Securities Registration: Employee Benefit Plan (s-8)

November 30 2021 - 8:50AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 30, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PROS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

76-0168604

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

3200 Kirby Drive, Suite 600

|

|

77098

|

|

Houston, Texas

|

|

(Zip Code)

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

|

|

|

|

|

2021 EQUITY INDUCEMENT PLAN

(Full title of the plan)

Damian W. Olthoff

General Counsel and Secretary

PROS Holdings, Inc.

3200 Kirby Drive, Suite 600

Houston, Texas 77098

(713) 335-5151

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

☒

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

|

Smaller reporting company

|

☐

|

|

Emerging growth company

|

☐

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

Title of securities to be registered

|

|

Amount to be registered (1)

|

|

Proposed maximum offering price per share (2)

|

|

Proposed maximum aggregate offering price (2)

|

|

Amount of registration fee

|

|

Common Stock, par value $0.001 per share, reserved for issuance pursuant to the 2021 Equity Inducement Plan

|

|

332,004

|

|

$

|

34.88

|

|

|

$

|

11,580,299.52

|

|

|

$

|

1,073.49

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Represents shares of Common Stock (as defined below) of PROS Holdings, Inc. (the “Registrant”). Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement (as defined below) shall also cover any additional shares of Registrant’s Common Stock that become issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction that results in an increase in the number of outstanding shares of Registrant’s Common Stock.

|

|

(2)

|

Estimated in accordance with paragraphs (c) and (h) of Rule 457 under the Securities Act solely for the purpose of calculating the registration fee on the basis of $34.88, which represents the average of the high and low price per share of Registrant’s Common Stock on November 26, 2021 as reported on the New York Stock Exchange (“NYSE”).

|

PART I

Information Required in the Section 10(a) Prospectus

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit plan covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

PART II

Information Required in the Registration Statement

Item 3. Incorporation of documents by reference

Registrant hereby incorporates by reference into this Registration Statement the following documents previously filed with the Commission:

Registrant hereby incorporates by reference into this Registration Statement the following documents previously filed with the Commission:

a. Registrant’s Annual Report on Form 10‑K for the fiscal year ended December 31, 2020 (the “Annual Report”), filed with the Commission on February 12, 2021, including the description of Registrant’s Common Stock contained in Exhibit 4.6 thereto;

b. all other reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) since the end of the fiscal year covered by the Annual Report; and

c. Registrant’s Registration Statement No. 001-33554 on Form 8-A filed with the Commission on June 21, 2007 pursuant to Section 12(b) of the Exchange Act, which describes the terms, rights and provisions applicable to Registrant’s outstanding Common Stock.

All reports and definitive proxy or information statements filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which de-registers all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents. Under no circumstances will any information furnished under current items 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless such Form 8-K expressly provides to the contrary. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Item 4. Description of securities

Not applicable.

Item 5. Interests of named experts and counsel

Not applicable.

Item 6. Indemnification of directors and officers

Under Section 145 of the DGCL, we have broad powers to indemnify our directors and officers against liabilities they may incur in such capacities, including liabilities under the Securities Act. Section 145 of the DGCL generally provides that a Delaware corporation has the power to indemnify its present and former directors, officers, employees and agents against expenses incurred by them in connection with any suit to which they are or are threatened to be made, a party by reason of their serving in such positions so long as they acted in good faith and in a manner they reasonably believed to be in or not opposed to, the best interests of the corporation and, with respect to any criminal action, they had no reasonable cause to believe their conduct was unlawful.

Our certificate of incorporation and bylaws provide that we will limit the liability of our directors, and will indemnify our directors and officers, to the maximum extent permitted by Delaware law. The DGCL provides that directors of a corporation will not be personally liable for monetary damages for breach of their fiduciary duties as directors, except for liability for any:

a.breach of their duty of loyalty to the corporation or its stockholders;

b.act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

c.unlawful payment of dividends or redemption of shares; or

d.transaction from which the directors derived an improper personal benefit.

These limitations of liability do not apply to liabilities arising under federal securities laws and do not affect the availability of equitable remedies such as injunctive relief or rescission.

We entered into separate indemnification agreements with our directors and officers in addition to the indemnification provided for in our bylaws. These indemnification agreements provide, among other things, that we will indemnify our directors and officers for certain judgments, fines, penalties, settlements amounts and expenses (including attorneys’ fees and disbursements) incurred by a director or officer in any proceeding, action or claim by reason of the fact of his or her capacity as a director or officer of our company, or by reason of anything done or not done by him or her in such capacity. The indemnification agreements also provide for procedures that will apply in the event that a director or officer makes a claim for indemnification.

We also maintain a directors’ and officers’ insurance policy pursuant to which our directors and officers are insured against liability for actions taken in their capacities as directors and officers. We believe that these indemnification provisions and insurance are useful to attract and retain qualified directors and officers.

Item 7. Exemption from registration claimed

Not applicable.

Item 8. Exhibits

The following exhibits are incorporated by reference herein.

|

|

|

|

|

|

|

|

|

|

|

Number

|

|

Exhibit

|

|

4.1

|

|

|

|

4.2

|

|

|

|

4.3

|

|

|

|

4.4

|

|

|

|

5.1*

|

|

|

|

23.1*

|

|

|

|

23.2*

|

|

|

|

24.1*

|

|

|

|

99.1*

|

|

|

|

* Filed herewith

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas on this 30th day of November 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROS HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andres Reiner

|

|

|

|

|

Andres Reiner

|

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Damian W. Olthoff and Christopher C. Chaffin and each of them acting alone, as his true and lawful attorney-in-fact and agent with full power of substitution, for him in any and all capacities, to sign any and all amendments to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact, proxy and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact, proxy and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

|

|

/s/ Andres Reiner

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

11/30/2021

|

|

|

Andres Reiner

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Stefan Schulz

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

|

|

11/30/2021

|

|

|

Stefan Schulz

|

|

|

|

|

|

/s/ Scott Cook

|

|

Senior Vice President and Chief Accounting Officer (Principal Accounting Officer)

|

|

11/30/2021

|

|

|

Scott Cook

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ William Russell

|

|

Chairman of the Board

|

|

11/30/2021

|

|

|

William Russell

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Carlos Dominguez

|

|

Director

|

|

11/30/2021

|

|

|

Carlos Dominguez

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Raja Hammoud

|

|

Director

|

|

11/30/2021

|

|

|

Raja Hammoud

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Catherine Lesjak

|

|

Director

|

|

11/30/2021

|

|

|

Catherine Lesjak

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Greg B. Petersen

|

|

Director

|

|

11/30/2021

|

|

|

Greg B. Petersen

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Timothy V. Williams

|

|

Director

|

|

11/30/2021

|

|

|

Timothy V. Williams

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mariette M. Woestemeyer

|

|

Director

|

|

11/30/2021

|

|

|

Mariette M. Woestemeyer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Leland T. Jourdan

|

|

Director

|

|

11/30/2021

|

|

|

Leland T. Jourdan

|

|

|

|

|

|

|

|

|

|

|

|

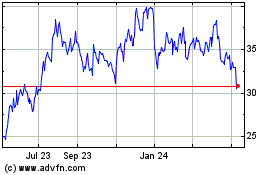

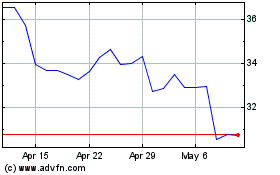

Pros (NYSE:PRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pros (NYSE:PRO)

Historical Stock Chart

From Apr 2023 to Apr 2024