,

2019

2018

Revenue Injection Molding $ 55,311 $ 51,343 CNC Machining 37,872

36,731 3D Printing 14,480 12,325 Sheet Metal 5,025 6,241 Other

764 1,105 Total revenue

113,452 107,745 Cost of revenue

54,592

49,837 Gross profit 58,860 57,908

Operating expenses Marketing and sales 18,577 16,572 Research and

development 8,013 6,665 General and administrative

12,822 12,943 Total operating

expenses

39,412 36,180

Income from operations 19,448 21,728 Other income, net

213 178 Income before income taxes

19,661 21,906 Provision for income taxes

4,150

3,855 Net income

$

15,511 $ 18,051 Net

income per share: Basic

$ 0.58

$ 0.67 Diluted

$

0.57 $ 0.66 Shares

used to compute net income per share: Basic 26,963,366 26,879,388

Diluted 27,177,039 27,197,099

Proto Labs,

Inc. Condensed Consolidated Statements of Cash Flows

(In thousands) (Unaudited) Three Months

Ended March 31, 2019 2018 Operating

activities Net income $ 15,511 $ 18,051 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 7,439 6,259 Stock-based compensation

expense 3,040 2,307 Deferred taxes 379 612 Amortization of

held-to-maturity securities 16 163 Other 236 106 Changes in

operating assets and liabilities

(8,619

) (1,353 ) Net cash

provided by operating activities

18,002

26,145 Investing

activities Purchases of property, equipment and other capital

assets (12,735 ) (25,513 ) Cash used for acquisitions, net of cash

acquired - (90 ) Purchases of other assets and investments (4,000 )

- Purchases of marketable securities - (3,389 ) Proceeds from

maturities of marketable securities

17,006

13,551 Net cash provided by (used

in) investing activities

271

(15,441 ) Financing

activities Payments on debt - (5,000 ) Proceeds from exercises

of stock options and other 174 2,880 Purchases of shares withheld

for tax obligations (594 ) (628 ) Repurchases of common stock

(17,309 ) -

Net cash used in financing activities

(17,729 ) (2,748

) Effect of exchange rate changes on cash and cash

equivalents

(240 )

432 Net increase in cash and cash

equivalents 304 8,388

Cash and cash equivalents, beginning

of period 85,046

36,707 Cash and cash equivalents, end of

period $ 85,350 $

45,095

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Net Income per Share (In thousands, except share

and per share amounts) (Unaudited) Three

Months Ended March 31,

2019

2018

Non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense and

unrealized loss on foreign currency

GAAP net income $ 15,511 $ 18,051 Add back: Stock-based

compensation expense 3,040 2,307 Amortization expense 871 764

Unrealized loss on foreign currency

247

156 Total adjustments 1 4,158 3,227

Income tax benefits on adjustments 2

(919

) (2,043 ) Non-GAAP

net income

$ 18,750 $

19,235 Non-GAAP net income per

share: Basic

$ 0.70 $

0.72 Diluted

$ 0.69

$ 0.71 Shares used

to compute non-GAAP net income per share: Basic 26,963,366

26,879,388 Diluted 27,177,039 27,197,099

1 Stock-based compensation expense,

amortization expense and unrealized loss on foreign currency were

included in the following GAAP consolidated statement of operations

categories:

Three Months Ended March 31,

2019

2018

Cost of revenue $ 733 $ 287 Marketing and sales 549

377 Research and development 423 314 General and administrative

2,206 2,093

Total operating expenses 3,178 2,784 Other income, net

247 156 Total

adjustments

$ 4,158 $

3,227 2 For the three-month periods

ended March 31, 2019 and 2018, income tax effects were calculated

using the effective tax rate for the relevant jurisdictions. Our

non-GAAP tax rates differ from our GAAP tax rates due primarily to

the mix of activity incurred in domestic and foreign tax

jurisdictions and removing effective tax rate benefits from

stock-based compensation activity in the quarter.

Proto Labs, Inc.

Reconciliation of GAAP to Non-GAAP Operating Margin (In

thousands) (Unaudited) Three Months Ended

March 31,

2019

2018

Revenue $ 113,452 $ 107,745 Income from operations

19,448 21,728 GAAP

operating margin 17.1 % 20.2 % Add back: Stock-based compensation

expense 3,040 2,307 Amortization expense

871

764 Total adjustments 3,911 3,071

Non-GAAP income from operations

$ 23,359

$ 24,799 Non-GAAP operating

margin 20.6 % 23.0 %

Proto Labs, Inc.

Reconciliation of GAAP Net Income to EBITDA and Adjusted

EBITDA (In thousands) (Unaudited) Three

Months Ended March 31,

2019

2018

GAAP net income $ 15,511 $ 18,051 Amortization expense 871 764

Depreciation expense 6,568 5,495 Interest income, net (581 ) (266 )

Tax expense

4,150

3,855 EBITDA

26,519

27,899 Add back: Stock-based

compensation expense 3,040 2,307 Unrealized loss on foreign

currency

247 156

Total adjustments 3,287 2,463 Adjusted EBITDA

$

29,806 $ 30,362

Proto

Labs, Inc. Comparison of GAAP to Non-GAAP Revenue Growth

(In thousands) (Unaudited)

Three Months Ended

March 31, 2019

Three

MonthsEndedMarch 31,

2018

% % Change

Constant

GAAP

Adjustments1

Non-GAAP GAAP

Change2

Currencies3 Revenues United

States $ 87,811 $ - $ 87,811 $ 84,167 4.3 % 4.3 % Europe 21,254

1,634 22,888 19,945 6.6 % 14.8 % Japan

4,387

88 4,475

3,633

20.8

%

23.2

% Total Revenue

$ 113,452

$ 1,722 $

115,174 $ 107,745 5.3 % 6.9

%

1 Revenue for the three-month period ended

March 31, 2019 has been recalculated using 2018 foreign currency

exchange rates in effect during comparable periods to provide

information useful in evaluating the underlying business trends

excluding the impact of changes in foreign currency exchange rates.

2 This column presents the percentage change from GAAP revenue for

the three-month period ended March 31, 2018 to GAAP revenue for the

three-month period ended March 31, 2019. 3 This column presents the

percentage change from GAAP revenue for the three-month period

ended March 31, 2018 to non-GAAP revenue for the three-month period

ended March 31, 2019 (as recalculated using the foreign currency

exchange rates in effect during the three-month period ended March

31, 2018) in order to provide a constant-currency comparison.

Proto Labs, Inc.

Product Developer Information (Unaudited)

Three Months Ended March 31, 2019 2018

Unique product developers and engineers served

20,573

18,816

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190425005261/en/

Investor Relations Contact:ProtolabsDan Schumacher,

763-479-7240Director of Investor

Relationsdaniel.schumacher@protolabs.comorMedia

Contact:ProtolabsSarah Ekenberg, 763-479-7560Marketing Manager, PR

& Mediasarah.ekenberg@protolabs.com

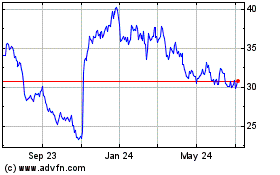

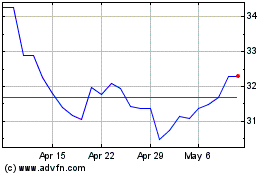

Proto Labs (NYSE:PRLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Proto Labs (NYSE:PRLB)

Historical Stock Chart

From Apr 2023 to Apr 2024