Current Report Filing (8-k)

November 30 2021 - 8:48AM

Edgar (US Regulatory)

0001392972false00013929722021-11-302021-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 30, 2021

PROS Holdings, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

001-33554

|

|

|

|

76-0168604

|

|

(Commission File Number)

|

|

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3200 Kirby Dr., Suite 600

|

Houston

|

TX

|

|

|

|

|

77098

|

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code

|

(713)

|

335-5151

|

|

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock $0.001 par value per share

|

|

PRO

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry Into a Material Definitive Agreement.

On November 30, 2021, PROS Holdings, Inc. (the “Company”) announced its acquisition of EveryMundo, LLC (“EveryMundo”) pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of November 30, 2021, by and among the Company, Worldwide Merger Sub, LLC (“Merger Sub”), EveryMundo and Seth Cassel, solely in his capacity as agent of the unitholders of EveryMundo.

Upon the terms and subject to the conditions set forth in the Merger Agreement, on November 30, 2021, Merger Sub merged with and into EveryMundo, with EveryMundo surviving the merger, resulting in EveryMundo becoming a wholly-owned subsidiary of the Company (the “Merger”). The purchase price for the Merger consists of (i) $80 million in cash, subject to adjustments for cash, indebtedness, working capital and transaction expenses and (ii) $10 million in contingent equity consideration, 50% of which will be issued 12 months after the closing of the Merger and 50% of which will be issued 24 months after the closing of the Merger, in each case subject to the satisfaction of certain conditions as set forth in the Merger Agreement. The Merger Agreement contains customary representations and warranties, covenants and agreements of the parties.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and incorporated herein by reference. The Merger Agreement has been attached to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company or EveryMundo. In particular, the representations and warranties contained in the Merger Agreement were made only for the purposes of the Merger Agreement as of specific dates and were qualified by disclosures between the parties and a contractual standard of materiality that is different from those generally applicable to stockholders, among other limitations. The representations and warranties were made for the purposes of allocating contractual risk between the parties to the Merger Agreement and should not be relied upon as a disclosure of factual information relating to the Company or EveryMundo.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information contained in Item 1.01 regarding the Merger is incorporated into this Item 2.01 by reference.

Item 7.01 Regulation FD Disclosure.

On November 30, 2021, the Company issued a press release announcing the Merger.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to this Item 7.01 and the accompanying Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and is not to be incorporated by reference into any filing of the Company.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROS HOLDINGS, INC.

|

|

Date: November 30, 2021

|

|

|

|

/s/ Damian W. Olthoff

|

|

|

Damian W. Olthoff

|

|

|

General Counsel and Secretary

|

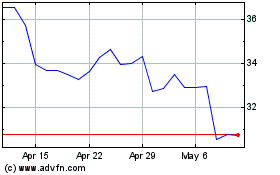

Pros (NYSE:PRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

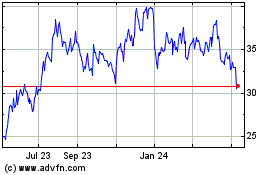

Pros (NYSE:PRO)

Historical Stock Chart

From Apr 2023 to Apr 2024