Disruptive Food Brands Get a Taste of Their Own Medicine -- Heard on the Street

May 11 2020 - 6:51AM

Dow Jones News

By Carol Ryan

Seeking comfort while sheltering at home, shoppers are reaching

for Hershey Bars rather than gluten-free energy balls. That is bad

news for challenger brands, whose healthy snacks were taking market

share from global food companies until very recently.

Discussing their latest quarterly results, executives at Nestlé,

Kraft Heinz and Procter & Gamble all said consumers are

returning to old-fashioned brands that had previously fallen out of

favor. The Hershey Company noted that its confectionery products

gained 3 percentage points of market share over the past month or

so. As consumers hoard nonperishable food, goods such as processed

cheese and canned soup that had been losing out to healthier

alternatives are recording their strongest sales in years.

It isn't yet clear if the trend will stick, but the shift is

significant. Challenger brands have been taking market share from

global food manufacturers for several years. In January and

February this year, insurgent brands -- defined as those that are

growing more than 10 times faster than their category -- captured

35% of the year-over-year growth in the consumer industry,

according to consulting firm Bain & Company. In March and

April, their share of growth shrank to 5%.

Lack of scale is now a disadvantage. Supermarkets have reduced

the range of products they offer to ensure everyday essentials are

available. That plays to the strengths of global manufacturers like

Nestlé and P&G who can deliver orders in bulk. In the short

term at least, small brands are being elbowed off the shelves.

The asset-light business model favored by insurgent brands also

has downsides. As they use third-party manufacturers rather than

owning factories, these companies struggle to increase capacity

when there is a big spike in demand. They are also competing with

deep-pocketed rivals for constrained logistics services.

Third-party transport costs have increased by 20% in certain

markets.

Even if the distribution squeeze is temporary, startups may not

have the cash to survive for long. Funding for these kinds of

businesses is drying up. Worldwide, the number of venture capital

investments in consumer brands fell 26% in the first quarter of

2020 compared with the same period of last year, PitchBook data

shows. Even before the crisis, investors had moved on to other hot

sectors such as health care and software. Last year, venture

capitalists handed over 54% less cash to consumer brands than in

2018, according to data tracked by Goldman Sachs.

Of course, entrepreneurs are nothing if not nimble and can focus

on selling their goods online. The problem for food brands in

particular is that over 90% of sales still happen in

bricks-and-mortar stores in most markets. Challengers with a

well-established online sales channel may fare better in the

current reversal.

Meanwhile, big food brands have an unlikely opportunity to

regain some of the ground they lost in recent years. They might

even buy up struggling rivals on the cheap.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

May 11, 2020 06:36 ET (10:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

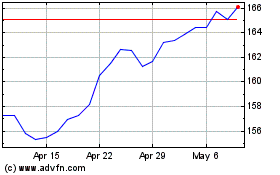

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

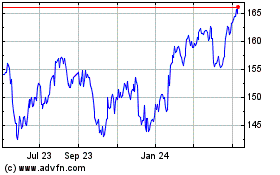

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024