By Sharon Terlep

Procter & Gamble Co., seeking to prove that the

consumer-products giant that invented Ivory soap, Crest toothpaste

and disposable Pampers diapers hasn't lost its touch, has spent

nearly a decade working on a new line of products it hopes will

fill American homes.

P&G has developed a way to make laundry detergent, hand soap

and shampoo without a key ingredient: water.

Executives said the new dry soaps and cleaners, which come in

the form of small, fabric-like "swatches" that foam when users add

water during washing or cleaning, will reduce substantially water

used in production and be lighter and smaller to package and ship.

That could make it easier for P&G to sell them online,

bypassing retailers such as Walmart Inc. and Amazon.com Inc.

P&G said it doesn't yet know how much mass appeal the

products, which are expected to appeal to younger and

environmentally conscious consumers, will have. The company will

face the challenge of convincing consumers that the soaps and

cleaners are as good as something they would buy in a bottle,

analysts said.

P&G launched Monday a website selling limited quantities of

dry hand soap and laundry detergent, with six more products going

on sale in early June, also in limited quantities. They will range

in cost from 60 swatches of face wash for $19 to 30 swatches of

laundry detergent for $29.

Initially called EC30, P&G executives are still deciding

whether the products, should they go on sale for the mass market,

would have their own brand or bear well-known P&G names such as

Mr. Clean, Tide and Olay.

The rollout comes as P&G is riding a sales rebound, and more

than a year after activist investor Nelson Peltz joined the

company's board following a costly proxy fight.

Mr. Peltz has pushed P&G to more aggressively pursue

breakthroughs, which P&G Chief Executive David Taylor has said

the company is already doing.

Despite a solid U.S. economy, household-goods makers in the last

couple of years have experienced stagnating sales amid increased

competition, a consumer shift toward smaller brands and higher

materials costs.

P&G late last year said it would increase prices for several

products to address rising costs and reverse a trend of price

cutting, and other consumer-goods companies have followed suit.

Lee Ellen Drechsler, the dry-soap project's research and

development director at P&G, in 2011 began tinkering with the

idea of condensing cleaning chemicals into minuscule fibers that

dissolve when wet -- similar, she said, to cotton candy.

"We realized we could make a suite full of products that

performed as well or even better than those made with water," said

Ms. Drechsler, a 26-year P&G veteran.

P&G earlier this year decided the lineup was ready for

broader public consumption after testing the idea with board

members and some consumers through a crowdfunding website last

summer, in which people paid to help fund the project in exchange

for receiving early versions of the product.

Mr. Peltz made P&G's lack of recent blockbusters a central

issue of the 2017 proxy fight, saying that the 182-year-old company

that pioneered laundry detergent had become too mired in

bureaucracy to innovate. Its last billion-dollar business, Tide

Pods, was released in 2012.

P&G executives said the company's pipeline hadn't dried up

but acknowledged a need to develop new products faster and with

different goals in mind. P&G said it needed to look more

broadly at factors such as packaging, emotional connection and

rival offerings, not simply quality and efficacy as measured in

labs and by consumer feedback.

P&G shares are up roughly 45% in the past year as the

company cut costs, reorganized internally and experienced stronger

sales. In the decade prior, P&G shares gained just 8% while the

S&P 500 nearly doubled.

Using the old metrics, "you would have thought P&G was

growing in every category," Kathy Fish, the company's R&D

chief, recently told investors. "It was very humbling to find we

weren't as good as we thought we were."

The dry soaps represent a test case for P&G. Typically an

R&D team must work with other departments to manufacture,

package and market a new offering. In the case of EC30, Ms.

Drechsler's team includes people from each unit. The EC30 lab has

its own production line.

Instead of waiting until the project was fully baked to begin

selling to consumers, P&G used crowdfunding site Indiegogo.com

to generate interest and real-life product testers. P&G quickly

sold out on the site.

The swatches meet the safety standards of any P&G product in

the market, Ms. Drechsler said. P&G had to repackage its Tide

Pods several years ago after young children and elderly people

ingested the colorful, concentrated detergent packets.

The company missed a few deadlines and had to ship the products,

which come in boxes made of bamboo to eliminate plastic waste, in

plastic bags. P&G is close to eliminating the bags, but still

needs them to keep the products dry throughout the shipping and

delivery process, said Tom Dierking, the project's design director.

It is also is working on packaging that better keeps swatches dry,

since several are used in or near water.

The amount of water used in the production of soaps and

detergents represents a fraction of water consumed in the process

of using the products. To substantially reduce water use, P&G

would need to work on ways to cut down on how much water is needed

to, for instance, do a load of laundry, said Deepak Rajagopal, an

assistant professor at the Institute of the Environment and

Sustainability at the University of California, Los Angeles.

"Most of the impact happens on the consumer side," he said.

P&G's Mr. Dierking said high-quality cleaning and

personal-care products require less washing time. "The most we can

do is use the best ingredients possible to minimize water usage,"

he said.

Elizabeth Bain, a 46-year-old lawyer from Oregon, got both the

personal-care and household cleaning lines through the Indiegogo

campaign. She has used the toilet cleaner, which mostly dissolved

overnight, and then she used the remnants to scrub the bowl clean

with a brush.

She said she might be more likely to buy the items if they came

with a new, non-P&G name. "I'm less concerned with brand

names," she said. "And more concerned with efficiency."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

April 22, 2019 11:37 ET (15:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

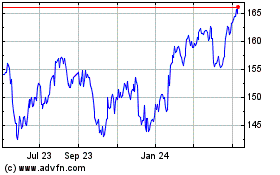

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

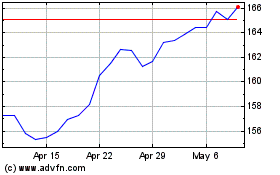

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024